Key Takeaways

-

What is MegaETH (MEGA)?: MegaETH is an Ethereum Layer-2 (L2) blockchain designed to deliver massive throughput and real-time performance for decentralized applications, rivaling the speed of centralized web services.

-

Core Problem Solved: It addresses the critical trade-off between speed and decentralization. By using a novel approach called Stateless Validation, MegaETH allows for high throughput without requiring validators to run expensive, data-center-grade hardware.

-

Groundbreaking Technology: The protocol uses "witnesses" to allow anyone with a basic laptop to validate the network. It further enhances security through a Day 1 dual-client validation partnership with Pi Squared, ensuring mathematical correctness and redundancy.

-

Tokenomics: MEGA has a total supply of 10 billion tokens. 5% of this supply was allocated for a public sale structured as an English auction, aiming for wide distribution.

-

Primary Use Case: To power a new generation of demanding on-chain applications, such as high-frequency DeFi, real-time gaming, and other dApps that require ultra-low latency.

Introduction to MegaETH: Redefining Blockchain Performance

A fundamental challenge has long haunted blockchain architecture: the faster you make a network, the harder and more expensive it becomes for anyone to verify its integrity. This dilemma, often part of the "blockchain trilemma," creates a difficult trade-off. High-performance chains typically demand powerful, expensive hardware for their validators, centralizing the network into the hands of a few entities who can afford to run data center operations. This forces a choice: high throughput or accessible, decentralized validation—but rarely both.

MegaETH emerges as a project that directly confronts this challenge. As an Ethereum Layer-2 scaling solution, its goal is not just to be fast, but to be verifiable for everyone. While its core infrastructure is designed to run on powerful machines to achieve throughput levels an order of magnitude higher than existing EVM chains, its validation process is ingeniously designed to be accessible to anyone with a standard laptop and an internet connection.

This is made possible through its core innovation: Stateless Validation. This guide provides a comprehensive overview of MegaETH, its revolutionary approach to verifiability, its unique dual-client architecture, its tokenomics, and its position in the competitive L2 landscape. For those looking to deepen their crypto knowledge, Phemex Academy offers a wealth of educational resources.

Summary Box (Quick Facts)

-

Ticker Symbol: MEGA

-

Chain: Ethereum Layer-2

-

Contract Address: To be announced (Network is in development)

-

Total Supply: 10,000,000,000 MEGA

-

Primary Use Case: Powering a high-performance, real-time blockchain for DeFi and other demanding applications.

-

Availability on Phemex: No (As of October 2025)

How Many MEGA Are There? Tokenomics and Public Sale

MegaETH's tokenomics are structured to support its long-term growth and decentralization, with a fixed total supply of 10 billion MEGA tokens.

Token Distribution and Public Sale

To ensure a fair and wide distribution from the outset, the project allocated 500 million MEGA tokens, or 5% of the total supply, for a public sale. The sale was conducted on the Ethereum Mainnet using USDT as the payment method. Key details of the sale include:

-

Sale Format: An English Auction with a defined ceiling price, allowing the market to determine the initial valuation within a set range.

-

Price Range: The auction started at a price of $0.0001 per token and had a ceiling price of $0.0999.

-

Participation: The sale was open to a global audience, with minimum and maximum bid amounts set to accommodate a range of investors.

-

Lock-Up Provisions: To align long-term interests, U.S. accredited investors were subject to a mandatory one-year lock-up on their tokens, for which they received a 10% discount. This lock-up was optional for non-U.S. participants.

Beyond the public sale, the remaining token supply is allocated to the team, advisors, ecosystem development, and investor rounds, ensuring resources are available for the protocol's continued innovation and adoption.

What Does MEGA Do? The Token's Role in the Ecosystem

The MEGA token is integral to the functioning, security, and governance of the MegaETH network. Its primary MEGA use case is to power the high-performance L2 ecosystem it aims to build. The token will likely serve several key functions:

-

Staking and Security: Token holders will be able to stake MEGA to participate in the network's consensus and security mechanisms, such as sequencer selection or validation services, earning rewards for their contributions.

