Introduction

In the world of blockchain, smart contracts are powerful but have a significant limitation: they cannot access information from outside their native network. This is known as the "oracle problem." Decentralized oracles are the solution, acting as a secure bridge between the blockchain (on-chain) and the real world (off-chain). Apro (AT) is a next-generation oracle platform that not only solves this fundamental problem but also extends its capabilities to serve the rapidly growing fields of Artificial Intelligence (AI) and Real-World Assets (RWAs).

This guide offers a comprehensive look into the Apro ecosystem. We’ll provide an Apro explained breakdown, exploring its innovative data services, its groundbreaking AI Oracle, its approach to tokenizing unstructured assets, and the technology that powers it all. For those interested in its market potential, we also cover the latest AT price trends and how you can get started on your trading journey.

Summary Box (Quick Facts)

-

Ticker Symbol: AT

-

Chain: Ethereum

-

Contract Address: 0x9be61a38725b265bc3eb7bfdf17afdfc9d26c130

-

Circulating Supply: 230 Million AT

-

Total Supply: 1 Billion AT

-

Primary Use Case: Decentralized AI and RWA oracle data services

-

Availability on Phemex: Yes (Spot)

What Is Apro?

So, what is Apro? At its core, Apro (AT) is a decentralized oracle network that provides reliable and secure data to smart contracts, decentralized applications (dApps), and AI models. Unlike first-generation oracles that primarily focus on delivering simple numerical data like asset prices, Apro is building a more sophisticated infrastructure designed for the complex data needs of the future.

It achieves this by combining off-chain processing with on-chain verification, creating a system that is both highly efficient and trustworthy. Apro’s vision is built on three key pillars:

-

APRO Data Service: A flexible and robust data delivery system for dApps, particularly in DeFi.

-

APRO AI Oracle: The first oracle solution designed specifically to provide real-time, verifiable data to Large Language Models (LLMs) and other AI systems.

-

APRO RWA Oracle: A specialized network for converting complex, unstructured real-world assets—like documents, images, and legal contracts—into verifiable on-chain facts.

By tackling these advanced areas, Apro positions itself as a critical piece of infrastructure for the next wave of Web3 innovation, enabling smarter, more data-rich applications.

How Many Apro (AT) Are There?

