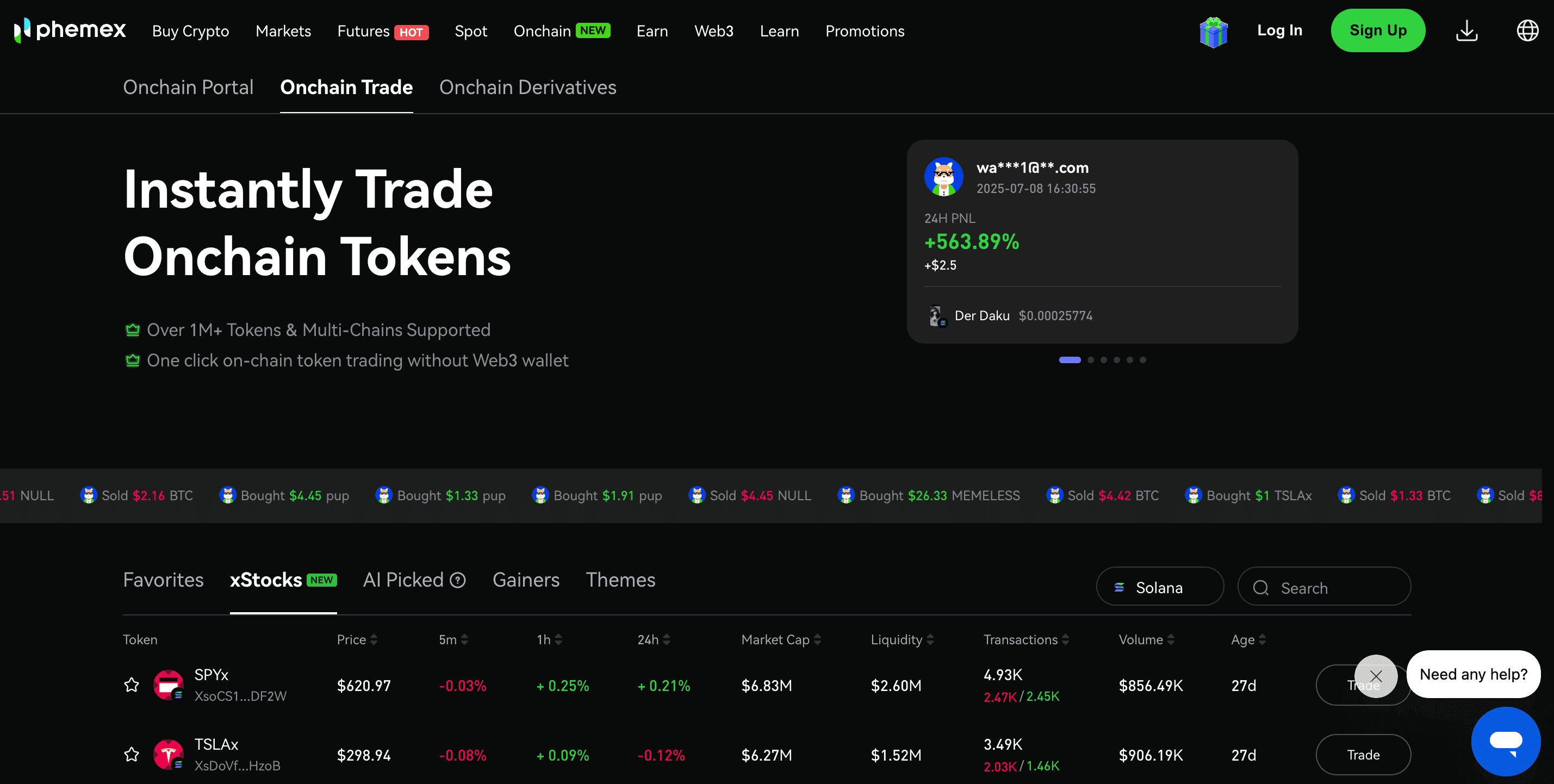

Phemex is committed to the continuous improvement of our trading platform, and today we are excited to announce a significant enhancement to our Onchain Trade feature. This powerful update introduces a dedicated section for assets sourced via the xStocks protocol.

This enhancement adds 10 new listings to our platform, bringing the total number of tradable tokenized stocks on Phemex Onchain to 15. As of this writing, all 15 assets are live and available for trading. This update also implements a dynamic auto-listing mechanism, ensuring Phemex users have timely access to a growing list of global equities as they become available from xStocks.

This expansion reinforces our mission to provide a single, powerful platform where you can seamlessly manage both digital assets and tokenized real-world assets.

