In 2021, the world talked about JPEG Apes. In 2025, they're talking about tokenized Treasury Bonds. This single sentence captures one of the most profound shifts in the digital asset landscape. Both Non-Fungible Tokens (NFTs) and Real-World Assets (RWAs) stem from the same revolutionary technology—blockchain tokenization—but they represent two vastly different philosophies of value, risk, and the future of finance itself.

The speculative, culture-driven frenzy that propelled the NFT market to unimaginable heights has given way to a quieter, more tectonic movement: the methodical, institutional-led transfer of real-world value onto the blockchain. This isn't just a simple trend; it's a Great Rotation of capital. It's a reallocation of focus from the purely digital and subjective to the digitally-represented, objectively-valued physical.

This guide will dissect this evolution in detail. We will move beyond surface-level definitions to provide a definitive, head-to-head comparison of RWAs and NFTs, backed by granular, on-chain data. We will analyze the powerful market forces driving this capital rotation and provide a forward-looking investment outlook for 2025 to help you understand where the real, sustainable potential lies.

Quick Definitions: A Tale of Two Tokens

Before we dive into the data, let's establish our foundational concepts with precision.

NFTs (Non-Fungible Tokens): A Certificate of Digital Authenticity

An NFT is a unique cryptographic token that cannot be replicated, serving as an unimpeachable proof of ownership for a one-of-a-kind digital item. This can be a piece of generative art, a collectible avatar, an in-game asset, or a digital key granting access to an exclusive community. Its value is derived from its verifiable scarcity, its history (provenance), and its cultural relevance within a specific digital ecosystem.

RWAs (Real-World Assets): A Digital Claim on Real-World Value

An RWA is a digital token that represents a legally recognized ownership claim on a tangible, off-chain asset. This can be a fractional share of a commercial real estate property, a tokenized representation of an Apple stock, a barrel of oil, or a claim on the yield from a portfolio of private credit loans. Its value is—and must be—directly and verifiably tied to the economic value and performance of the underlying real-world asset it represents.

The Definitive Comparison: RWA vs. NFT Head-to-Head

The fundamental differences between these two asset classes become clear when you place them side-by-side. While both live on the blockchain, they operate in separate universes of value, purpose, and risk.

| Feature | RWA (Real-World Asset) | NFT (Non-Fungible Token) |

| Source of Value | Off-Chain (The underlying physical or financial asset) | On-Chain (Scarcity, community, culture, art) |

| Fungibility | Often fungible (One tokenized bond is the same as another) | Always non-fungible (Each token is unique) |

| Primary Purpose | Yield Generation, Investment, Financialization | Digital Ownership, Provenance, Community Identity |

| Valuation Model | Traditional Finance Metrics (Cash flow, appraisals, yield) | Subjective (Artistic merit, cultural relevance, hype) |

| Legal Framework | Heavily Reliant on Legal Contracts & SPVs | Reliant on Smart Contract Code & Platform Terms |

| Typical Investor | Yield-seekers, Diversifiers, Institutional Players | Collectors, Speculators, Community Members |

Unpacking the Differences: A Deeper Analysis

Let's expand on these key distinctions:

-

Source of Value: Atoms vs. Bits: An RWA's value is anchored in the physical world of atoms. A tokenized bond's worth is determined by the creditworthiness of the issuer and prevailing interest rates. An NFT's value is born from the digital world of bits; its worth is determined by collective belief, artistic merit, and the strength of its community.

-

Valuation: Spreadsheets vs. Sentiment: You can value an RWA with a spreadsheet. You can calculate the yield on a tokenized private credit portfolio or the net operating income of a tokenized property. Valuing an NFT is akin to valuing fine art; it is a function of social sentiment, cultural significance, and market psychology.

-

Legal Framework: Lawyers vs. Code: The integrity of an RWA rests on a mountain of legal paperwork—special purpose vehicles (SPVs), deeds, and contractual obligations that ensure the on-chain token has a valid claim on the off-chain asset. The integrity of an NFT rests on the immutability of its smart contract code. "Code is law" in the NFT world; in the RWA world, the law is law, and the code is merely its servant.

