Summary Box (Quick Facts)

-

Ticker Symbol: KITE

-

Chain: Kite Blockchain (EVM-Compatible Layer-1)

-

Contract Address: Native L1 token, no contract address.

-

Circulating Supply: To be determined upon mainnet launch.

-

Total Supply: 10,000,000,000 KITE

-

Primary Use Case: Powering autonomous AI agent transactions and governance.

-

Current Market Cap: Not available (pre-mainnet).

What Is Kite?

Artificial Intelligence (AI) has advanced to a point where autonomous agents can analyze markets, manage complex workflows, and execute multi-step plans with superhuman speed and accuracy. However, a major bottleneck prevents these AIs from reaching their full potential: they are imprisoned by financial and identity infrastructure built for humans. This is the core problem Kite aims to solve.

So, what is Kite? In simple terms, Kite is a purpose-built Layer-1 blockchain designed to be the economic backbone for the "agentic economy." It provides the infrastructure needed for AI agents to be treated as first-class economic actors. Today, businesses face a dilemma: either give an AI agent full financial authority and risk catastrophic loss, or require manual human approval for every action, which eliminates the AI’s autonomy. Kite resolves this by giving each AI its own cryptographic identity, a secure wallet, and programmable spending rules. This allows agents to pay for services, manage funds, and coordinate with other AIs safely and autonomously.

Kite explained further, it is creating a new set of rules for an economy where machines can transact with other machines securely and efficiently. By removing the human-centric friction from digital payments and identity, Kite aims to unlock a projected multi-trillion-dollar agent economy that is currently held back by outdated systems.

How Many KITE Tokens Are There?

The Kite network is designed with a finite maximum supply of 10,000,000,000 (10 billion) KITE tokens, establishing a non-inflationary long-term model. The tokenomics are structured to bootstrap the network in its early stages through token emissions that reward participation.

However, the vision is for the network to become self-sustaining. Over time, the rewards for validators and stakers will transition from being funded by new emissions to being funded entirely by protocol revenues. These revenues will be generated from a small commission on every transaction processed by AI agents on the network. This model ensures that the network’s health and the token's value are directly tied to the real-world utility and adoption of the Kite ecosystem, rather than perpetual token inflation.

What Does KITE Do?

The KITE token is the native utility asset that powers every function within the Kite ecosystem. Its role is essential for securing the network and enabling the agentic economy. The primary KITE use case is to serve as the medium of exchange and governance for AI-driven services.

Key functions of the KITE token include:

-

AI Service Payments: KITE is the currency used by AI agents to pay for services on the network, such as API calls, data queries, or computational resources. The protocol is designed for "pay-per-request" micropayments, making these interactions economically viable.

-

Staking and Network Security: Validators on Kite's Proof-of-Stake network must stake KITE tokens to participate in consensus and secure the blockchain. Delegators can also stake their KITE with validators to earn a share of the network rewards, contributing to the overall security and decentralization of the platform.

-

Programmable Governance: KITE token holders have the power to influence the future of the protocol. They can vote on key decisions, including technical upgrades, parameter changes, and the allocation of ecosystem funds. This ensures that the network evolves in alignment with the interests of its community.

-

Ecosystem Access: Developers and service providers who wish to build or integrate with the Kite network may be required to hold or stake KITE. This aligns their incentives with the long-term success of the ecosystem.

KITE vs. ZEROBASE

While both Kite and ZEROBASE are building specialized blockchain infrastructure, they target fundamentally different problems and ecosystems. A comparison of KITE vs. ZEROBASE highlights two distinct visions for the future of Web3.

