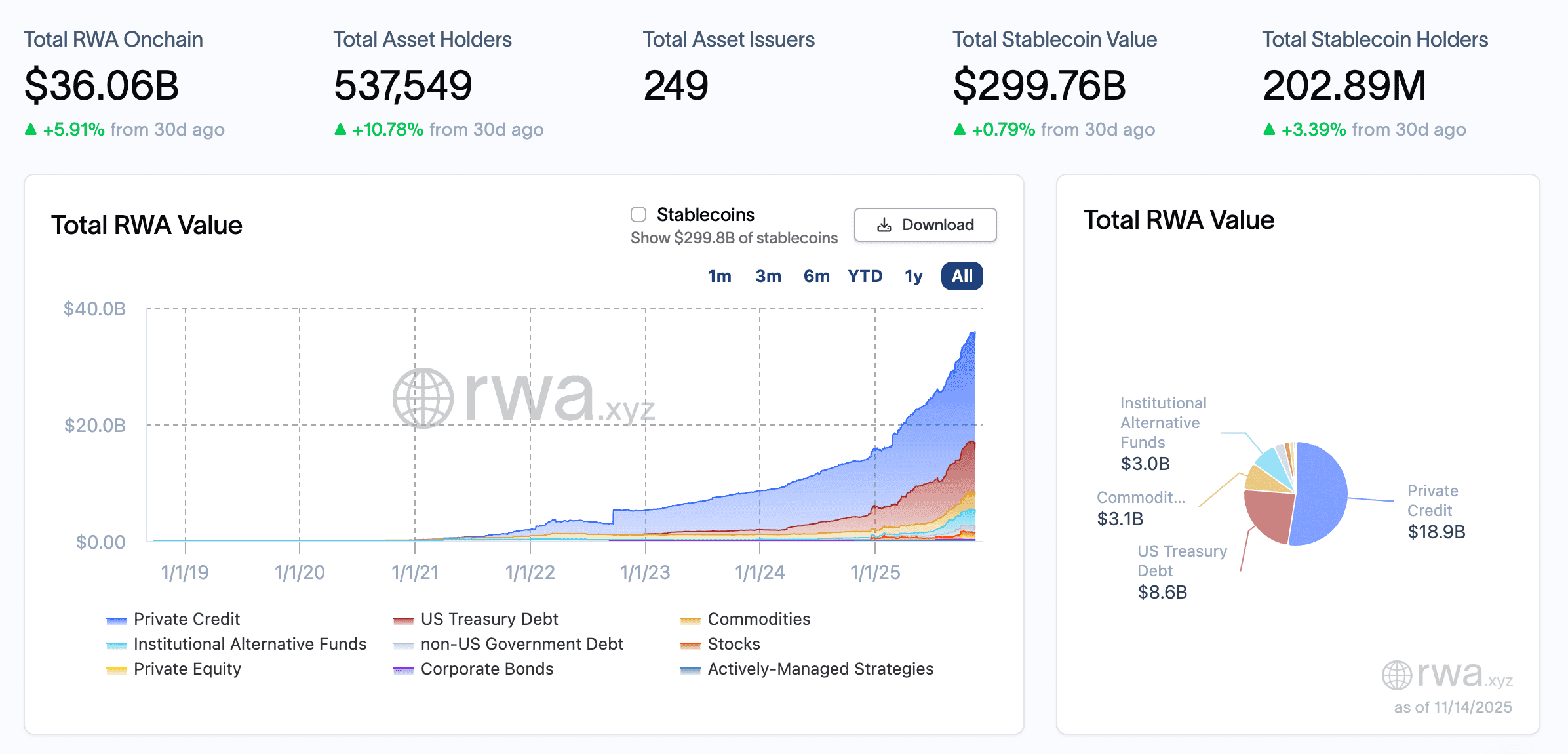

The tokenized real-world asset (RWA) market has hit $36.06 billion, up 5.91% over the past 30 days, driven by significant regulatory advances and institutional adoption. This week, the FDIC confirmed plans for tokenized deposit insurance guidance, a pivotal milestone. With 537,549 holders and 249 issuers, the RWA ecosystem continues to expand. Explore trends and trade top RWA tokens on Phemex.

