Summary Box (Quick Facts)

-

Ticker Symbol: CLO

-

Chain: Cross-chain (EVM, Solana, Sui)

-

Total Supply: 1,000,000,000

-

Primary Use Case: Cross-chain DeFi (Swaps, Lending, Bridging)

-

Key Feature: Solves liquidity fragmentation across blockchains.

-

Availability on Phemex: Yes (Futures)

What Is CLO?

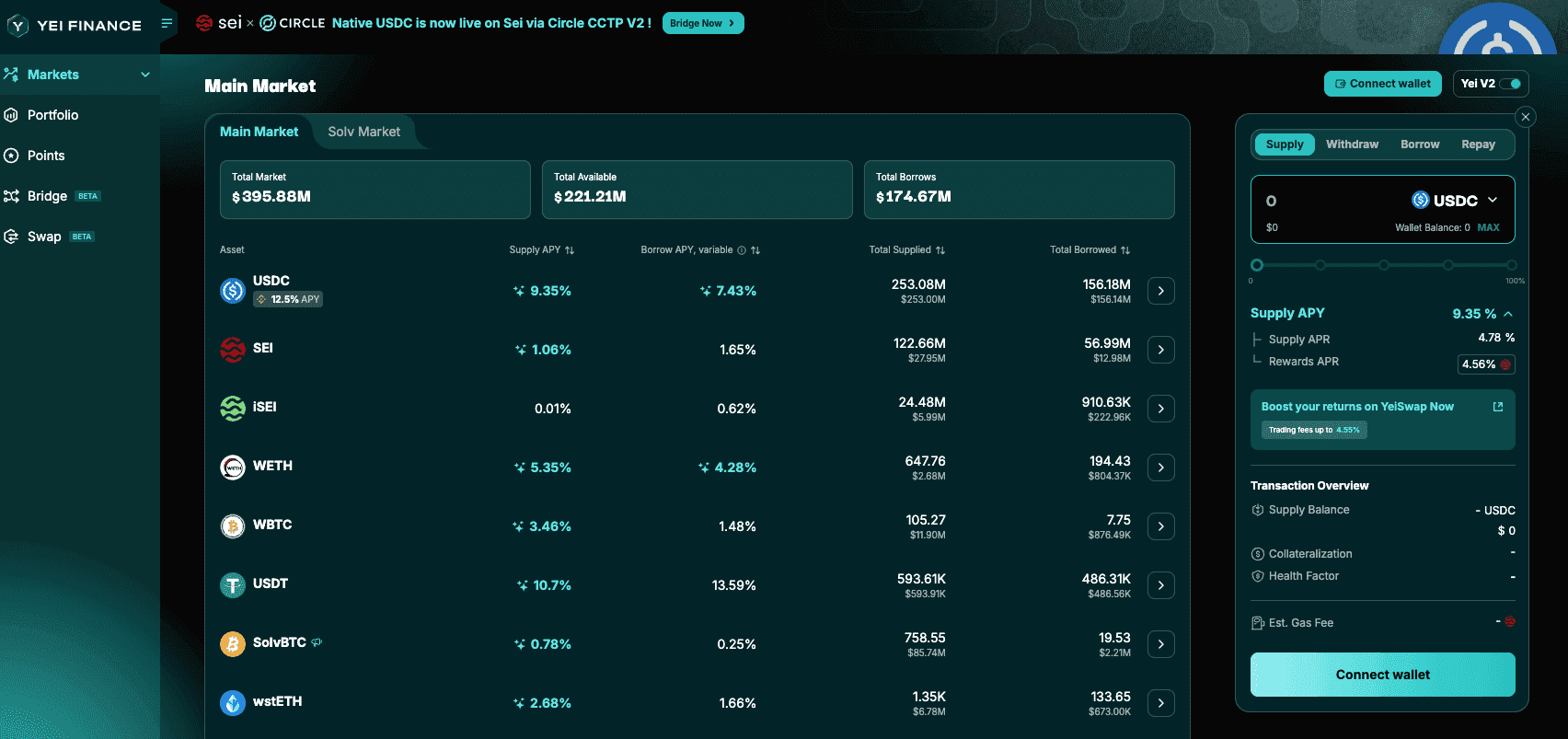

What is CLO? CLO is the native token of Yei Finance, a pioneering protocol designed to solve one of the biggest challenges in decentralized finance: liquidity fragmentation. In today's crypto landscape, every blockchain often operates in isolation, scattering liquidity and making it inefficient for users to move assets and seek yield across different networks.

To put it simply, Yei Finance explained, it acts as a universal hub for DeFi. It is being built to allow users to seamlessly swap, lend, and bridge assets across multiple chains without friction. By creating a unified ecosystem, Yei Finance enables flawless interactions between different DeFi applications, allows for the modular stacking of various yield sources, and provides a central application to track all cross-chain activities. This empowers both blockchain aficionados and strategic investors to pursue new opportunities efficiently and securely.

How Many CLO Are There?

