Decentralized finance (DeFi) is revolutionizing financial systems, but security and stability remain critical challenges. Resolv (RESOLV) is a utility token powering the Resolv protocol, a DeFi platform designed to address these issues with innovative solutions. Its flagship product, the USR stablecoin, is pegged to the US dollar and backed by Ethereum (ETH) and Bitcoin (BTC), using a delta-neutral strategy for price stability. Resolv’s standout feature is its asset recovery mechanism, enabling ERC-20 token holders to recover stolen assets through a decentralized process, setting a new standard for DeFi security. Learn more about Resolv.

Resolv (RESOLV) is making waves in DeFi with its airdrop campaign, real-yield stablecoin model, and upcoming trading launch on Phemex. This guide explores the Resolv protocol, its features, and its role in DeFi, helping you understand why RESOLV is poised to make waves in the crypto community.

Quick Facts: RESOLV (RESOLV)

-

Ticker Symbol: RESOLV

-

Chain: Immutable

-

Contract Address: /

-

Circulating Supply: /

-

Total supply: 1,000,000,000

-

Primary Use Case: Governance and incentives within the Resolv protocol

-

Current Market Cap: /

❓ What Is Resolv Protocol?

The Resolv protocol is a DeFi platform focused on delivering secure, yield-generating stablecoin solutions. Unlike traditional stablecoins that rely solely on collateralization, Resolv employs a dual-tranche system to balance stability and profitability. Its USR stablecoin, backed by ETH and BTC, uses a delta-neutral strategy with futures to maintain a 1:1 dollar peg, ensur1ing resilience even during market volatility.

Resolv’s asset recovery mechanism tackles one of DeFi’s biggest pain points: hacks. In 2022, crypto losses exceeded $3.7 billion, per Chainalysis. Resolv allows users to convert ERC-20 tokens into “Vaulted Assets,” which can be recovered if stolen. Users file a claim within 48 hours, and a decentralized jury of experts reviews the case. If fraud is confirmed, assets are frozen and returned within 36 hours, offering unparalleled protection in DeFi.

How Does the Delta-Neutral Strategy Work?

Resolv’s delta-neutral strategy minimizes price volatility by taking offsetting positions in futures markets. For example, if ETH’s price drops, gains from short futures positions offset the loss, ensuring USR’s dollar peg. This approach not only stabilizes the stablecoin but also generates yields through futures and lending markets, which are shared with stakers and users, making USR a unique blend of security and profitability.

How Many RESOLV Tokens Are There?

Resolv (RESOLV) has a fixed total supply of 1,000,000,000 tokens, ensuring a non-inflationary framework that aligns with long-term governance and ecosystem development.

The token allocation is designed to balance immediate community incentives with sustainable protocol growth over time:

| Allocation Category | Percentage | Unlock Details |

|---|---|---|

| Airdrop (Season 1) | 10% | Fully unlocked at TGE (Token Generation Event); top wallets subject to vesting |

| Ecosystem & Community | 40.9% | Up to 10% unlocked at TGE; remainder vested over 24 months |

| Team & Contributors | 26.7% | 1-year cliff, followed by 30-month linear vesting |

| Investors | 22.4% | 1-year cliff, followed by 24-month linear vesting |

This structured vesting model reflects the project’s commitment to long-term alignment, ensuring that contributors and early supporters remain engaged while protecting the protocol from early liquidity shocks.

Importantly, with only a small portion of the supply unlocked at launch, market supply pressure will remain low initially — giving RESOLV room to price based on utility and demand, not just unlocks.

As more tokens gradually enter circulation, the RESOLV tokenomics are expected to support staking, governance, and ecosystem incentives in tandem.

What Does RESOLV Do?

Within the Resolv ecosystem, the RESOLV token plays a pivotal role in governance and incentivization. Token holders can propose and vote on changes to the protocol, influencing its development and strategic direction.

Additionally, RESOLV tokens may be used to incentivize participation in the protocol, such as providing liquidity or staking, thereby fostering a vibrant and engaged community.