Market Trends: Following the Money in the Great Rotation

The most compelling way to understand the RWA vs. NFT dynamic is to follow the capital. The data tells a clear and unambiguous story of a market undergoing a fundamental transformation.

The NFT Market's "Great Reset"

To call the period after the 2021-2022 NFT boom a simple "correction" would be an understatement. It was a Great Reset—a necessary and painful cleansing of speculative excess that has revealed a more mature, if smaller, market.

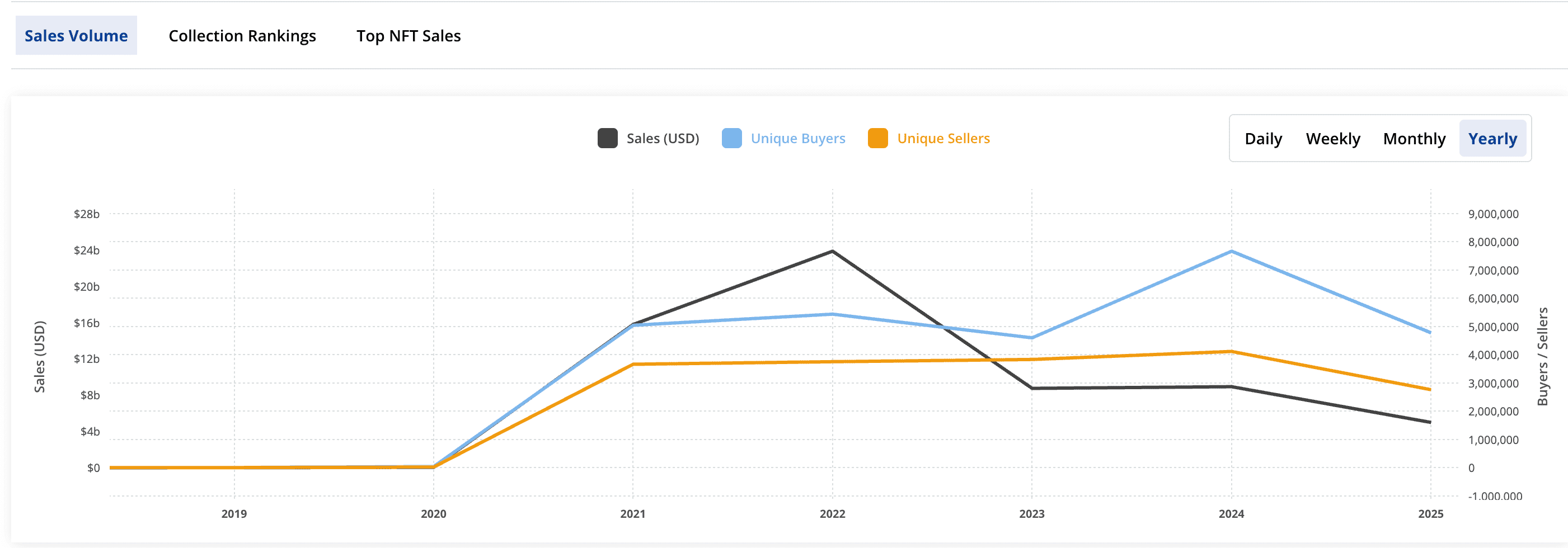

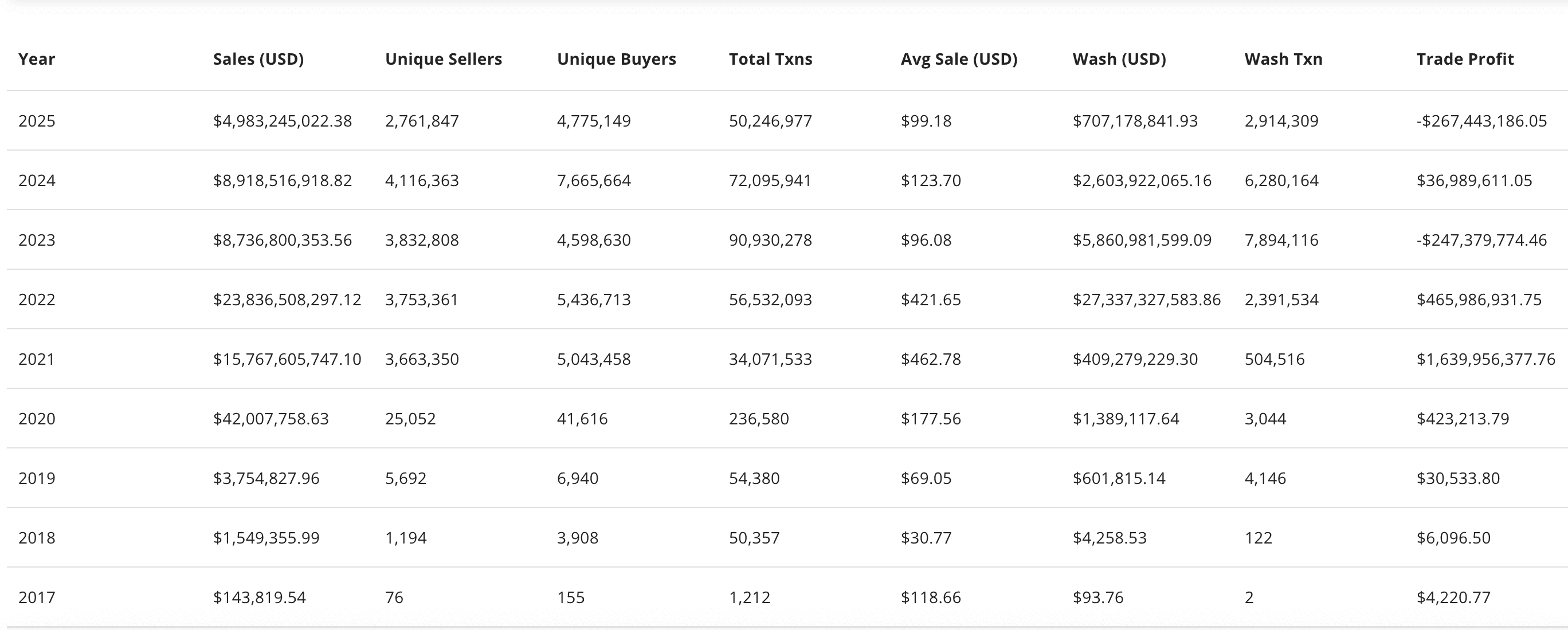

According to data from CryptoSlam, the global NFT market hit a speculative zenith in 2022 with 27.3 billion of that year's gross volume is estimated to have been from wash trading. This widespread practice, where a user is on both sides of a trade to artificially inflate volume and prices, suggests the "real" organic market was always smaller. The subsequent downturn was not just a crash, but a return to a more honest baseline of activity.

The yearly sales figures tell a story of stabilization. After the 2022 peak, organic-equivalent sales volume reset to 8.9 billion in 2024. This isn't a continuous freefall; it's the market finding a new, more sustainable equilibrium. The average sale price reflects this perfectly, falling from a hype-driven $421 in 2022 to a more sober $96 in 2023.

But the most fascinating insight comes from the user data. While the black line (Sales USD) on the chart has fallen dramatically from its peak, the blue line (Unique Buyers) shows a different, more optimistic story. The number of unique participants actually peaked later, in 2024 with 7.6 million buyers, even as total volume was significantly lower. This indicates that while the multi-million dollar headlines are gone, more individual users are now entering the market at more accessible price points. The NFT space is becoming broader and more distributed, even as it has become less frothy. It is transitioning from a high-value, low-participation market to a low-value, high-participation one.

