Summary

-

What is High-Frequency Trading: High-Frequency Traders (HFTs) use computer algorithms called ‘algobots’ for arbitrage profits from minuscule price variations across near-instant time intervals.

-

Benefits of High-Frequency Trading: Incredible speeds, high turnover rates and order-to-trade ratios.

-

Is high-frequency trading ethical: Though HFTs are generally employed to improve liquidity, the speed they trade at often means that the liquidity they provide vanishes too quickly. This ‘ghost liquidity’ prevents traders from placing orders, flushing out smaller players from the market.

The stock market is not a place for the easygoing. It demands focus and the ability to react calmly to all kinds of situations. With trillions of dollars worth of shares being exchanged across the world every day, there’s little room for error.

An inherent characteristic of healthy financial markets is liquidity. An asset is worthless if no one is willing to buy it. Middlemen called ‘market makers’ profit from providing this liquidity, offering trades at all kinds of price levels for a fee. While the percentage cut has become smaller as markets became larger and more tech-savvy, these intermediaries have evolved too.

What is High-Frequency Trading?

Computers are far from intelligent enough to replace humans altogether, but they can still perform many tasks better than any human on the planet. High-Frequency Traders (HFTs) use computer algorithms called ‘algobots’ for arbitrage profits from minuscule price variations across near-instant time intervals.

How does high-frequency trading work?

In less time than it takes to blink, HFTs can place orders and generate profits by reducing the inefficiencies of manual market makers. Though high-frequency trading algobots are generally used at hedge funds and other institutional investment firms, the use of bots in trading appears to have helped retail investors too.

Bid-ask spreads are dramatically lower than they were twenty years ago, though this is partly due to the shift in stock trading from fractions to pennies in 2001. Still, electronic trading has improved market liquidity, and a study found that bid-ask spreads increased by 9% in Canada after the government introduced fees limiting HFTs in 2012.

However, high-frequency trading isn’t all positives and profits. The long-term effects of large-scale algorithmic trading on both markets and retail investors are still a little ambiguous. While bid-ask spreads are lowering, there could be diminishing returns for liquidity beyond a certain threshold.

History of HFTs

The New York Stock Exchange (NYSE) employed Supplemental Liquidity Providers (SLPs) to add competition to existing liquidity quotes on the exchange. The average SLP rebate is much less than a cent, but with millions of transactions per day, this can still be quite lucrative.

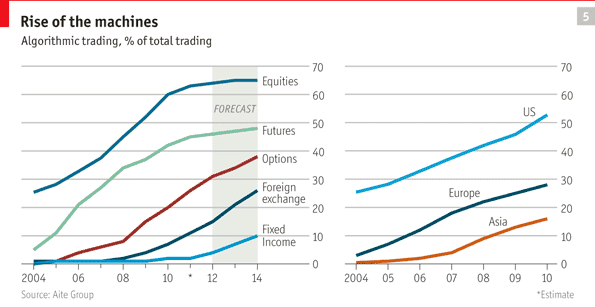

The Securities and Exchange Commission authorized automated trading in 1998, and high-frequency trading began around a year later. At the time, trade execution was still at a few seconds, reduced to mere milliseconds by 2010. Today, HFTs make decisions at hundredths of a microsecond, and as computing power continues to increase, automated trading is only getting faster.

Rise of algorithmic trading (source)

Benefits of High-Frequency Trading

HFT has a faster execution speed

High Turnover rates and order-to-trade ratios

HFTs have a Massive Overseas Growth Potential

HFTs also have massive growth potential overseas, with stock exchanges worldwide becoming more open to the concept and some even offering support. However, lawsuits have been filed against exchanges for providing HFTs an unfair time-advantage, and the opposition is slowly rising.

In 2012, France became the first nation to announce a separate tax on HFTs, followed quickly by Italy. A study assessing the impact of HFTs on the Treasury market’s bout of volatility in 2014 yielded inconclusive results, claiming no single cause for the turbulence. The study did not abandon the idea that HFTs could pose risks to financial markets in the future but couldn’t conclude on how or in what capacity.