⚔️ RESOLV vs Bitcoin

| Feature | RESOLV (RESOLV) | Bitcoin (BTC) |

|---|---|---|

| Core Purpose | Governance token for a delta-neutral stablecoin protocol | Decentralized digital currency and store of value |

| Use Case | Used in DeFi governance, incentives, liquidity support | Peer-to-peer payments, long-term wealth preservation |

| Consensus Mechanism | Built on Immutable; leverages smart contract infrastructure | Proof-of-Work (PoW) mining |

| Transaction Speed | High-speed, low-cost (via Immutable infrastructure) | Slower confirmations (~10 min per block) |

| Transaction Fees | Low gas fees due to Layer-2 scalability | Relatively high fees during network congestion |

| Stability Mechanism | Delta-neutral strategy (long spot + short perpetuals) for USR stablecoin | No stability mechanism; highly volatile |

| Supply Cap | 1,000,000,000 RESOLV | 21,000,000 BTC |

| Token Utility | Governance, staking incentives, DAO participation | Currency, collateral, inflation hedge |

| Inflationary Risk | Fixed max supply; no ongoing minting | Deflationary by design (halving every ~4 years) |

| Security Model | Secured by Immutable and smart contract audits | Secured by PoW mining and global node distribution |

| Decentralization Level | Protocol governed by DAO; development team active | Highly decentralized through global miner and node base |

| Market Position | Emerging DeFi infrastructure project | Top cryptocurrency by market cap, adoption, and liquidity |

The Technology Behind RESOLV

At its core, Resolv is not just another stablecoin project. It is a meticulously engineered ecosystem that reimagines how decentralized currencies can maintain their peg without being backed by fiat reserves or relying on overcollateralized debt positions (like DAI).

Instead of conventional mechanisms, Resolv uses a delta-neutral portfolio, a strategy well-known among hedge funds but rarely seen in on-chain implementations. Here's how it works:

-

Collateral in Volatile Assets: Users deposit major cryptocurrencies like ETH and BTC as collateral.

-

Hedging with Derivatives: These long spot positions are hedged by taking short positions in perpetual futures markets, making the portfolio delta-neutral.

-

Stablecoin Minting: Users can then mint USR, a stablecoin that remains pegged to the U.S. dollar, backed by this balanced exposure.

This means the protocol can absorb volatility without the need to constantly sell assets or maintain massive reserves of fiat.

Resolv also introduces the Resolv Liquidity Pool (RLP) — an opt-in insurance layer. RLP participants earn protocol fees in exchange for absorbing some of the tail risks (e.g., funding rate mismatches or liquidations during black swan events). This modular design creates a self-balancing mechanism where risks are openly priced and assumed by willing participants, fostering a more robust DeFi architecture.

