The global cloud computing market is a behemoth, an industry dominated by a few powerful incumbents like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These centralized platforms form the backbone of the modern internet, providing the storage, computing power, and services that underpin countless businesses. However, this concentration of power has led to concerns around cost, vendor lock-in, and single points of failure. In response, a new model is emerging from the Web3 space: Decentralized Physical Infrastructure Networks, or DePIN.

Among the projects exploring this new frontier is Impossible Cloud, a platform designed to offer enterprise-grade, decentralized cloud services. With its native utility token, ICNT, the project aims to build a global network of professional data centers, coordinated by a blockchain-based protocol. This article provides a comprehensive and neutral overview of Impossible Cloud, exploring its technology, tokenomics, and position within the competitive cloud industry. It is an examination of an ambitious project seeking to provide a viable alternative to the traditional cloud paradigm.

Quick Facts: Impossible Cloud (ICNT) at a Glance

-

Ticker Symbol: ICNT

-

Chain: Base

-

Contract Address: 0xE0Cd4cAcDdcBF4f36e845407CE53E87717b6601d

-

Circulating Supply: Approximately 167.22 Million ICNT

-

Max Supply: 700,000,000 ICNT

-

Primary Use Case: A utility token for facilitating payments and security within a decentralized cloud network.

-

Current Market Cap: /

-

Availability on Phemex: Coming soon.

What Is Impossible Cloud (ICNT)?

To begin, what is Impossible Cloud? At its core, Impossible Cloud is a decentralized cloud storage and service platform built to serve enterprise clients. It operates by creating a distributed network from the underutilized capacity of existing, professional-grade data centers. Instead of building its own physical infrastructure, it acts as an orchestrator, pooling resources from multiple independent providers to create a single, unified cloud service offering.

The problem the project seeks to address is multifaceted. The current cloud market structure, often described as an oligopoly, presents several challenges for businesses:

-

High Costs: Pricing structures, particularly for data egress (transferring data out of the cloud), can be complex and expensive.

-

Centralization Risks: Relying on a single provider creates systemic risk. An outage in a major cloud region can impact thousands of services simultaneously.

-

Vendor Lock-In: Migrating large-scale infrastructure from one cloud provider to another is often a costly and technically complex endeavor, discouraging competition.

Impossible Cloud's approach is to use decentralization as a tool to mitigate these issues. By leveraging a distributed network of providers, it aims to reduce operational overhead and offer more competitive pricing. ICNT explained in this context, is the native token that facilitates the economic operations of this network. It functions as the primary mechanism for payments to infrastructure providers and for securing network participation.

The project positions itself within the DePIN sector, which focuses on using blockchain and crypto-economic incentives to build and manage real-world physical infrastructure. Unlike purely digital DeFi applications, DePIN projects like Impossible Cloud represent a tangible link between the blockchain world and physical hardware services.

How Many ICNT Tokens Are There?

The tokenomics of a project are fundamental to its economic design and sustainability. The ICNT token operates on a clear and finite supply model.

The maximum supply of ICNT is capped at 700,000,000 tokens. This is a fixed limit, meaning no additional tokens can be created or minted in the future. This hard cap introduces an element of scarcity into the economic model.