| Feature | Kite (KITE) | ZEROBASE (ZBT) |

| Primary Use Case | Powering the AI agent economy with a focus on autonomous machine-to-machine (M2M) micropayments and identity. | A decentralized infrastructure for verifiable off-chain computation using Zero-Knowledge Proofs (ZKPs). |

| Core Technology | Three-layer identity architecture (User, Agent, Session), state channels for micropayments, programmable constraints. | Utilizes ZKPs and Trusted Execution Environments (TEEs) to power privacy-preserving DeFi products like staking and logins. |

| Target Audience | AI developers, businesses deploying autonomous agents, and services in the emerging agentic economy. | DeFi users, institutions, and developers needing privacy, compliance, and cryptographic assurance for financial products. |

| Transaction Model | Optimized for extremely high-frequency, low-value transactions (micropayments) suitable for AI agents. | Focused on secure, private, and verifiable transactions for DeFi applications like staking and confidential trading. |

| Key Innovation | Creating a new economic framework for AI agents to act as autonomous, financially independent entities. | Applying Zero-Knowledge technology to enhance privacy, security, and compliance in existing and new DeFi ecosystems. |

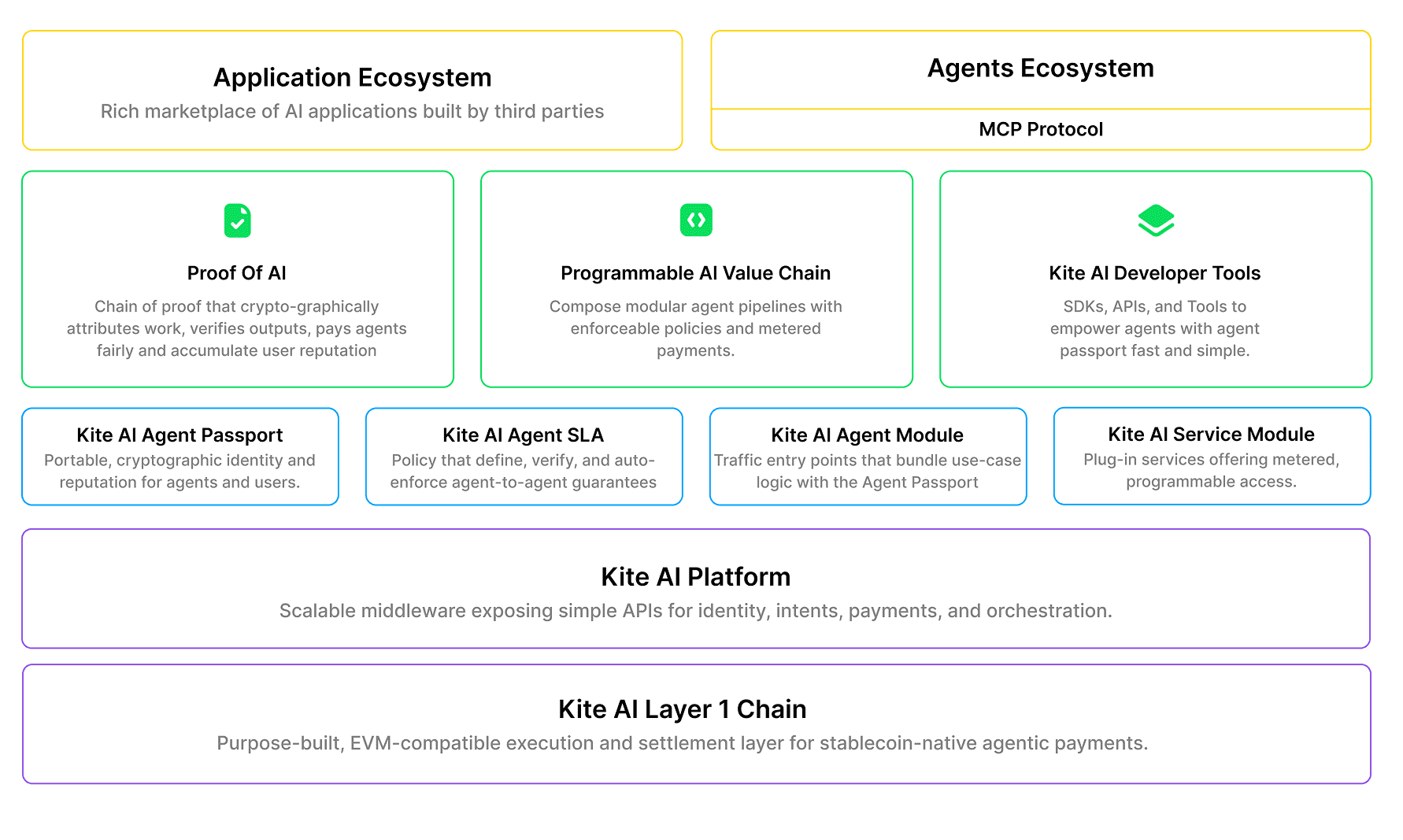

The Technology Behind KITE

Kite's technical foundation is its most significant innovation, designed from the ground up to address the unique challenges of the agentic economy. Its architecture combines a high-performance blockchain with novel identity and payment systems.

The SPACE Framework

The core of Kite’s design is the SPACE framework, which addresses the five fundamental failures of existing infrastructure for AI:

-

Stablecoin-native: All transactions are settled in stablecoins for predictable, low-volatility payments.

-

Programmable constraints: Users define cryptographic spending rules and boundaries that are enforced by the blockchain, preventing rogue or compromised AIs from causing financial damage.

-

Agent-first authentication: A hierarchical identity system gives agents their own verifiable credentials without exposing the user’s master keys.

-

Compliance-ready: Every action creates an immutable, verifiable audit trail on the blockchain, ensuring transparency and accountability.

-

Economically viable micropayments: The architecture enables true pay-per-request pricing at a global scale.

Three-Layer Identity Architecture

This is a cornerstone of Kite's security model. It separates authority into three distinct levels to ensure defense-in-depth:

-