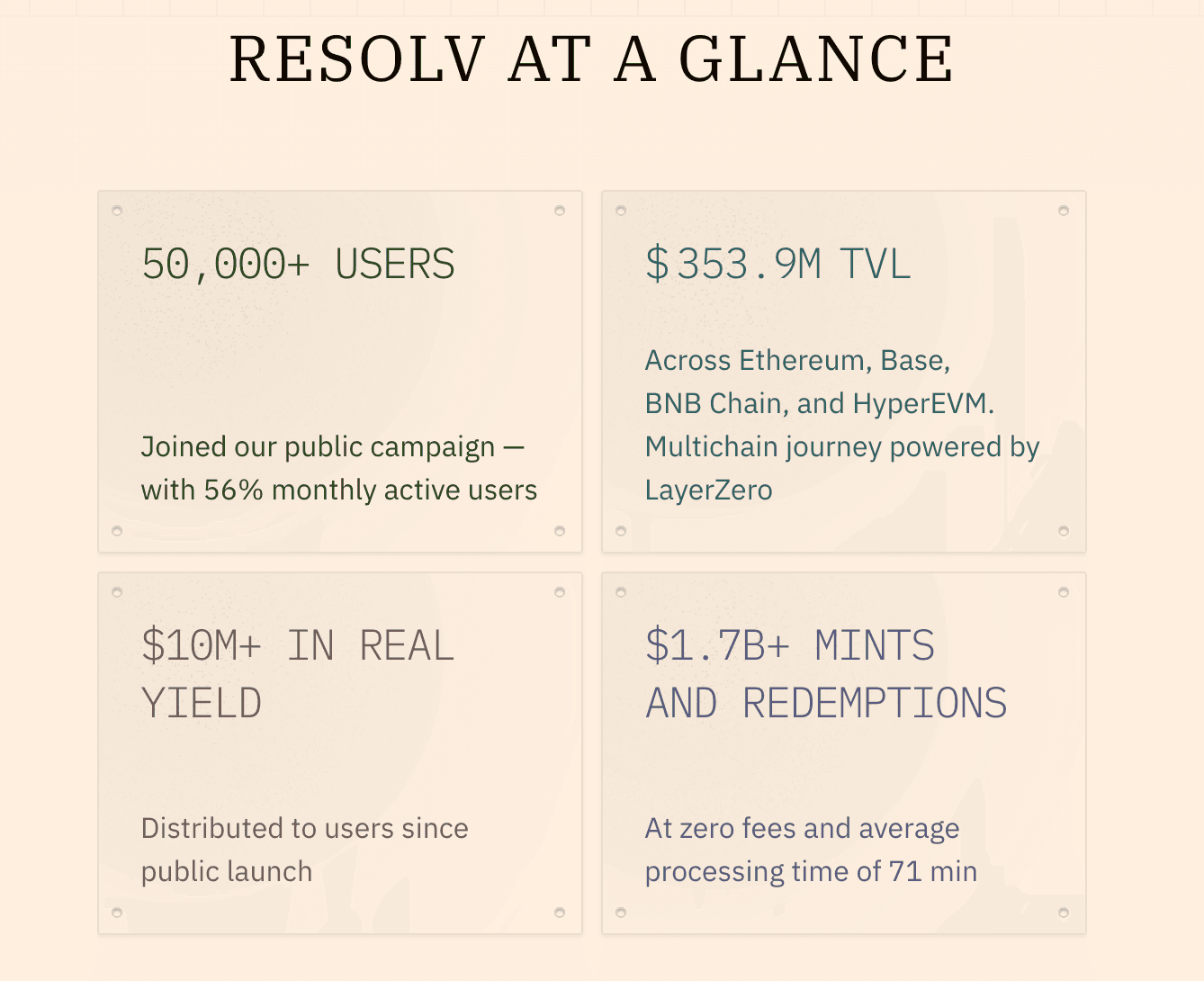

RESOLV by the Numbers(Data as of June 09, 2025)

As of its pre-token launch phase, Resolv has already demonstrated notable on-chain activity:

-

50,000+ users participated in its public campaign, with ~56% remaining active monthly

-

$353.9M in total value locked (TVL) across Ethereum, Base, BNB Chain, and HyperEVM via LayerZero

-

$10M+ in real yield distributed to users since launch

-

$1.7B+ in stablecoin mints and redemptions, processed with zero fees and a 71-minute average time

? Team & Origins

Resolv was founded in 2023 by a team of experienced DeFi builders: Ivan Kozlov, Tim Shekikhachev, and Fedor Chmilevfa. The trio brings together a background in decentralized finance, risk engineering, and smart contract development — skills that lie at the core of Resolv’s delta-neutral architecture and on-chain asset strategy.

From the beginning, the team positioned Resolv not just as a product, but as a solution to one of crypto’s biggest unresolved challenges: creating a stable, scalable digital dollar without relying on fiat reserves.

The project began its development quietly, building its infrastructure across Ethereum Layer 2s and cross-chain protocols like LayerZero, before going public with its testnet and stablecoin mechanics in early 2024.

In April 2025, Resolv raised $10 million in seed funding from a group of respected Web3 investors, including CyberFund, Maven 11, and a small group of DeFi-native capital allocators. According to Media, the raise reflects growing institutional appetite for next-generation stablecoin models that emphasize real yield and on-chain transparency.

? Key News & Events

? April 2025 – Resolv Raises $10M to Build On-Chain Stablecoin Infrastructure

In April 2025, Resolv Labs completed a $10 million seed funding round to support its vision for a fully on-chain, delta-neutral stablecoin system. The round was led by CyberFund and Maven 11, with funds allocated toward:

-

Expanding deployment across Ethereum L2s and LayerZero-compatible chains

-

Building the Resolv Liquidity Pool (RLP) as an internal risk-balancing mechanism

-

Further development of the USR stablecoin, backed by BTC, ETH, and derivatives

? May–June 2025 – Ongoing Airdrop Campaigns and Listing Incentives

To drive early adoption and community participation, Resolv launched a multi-phase airdrop campaign for its native RESOLV token. This includes both wallet-based retroactive rewards and activity-based distributions across testnet, mainnet, and ecosystem partners.