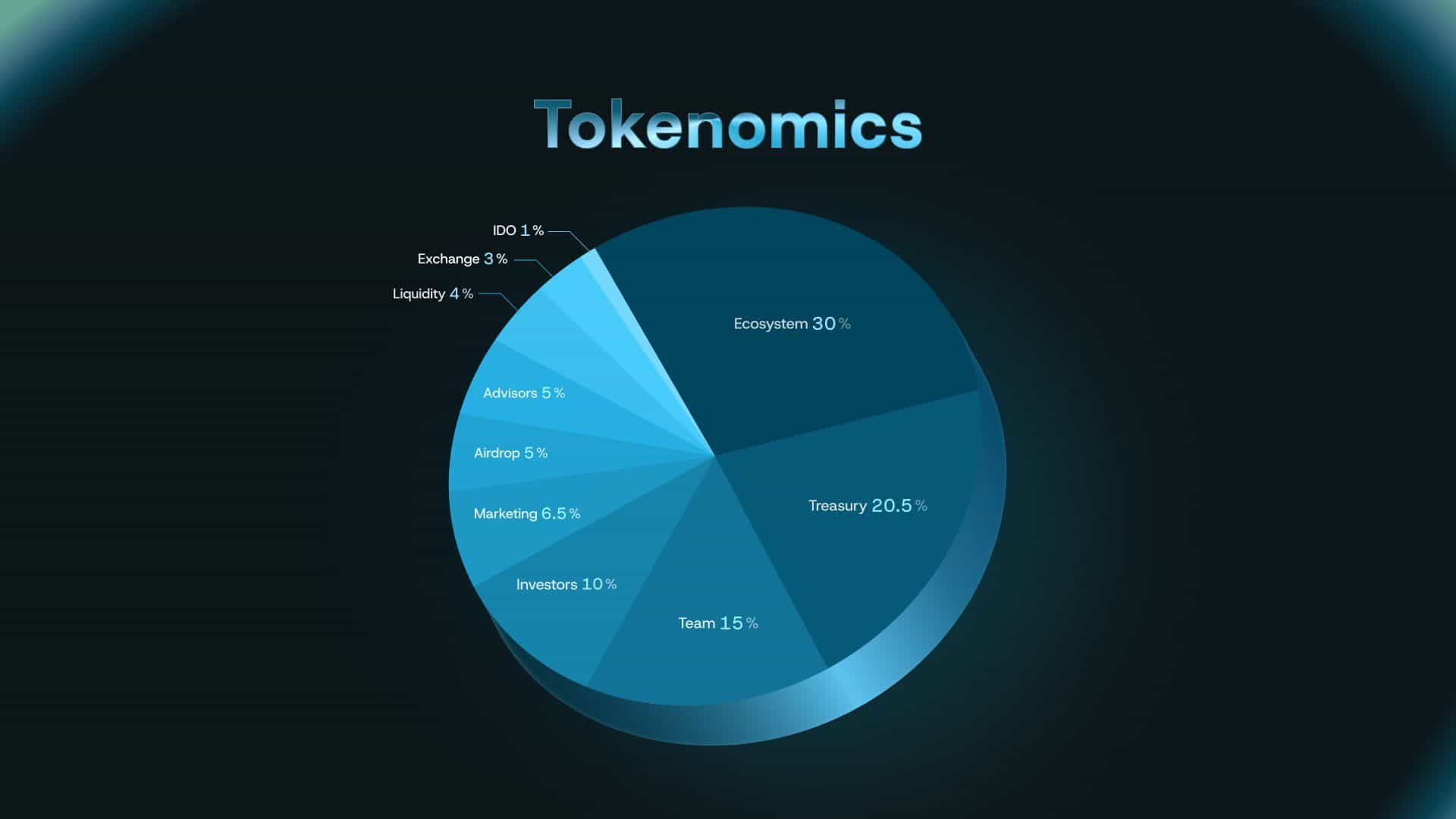

The total supply of CLO is capped at 1 billion tokens, creating a clear and finite limit for its ecosystem. This fixed supply ensures that the token is deflationary by design, as no new tokens can be minted beyond this amount.

The distribution of these tokens is strategically planned to foster long-term growth and decentralization:

-

Ecosystem & Community (35%): The largest portion is dedicated to the ecosystem (30%) for grants, liquidity provider incentives, and partnerships, plus an airdrop (5%) to reward early adopters and bootstrap the community.

-

Operations & Growth (27%): This includes a DAO-controlled treasury (20.5%) for operations and strategic investments, alongside a marketing allocation (6.5%) to drive user acquisition and brand growth.

-

Core Contributors & Backers (30%): This is allocated to the team (15%), early investors (10%), and advisors (5%) who provided initial funding and strategic guidance.

-

Market Liquidity (8%): A portion is reserved for on-chain liquidity pools (4%), exchange listings (3%), and an Initial DEX Offering (IDO) (1%) to ensure stable and deep markets from the start.

A unique feature of the CLO token launch is its airdrop claim mechanism, which directly impacts circulating supply. Early users have a choice: claim their full airdrop allocation immediately or wait 90 days to receive a 2.5x larger allocation. This model incentivizes long-term holding and staggers the release of new tokens into the market.

What Does CLO Do?

CLO is the fuel that powers the entire Yei Finance ecosystem. The primary CLO use case is to unify fragmented liquidity across the crypto world through its multi-faceted protocol.

