Key Takeaways:

-

What is Avantis (AVNT)? Avantis is a decentralized perpetuals exchange built on the Base network, specializing in high-leverage trading for both cryptocurrencies and real-world assets (RWAs) like forex and commodities.

-

Innovative Trading Features: It introduces unique functionalities like zero-fee perpetuals, where traders only pay fees on profitable trades, and offers leverage up to 500x.

-

Strong Backing: The project is supported by prominent investors, including Pantera Capital and Coinbase, highlighting its credibility in the industry.

-

AVNT Token Utility: The native AVNT token is central to the ecosystem, used for governance, staking to enhance protocol security, and as an incentive for platform users.

-

Availability on Phemex: You can trade AVNT on Phemex, making it accessible for your trading strategies.

Summary Box (Quick Facts)

-

Ticker Symbol: AVNT

-

Chain: Base

-

Contract Address: 0x696F9436B67233384889472Cd7cD58A6fB5DF4f1

-

Circulating Supply: Approximately 209.22 million AVNT

-

Max Supply: 1 billion AVNT (fixed)

-

Primary Use Case: Governance, staking, and incentives on the Avantis perpetuals exchange.

-

Current Market Cap: Approximately $226.17 million

What Is Avantis (AVNT)?

Avantis explained simply, is a decentralized exchange (DEX) designed for perpetual futures trading. It operates on the Base network, an Ethereum Layer 2 solution, which allows for significantly faster and more affordable transactions. What truly sets Avantis apart is its mission to bridge decentralized finance (DeFi) with global macro markets. The platform facilitates trading not only in cryptocurrencies but also in real-world assets (RWAs), such as foreign exchange (forex) and commodities. This enables users to trade a diverse range of over 80 markets with high leverage, up to 500x, all within a transparent and permissionless on-chain environment.

The core problem Avantis solves is the inefficiency and high cost often associated with derivatives trading. It achieves this through a "Universal Leverage Layer," an innovative architecture where a single USDC-based liquidity vault serves as the counterparty for all trades. This synthetic model creates deep, capital-efficient liquidity across numerous markets without needing separate pools for each asset pair. By combining this with groundbreaking features like zero-fee perpetuals, Avantis is establishing itself as a significant and forward-thinking platform in the DeFi space. To build your foundational knowledge of DeFi and other essential crypto topics, explore the Phemex Academy.

How Many AVNT Are There?

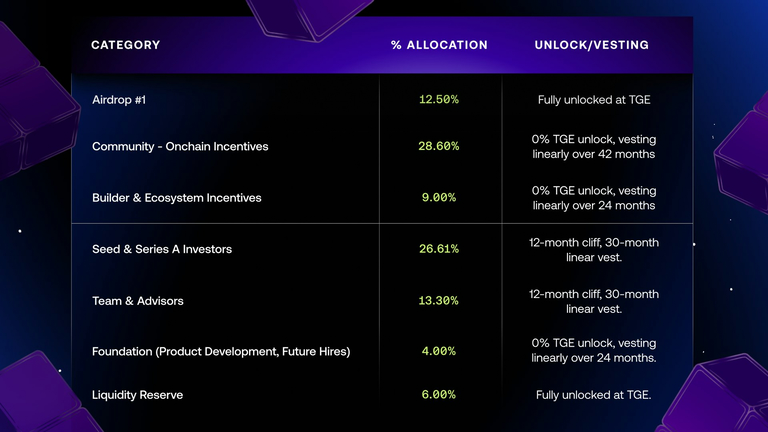

The total supply of Avantis (AVNT) is fixed at 1 billion tokens, establishing it as a deflationary asset since no new tokens can be minted. This fixed supply model is designed to create scarcity and align value with the platform's growth and revenue. As of September 2025, the circulating supply is approximately 209.22 million AVNT. The token distribution model, or tokenomics, prioritizes the long-term health of the ecosystem. A significant portion, over 50%, is allocated to community incentives, including staking rewards, airdrops to early users, and ecosystem development funds, ensuring the community remains central to the project's growth.

Token Distribution,Source:Avantis Whitepaper

What Does AVNT Do?

The AVNT token is the backbone of the Avantis ecosystem, serving multiple critical functions. The primary AVNT use case is governance, empowering token holders to actively participate in the protocol's future. They can vote on key decisions such as protocol upgrades, adjustments to the fee structure, and the listing of new assets.

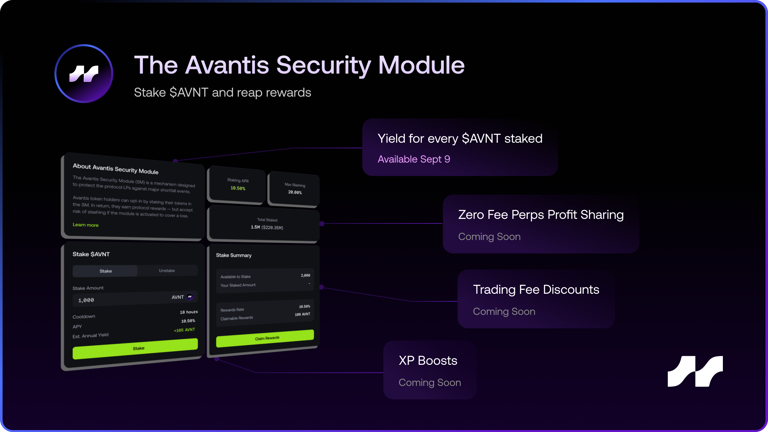

Furthermore, AVNT holders can stake their tokens in the protocol's security module. This not only helps backstop potential vault losses, making the platform more resilient, but also allows stakers to earn a share of the platform's trading fee revenue. The token also functions as a powerful incentive to drive platform activity, rewarding traders, liquidity providers, and referrers for their participation and contribution to the ecosystem's liquidity and volume.