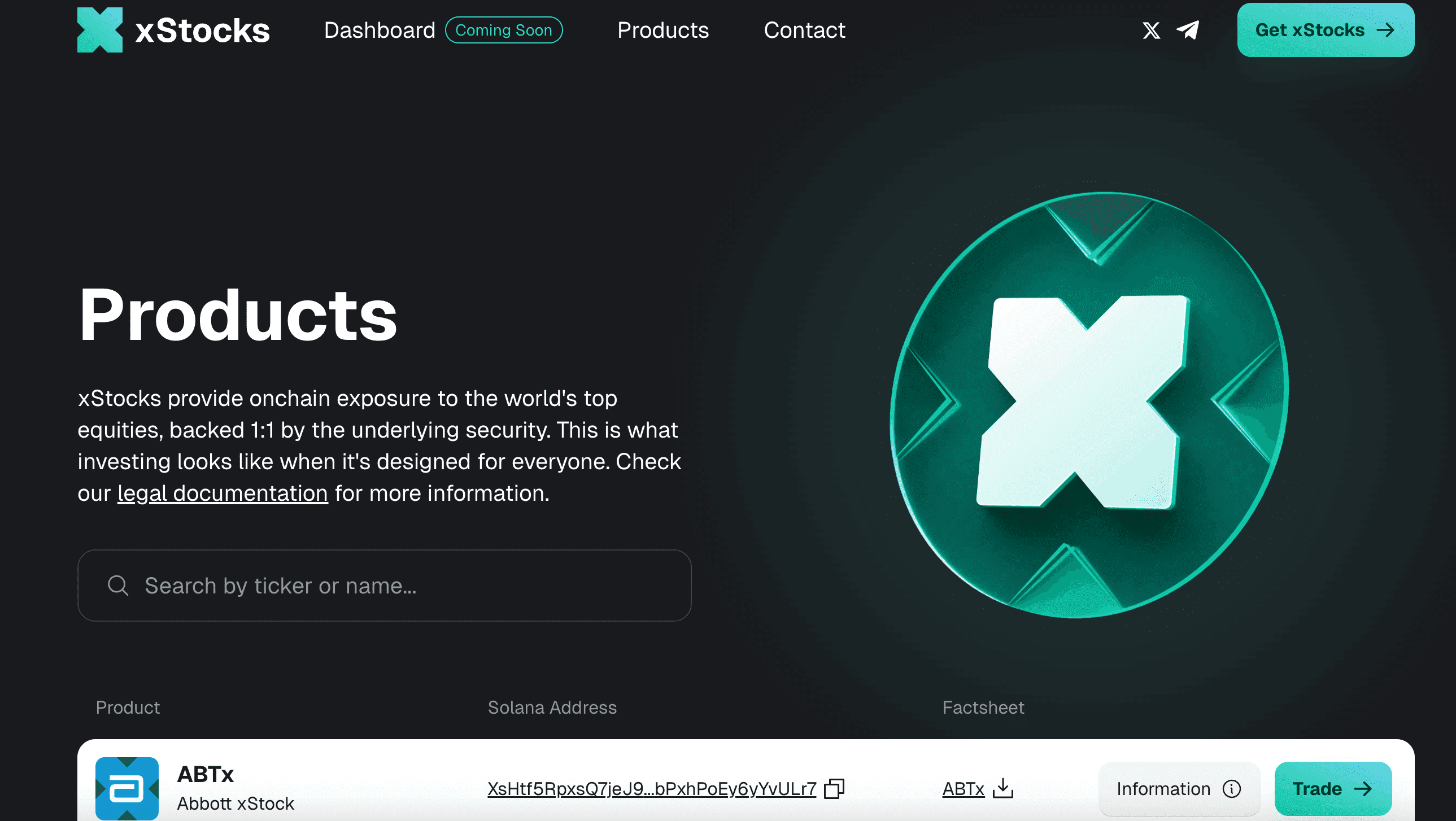

What is xStocks?

xStocks provides a sophisticated bridge for U.S. equities to the Solana blockchain, an initiative led by the Swiss-registered company, Backed Finance. Operationally, its Jersey-based entity, Backed Assets, acquires real U.S. stocks through Interactive Brokers' IBKR Prime service. These assets are then secured in segregated accounts with Clearstream, a custody institution within the Deutsche Börse Group.