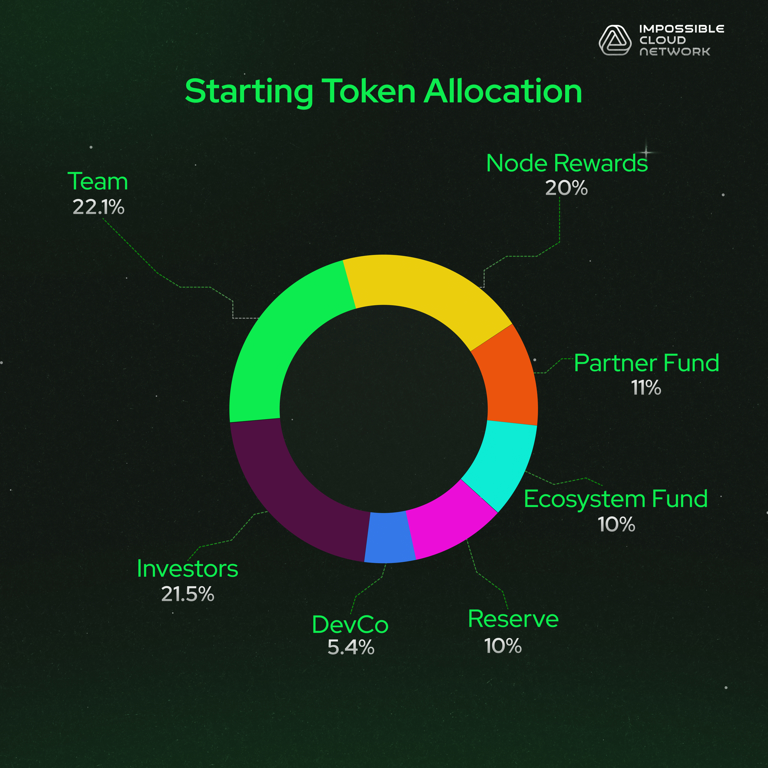

Of this total, the circulating supply is a smaller subset, currently around 167.22 million ICNT. The remaining non-circulating tokens are allocated to various pools, including the team, advisors, ecosystem treasury, and early investors. These tokens are subject to predetermined vesting schedules, which are designed to release the supply gradually over several years. This is a standard practice intended to align the long-term incentives of all stakeholders and prevent sudden supply shocks to the market. A detailed breakdown of the allocation and vesting schedule can be found in the project's official whitepaper documentation.

