Summary Box (Fast Facts)

- Ticker Symbol: HFT

- Current Price: $0.13

- Chain: Ethereum

- Contract Address: 0xb3999F658C0391d94A37f7FF328F3feC942BcADC

- Market Cap: $75.63M

- Circulating Supply: 581.88M

- ATH / ATL Price: $2.58 / $0.043

- All-Time ROI: -67.5% (from IEO price of $0.40)

- Availability on Phemex: Yes (Spot, Futures)

What Is Hashflow?

Hashflow (HFT) is a decentralized trading protocol revolutionizing cross-chain asset swaps in the DeFi space. Unlike traditional decentralized exchanges (DEXs) that rely on automated market makers (AMMs), Hashflow employs a request-for-quote (RFQ) system, ensuring zero-slippage trades and protection against maximal extractable value (MEV) exploits. This innovative approach allows users to trade across blockchains like Ethereum, Arbitrum, Avalanche, BNB Chain, Optimism, Polygon, and Solana without external bridges or synthetic assets, delivering trades at the exact quoted price with no hidden fees.

The HFT token is the backbone of the Hashflow ecosystem, powering governance through a decentralized autonomous organization (DAO) and incentivizing participation via the gamified “Hashverse” platform. Recently, HFT has captured trader attention with a remarkable 190% surge within 48 hours, stabilizing around $0.12–$0.13 as of July 1, 2025. This rapid appreciation has sparked debate: is HFT poised for further gains, or does its volatility signal caution? What is Hashflow? It’s a protocol blending transparency, efficiency, and multichain accessibility, positioning it as a leader in decentralized trading.

Current Price & Market Data (as of July 1, 2025)

HFT trades at $0.13, reflecting strong short-term momentum. The token surged 30.31% in the last 24 hours and 65.1% over 7 days, driven by a 190% rally within 48 hours. However, a -13.94% dip over 30 days underscores its volatility. With a market cap of $75.63M, Hashflow ranks #545 on CoinMarketCap, supported by a 24-hour trading volume of $123.1M, signaling robust liquidity.

Compared to its all-time high (ATH) of $2.58 on November 7, 2022, HFT is down significantly but remains above its all-time low (ATL) of $0.043 from April 7, 2025. This positions HFT in a recovery phase with potential to test higher levels. For real-time data, view the HFT/USD chart on TradingView.

Price History & Performance Overview

Hashflow’s HFT token launched via an initial exchange offering (IEO) on November 30, 2022, at $0.40, soaring to its ATH of $2.58 shortly after, fueled by hype around its RFQ model and backing from Jump Crypto and Coinbase Ventures. The 2022 bear market dragged HFT down to $0.283975 by year-end, a -91.99% drop. In 2023, HFT rebounded 31.60% to $0.373702, driven by DeFi adoption and multichain expansion. The 2024 bear cycle pushed HFT to its ATL of $0.043, but a 137.38% surge in late 2024 and the recent 190% rally signal renewed bullish sentiment.

Key events like the Hashflow 2.0 upgrade, introducing intent-based Smart Order Routing, and the 2024 “Fee Switch” redistributing 50% of revenue to stakers have catalyzed price recovery. HFT’s 8% 30-day volatility rate highlights its high-risk, high-reward profile, appealing to speculative traders.

Whale Activity & Smart Money Flows

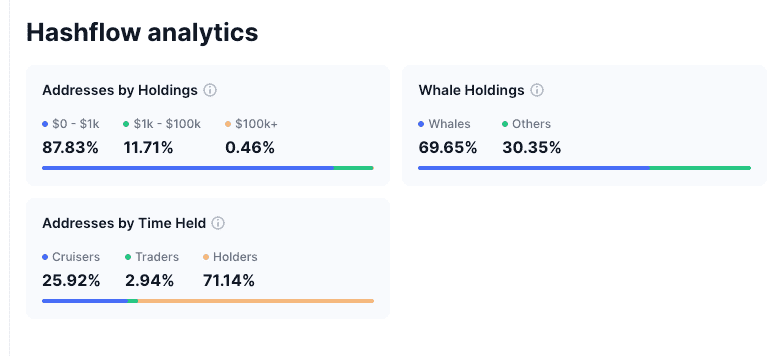

Whale activity in Hashflow reveals a concentrated yet dynamic landscape as of July 1, 2025. Analytics indicate that whales control 69.65% of the total HFT supply, significantly higher than the 40% held by the top 10 wallets per Etherscan, suggesting a broader definition of large holders influencing price action. Recent Lookonchain data highlights bullish intent, with a whale accumulating 2.5M HFT ($325,000) in June 2025, though a 1.8M HFT outflow to exchanges in May 2025 signals potential profit-taking. The address distribution further shows 87.83% of wallets hold less than $1k, 11.71% between $1k–$100k, and just 0.46% above $100k, underscoring retail dominance but also whale concentration. Holder behavior is encouraging, with 71.14% classified as long-term holders, 25.92% as cruisers, and 2.94% as traders, suggesting resilience against panic selling despite the 190% rally. Smart contract interactions average 1,200 daily transactions, tied to governance and Hashverse staking. While whale accumulation supports upside potential, the November 2024 unlock of 160.4M tokens and high whale ownership pose sell-off risks, making smart money tracking for HFT critical for gauging future movements.