-

Gas Fees: While MegaETH is designed for high efficiency, transactions will still require fees to prevent spam and compensate network operators. The MEGA token will likely be used to pay for these gas fees.

-

Governance: As the protocol matures, the MEGA token is expected to grant holders the right to participate in governance, voting on key parameters, upgrades, and the allocation of ecosystem funds.

-

Ecosystem Enablement: The token will be the primary medium of exchange and value accrual within the dApps and services built on top of MegaETH, from DeFi protocols to NFT marketplaces and gaming platforms.

MEGA vs. Ethereum L1: A Tale of Two Philosophies

Comparing MegaETH to its foundational layer, Ethereum, highlights the symbiotic relationship between L1s and L2s. They are not direct competitors but rather complementary systems with different design goals.

| Feature | MegaETH (L2) | Ethereum (L1) |

| Primary Goal | Execution and Throughput: To provide a hyper-fast, low-cost environment for applications to run at scale. | Security and Decentralization: To act as a global, decentralized settlement layer that is incredibly secure and censorship-resistant. |

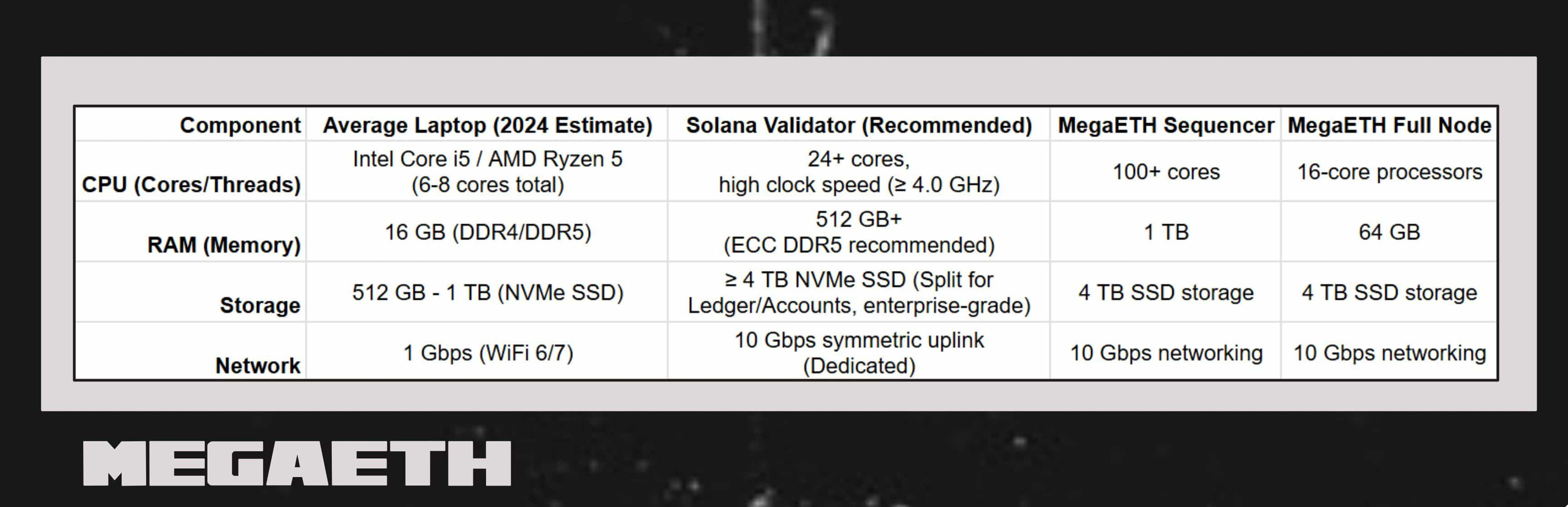

| Hardware | Sequencers require data-center grade hardware (100+ cores, 1TB RAM) for maximum performance. Validators, however, use consumer-grade laptops. | Validators have moderate hardware requirements, designed to be accessible to as many individuals as possible to maximize decentralization. |