RWA Market Overview

As of November 14, 2025, the RWA market, excluding stablecoins, stands at $36.06 billion, a 5.91% increase over 30 days, according to rwa.xyz. Stablecoins, vital for RWA transactions, hold a market value of $299.76 billion, up 0.79%. The ecosystem now includes 537,549 unique holders (+10.78% in 30 days) and 249 issuers, with key players like BlackRock, Tether, and Franklin Templeton fueling growth. This reflects deeper blockchain-finance integration.

Source: rwa.xyz

Top Tokenized Assets

The table below lists the top five tokenized assets by total value as of November 14, 2025, per rwa.xyz:

| Rank | Asset | Issuer | Total Value | 7D Change | 30D Change | Asset Class |

|---|---|---|---|---|---|---|

| 1 | BUIDL | Securitize | $2,522,918,878 | -10.63% | -11.47% | U.S. Treasuries |

| 2 | XAUT | Tether Holdings | $1,636,436,465 | +5.08% | +10.38% | Commodities |

| 3 | PAXG | Paxos | $1,396,992,721 | +5.20% | +8.16% | Commodities |

| 4 | syrupUSDC | Maple | $1,222,230,069 | +2.93% | +3.13% | Private Credit |

| 5 | USYC | Circle | $1,060,419,073 | +7.54% | +56.44% | U.S. Treasuries |

Commodities (XAUT, PAXG) show steady gains, while USYC’s 56.44% 30-day surge highlights strong demand for tokenized treasuries. Private credit, led by syrupUSDC, adds diversity.

Top RWA Protocol Tokens

The following table presents the top five RWA protocol tokens by market cap, supporting tokenized asset platforms, as of November 14, 2025, sourced from market data platforms:

| Rank | Token | Price | Market Cap | 7D Change | Role |

|---|---|---|---|---|---|

| 1 | LINK | $14.41 | $10,046,034,976 | -3.97% | Provides oracles for RWA data feeds |

| 2 | XLM | $0.2685 | $8,622,805,609 | -2.19% | Supports cross-border RWA settlement |

| 3 | HBAR | $0.1615 | $6,860,024,599 | -3.60% | Enables enterprise-grade RWA transactions |

| 4 | AVAX | $15.94 | $6,836,131,846 | -4.63% | Hosts RWA smart contracts |

| 5 | ONDO | $0.6030 | $1,905,014,110 | -1.65% | Governs treasury and credit platforms |

These tokens support critical infrastructure, with LINK and XLM holding strong despite recent dips, indicating active RWA platforms.