On-Chain & Technical Analysis

Technical analysis for Hashflow shows cautious optimism. On the daily chart, HFT trades above its 10-day ($0.11) and 20-day ($0.10) EMAs, reflecting short-term strength, but below the 50-day ($0.15) and 200-day ($0.18) EMAs, indicating resistance. Support holds at $0.10, with resistance at $0.15, $0.214, and $0.231, per Bollinger Bands. The recent 190% rally tested the $0.15 resistance, stabilizing at $0.13.

The RSI at 51.54 suggests neutral momentum with a bullish tilt, while a MACD bullish crossover signals potential upside. Volume surged 333.7% in 24 hours, aligning with price gains. Fibonacci retracement levels highlight $0.145 as a key zone. Technical analysis for Hashflow supports a potential breakout if momentum persists.

Short-Term Price Prediction (2025–2026)

HFT’s recent 190% rally has traders questioning whether to enter now or wait for clarity. Below are three scenarios, incorporating technical levels and market dynamics:

Bullish Continuation (Positive Scenario)

If Hashflow sustains momentum and DeFi adoption grows, HFT could consolidate above $0.10 before breaking the $0.15 resistance. A confirmed breakout with strong volume could push HFT to $0.338 by late 2025, a 160% gain, driven by Hashverse engagement and staking rewards. By 2026, prices could reach $0.55, per CoinMarketCap forecasts.

- Entry Strategy: Enter after a breakout above $0.15 with high volume confirmation.

- Profit-Taking Targets: Monitor $0.156, $0.17, and $0.21.

- Risk Management: Set stop-loss below $0.10 to limit downside.

The Hype Is Over (Bearish Scenario)

If market consolidation or profit-taking dominates, HFT could fall below $0.10, triggering declines to $0.067 or $0.05 by mid-2025. Regulatory pressures or token unlocks could exacerbate this, with $0.07 possible by 2026 if bearish sentiment persists.

- Stay Cautious: Avoid entries if HFT breaks below $0.10 with high selling volume.

- Long-Term Accumulation: Accumulate near $0.067 or $0.05 during stabilization.

Consolidation (Neutral Scenario)

HFT may remain range-bound between $0.10 support and $0.15 resistance, reflecting market indecision. This consolidation could persist through 2025, with prices stabilizing at $0.20 by 2026 if macro conditions remain neutral.

- Range Trading: Trade fluctuations between $0.10 and $0.15.

- Observe Breakout Signals: Watch for volume spikes signaling a breakout.

These scenarios align with technical indicators and sentiment, with $0.10 and $0.15 as pivotal levels.

Long-Term Price Forecast (2027–2030)

Hashflow’s long-term outlook hinges on DeFi adoption and ecosystem growth. By 2027, HFT could hit $0.90 in a bullish case, driven by rising TVL in DeFi (currently hundreds of billions USD). By 2030, prices may range from $1.47 to $2.42 if Hashflow captures DEX market share. Compared to Uniswap or Curve, Hashflow’s RFQ model is unique, but competition remains fierce. Speculative 2031–2033 forecasts suggest $3.59–$7.49 if regulatory clarity and adoption align. These projections are speculative and not financial advice, as volatility and external factors could shift outcomes.

Fundamental Drivers of Growth

Hashflow’s RFQ model ensures zero-slippage and MEV protection, a competitive edge in DeFi. Its multichain support across seven blockchains has facilitated $18B in trade volume since 2021. The Hashverse gamified platform, with a 1M HFT prize pool launched in 2024, drives user engagement. Partnerships with DeFi projects and backing from Alameda Research bolster credibility. The HFT token’s governance and staking roles, enhanced by the 2024 Fee Switch redistributing 50% of revenue, fuel demand. These fundamentals position Hashflow for sustained growth.

Key Risks to Consider

Risks of investing in Hashflow include competition from Uniswap and emerging DEXs, which could erode market share. Token dilution, with 581.88M of 1B total supply circulating and 160.4M tokens unlocked in 2024, risks sell pressure. Regulatory scrutiny on DeFi could disrupt operations, while declining Google Trends interest signals waning retail hype. Weakening developer or community activity could further hinder growth, necessitating careful risk assessment.

Analyst Sentiment & Community Insights

Analysts are cautiously bullish on HFT. CoinMarketCap predicts a 2025 high of $0.338, while CoinCodex forecasts $0.47–$0.83. X posts highlight Hashflow’s undervalued $75.63M market cap and zero-slippage model, but Reddit threads express dilution concerns. The Fear & Greed Index at 66 (Greed) reflects optimism, though some traders see it as a sell signal. Google Trends shows moderate “Hashflow HFT” interest, with CoinGecko’s 4.2/5 community rating indicating strong support.

Is Hashflow a Good Investment?

Hashflow’s zero-slippage DEX model and multichain scalability offer long-term potential in DeFi. The HFT token’s governance and staking utility, coupled with the Hashverse, strengthen its case. However, dilution, competition, and regulatory risks temper optimism. This is not financial advice; investors should research thoroughly and consult advisors. The Hashflow investment potential remains promising for 2025–2030, but volatility demands caution.

Why Trade Hashflow on Phemex?

Phemex is a top-tier centralized exchange known for security, speed, and trader-focused innovation. Its tools cater to all traders:

- Spot Trading: Trade HFT and 100+ assets with deep liquidity.

- Futures Contracts: Access HFT futures with up to 100x leverage.

- Trading Bots: Automate HFT strategies with AI-powered bots.

- Phemex Earn: Earn passive income, potentially with HFT.

- Pulse (SocialFi): Engage in Web3 social trading for rewards.

HFT is listed on Phemex for spot and futures trading, offering flexibility for short-term and long-term strategies. Trade HFT on Phemex to leverage its advanced tools and liquidity.