User Identity (Root Authority): This is the human user, whose private keys are kept in a secure environment (like a hardware wallet) and never exposed. The user sets the overall rules and delegates authority.

-

Agent Identity (Delegated Authority): Each AI agent is given its own unique on-chain identity and wallet, mathematically derived from the user's wallet. This link is verifiable, but the agent cannot access the user's funds or keys. Its actions are strictly confined by the programmable constraints set by the user.

-

Session Identity (Ephemeral Authority): For a specific task (e.g., "purchase market data for the next 5 minutes"), a temporary, single-use session key is generated. This key is valid only for that specific task, amount, and time window. Once the task is complete, the key becomes useless. Compromising a session key only affects one minor operation, not the entire agent or user account.

Agent-Native Payment Rails

To handle the massive volume of transactions AI agents will generate, Kite utilizes programmable micropayment channels (a form of state channels). Instead of putting every tiny transaction on the blockchain, a user and a service open a payment channel with a single on-chain transaction. They can then conduct thousands or even millions of instant, off-chain transactions with near-zero fees. When they are finished, a second on-chain transaction closes the channel and settles the final balance. This architecture is what makes it possible to charge fractions of a cent for an API call, enabling entirely new, usage-based business models.

Native Interoperability

Kite is not building a walled garden. Its design embraces native compatibility with existing and emerging standards to ensure seamless integration. This includes support for the x402 standard for AI commerce, Google’s A2A protocol for agent-to-agent communication, Anthropic’s MCP for model interoperability, and OAuth 2.1 for compatibility with traditional web services. This focus on interoperability is critical for driving adoption, as developers can integrate Kite without having to abandon their existing tools and platforms.

Team & Origins

The Kite project was founded by a team of seasoned veterans with deep expertise in AI and large-scale data infrastructure. The team’s background includes leadership and engineering roles at top technology companies like Databricks and Uber, as well as academic roots at institutions like UC Berkeley and Princeton University. This blend of enterprise-level engineering experience and cutting-edge research provides the foundation needed to build a platform as ambitious and technically complex as Kite.