Following this, a Solana smart contract mints corresponding tokens, such as TSLAx, at a strict 1:1 ratio to the underlying shares—meaning 1,000 Tesla shares in custody create 1,000 TSLAx tokens. Governed by Backed's smart contract, these tokens can be integrated into third-party exchanges for spot and derivatives trading. The system guarantees a full redemption cycle: any holder of a token like TSLAx can exchange it through Backed for the actual, custodied Tesla share. This transparent process of collateralization, minting, and redemption, as detailed by Backed Finance, establishes a trustworthy model for merging TradFi and DeFi.

How This Update Strengthens Your Trading Strategy

This significant update to Onchain Trade further amplifies its core benefits, providing even more powerful tools for your investment strategy.

1. Deeper Portfolio Diversification

While Onchain Trade already offered a way to hedge against crypto volatility, this expansion provides far greater choice. With a wider array of stocks from various sectors now available, you have more granular control to build a truly diversified portfolio. You can now balance your crypto holdings with assets from high-growth tech to stable industrial giants, more effectively reducing correlation risk.

2. More Opportunities for Your Idle USDT

The expanded list of assets means more opportunities to put your capital to work. Instead of letting your USDT sit idle, you can now deploy it across a broader spectrum of the global stock market. See an opportunity in a newly listed stock? You can act on it instantly, transforming your stablecoins into productive, return-generating assets with greater flexibility than ever before.

3. Continued 24/7 Access to an Expanding Market

The foundational benefit of 24/7 market access remains, but its power is now magnified. As we continue to auto-list new assets via the xStocks integration, your ability to react to global news and market events around the clock applies to an ever-expanding universe of stocks. This is the agility of crypto, now applied to a richer selection of global equities.