The RWA TVL Surge: A Multi-Chain, Multi-Asset Juggernaut

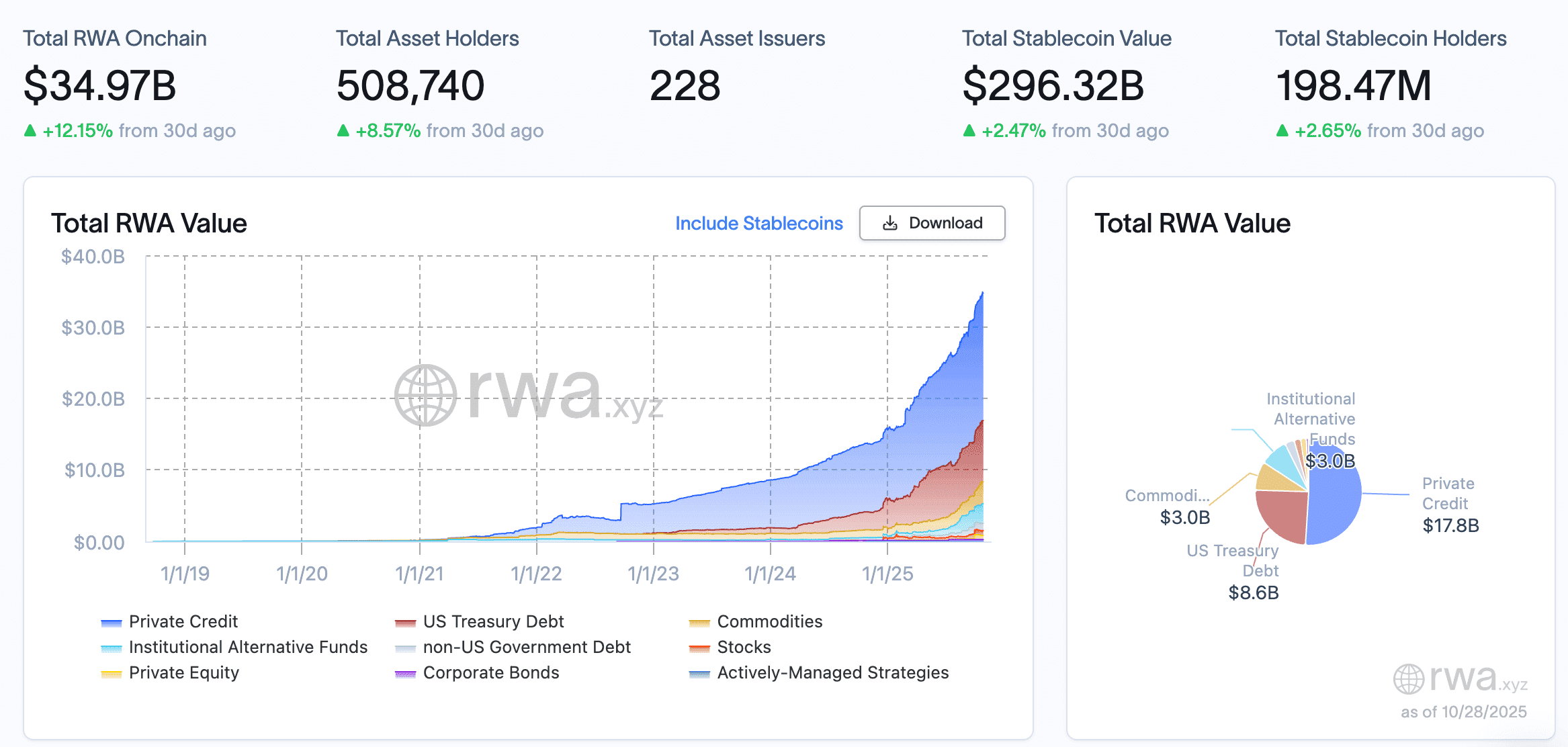

While the NFT market was resetting, the RWA sector was experiencing a quiet, methodical explosion. This was not a story of hype, but of relentless, compounding growth in on-chain value, driven by institutional adoption and a market-wide search for real yield.

Data from the analytics platform rwa.xyz is unequivocal. As of October 2025, the total value of on-chain RWAs has surged to nearly $35 billion, a figure that has grown over 12% in the last month alone. This isn't a monolithic block of speculative capital. A closer look at the asset breakdown reveals a sophisticated, institutional-grade portfolio being built on-chain:

-

$17.8 billion in Private Credit: This is the silent giant of RWA. Traditionally an opaque and inaccessible asset class for all but the largest institutions, it is now being tokenized to provide transparent, high-quality, and non-crypto-correlated yield to DeFi protocols and investors.