Its core functions include:

-

Seamless Cross-Chain Operations: Yei Finance is designed to allow users to swap, lend, and bridge digital assets across different blockchains without complex, multi-step processes.

-

Governance: As the protocol’s governance token, CLO empowers its holders with the ability to vote on key decisions, such as protocol upgrades, fee structures, and treasury allocations. This ensures the platform evolves in a decentralized manner, guided by its community.

-

Staking: Users can stake their CLO tokens to earn rewards from protocol revenue. This aligns the financial incentives of token holders with the long-term growth and security of the Yei Finance ecosystem.

CLO vs. OpenEden

CLO (Yei Finance) and OpenEden both operate in the digital asset space but serve fundamentally different purposes. Yei Finance is a core DeFi protocol focused on unifying crypto-native assets, while OpenEden bridges traditional financial assets with the blockchain.

| Feature | CLO (Yei Finance) | OpenEden(EDEN) |

| Primary Use Case | Cross-chain DeFi: lending, swapping, & bridging. | Tokenization of Real-World Assets (RWA), like US T-Bills. |

| Asset Type | Native cryptocurrencies across multiple chains. | Tokenized real-world securities ($TBILL). |

| Core Product | A unified liquidity protocol to end fragmentation. | A platform to bring traditional financial assets on-chain. |

| Underlying Ecosystem | Operates within DeFi on EVM & non-EVM chains. | Bridges Traditional Finance (TradFi) with DeFi on Ethereum. |

| Target Audience | DeFi users, traders, and cross-chain yield seekers. | Institutional investors, DAOs, and Web3 treasuries. |

