Grid trading is a trading strategy that takes advantage of crypto price movement by placing strategic limit buy and sell orders. Grid traders set lower and upper limits in a grid where they execute buy and sell orders. If the price drops below the lower limit, a buy order is executed. If the price rises above the upper limit, a sell order is executed.

What is an Example of Grid Trading?

For example, if the price of Bitcoin (BTC) is $60,000, a trader could set a lower limit of $59,000 and an upper limit of $61,000. The area between these two limits is their “grid.” Once the price drops to $59,000, a buy order is executed, and when it rises to $61,000, a sell order is executed. Traders can set multiple buy and sell orders at different points in their grids.

In each grid trade, a trader must select one lower limit and one upper limit manually. These orders are automatically executed by the trading bot at certain price intervals. Inside the grid, they have at least one buy order and one sell order, but they can set as many additional orders as they want.

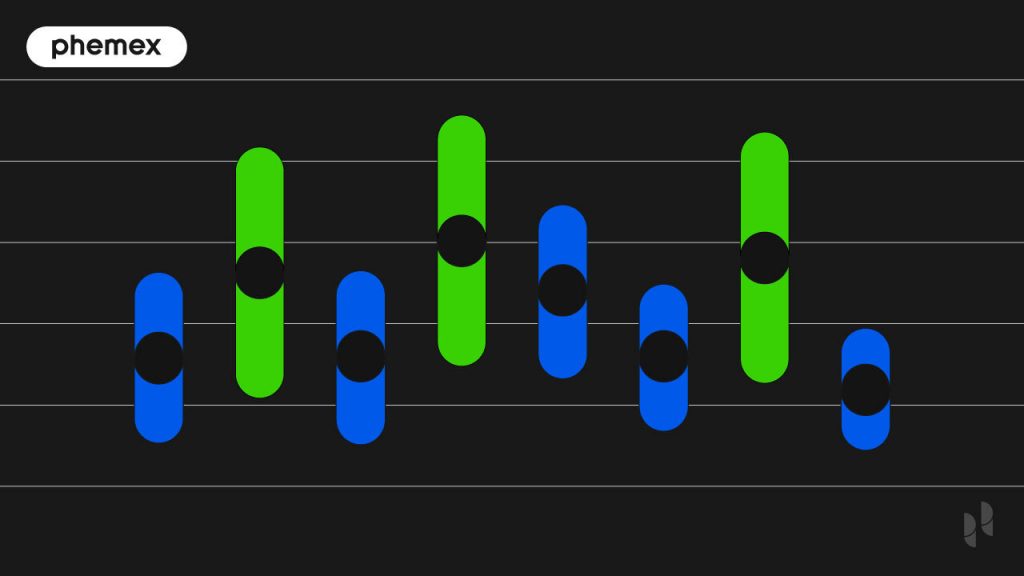

An illustration showing grid trading in volatile crypto markets (Source: TradingView)

The larger the gap between the lower and upper limits, the higher the profit potential. For example, if a buy order is set at $60,000, the trader will profit more by setting a sell order at $65,000 than at $61,000.

What are the Benefits of Grid Trading?

Grid trading is popular in the crypto trading community because it can be automated and allows traders to profit in sideways markets. Notable advantages to grid trading include:

- Automation: After you manually set limits including grid buy/sell orders, the trading bots carry out trades on your behalf. Trading bots run 24/7 and traders can make a profit without tracking price movement themselves.

- Profitability in sideways markets: Grid trading allows traders to profit when the market isn’t showing any clear trend. Crypto prices often go sideways for months at a time, and this strategy takes advantage of those conditions.

- Grid density options: A trader can set dozens or even hundreds of automatic buy/sell limit orders. This allows them to minimize their risk and maximize their chance of profitability.

The idea behind grid trading is to buy low and sell high in the short term. Hundreds of different trading strategies can be executed in grid trading based on the number of grids, time charts, and crypto trends. The most common grids have six buy and sell limit orders.

How does Grid Trading Work?

Grid trading is performed on short time charts such as minute or hourly charts, which differ significantly from daily charts in terms of price volatility. Specifically, grid trading is mostly performed on 1-minute, 5-minute, 15-minute, and 1-hour charts.

While the price of crypto might appear stable over the long chart, abundant volatility in the short-term charts can be taken advantage of. For reference, compare the way the Bitcoin chart looks on the Phemex spot terminal:

A weekly chart of the BTC/USDT pair (Source: Phemex trading terminal)

Bitcoin appears very bullish in the weekly chart, rising from a low of 40,000 USDT to 60,000 USDT in just 3 weeks. The chart indicates a clear upward trend. However, the hourly and minute charts tell a different story. This is how Bitcoin appears in the 5-minute chart:

Bitcoin appears more volatile in the 5-minute chart of the BTC/USDT pair. (Source: Phemex trading terminal)

Bitcoin seems highly volatile in this chart, with the price fluctuating frequently between 60,200 USDT and 61,400 USDT during the last 12 hours. A grid trader could set a grid with a lower limit of 60,000 USDT and an upper limit of 62,000 USDT to take advantage of this short-term volatility.

The trading bot could trigger multiple buy orders at low price ranges, causing a trader’s position to grow. This could increase their profit margin at the end of the trade. If the price continues moving in their direction, they are more likely to profit.