Avantis Security Module,Source:Avantis Whitepaper

Avantis vs. Ethereum

While Avantis is built upon Base, an Ethereum Layer 2 network, its role and functionality are distinct from Ethereum itself. The following table highlights their key differences:

| Feature | Avantis (AVNT) | Ethereum (ETH) |

| Technology | A specialized decentralized application (dApp) for perpetuals trading on the Base L2. | A general-purpose Layer 1 blockchain that hosts a vast ecosystem of dApps and smart contracts. |

| Speed and Fees | High speed and low fees, inheriting the benefits of the Base Layer 2 scaling solution. | Slower transaction speeds and higher "gas" fees on its mainnet, which can be a barrier for high-frequency trading. |

| Use Case | The AVNT token is used for governance, staking for protocol security, and earning platform revenue. | Ether (ETH) is the native currency used to pay for network transaction fees (gas) and acts as a primary store of value. |

| Decentralization & Security | Inherits security from the Ethereum mainnet via Base. Governance is decentralized among AVNT token holders. | Highly decentralized with a global network of validators securing the blockchain through a Proof-of-Stake consensus mechanism. |

The Technology Behind Avantis

Avantis's technical foundation is its innovative, capital-efficient synthetic derivatives engine built on the Base network. At its core is the "Universal Leverage Layer," which uses a single, aggregated USDC liquidity vault to act as the counterparty for all trades on the platform. This synthetic model eliminates the need for traditional order books or separate liquidity pools for each of the 80+ supported markets, allowing for deep liquidity and capital efficiency.

The protocol incorporates sophisticated risk management tools for liquidity providers (LPs). LPs can choose between different risk tranches and set time-lock parameters, allowing them to function as passive lenders or more active market makers with customized risk-reward profiles. To enhance the trading experience and compete with centralized platforms, Avantis has also developed "Flashblocks" to reduce latency and has pioneered zero-fee perpetuals for popular assets, where fees are only paid on profitable trades. This technology is secured by leveraging Ethereum's robust security via the Base network.

Team & Origins

Avantis was co-founded by Harsehaj Singh (CEO) and Raymond Dong (COO), who bring extensive experience from both traditional finance and crypto venture capital, with past roles at prominent firms like Pantera Capital, Lazard, and McKinsey. The project is supported by a global team of engineers and designers. The protocol's governance is managed by the Avantis Foundation, an entity based in the Cayman Islands. Avantis has successfully raised significant funding, securing $4 million in a seed round led by Pantera Capital in 2023 and an additional $8 million in a Series A round in 2025.

Key News & Events

-

Major Exchange Listings: In September 2025, AVNT was listed on several major centralized crypto exchanges, significantly boosting its trading volume and market visibility. The news about AVNT listings generated considerable interest in the market.

-

Community Airdrop: Avantis executed a substantial airdrop in September 2025, distributing a large portion of its token supply to over 65,000 early users and community members to reward their initial support and decentralize governance.

-

Ambitious Roadmap: The project's future roadmap includes further expansion into real-world assets, with plans to list over 100 new assets, including equities. Additionally, the team is developing Avantis v2, which may involve a dedicated Layer 2 solution for enhanced capital efficiency and cross-margin trading capabilities.

Is AVNT a Good Investment?

Evaluating the AVNT investment potential requires a balanced view of its strengths and risks. The project's fundamentals appear strong, evidenced by its significant trading volume and its position as a leading DEX on the Base network. The innovative technology, particularly the zero-fee model and RWA integration, provides a unique value proposition. Furthermore, the backing from top-tier venture capital firms like Pantera Capital and Founders Fund lends substantial credibility.

However, as with any digital asset, an investment in AVNT carries risks. The cryptocurrency market is inherently volatile, and the AVNT price could fluctuate significantly. The decentralized derivatives space is also competitive, and the project's long-term success will depend on its ability to continue innovating and attracting users. Regulatory uncertainty surrounding DeFi and derivatives could also pose a future risk.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Crypto trading involves significant risks; only invest what you can afford to lose. We encourage you to conduct thorough research and consult with a qualified professional. To learn more about risk management, visit the Phemex Academy.

How to Buy AVNT on Phemex?

For those interested in adding Avantis to their portfolio, Phemex offers a straightforward way to do so. You can now trade AVNT on the platform. For a step-by-step walkthrough, please see our detailed guide on "How to buy Avantis (AVNT)."

FAQs

What is Avantis (AVNT)?

Avantis is a decentralized perpetuals exchange on the Base network, allowing users to trade both cryptocurrencies and real-world assets like forex and commodities with up to 500x leverage.

How many AVNT tokens are there?

The maximum supply of AVNT is fixed at 1 billion tokens.

What is the main use of the AVNT token?

The AVNT token is primarily used for protocol governance, staking to secure the network and earn a share of platform fees, and incentivizing user participation.

Where can I find news about AVNT?

You can stay updated on news about AVNT through official project channels and by following reputable crypto news outlets. Major platform updates and listings are key events to watch.

Is the AVNT price volatile?

Yes, like most cryptocurrencies, the AVNT price is subject to market volatility. Its value can change rapidly based on trading activity, market sentiment, and broader industry trends.

Who is behind the Avantis crypto project?

Avantis was co-founded by Harsehaj Singh and Raymond Dong and is backed by prominent investors like Pantera Capital and Coinbase.