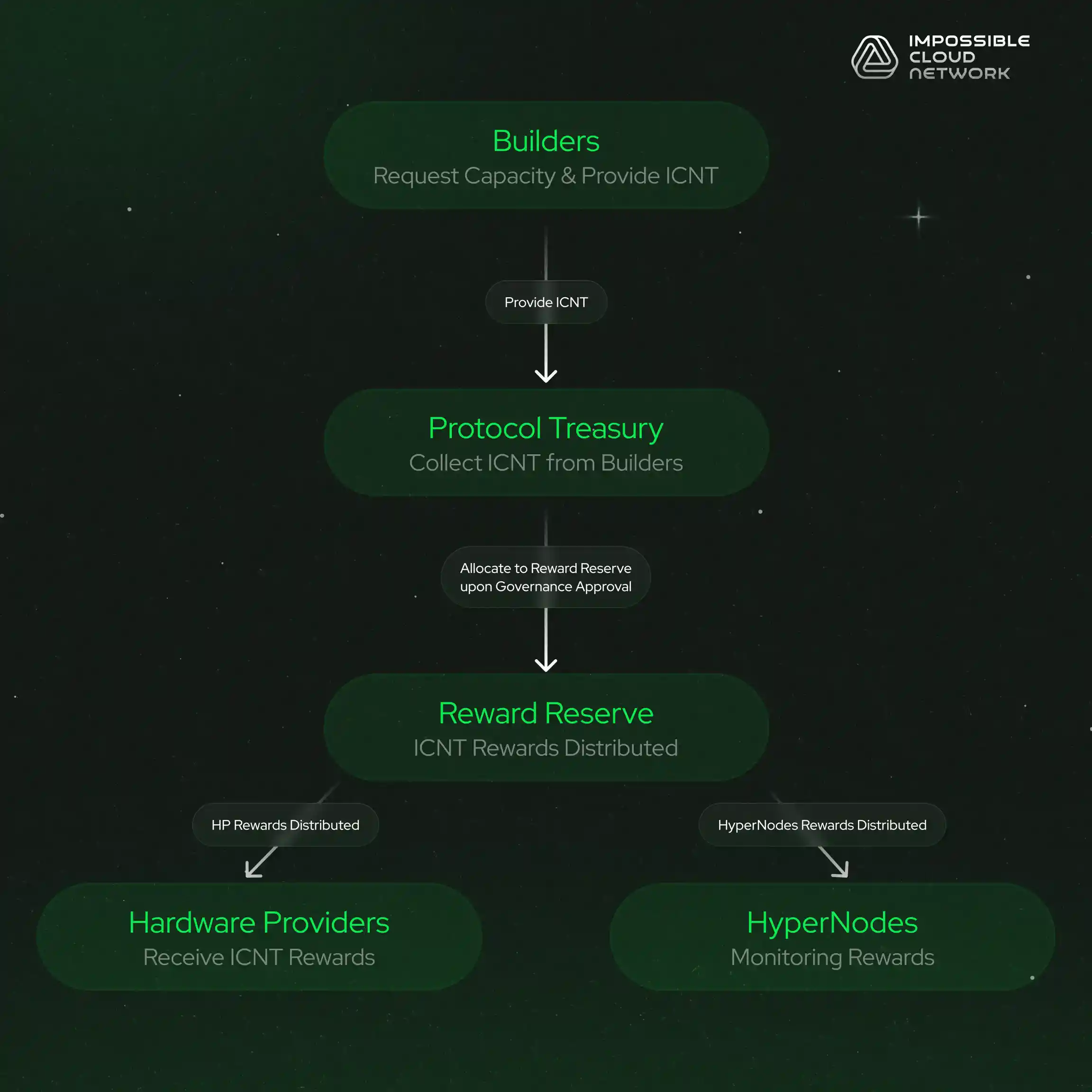

An important aspect of ICNT's economic model is its connection to platform revenue. Impossible Cloud serves its enterprise customers by billing them in traditional fiat currencies such as USD and EUR, a strategic choice to simplify adoption for Web2 businesses. A portion of this revenue is then programmatically used to purchase ICNT tokens from the open market. These acquired tokens are then distributed to the network's Storage Providers as payment for their services.

This creates a direct relationship between platform usage and demand for the token:

-

Increased customer adoption leads to higher fiat revenue.

-

Higher revenue results in larger-scale ICNT buybacks from the market.

-

This market activity is intended to support the token's value, which in turn helps incentivize high-quality data centers to join and secure the network.

This model differs from simple transactional burning, as it directly recycles real-world revenue back into the protocol's native economy to reward its participants.

What Does the ICNT Token Do?

The utility of a token determines its role and necessity within its ecosystem. The ICNT use case is multifaceted, serving critical functions in the operation, security, and economy of the Impossible Cloud network.

The token's functions can be broken down into three main categories:

-

Medium of Exchange for Providers: While customers pay in fiat, the backend of the network operates on ICNT. As described above, fiat revenue is converted into ICNT through market purchases. This ICNT is then used as the sole currency for compensating the data center operators (Storage Providers) who contribute their storage and compute resources to the network. This design ensures that the ICNT token has a constant source of utility-driven demand that is directly proportional to the platform's commercial success.

-

Collateral and Network Security (Staking): To qualify as a Storage Provider on the Impossible Cloud network, data centers must meet strict performance criteria known as Service Level Agreements (SLAs). To guarantee compliance with these standards for uptime and data availability, providers are required to stake a specific amount of ICNT as collateral. If a provider fails to meet their obligations, a portion of this staked collateral can be "slashed" or forfeited as a penalty. This staking mechanism serves two purposes: it financially incentivizes reliability and high performance, and it removes a portion of the ICNT supply from active circulation, which can impact the token's supply-demand dynamics.

-

Potential for Future Governance: The long-term vision for Impossible Cloud includes the implementation of a decentralized governance system. In such a system, holders of the ICNT token would gain the ability to participate in key decisions regarding the protocol's future. This could include voting on network upgrades, changes to fee structures, or the allocation of funds from the ecosystem treasury. This would evolve ICNT from a purely functional utility token to one that also represents a stake in the governance of the network.

For individuals and institutions interested in engaging with this ecosystem, the ability to trade ICNT on established platforms is essential for liquidity and access. The token's forthcoming listing on Phemex represents a step towards broader market accessibility.