High Dominance

Common HFT Strategies in Crypto

HFT (High-Frequency Trading) encompasses various strategies tailored for crypto markets. Here are some common approaches:

-

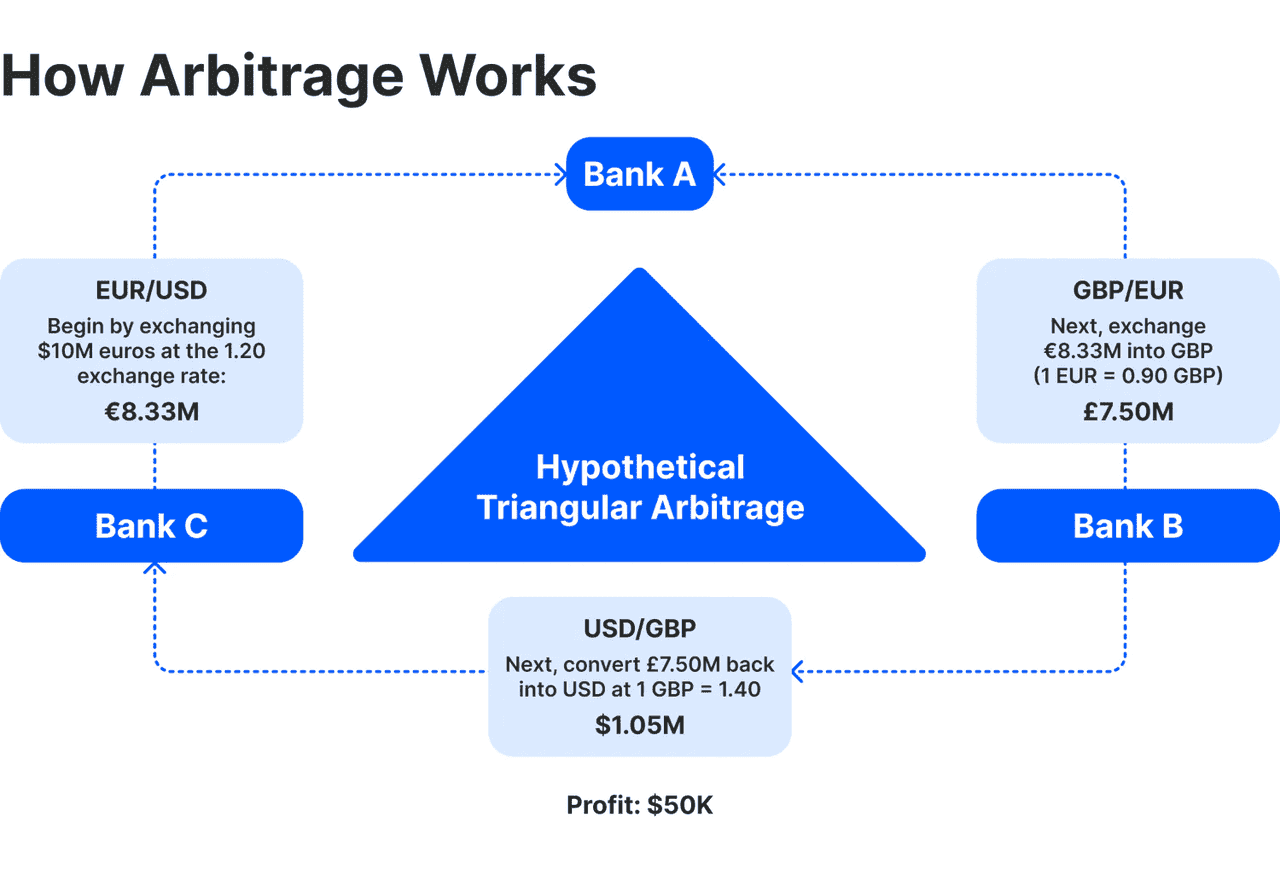

Arbitrage Trading: Profiting from price differences in the same asset across different exchanges. This includes:

-

Exchange Arbitrage: Buying low on one exchange and selling high on another.

-

Triangular Arbitrage: Exploiting price discrepancies across three trading pairs (e.g., ETH -> BTC -> USDT).