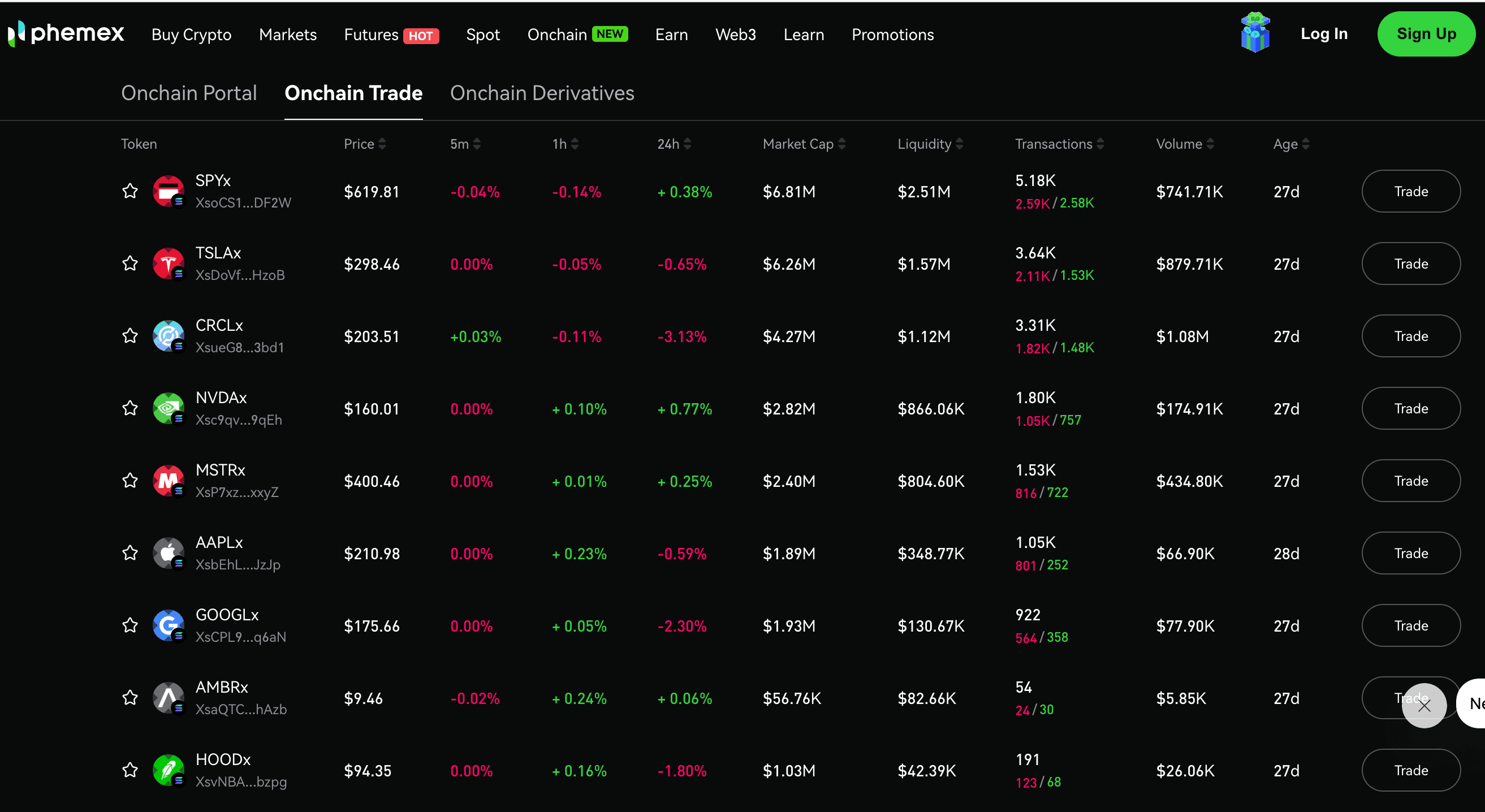

What's Available: 15 Live Tokenized Stocks

With this latest enhancement, the Phemex Onchain list now features a total of 15 tokenized stocks available for trading. This expansion includes the newly listed assets made available through the xStocks protocol, giving you access to a premier selection of global market leaders.

Technology & Innovation Leaders:

-

TSLA (Tesla, Inc.)

-

AAPL (Apple Inc.)

-

GOOGL (Alphabet Inc.)

-

NVDA (NVIDIA Corporation)

-

MSFT (Microsoft Corporation)

-

AMZN (Amazon.com, Inc.)

-

META (Meta Platforms, Inc.)

Financial & Payment Innovators:

-

PYPL (PayPal Holdings, Inc.)

-

COIN (Coinbase Global, Inc.)

-

SQ (Block, Inc.)

Broad Market ETFs:

-

SPY (SPDR S&P 500 ETF Trust): Tracks the 500 largest U.S. companies.

-

QQQ (Invesco QQQ Trust): Tracks the tech-heavy NASDAQ-100 index.

Other Major Companies:

-

BABA (Alibaba Group Holding Limited)

-

JNJ (Johnson & Johnson)

-

DIS (The Walt Disney Company)

This dynamic list will continue to grow, so be sure to check the Onchain Trade page for the latest additions.

How It Works: The Technology Behind the Newly Added Assets

The new assets available in this update are enabled through a technical integration with the xStocks protocol, a specialized infrastructure for tokenizing real-world assets. This approach ensures all newly added stocks are built on a foundation of transparency and full collateralization.

-

Asset Tokenization: The xStocks protocol creates digital tokens on the blockchain that represent legal ownership of a real-world share.

-

Guaranteed 1:1 Asset Backing: This is the core of the system's integrity. For every tokenized stock traded via the Phemex interface, the xStocks protocol ensures a corresponding real share is purchased and held in a regulated, audited custodian account. This 1:1 backing guarantees that the token's value is directly and verifiably tied to the underlying asset.

-

Seamless User Experience: From your perspective on Phemex, the experience remains seamless. You simply navigate to the Onchain Trade section, select your desired stock (e.g., NVDA/USDT), and execute your trade. The complex settlement and custody of the real-world share are handled in the background by the xStocks infrastructure.

Phemex Onchain Trade vs. Traditional Brokerages: A Factual Comparison

| Feature | Phemex Onchain Trade | Traditional Stock Brokerage |

| Trading Hours | 24/7/365 | Restricted hours, weekdays only |

| Funding Currency | USDT & other digital assets | Fiat Currency (USD, EUR, etc.) |

| Funding Speed | Near-instant crypto deposits | 1-3 business days for bank transfers |

| Global Access | Widely accessible | Often restricted by jurisdiction |

| Account Setup | Instant for existing Phemex users | Multi-day verification process |

| Fractional Investing | Natively supported via tokenization | Limited availability by broker |

| Portfolio Integration | Unified with crypto holdings | Siloed from digital asset portfolios |

Explore the Enhanced Onchain Trading Experience

This latest update to Onchain Trade is another major step toward our vision of a unified financial platform. We are dedicated to providing you with the tools you need to build a modern, resilient, and diversified portfolio.

Ready to explore the full selection of 15 live stocks?

-

Log In: Access your Phemex account.

-

Fund Your Account: Ensure you have USDT in your wallet.

-

Navigate to Onchain Trade: Discover the new, dedicated xStocks section and start trading the expanded list of assets.

Experience the power of a truly integrated financial platform today.

Start Trading Stocks with USDT Now – Join the Future of Investing!