ICNT vs. Filecoin: A Comparative Analysis

To better understand Impossible Cloud's positioning, it is useful to compare it not to a store-of-value asset like Bitcoin, but to another major project in the decentralized storage space: Filecoin (FIL). Both projects aim to decentralize data storage, but they employ different technologies and target different market segments.

| Feature | Impossible Cloud (ICNT) | Filecoin (FIL) |

| Core Technical Focus | Focuses on high-performance, S3-compatible object storage designed for active use cases, with plans for compute and other services. | A highly distributed marketplace for data storage, with a strong emphasis on long-term, archival, and "cold" storage use cases. |

| Target Market | Primarily targets Web2 and Web3 enterprises seeking a direct, cost-effective alternative to AWS S3, with fiat payment options. | Caters primarily to Web3-native users and developers who are comfortable operating within a fully crypto-native economic system. |

| Economic Model | Utilizes a hybrid fiat-to-crypto model. Fiat revenue is used to buy ICNT on the market to pay providers. | A closed-loop crypto economy where both payments from users and rewards to providers are conducted exclusively in the FIL token. |

| Decentralization Type | A "federated" or "curated" model. It relies on a vetted network of professional data centers to ensure enterprise-level performance. | A "permissionless" model. It allows anyone with the required hardware to become a storage provider, maximizing decentralization. |

| Primary Value Prop. | Aims to offer performance and reliability on par with centralized clouds, but at a significantly lower price point. | Offers extreme censorship resistance and data permanence through its hyper-decentralized and geographically distributed network. |

In summary, the two projects address different needs. Filecoin is structured as a vast, resilient, and permissionless public data archive. Impossible Cloud is architected as a performance-oriented, enterprise-focused cloud services provider that prioritizes ease of adoption for traditional businesses.

The Technology Behind Impossible Cloud

Impossible Cloud's technical architecture is a pragmatic blend of established Web2 standards and decentralized Web3 components.

The on-chain activity for the ICNT token is managed on Base, an Ethereum Layer 2 (L2) network developed with support from Coinbase and built on the open-source OP Stack. The selection of Base offers several strategic advantages. It allows the project to inherit the security and decentralization of the Ethereum mainnet while benefiting from the L2's high transaction speeds and low fees. This makes on-chain operations like provider payments and staking transactions both efficient and economical.

The core of the customer-facing service, however, is its Amazon S3-compatible API. Amazon's Simple Storage Service (S3) has become the de facto industry standard for object storage. A vast number of applications, tools, and developer workflows are built to integrate with the S3 API. By offering full compatibility, Impossible Cloud provides a near-seamless migration path for existing businesses. A developer can switch from AWS S3 to Impossible Cloud by changing only a few configuration parameters, dramatically lowering the technical barrier to adoption.

To ensure data security and high availability, the platform employs a technique known as erasure coding across a multi-region infrastructure. When a user uploads a file, it is first encrypted. Then, instead of simply being copied, the file is broken into multiple fragments with built-in redundancy. These fragments are then distributed across numerous, geographically separate data centers within the network. This architecture ensures that the file remains fully accessible and can be reconstructed even if several provider nodes go offline. This distributed, fault-tolerant design is what enables Impossible Cloud to offer enterprise-grade SLAs, including a 99.95% uptime guarantee.

The project also maintains a network of infrastructure partners, including well-known Web3 service providers, to support its underlying architecture and ensure its scalability and reliability.

Team & Origins

Impossible Cloud is developed by Impossible Cloud Technologies GmbH, a company based in Hamburg, Germany. Unlike many anonymous projects in the crypto space, Impossible Cloud is led by a public-facing team of entrepreneurs with a history in the technology sector.

The leadership team includes:

-

Kai Wawrzinek: A co-founder with prior experience as a serial entrepreneur, notably as a co-founder of Goodgame Studios, a gaming company that grew to a significant scale.

-

Christian Kaul: A co-founder who brings deep technical expertise in building and managing scalable, distributed systems.

-

Marcel Buerkner: A co-founder focused on the operational and strategic aspects of the business.