Key News & Events

As a project building foundational infrastructure for a future-facing economy, staying updated on news about KITE is essential. The most significant upcoming milestone for Kite is its mainnet launch. The project has already established a strong foundation with its technical whitepaper and is currently in the development and testing phase. The launch of the mainnet will mark the official birth of the Kite ecosystem, allowing developers to begin building applications and AI agents to start transacting on the network. The team has also signaled strong backing from prominent venture capital, which provides a long runway for development and ecosystem growth.

Is KITE a Good Investment?

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Cryptocurrency trading involves significant risks, and you should only invest what you can afford to lose.

Evaluating the KITE investment potential requires a careful analysis of its groundbreaking technology, market positioning, and the inherent risks.

Potential Strengths:

-

First-Mover Advantage: Kite is a pioneer in building infrastructure specifically for the agentic economy, a market projected to be worth trillions of dollars. By solving a clear and critical bottleneck, it has positioned itself at the forefront of a major technological shift.

-

Strong Technical Foundation: The three-layer identity architecture, programmable constraints, and micropayment channels are not just incremental improvements but fundamental innovations that provide a clear advantage over existing systems.

-

Huge Addressable Market: As AI becomes more integrated into business and daily life, the need for a secure and efficient way for AIs to transact will become paramount. Kite is building the rails for this future economy.

-

Interoperability: By embracing existing standards, Kite lowers the barrier to adoption for developers and enterprises, which could accelerate its growth.

Potential Risks:

-

Adoption Hurdles: The success of any Layer-1 blockchain depends on attracting a vibrant ecosystem of developers, users, and services. Kite faces the challenge of building this network effect from the ground up.

-

Competition: While Kite’s approach is unique, it operates in the broader blockchain space, where competition for developers and capital is fierce. Other platforms may attempt to build similar features.

-

Market Volatility: Like all cryptocurrencies, the KITE price, once launched, will be subject to the high volatility of the broader crypto market. Its value will be influenced by market sentiment, macroeconomic factors, and project-specific developments.

In conclusion, Kite presents a high-risk, high-reward proposition. It is an ambitious project tackling a massive, future-facing opportunity with innovative technology.

How to Buy KITE on Phemex

Phemex offers a straightforward and secure platform to purchase KITE. Follow these simple steps to add KITE to your portfolio.

-

Sign Up for a Phemex Account: Visit the Phemex website or download the app. If you don’t have an account, you’ll need to create one and complete the necessary identity verification (KYC).

-

Fund Your Account: You can deposit cryptocurrency (such as USDT) into your Phemex wallet or purchase it directly using a credit/debit card, bank transfer, or other available payment methods.

-

Navigate to the Trading Page: Once your account is funded, go to the "Spot Trading" section. Use the search bar to find the KITE trading pair, which will likely be KITE/USDT.

-

Place Your Order to Buy KITE: You have several order options. A "Market Order" will buy KITE at the current market price, while a "Limit Order" allows you to set a specific price at which you wish to buy. Enter the amount of KITE you want to purchase.

-

Confirm and Trade: Review your order details carefully and click "Buy KITE" to execute the transaction. Once confirmed, you can manage your holdings and Trade KITE from your Phemex wallet.

FAQs

What is the main problem Kite solves?

Kite solves the critical infrastructure problem that prevents AI agents from transacting and operating autonomously in the digital economy. It provides them with secure identities, programmable spending rules, and an efficient payment system, transforming them from simple tools into trustworthy economic actors.

Is KITE an ERC-20 token?

No, KITE is the native token of its own purpose-built, EVM-compatible Layer-1 blockchain. It is not an ERC-20 token that runs on the Ethereum network. This independent infrastructure is what allows Kite to be highly optimized for AI agent transactions.

How does Kite make AI transactions safe?

Kite’s security comes from its unique three-layer identity model (User, Agent, Session) and programmable constraints. This ensures that an AI agent’s authority is limited and task-specific, and that it can never access a user's main funds. All rules are enforced by smart contracts on the blockchain, providing mathematical certainty instead of just promises.