-

Cross-border Arbitrage: Taking advantage of regional price differences, though often involving slower processes.

-

-

Market Making: Providing liquidity by placing simultaneous buy and sell limit orders, earning the spread between them. HFT market makers constantly adjust their orders based on market movements to avoid large inventory exposure.

-

Momentum Ignition/Trend Following: Detecting short-term momentum shifts and trading accordingly, such as buying during sudden buy surges or selling during sell-offs, to exploit micro-trends.

-

Mean Reversion/Statistical Arbitrage: Identifying price deviations from norms and betting on reversion to historical relationships between assets.

-

Order Book Analytics: Analyzing real-time order book data to anticipate large orders or trends, a strategy that borders on predatory trading but remains legal when based on publicly available information.

-

Latency Arbitrage: Exploiting delays in market information between exchanges, though this is controversial within the HFT community.

These strategies highlight the dynamic and fast-paced nature of HFT in the crypto space.

How Arbitrage Works (source)

How the algorithms used in High-Frequency Trading work?

Large orders placed by pension funds or insurance companies can significantly affect stock prices, and algorithmic trading hopes to reduce this impact by separating these orders into multiple trades. Because HFTs are based on a large number of orders, they help both in price discovery and in the price formation process.

Additionally, the algorithms used in these systems are used for adaptive control of the order sending schedule, reading real-time data feeds, recording trade signals, and identifying arbitrage opportunities. In fact, these algobots can now even place trades based on trend speculation and market news.

HFT algorithms use two-sided orders to benefit from bid-ask spreads. They also attempt to predict potential large-scale orders through tracking smaller orders and analyzing patterns and trade times. In these cases, the HFT algorithm will capitalize on the large pending orders, adjusting prices to fill them up.

High-frequency trading is usually reserved for specialized firms, and its use by traders and retail investors is practically irrelevant. HFTs require the fastest computers, including regular and expensive hardware upgrades. Additionally, these units require high-cost facilities to be placed as close to the exchange’s servers as possible.

They also need access to real-time data feeds to avoid even the slightest delay and computer algorithms that are competing for efficiency against other HFTs.

Downsides of High-frequency trading

Greater liquidity and lower bid-ask spreads are great for markets, but there is a cost to high-frequency trading, and it isn’t always evident to investors. When an exchange employs an HFT firm to create markets, they provide them with access to their incoming orders. This allows them to see trade volumes just before it impacts the market.

If a large buy volume for a stock comes through on one exchange, HFTs can race to accumulate shares from other exchanges to sell at a higher price. Some consider this akin to paying for a trading advantage and claim that it doesn’t really help improve liquidity in stock markets. Barnard professor Rajiv Sethi called it a ‘superfluous financial intermediation,’ jumping in between buyers and sellers instead of making markets more efficient.

High-frequency traders often scare off other market participants because no one wants to compete with a robot that can trade faster than you can say ‘money.’

Economists call this ‘adverse selection,’ which affects other HFTs as much as it affects retail investors. Competing HFTs lead to fake quotes or ‘spoofing,’ where they create trades to draw the other algobots out.

Some critics believe HFTs don’t create markets as much as they make directional bets on stocks, resulting in lower liquidity and higher intra-day volatility. Others also point out that while HFTs are profitable, they don’t add value to financial markets, and competing is expensive. In 2012, Knight Capital accidentally bought and sold $7 billion worth of stocks at a loss due to a recently installed software upgrade.

The error cost them $440 million, and while Getco eventually acquired them to form KCG Holdings, the firm continues to struggle. The biggest bottlenecks for the growth of HFTs are its declining profit potential, high operational costs, regulatory issues, and marginal room for error.

Spread Networks famously spent $300 million to improve trading speeds by drilling a fiber optic cable in a line from Chicago to New York. There are no silver medals in an HFT war, and competing strategies depend on being faster than regular investors and other algobots as well. This means as soon as one HFT improves, the others must spend the money required to catch up or risk losing money to competitors.