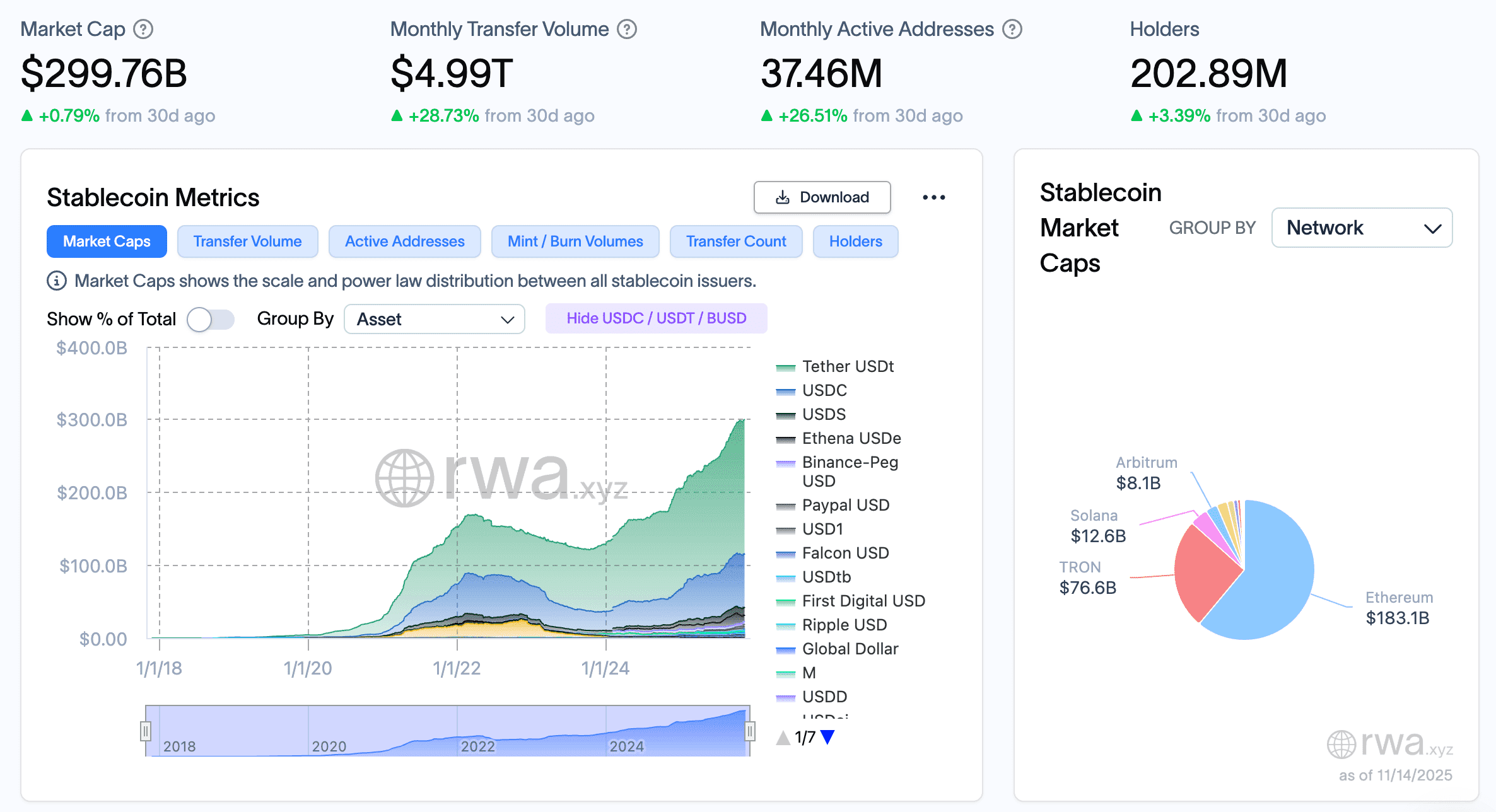

Stablecoin Trends

Stablecoins enhance RWA transactions with instant settlement and cross-border functionality. As of November 14, 2025, USDT leads with a $186.3 billion market value (+0.4% weekly), followed by USDC at $74.8 billion (+0.08%), per rwa.xyz. PYUSD surged 21.95% to $3.5 billion, driven by payment adoption, while USDtb fell 16.3% to $1.5 billion due to adjustments. Emerging use cases include cross-border remittances and DeFi lending, with rwa.xyz data showing a 15% rise in stablecoin transaction volume this month.

Regulatory support, like tokenized deposit guidance, is expected to further integrate stablecoins into RWA ecosystems, enhancing liquidity and trust. Additionally, stablecoins are gaining traction in tokenized real estate settlements, with a 10% increase in such transactions reported this quarter, signaling their expanding role in diversified asset classes.

Market Outlook

Looking ahead, the RWA market is projected to reach $40 billion by the end of 2025, driven by a 6-8% quarterly growth rate based on current trends. Regulatory clarity from the U.S. and Singapore could attract $5-10 billion in institutional capital, while Asia’s initiatives, including Hong Kong’s pilot, may add $3 billion. However, market volatility and regulatory hurdles could cap gains at 5% if adoption slows. Traders should also watch for potential European Union regulations, based on ongoing policy discussions, which may introduce standardized RWA frameworks by mid-2026, potentially adding $2-4 billion if adopted widely. Early stablecoin adoption trends, building on this month’s 15% volume rise, suggest a possible 20% increase by Q1 2026, further supporting RWA growth.