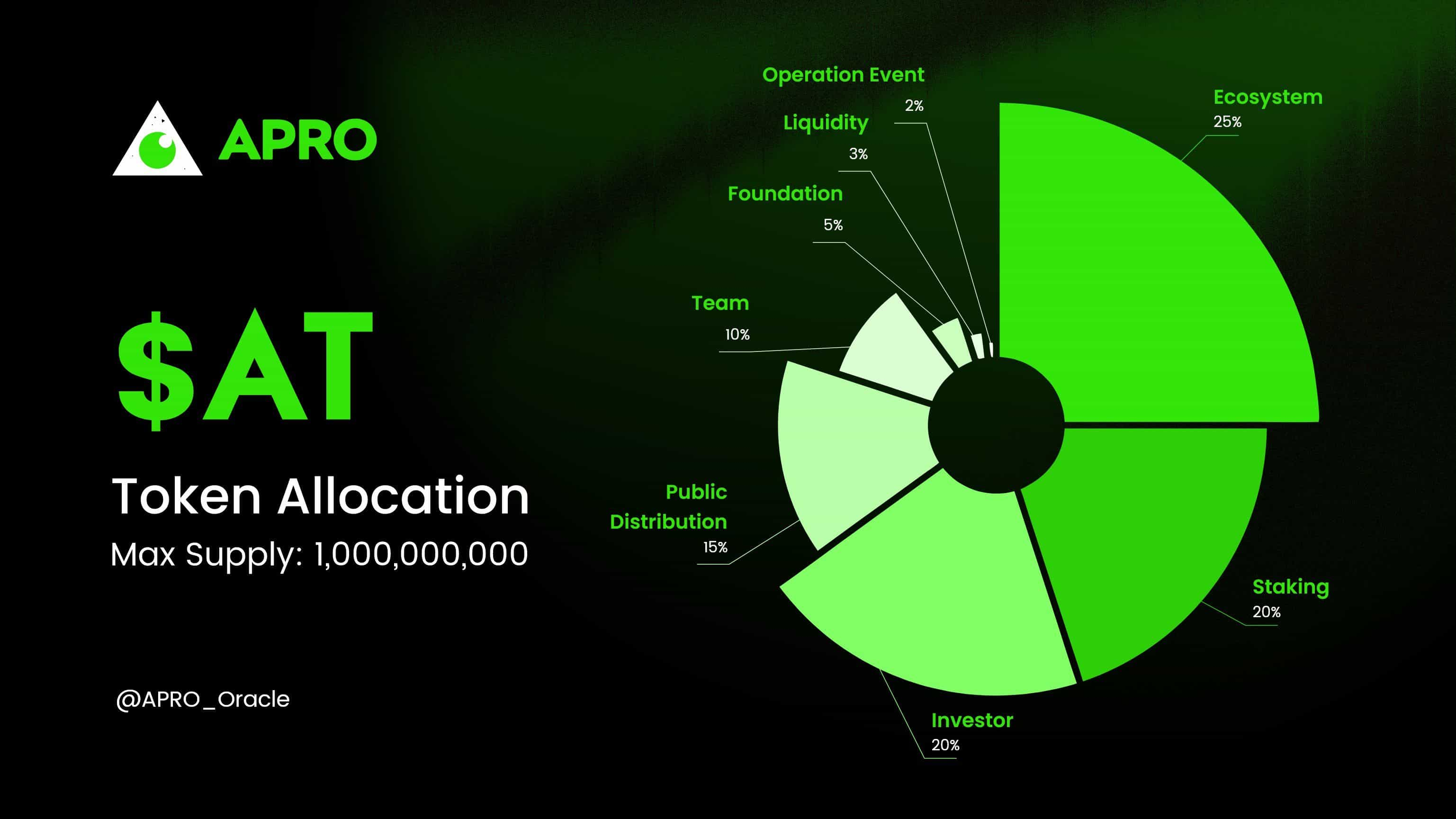

The tokenomics of the AT token are designed to support a sustainable and predictable ecosystem with a clear distribution strategy. The total and maximum supply of AT is capped at 1 billion tokens. Currently, the circulating supply stands at 230 million AT.

Because there is a fixed maximum supply, the AT token is inherently deflationary; no new tokens can be minted beyond the 1 billion cap. This scarcity can be a positive factor for long-term value. The allocation of the total supply is distributed across key areas to foster growth, security, and community engagement:

-

Ecosystem: 25%

-

Staking: 20%

-

Investors: 20%

-

Public Distribution: 15%

-

Team: 10%

-

Foundation: 5%

-

Liquidity: 3%

-

Operation Event: 2%

This balanced distribution ensures that resources are dedicated to long-term development, rewarding community participation through staking, and maintaining healthy liquidity in the market.

What Does Apro (AT) Do?

The primary Apro use case is to function as a multi-faceted data oracle, serving distinct but interconnected domains within the Web3 ecosystem. Its utility is best understood by examining its three core services.

1. APRO Data Service: Push & Pull Models

This is the foundational layer of Apro, providing essential data feeds for dApps, especially in the DeFi sector. It operates on two flexible models:

-

Data Push: In this model, decentralized nodes continuously monitor data and "push" updates to the blockchain when a specific condition is met, such as a price changing by a certain percentage or a set time interval passing. This is ideal for DeFi protocols that need highly reliable, real-time data for lending, borrowing, and other critical functions.

-

Data Pull: This on-demand model allows dApps to "pull" or request data precisely when they need it. It is designed for applications where continuous updates are unnecessary and would lead to wasted costs, such as derivatives platforms that only need the latest price during a trade execution. This method is highly cost-efficient and scalable.

2. APRO AI Oracle: Grounding AI in Reality

One of the biggest challenges for Large Language Models (LLMs) like GPT is their inability to access real-time data and their tendency to "hallucinate"—producing confident but factually incorrect information. The APRO AI Oracle is designed to solve this.