HFTs don’t just rely on fast data-transfer speeds but also the time it takes for the algorithms to process the information and decide what action to take. More efficient algorithms can marginally help improve times, but tasking some of the world’s most intelligent minds with this complex job may not be the best use of human resources. Experts also point out that while HFTs have reduced arbitrage opportunity durations from 97ms to 7ms, profitability has largely remained the same.

The rate of technological innovation has enabled seemingly endless possibilities for trading, but regulatory regimes have been too slow to keep pace with it. With how quickly algorithmic and high-frequency traders place orders, a handful of firms were allowed a massive advantage when these systems initially emerged. Though HFTs may reduce opportunities for traders in established markets, emerging markets could still benefit through high-stakes HFT ventures.

What is the future of High-frequency trading?

High-frequency trading is a controversial topic, and over the years, it has received its fair share of criticism. Replacing broker-dealers with algorithms, the decisions HFTs make in milliseconds could have more extended effects on the market.

In 2010, the Dow Jones Industrial Average suffered its largest intraday drop of a thousand points, plummeting 10% in twenty minutes before correcting upward. Following a government investigation into the incident, they reported that a massive HFT order had triggered a sell-off, leading to the crash.

Though HFTs are generally employed to improve liquidity, the speed they trade at often means that the liquidity they provide vanishes too quickly. This ‘ghost liquidity’ prevents traders from placing orders, flushing out smaller players from the market. For example, exchanges could delay the speed at which information is transmitted to HFTs, or use periodic batch auctions instead of a stream of continuous orders.

This allows for more control over the trading window instead of leaving bids to be filled in milliseconds. The actual effects of HFTs on financial markets are hard to quantify, and while its effects aren’t avoidable, creating better market structures could make them irrelevant and improve trading as a whole.