| Speed & Fees | Designed for ultra-low latency (sub-second block times) and minimal transaction fees to support high-frequency applications. | Slower block times (12 seconds) and higher fees, which makes it prohibitively expensive for certain types of applications. |

| Validation Model | Uses Stateless and Dual-Client Validation, where the heavy lifting is done by the sequencer and proofs are verified by lightweight nodes. | Traditional stateful validation, where every validator must process every transaction and maintain a full copy of the entire blockchain state. |

In essence, MegaETH offloads the intensive work of transaction execution from Ethereum, while still relying on Ethereum as its ultimate arbiter of truth and security.

The Technology Behind MEGA: Solving the Validation Dilemma

MegaETH’s most significant contribution is its novel approach to blockchain validation, which allows it to achieve elite performance without sacrificing decentralization.

The Problem: High Throughput Demands Heavy Hardware

MegaETH is engineered for speed, utilizing powerful, data-center-grade machines for its sequencers (100+ cores, 1TB of RAM). Even its full nodes require enthusiast-level hardware. If validation required the same, the network would be centralized. True decentralization requires that an average user can trustlessly verify the system is following the rules without specialized equipment.

The Solution: Stateless Validation

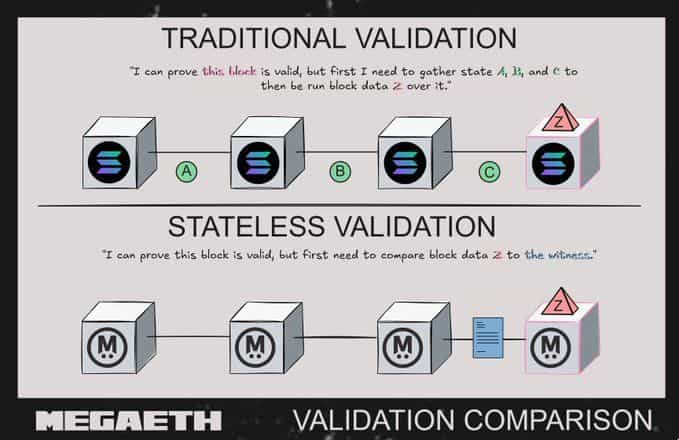

This is where MegaETH’s core innovation, Stateless Validation, comes in. It shifts the burden of validation away from storage and computation. Instead of needing to store the entire blockchain state, stateless validators only need to check that each new block is valid against the previous state. The key insight is simple: you don't need a map of the whole world to verify a route from A to B; you just need the relevant section of the map.

Comparing traditional, stateful validation to MegaETH's stateless model where the sequencer is generating cryptographic proof of all prior block data so that the validator need only the witness (blue) and the current block data to verify it's validity

Here’s how it works:

-

The Witness: The MegaETH sequencer provides stateless validators with a "witness." This is a cryptographic proof containing only the small pieces of state data required to execute the transactions in a specific block (e.g., Alice's and Bob's account balances for a transfer).

-

Data Authentication: The validator uses the witness to compute a state root. If this computed root matches the trusted state root from the previous block, it proves the data provided by the sequencer is authentic.

-

Execution: Using this verified data, the validator executes the transactions in the block.

-

Final Verification: The validator computes a new state root based on the results of the transactions and confirms it matches what the sequencer proposed for the new block.

This entire process happens without the validator ever needing to access or store the full blockchain state. Furthermore, MegaETH distributes this work across a network of nodes, with each validator only checking a portion of new blocks, drastically reducing hardware requirements to just 2 CPU cores, 1 GB of RAM, and zero permanent storage.