The project's credibility is supported by a successful seed funding round that raised over €7 million. The round was led by HV Capital, a prominent European venture capital firm, and notably included Protocol Labs, the organization that created Filecoin and IPFS. The participation of Protocol Labs is significant, as it indicates validation from established leaders within the decentralized infrastructure space. This level of institutional backing from both traditional and crypto-native venture capital provides the project with both financial resources and strategic guidance.

Key News & Events

A project's development and trajectory can be observed through its major milestones. For those tracking news about ICNT, several recent events are noteworthy:

-

Mainnet Launch: The successful deployment of the Impossible Cloud Storage mainnet was a pivotal moment, transitioning the project from a concept into a live, operational service capable of generating revenue.

-

Migration to Base Blockchain: The ICNT token was recently migrated from its original chain to Base. This move was made to leverage the L2's advantages in scalability, transaction speed, and lower costs.

-

Forthcoming Exchange Listing: The planned listing of ICNT on Phemex is an important step for the token's market presence. A listing on a regulated exchange can increase liquidity, improve price discovery, and make the token accessible to a broader audience.

-

Customer Onboarding: The project has reported onboarding B2B and enterprise clients, demonstrating that its value proposition of a low-cost, S3-compatible cloud storage solution is gaining traction in its target market.

These developments indicate a project focused on executing its technical roadmap and building commercial momentum.

Project Analysis and Factors to Consider

Any analysis of the ICNT investment potential must be approached with a neutral perspective, acknowledging both its potential strengths and the significant challenges it faces.

(Disclaimer: This content is for informational purposes only and should not be construed as financial advice. The cryptocurrency market is highly volatile, and you should conduct your own thorough research before making any financial decisions.)

Potential Strengths and Differentiating Factors:

-

Large Addressable Market: The cloud computing industry is one of the largest and fastest-growing sectors in technology. A decentralized solution that can capture even a small fraction of this market has a substantial ceiling for growth.

-

Enterprise-Focused Go-to-Market Strategy: The combination of S3 compatibility and fiat payment options is specifically designed to reduce friction for traditional businesses, which represent the largest segment of the cloud market.

-

Experienced Team and Institutional Backing: The project is led by a public team with a background in scaling tech companies and is supported by reputable venture capital firms from both the Web2 and Web3 worlds.

-

Tokenomics Linked to Revenue: The revenue-to-buyback mechanism creates a direct link between the platform's real-world business performance and the economic activity of its native token.

Challenges and Risk Factors:

-

Intense Competition: The primary challenge is competing with established cloud providers. AWS, Azure, and Google Cloud possess massive economies of scale, extensive feature sets, and deep-rooted customer relationships that are difficult to displace.

-

Execution and Scalability Risk: Delivering a cloud service that matches the performance, reliability, and security of incumbents at a global scale is a significant and ongoing technical and operational challenge.

-

Market Volatility: As a cryptocurrency asset, the ICNT price is subject to the high volatility of the broader digital asset market, which may not always reflect the project's underlying fundamentals.

-

The Path to Full Decentralization: The current federated model, while beneficial for performance, is less decentralized than permissionless protocols. The long-term transition to a more decentralized governance and operational structure presents its own set of technical and community-related challenges.

In conclusion, Impossible Cloud (ICNT) represents a structured and enterprise-oriented approach to the DePIN thesis. It combines a pragmatic business model with decentralized technology to challenge a highly centralized market. Its potential will be determined by its ability to execute its technological vision, effectively compete for enterprise clients, and navigate the inherent risks of both the startup and cryptocurrency landscapes. For observers of the DePIN space, it is a notable project to watch as it attempts to build a more distributed foundation for the future of cloud computing.

Disclaimer: The information presented in this article is for educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not treat any of the article's content as such. Phemex does not recommend that any specific cryptocurrency should be bought, sold, or held by you. The cryptocurrency market is subject to high market risk and volatility. Past performance is not indicative of future results. All investment strategies and investments involve risk of loss. You should conduct your own due diligence and consult a qualified financial advisor before making any investment decisions. Phemex is not responsible for any investment decisions you make based on the information provided in this article.