-

$8.6 billion in U.S. Treasury Debt: The bedrock of the traditional financial system is now tokenized and serving as the benchmark for the "risk-free rate" in crypto. The existence of this asset class on-chain is a prerequisite for building more complex financial products.

-

$6.0 billion (combined) in Funds, Commodities & Equities: This includes significant holdings in tokenized gold via protocols like Tether Gold (XAUT) and Paxos Gold (PAXG), as well as emerging tokenized stock offerings.

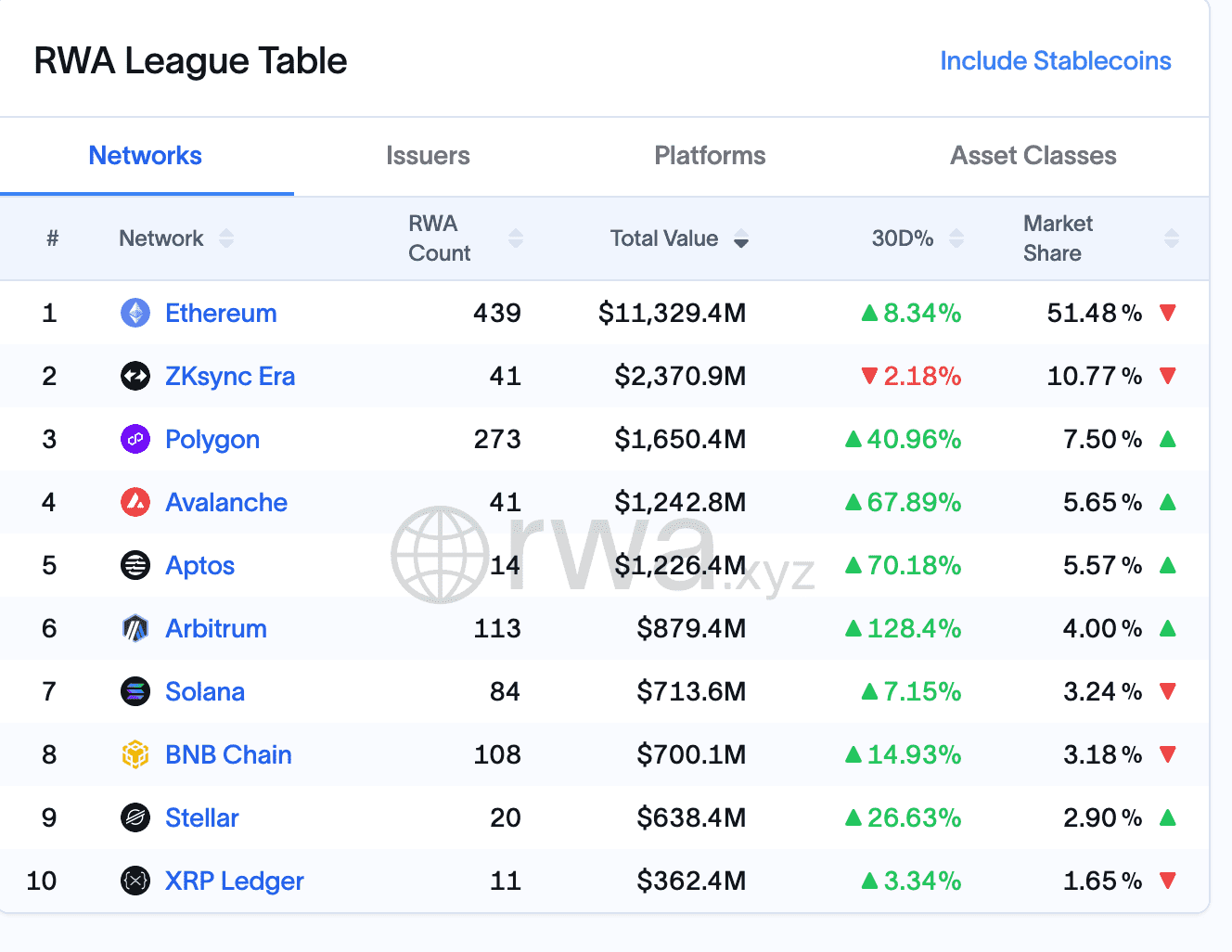

Furthermore, the "RWA League Table" reveals that this is a rapidly expanding multi-chain phenomenon. While Ethereum remains the undisputed king with $11.3 billion in value (51.5% market share), the real story is the explosive growth on Layer 2s and competing L1s. Seeking lower transaction fees and faster settlement, RWA protocols are expanding aggressively. In the last 30 days alone, the RWA value on Arbitrum has skyrocketed by 128%, on Avalanche by 68%, and on Polygon by 41%. This is critical: RWA is not a single-ecosystem trend but a fundamental financial primitive being adopted across all of crypto.

Investment Outlook for 2025: Where is the Alpha?

Given these powerful trends, how should an investor view the potential of each sector?

NFTs' Next Chapter: The Search for Sustainable Utility

The investment "alpha" in the 2025 NFT market will not be found by chasing the next 10,000 PFP collection in hopes of recapturing the $421 average sale price of 2022. The data shows the market has fundamentally shifted. Instead, the opportunity lies in the infrastructure and platforms serving the millions of unique buyers who are now participating at lower, more sustainable price points. The focus should be on:

-

Utility-Driven Platforms: Projects focused on ticketing (where the NFT is a verifiable, anti-scalping ticket), loyalty programs (like Starbucks' Odyssey), and digital identity solutions.

-

Gaming Infrastructure: The underlying technology that powers the ownership and trading of in-game assets. This includes L2/L3 solutions optimized for gaming and marketplaces with superior user experiences.

-

Real-World Integration (Phygital): Projects that successfully link NFTs to physical goods, verifying authenticity and creating a new layer of ownership for luxury items, collectibles, and more.

RWAs' Scaling Challenge: The Trillion-Dollar Journey