It acts as a trusted data source for AI, aggregating and verifying information from multiple sources before delivering it. By doing so, it ensures AI models can provide accurate, up-to-date insights for tasks like market analysis or portfolio tracking. This grounds AI responses in verifiable facts, eliminating hallucinations and making AI a reliable tool for Web3 applications.

3. APRO RWA Oracle: Unlocking Unstructured Assets

Real-World Assets (RWAs) represent a trillion-dollar market, but many of these assets are "unstructured"—they exist as documents, images, legal contracts, or videos. Traditional oracles cannot process this type of data.

The APRO RWA Oracle introduces a revolutionary dual-layer system to handle this. It uses AI to ingest and interpret unstructured data (Layer 1) and then uses a decentralized consensus mechanism to verify and enforce its authenticity on-chain (Layer 2). This allows for the tokenization of complex assets like pre-IPO equity, real estate titles, and insurance claims, opening up vast new possibilities for DeFi.

Apro vs. API3

While both Apro and API3 are decentralized oracle projects aiming to solve the oracle problem, they approach the challenge with different architectures and strategic focuses. Understanding these differences is key to seeing where each platform excels. Apro vs. API3 can be best understood through a direct comparison.

Here is a breakdown of their key distinctions in a table format:

| Feature | Apro (AT) | API3 (API3) |

| Core Architecture | A hybrid model combining off-chain computing with on-chain verification across a network of independent node operators. | A "first-party oracle" model where API providers run their own oracle nodes directly, eliminating third-party middlemen. |

| Data Source Model | Aggregates data from multiple sources (both first-party and third-party) and uses a consensus mechanism to validate it. | Focuses exclusively on first-party data, arguing it is more secure as it avoids potential man-in-the-middle attacks from third-party nodes. |

| Key Innovation | Specializes in advanced data types through its AI Oracle (for LLMs) and RWA Oracle (for unstructured assets like documents). | Centers on creating a seamless, decentralized network of APIs called dAPIs and enabling direct data provider-to-dApp connections. |

| Target Market | Broad, with a strategic focus on the emerging AI and Real-World Asset (RWA) sectors alongside traditional DeFi. | Primarily focused on DeFi and other dApps that rely on traditional, web2-style API data feeds. |

| Governance | Governance structure is managed by the core foundation and team, with plans for increasing decentralization over time. | Governed by a decentralized autonomous organization (DAO), where API3 token holders can participate in staking and decision-making. |

| Token Utility | The AT token is used for network operations, staking, and accessing specialized data services. | The API3 token is used for staking to secure the network, DAO governance, and for dApp subscription fees. |

The Technology Behind Apro

Apro’s innovative services are supported by a sophisticated and secure technical architecture designed for reliability, scalability, and trust.

Hybrid Architecture: Off-Chain and On-Chain

At its core, Apro uses a hybrid model that leverages the best of both worlds. Data is collected, aggregated, and computed off-chain, which is fast and cost-effective. The verified and finalized data is then delivered on-chain with cryptographic proof of its integrity. This approach allows Apro to handle large volumes of data and complex computations without congesting the blockchain.

Security and Reliability Mechanisms

To ensure its oracle network is secure and stable, Apro implements several key technologies:

-

Hybrid Node Approach: Combines on-chain and off-chain computing resources to enhance efficiency and performance.

-

Multi-Network Communication: Establishes a decentralized network communication scheme to avoid single points of failure and ensure constant uptime.

-

TVWAP Price Discovery Mechanism: Applies a Time-Weighted Average Price (TVWAP) mechanism to ensure data prices are fair and accurate, protecting against short-term volatility and malicious price manipulation.

The AI Oracle Engine

The AI Oracle is powered by a decentralized process:

-

Multi-Source Data Collection: It gathers data from numerous independent sources, including centralized and decentralized exchanges.

-

Consensus Validation: The network uses a Byzantine Fault Tolerant (BFT) consensus mechanism to validate the data’s accuracy before making it available.