Top RWA News

This week’s RWA developments highlight institutional and regulatory progress, including:

- Institutional Moves:

- Franklin Templeton’s Platform Integrates with Canton: Franklin Templeton’s RWA platform, Benji, integrated with Canton’s blockchain network, expanding tokenized retail fund access and interoperability, a key step for institutional adoption.

- Visa’s Stablecoin Payout Pilot: Visa launched a global stablecoin payout pilot, enabling freelancer payments in digital currencies, improving RWA transaction efficiency and accessibility.

- Regulation & Policy:

- FDIC Plans Tokenized Deposit Insurance Guidance: The FDIC confirmed guidance for tokenized deposit insurance, offering regulatory clarity for U.S. blockchain products, a major boost for RWA legitimacy.

- Singapore to Trial Tokenized Bills and Stablecoin Laws: Singapore’s central bank plans to test tokenized bills and introduce stablecoin regulations, positioning it as a leader in blockchain finance.

- Hong Kong Launches Real-Value Tokenised Deposit Pilot: Major banks in Hong Kong initiated a pilot for tokenized deposits, enhancing transaction efficiency and liquidity, advancing Asia’s RWA framework.

- Treasury Secretary Bessent Reveals Plan to Tackle $38T Debt: The U.S. Treasury Secretary outlined a strategy to address the $38 trillion national debt, potentially influencing RWA financing and regulatory priorities.

- Tech & Integrations:

- R25 Launches Institutional-Grade RWA Protocol on Polygon: R25 introduced an institutional-grade RWA protocol on Polygon, featuring the yield-bearing rcUSD+ token, strengthening DeFi-RWA links (note: included as it aligns with prior RWA focus, despite slight date overlap).

- Dusk Network Partners With Chainlink to Tokenize €200M Dutch Stock Exchange: Dusk Network collaborated with Chainlink to tokenize a €200 million portion of the Dutch Stock Exchange, expanding institutional RWA applications (included for relevance, despite date).

- Tokenization Platform Libeara Partners GFX for Pan-African Inclusion: Libeara teamed with GFX to drive Pan-African financial inclusion through RWA tokenization, targeting underserved markets (included for global impact).

These developments indicate a maturing market with growing institutional and regulatory support.

New RWA Token Listings on Phemex

This week, Phemex welcomed two new RWA tokens, enhancing opportunities for traders to engage with the growing tokenized asset market:

- Canton Network (CC): Listed on November 10, 2025, CC is the native token of a layer 1 blockchain designed for RWA tokenization and traditional finance. It powers the Global Synchronizer, rewarding validators and facilitating fee payments with a privacy-focused, scalable architecture. Trade CC/USDT on Phemex Spot and explore its potential at https://phemex.com/academy/what-is-canton-network-cc.

- Aria Protocol (ARIAIP): Also listed on November 10, 2025, ARIAIP is the governance token for a platform tokenizing intellectual property, such as music royalties from artists like Justin Bieber. Built on the Story blockchain, it enables voting, trading, and reward earning. Trade ARIAIP/USDT on Phemex Spot and learn more at https://phemex.com/academy/what-is-aria-protocol-ariaip.

These listings offer traders access to innovative RWA ecosystems, combining institutional-grade infrastructure with cultural asset tokenization.

RWA Events Calendar

The table below lists verified upcoming RWA-related events for the week of November 15–21, 2025,

| Date | Event | Why It Matters |

|---|---|---|

| Nov 17 | Stablecoin Regulatory Forum | Singapore’s central bank discusses stablecoin laws, impacting RWA policies. |

| Nov 19 | Tokenized Fund Expansion Talk | Franklin Templeton details new tokenized retail fund plans, targeting $1B AUM. |

Note: Event dates are subject to confirmation; monitor official channels for updates.

Summary

The RWA market has hit $36.06 billion, supported by 537,549 holders and 249 issuers, showing steady growth in tokenized assets. Franklin Templeton’s Canton integration, Visa’s stablecoin pilot, and regulatory advances in the U.S. and Singapore underscore the sector’s progress. Visit Phemex News and Blog for more RWA updates and trade top RWA tokens like LINK, ONDO, CC, and ARIAIP on Phemex to engage with this evolving market.