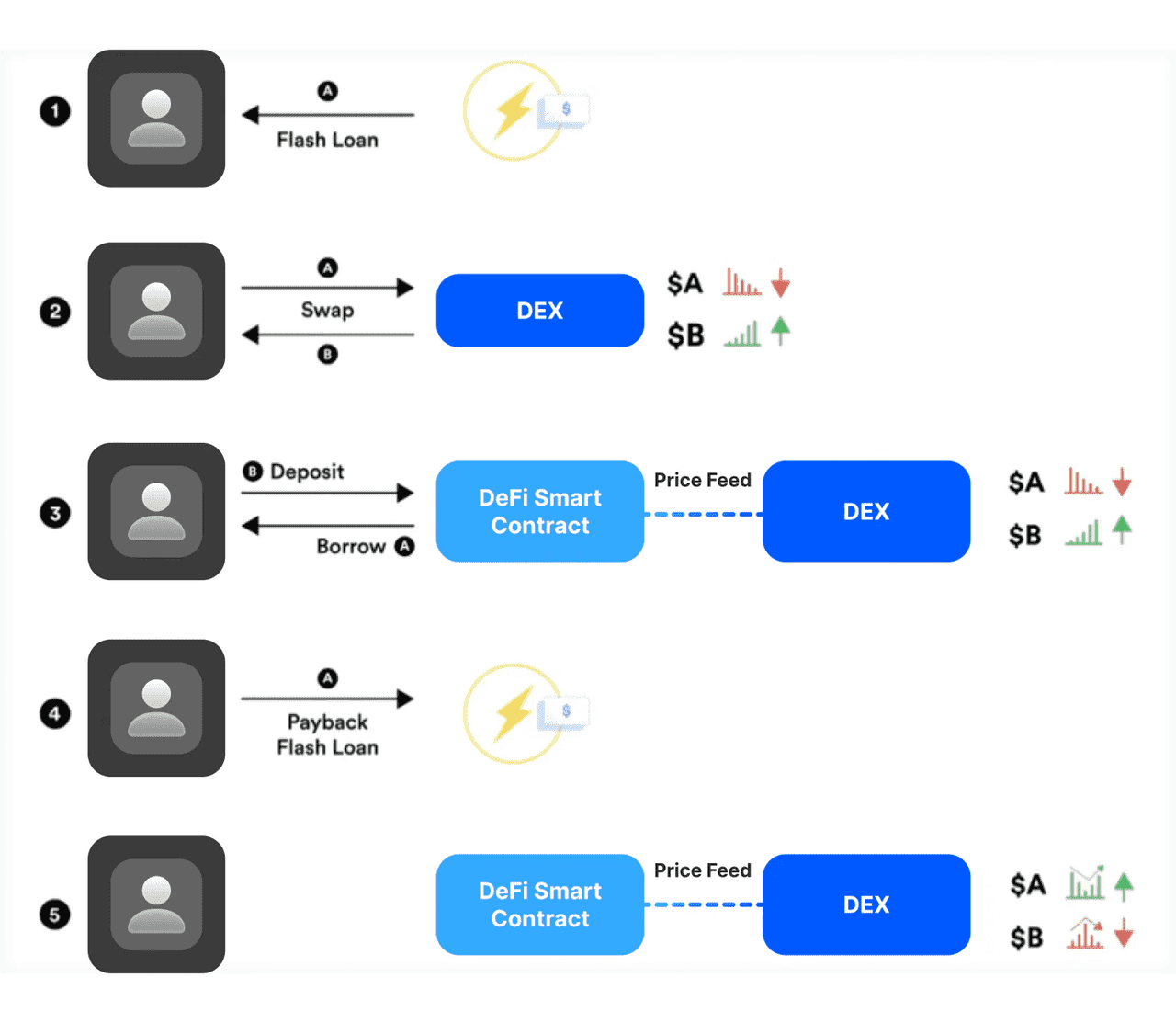

DeFi Arbitrage Example (source)

Recent Developments (2023–2025) in Crypto HFT

The period from 2023 to 2025 has been quite eventful for algorithmic and high-frequency trading in the crypto space. Here are some key developments and trends:

Institutional Influx and Big Players: Traditional high-frequency trading (HFT) firms like Jump Trading, DRW (Cumberland), Citadel Securities, and others have increasingly entered the crypto space, becoming key liquidity providers. Jump Crypto notably responded to the Wormhole bridge hack in 2022. However, this growth has attracted scrutiny, with the CFTC investigating Jump for certain trading practices, indicating a shift toward regulatory oversight similar to traditional markets. By 2025, crypto trading had evolved into a competitive arena dominated by major quant firms, raising professionalism but also risks.

Regulatory Attention and Guidelines: Global regulators began to tackle algorithmic trading in crypto, with exchanges implementing surveillance for manipulative practices. The SEC's actions from 2023 to 2025 addressed unfair trading on various platforms, while Asian exchanges adopted stricter latency fairness rules. Overall, regulations are being updated to align crypto trading with existing market abuse laws.

Technology Arms Race Continues: The pursuit of lower latency continued, with exchanges exploring hardware acceleration and "crypto colocation" to achieve microsecond latency.

AI and Machine Learning in Trading: From 2023 to 2025, firms experimented with AI and machine learning (ML) to enhance trading strategies. While HFT relies on speed, some firms used ML for short-term price predictions and strategy optimization. AI is increasingly utilized for strategy development and risk management, though simpler algorithms often outperform more complex ones in ultra-short-term trading.

HFT in Decentralized Finance: The concept of Maximal Extractable Value (MEV) gained prominence, where firms optimize transaction ordering on platforms like Ethereum. MEV has both positive (arbitraging prices) and negative (sandwich attacks) implications, prompting the DeFi community to explore mitigative measures. HFT firms from centralized finance are now also engaging in DeFi arbitrage.

New Venues and Competition: New exchanges aimed at algorithmic traders have emerged, offering advanced features and unique order types. Following the collapse of FTX, existing exchanges enhanced their offerings, while decentralized exchanges innovated with on-chain order books, creating opportunities for HFT on blockchain.

In summary, the 2023-2025 period cemented that HFT is an integral part of crypto markets. It moved from a niche or even frowned-upon concept (in early crypto days, people were suspicious of bots) to an accepted, even welcomed participant (exchanges welcome them as critical liquidity providers). The landscape has professionalized: many of the practices from mature financial markets are now present in crypto. The flip side is that crypto markets, being inherently volatile and sometimes driven by retail sentiment, still throw curveballs that HFT algorithms must carefully navigate.