Pushing Further: Dual-Client Validation with Pi Squared

MegaETH enhances its security with a second, independent stateless validation implementation from day one. This is achieved through a partnership with Pi Squared, a project that uses a specialized compiler (LLVM-K) to transform mathematical specifications of the EVM (known as KEVM) into high-performance executable code.

This creates a dual-client validation architecture:

-

MegaETH’s own stateless validators and Pi Squared's network of verifiers both receive the same witness from the sequencer.

-

Simultaneously and independently, both clients compute what the new state root should be.

-

For a block to be considered valid, both systems must arrive at the exact same result.

This creates an exceptional level of security and redundancy, as a malicious state transition would need to fool two entirely independent and mathematically precise implementations.

Team & Origins

MegaETH was co-founded by a team of experienced researchers and engineers, including Yilong Li, Lei Yang, and Shuyao Kong. The project has garnered significant attention and credibility within the blockchain research community, attracting backing from prominent investors like Dragonfly Capital and receiving praise from Ethereum co-founder Vitalik Buterin. This strong technical foundation and industry support are key pillars of the project's development.

Key News & Events

-

Public Sale (October 2025): The project conducted a public sale for 5% of its total token supply, utilizing an English auction format to establish a market-driven initial price.

-

Partnership with Pi Squared: The announcement of a day-one dual-client validation architecture with Pi Squared was a major technical milestone, differentiating MegaETH from nearly all other blockchains.

-

MiCA-Compliant Whitepaper: The release of a whitepaper compliant with the European Union's Markets in Crypto-Assets (MiCA) regulations signals a proactive approach to regulatory clarity and institutional adoption.

Is MEGA a Good Investment?

Evaluating MegaETH's investment potential requires weighing its ambitious technological vision against the inherent risks of an early-stage project.

The Bull Case for MegaETH

The primary argument in favor of MegaETH is that it offers a compelling solution to one of the most fundamental problems in the blockchain space. If it successfully delivers on its promise of high throughput combined with decentralized validation, it could attract a massive ecosystem of developers building next-generation dApps. The dual-client validation model provides a level of security that is rare for new networks, which could appeal to risk-averse institutional capital. The project's strong technical team and high-profile backers add significant credibility.

Risks and Considerations

As with any pioneering technology, there is significant execution risk. The concepts of stateless and dual-client validation are complex, and their real-world implementation at scale remains to be proven. The L2 market is also intensely competitive, with numerous well-funded and established players. Finally, the success of the MEGA token will be tied to the network's ability to attract users and developers, a process that takes time and effort.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves significant risks, and you should only invest what you can afford to lose. The market is highly volatile, and past performance is not indicative of future results.

How to Buy MEGA on Phemex

As of October 2025, MegaETH (MEGA) is not yet available for trading on Phemex or other major exchanges. The project's initial token distribution occurred through its public sale. Investors interested in acquiring MEGA should monitor official project announcements for information on future exchange listings.

FAQs

What is stateless validation?

Stateless validation is a method that allows a blockchain validator to verify new blocks without needing to store the entire history or "state" of the blockchain. They are provided with a small, proven piece of the state (a "witness") needed for a specific transaction, making validation possible on very low-end hardware.

What makes MegaETH different from other Layer-2 solutions?

MegaETH's primary differentiators are its unique combination of extremely high throughput (enabled by powerful sequencers) and its accessible, decentralized validation (enabled by stateless and dual-client models). This architecture aims to solve the speed-vs-decentralization trade-off more effectively than its competitors.

What is the total supply of MEGA tokens?

The total fixed supply of MEGA tokens is 10 billion.

What is dual-client validation?

Dual-client validation is a security measure where two independent software implementations of the same protocol are used to verify transactions. A block is only confirmed if both clients agree on the outcome, significantly reducing the risk of bugs or malicious attacks.

Ready to continue your crypto journey? Explore Phemex Academy to deepen your understanding of blockchain technology, learn advanced trading strategies, and build your wealth safely.