As part of the token generation event (TGE) and listing, Resolv announced.

? RESOLV Listing Feast: $60,000 Candy Bomb!

Users can deposit and trade RESOLV to share in a $60,000 candydrop pool — designed to reward both early supporters and active participants.

This campaign complements the broader rollout of the RESOLV token and supports deeper market participation ahead of its official public trading debut.

⏳ Campaign timing: Around token launch (June 2025)

? New to Phemex? Unlock Up to 4,800 USDT in Mystery Box Rewards

If you haven’t signed up for Phemex yet, now’s the perfect time.

New users are eligible to claim a Mystery Box worth up to 4,800 USDT in welcome rewards.

? All it takes is a few simple steps:

-

Create your Phemex account

-

Complete basic tasks like deposits or trades

-

Open your Mystery Box and see what you win

Don’t miss the chance to start trading RESOLV with a head start.

RESOLV Investment Potential: Risk & Reward

This is not financial advice. Always DYOR.

When evaluating the RESOLV investment potential, we must weigh several dimensions:

✅ Bullish Factors

-

First-Mover Advantage in Delta-Neutral Stablecoins

While algorithmic stablecoins like TerraUSD failed spectacularly, Resolv takes a more disciplined, hedge-fund-style approach to price stability. If this works, Resolv could set a new standard for stablecoin mechanics. -

Strong Backing and Team

With a $10M seed round and backing from respected crypto investors such as CyberFund and Maven 11, the project is not flying blind. The founding team has clear domain expertise in DeFi, derivatives, and risk systems. -

Yield-Bearing Mechanics

RESOLV stakers and LPs can earn protocol fees, which may appeal to passive investors. As TVL (total value locked) grows, yield dynamics may become more attractive. -

Governance Power

RESOLV is a true governance token, meaning holders can vote on treasury allocation, USR collateral adjustments, and more. If the protocol gains adoption, these governance rights could become quite valuable. -

Narrative Alignment

Resolv aligns with macro trends such as “Real Yield,” “On-chain Derivatives,” and “Stablecoin 3.0” — themes investors are closely watching in 2025.

⚠️ Bearish Considerations

-

Complex Mechanism Risk

While delta-neutral strategies are common in TradFi, translating them to crypto introduces smart contract risks, oracle dependencies, and liquidation sensitivity. -

Early-Stage Volatility

As a newly launched token, RESOLV may experience wild price swings. With limited circulating supply initially, any major buy/sell event can trigger sharp movements. -

Regulatory Fog

Stablecoins remain under heavy scrutiny by regulators. Although USR is not fiat-backed, its association with derivatives and financial engineering could raise concerns in certain jurisdictions.

How to Buy RESOLV

Ready to get your hands on RESOLV?

-

Create an account on Phemex

Sign up and complete KYC to access trading and airdrop eligibility. -

Deposit crypto or fiat

Fund your account with USDT, ETH, or fiat using your preferred payment method. -

Buy RESOLV

Go to the spot trading page and search for the RESOLV/USDT pair. Trading opens at 13:10 UTC on June 10, 2025. -

Claim airdrop rewards

Trade or deposit at least 100 USDT worth during the listing event (June 10–17 UTC) to receive exclusive RESOLV rewards.

Final Thoughts: Should You Get Involved?

Resolv (RESOLV) represents more than just a new token launch — it signals a broader shift in how the crypto world approaches stability, governance, and composable finance. By combining delta-neutral mechanics with a scalable ecosystem design, Resolv is aiming to tackle some of DeFi’s toughest long-term challenges.

That said, it’s still early days. With a fixed supply, structured vesting, and real on-chain traction, RESOLV enters the market with strong fundamentals — but also with the volatility and unknowns typical of emerging protocols.

If you're a trader seeking short-term opportunities, a builder watching stablecoin innovation, or a long-term holder exploring new governance layers, RESOLV deserves a spot on your radar.

And with its launch campaign going live on Phemex — complete with rewards and trading — it’s also a moment where early curiosity might just be worth acting on.

Disclaimer:

Cryptocurrencies are subject to high market risk and volatility. This content is for informational purposes only and does not constitute financial or investment advice. Always conduct your own research and consult with a licensed financial advisor before making investment decisions. Phemex does not guarantee the performance of any asset. Trading and holding cryptocurrencies may result in loss of capital.