-

Secure Communication: It uses a protocol called AgentText Transfer Protocol Secure (ATTPs) to encrypt and protect communication between AI agents and the oracle, ensuring data integrity.

The RWA Oracle's Dual-Layer System

For unstructured assets, Apro uses a unique two-layer system:

-

Layer 1 (AI Ingestion): AI models analyze unstructured data like documents or images to extract key information and convert it into a structured format.

-

Layer 2 (Consensus & Enforcement): A decentralized network of nodes verifies the AI-generated output, reaching a consensus on its validity before recording it on the blockchain as an immutable "proof-of-record."

Team & Origins

The founders and core development team behind the Apro project have chosen to remain anonymous. In the crypto industry, this is often a deliberate choice to promote decentralization and shift the focus away from individuals and onto the technology and community itself. All official information, technical details, and project updates are communicated through the official Apro website and its comprehensive whitepaper.

Key News & Events

Keeping up with news about Apro is key to understanding its trajectory. Some major milestones and events for the project include:

-

Broad Multi-Network Integration: Apro has successfully deployed its data services across 15 major blockchain networks, demonstrating strong interoperability.

-

Phemex Listing: The AT token has been listed on Phemex for spot trading, increasing its accessibility to a wider audience of traders and investors.

-

Launch of AI and RWA Oracles: The development and introduction of its specialized oracles for AI and Real-World Assets mark a significant step forward, differentiating Apro from other oracle providers in the market.

Is Apro (AT) a Good Investment?

Disclaimer: This section is for informational purposes only and does not constitute financial advice. Crypto trading involves significant risks; only invest what you can afford to lose.

Assessing the Apro investment potential requires analyzing its unique market position, technology, and associated risks.

Potential Strengths:

-

First-Mover Advantage: As the first oracle solution designed specifically for AI and unstructured RWAs, Apro is tapping into two of the largest growth narratives in the tech and crypto industries.

-

Critical Infrastructure: Oracles are a non-negotiable component of a functioning Web3 ecosystem. As the industry grows, so will the demand for sophisticated data solutions like Apro.

-

Robust Technology: Its hybrid architecture, security mechanisms like TVWAP, and innovative dual-layer RWA system provide a strong technical foundation.

Potential Risks:

-

Competition: The oracle space is highly competitive, with established players. Apro will need to continue innovating to capture market share.

-

Market Volatility: Like all altcoins, the AT price is subject to high volatility and broader market trends.

-

Execution Risk: The vision for AI and RWA oracles is ambitious. The project's success will depend on its ability to execute its roadmap and foster widespread adoption.

In conclusion, Apro presents a compelling investment case based on its forward-thinking technology and strategic focus on high-growth sectors. However, potential investors should conduct thorough research and weigh these strengths against the inherent risks of the crypto market.

How to Buy Apro (AT) on Phemex

Phemex makes it easy to add AT to your portfolio. If you’re ready to get started, you can trade AT directly on our spot market.

For a detailed walkthrough on creating an account, depositing funds, and placing your first trade, visit our dedicated guide on Phemex Academy: How to buy AT.

FAQs

1. What is the difference between Apro's Push and Pull data models?

The Push model automatically sends data updates to the blockchain when certain conditions are met, making it ideal for applications needing constant, real-time feeds. The Pull model allows dApps to request data on-demand, which is more cost-effective for applications that only need information at specific moments, like during a transaction.

2. How does the APRO AI Oracle prevent "hallucinations"?

It prevents AI hallucinations by grounding AI models in verifiable, real-time data. Instead of generating responses based only on static training data, the AI can query the Apro oracle to retrieve cryptographically signed facts from a decentralized network, ensuring its outputs are accurate and up-to-date.

3. What are "unstructured RWAs" and how does Apro handle them?

Unstructured RWAs are real-world assets that don't fit into neat numerical formats, such as legal contracts, property deeds, images, or logistics records. Apro uses a unique dual-layer system where AI first interprets this complex data, and then a decentralized network of nodes verifies the interpretation before immutably recording it on the blockchain.