The 5 Most Important Grid Trading Parameters

Some grid trading bots are downloaded as software and others are built-in on exchanges, but they all tend to require similar parameters. Traders input these parameters manually in their bot. These are the most important parameters to understand in grid trading:

- Take-Profit: the maximum crypto price you choose to set for your trade. If the crypto’s price reaches this value, the grid will automatically sell all positions and the profit will be deposited in USDT or other stablecoins in your account.

- Stop-Loss: the lowest price point for your trade where you automatically exit. If the price drops below this price level, the stop loss will be triggered and you’ll exit your position at a loss.

- Upper Limit: The upper limit is the top price limit of your grid. The bot won’t place sell orders above this limit. The higher your upper limit, the larger your profit potential.

- Lower Limit: The lower limit is the bottom price limit of your grid. The bot won’t place buy orders below this limit. The lower limit is often a bit higher than the stop loss.

- Grid Number: The grid numbers signify the maximum number of buy and sell orders you can assign for your grid. The orders are evenly distributed, so if you assign a grid number of 10, you’ll have 5 buy orders and 5 sell orders.

Here are sample parameters for a grid trade based on the 5-minute chart for the BTC/USDT pair above:

- Upper limit: 62,000 USDT

- Lower limit: 60,000 USDT

- Grid number: 8

- Total investment: 10,000 USDT

- Current BTC price: 60,998.54 USDT

All positions are open at the current price. We now have to decide on eight automatic buy and sell limit orders (four of each type) because we chose a grid number of eight. Because the price here will fluctuate between 60,000 USDT and 62,000 USDT, we can adjust our grid accordingly.

Where to place buy/sell orders?

Buy orders will be placed at:

- 59,500 USDT

- 60,000 USDT

- 60,500 USDT

- 61,000 USDT

Sell orders will be placed at:

- 60,500 USDT

- 61,000 USDT

- 61,500 USDT

- 62,000 USDT

This trade could open four buy orders and four sell orders for this grid, as we set the grid number to eight. However, the price might not dip below our buy orders, and we could end up with only two open orders on the trade. It all depends on the performance of Bitcoin.

This sample trade is optimized for the price volatility of Bitcoin for one single day. Traders have to adjust their trading bots daily according to the involved crypto’s performance.

When to close Grid Trades?

A smart trader must know when to close their trade and take profit. Taking profit is important to minimize the risk of liquidation should the markets shift against your position. The best time to close is when you’re satisfied with the profits you’ve made on the entire grid.

Is Grid Trading profitable?

Observe the grid as a whole instead of paying attention to each individual trade inside the grid. Set profitability targets for your grid, such as 5% or 10%, and close your trade once you’ve hit them.

Timing the Markets

The best time for grid trading is when there are tiny price fluctuations below 2-3% daily. If the price of crypto appreciates exponentially, the bots will take profit early. If the price depreciates fast, the stop losses will be triggered.

Sideways price action is why grid trading is popular in foreign exchange (forex) markets. In forex currency trading, the prices tend to go sideways for years. For instance, the US dollar’s value has remained at 85% of the Euro’s value for over a decade. Grid trading is an optimal approach to such sideways movement.

Risk Management in Grid Trading

Risk-averse crypto traders want to know their positions are hedged. The good news is that grid trading is inherently hedged because it involves multiple trades, and good trades can offset bad trades. You can further minimize risk by watching the bots trade and setting stop-losses and take-profits carefully.

In addition, a trader has to be in tune with trends and news in the crypto industry. The price of crypto can appreciate or depreciate rapidly based on news coverage. Optimistic announcements such as new exchange listings tend to boost prices. Bad news, such as government regulations or software bugs tends to push prices down.

Grid traders also have to choose a crypto exchange wisely to avoid paying large commissions for the hundreds of trades they make. Phemex offers an ideal platform for grid trading, with no trading fees for paid members (starting at $9.99/month).

Conclusion

Grid trading is an automated trading strategy in which the trader sets upper and lower trade limits. This strategy takes advantage of volatility on short-term charts such as 1-minute, 5-minute, or 15-minute charts. Once the price hits the limits specified in the grid settings, a buy or sell order is triggered automatically.

The technique is best executed in a sideways market without massive price fluctuations. If a trader follows the latest news and re-configures their grid daily, this strategy can be quite profitable.

PhemexPulse

PhemexPulse is a cutting-edge social trading platform nestled within the Phemex Web 3.0 ecosystem, designed to bring together the cryptocurrency community. It enables traders to earn from their social interactions online, offering access to a daily prize pool of 1,350 Phemex Tokens for simply engaging in conversations within Phemex Pulse. In essence, it's a social media platform that rewards its users for participation. Additionally, PhemexPulse allows for direct engagement with top cryptocurrency influencers and the ability to trade unique inscription tokens introduced by these influencers. Through fostering community interaction and collaboration, PhemexPulse aims to establish itself as a pivotal gathering point in the crypto social sphere.

For any inquiries contact us at support@phemex.com

Follow our official Twitter | Join our community on Telegram

Trade crypto on the go: Download for iOS | Download for Android

Phemex | Break Through, Break Free

Read More

- What is Grid Trading & How does it Work?

- How To Trade Crypto: The Ultimate Investing Guide

- What is Social Trading in Crypto & How does it Work?

- TradingView: What Is It and How to Use It to Trade with Phemex

- Buy Low, Sell High Crypto: 4 Things To Do (3 To Avoid)

- What is Copy Trading: Replicate any Trading Portfolio

- Crypto Trading vs. Investing: Key Differences Explained

- What is High-Frequency Trading and How does HFT work?