The potential for RWAs is, by all measures, orders of magnitude larger. The opportunity is not just in the continued growth of the overall TVL, but in identifying the next frontiers of a market still in its infancy:

-

The Chain Wars: While Ethereum is the current leader, the explosive growth on chains like Avalanche and Arbitrum suggests a battle for RWA dominance is underway. The chains that can provide the best combination of security, low cost, and regulatory compliance will attract the next wave of asset issuers.

-

The Next Asset Class: U.S. Treasuries were the first major asset to be tokenized at scale. The next multi-billion dollar opportunity will come from the protocol that successfully standardizes the tokenization of another major asset class. Will it be private equity, residential real estate, or even more exotic assets like carbon credits?

-

The Retail Experience: Currently, accessing RWA yield can still be complex. The platforms that can abstract away this complexity and offer a seamless, user-friendly "yield account" powered by on-chain RWAs will be the winners of the retail market.

Conclusion: The Right Tool for the Right Job

Ultimately, RWA and NFT are not competitors for the same throne. They are two distinct, powerful tools designed for different jobs, representing the two faces of the tokenization revolution.

NFTs are the vehicle for investing in culture. They are the native asset class of the digital world, capturing the value of community, identity, and art. Their market has undergone a painful but necessary reset, and is now building a broader, more sustainable base focused on tangible utility.

RWAs are the vehicle for investing in value. They are the bridge that allows the stability, yield, and proven worth of the real world to flow onto the blockchain, enhancing it with newfound efficiency and accessibility. Their growth is just beginning, is driven by the largest financial institutions in the world, and represents one of the largest addressable markets in human history.

An investor in 2025 doesn't need to choose one over the other. A truly diversified digital asset portfolio will likely hold both: NFTs for high-growth cultural bets and community access, and RWAs for stable yield generation and exposure to traditional asset classes. They are not enemies; they are two essential frontiers in the unstoppable adoption of blockchain technology.

Now that you understand the difference and the data behind the trends, explore the top RWA investment opportunities in our Ultimate Guide to Real-World Assets.