The Technology Behind CLO

The technical foundation of Yei Finance is its ambitious cross-chain architecture. The protocol is engineered to function across major EVM (Ethereum Virtual Machine) chains as well as non-EVM chains like Solana and Sui. This interoperability is critical to its mission of ending liquidity fragmentation.

To achieve this, Yei Finance will integrate leading cross-chain messaging layers such as Wormhole and LayerZero. These technologies enable secure and reliable communication between different blockchains, allowing the protocol to execute complex transactions (like swaps and loans) that span multiple networks. The roadmap also includes the development of a proprietary cross-chain decentralized exchange (DEX), a decentralized bridge, and yield optimization vaults.

Team & Origins

While specific details about the founders and core contributors of Yei Finance are not publicly disclosed, the project is backed by early investors and strategic advisors. This approach, where the team remains pseudonymous, is common in the decentralized finance space, prioritizing the protocol's technology and community-driven governance over the identities of its creators.

Key News & Events

The Yei Finance roadmap outlines several major milestones that are critical for its launch and growth. The project is currently building towards its Token Generation Event (TGE) and mainnet launch.

Key upcoming events include:

-

Q4 2025:

-

Launch of Yei Finance cross-chain lending markets and decentralized bridge.

-

Yei Finance mainnet deployment on major EVM-compatible chains.

-

Q1 2026:

-

Launch of the Yei Finance cross-chain DEX and proprietary messaging layer.

-

Expansion to major non-EVM chains, including Solana and Sui.

-

Introduction of cross-chain yield optimization vaults.

-

The airdrop for early community members will be a significant event, with its unique 2.5x reward multiplier for vesting.

Is CLO a Good Investment?

Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.

The CLO investment potential is closely linked to Yei Finance's ability to solve the significant problem of liquidity fragmentation in DeFi.

-

Market Positioning: If successful, Yei Finance could become essential infrastructure for the entire crypto ecosystem, positioning it for substantial growth. The clear and detailed roadmap provides a transparent outlook on its development plans.

-

Tokenomics: The fixed supply of 1 billion tokens and strategic allocations for ecosystem growth and community rewards create a strong foundation. The utility in governance and staking gives the token intrinsic value within its ecosystem.

-

Risks: As a new and ambitious project, Yei Finance faces significant execution risk. It must deliver on its complex technological promises in a competitive landscape. As with all cryptocurrencies, CLO will be subject to market volatility and potential regulatory risks.

In conclusion, CLO offers a compelling proposition for those who believe in a cross-chain future for DeFi. However, potential investors should conduct thorough research and carefully weigh the potential rewards against the inherent risks. For the latest CLO price information following its launch, you can check the Phemex platform.

How to Buy CLO on Phemex

For those interested in How to buy CLO after its launch, Phemex provides a secure and user-friendly platform. You can visit Phemex to Trade CLO and stay informed with the latest News about CLO as it becomes available.

FAQs

1. What problem does Yei Finance solve?

Yei Finance aims to solve liquidity fragmentation by creating a unified protocol that allows users to easily swap, lend, and bridge assets across different blockchains, both EVM and non-EVM.

2. What is the main utility of the CLO token?

The CLO token is used for governance, allowing holders to vote on the protocol's future, and for staking, which rewards users for helping secure the network and aligning with its growth.

3. When can I get CLO tokens?

The CLO Token Generation Event (TGE) is scheduled for Q4 2025. Following the launch, you will be able to trade CLO on Phemex. Explore Phemex Academy to learn more about preparing for new token launches.