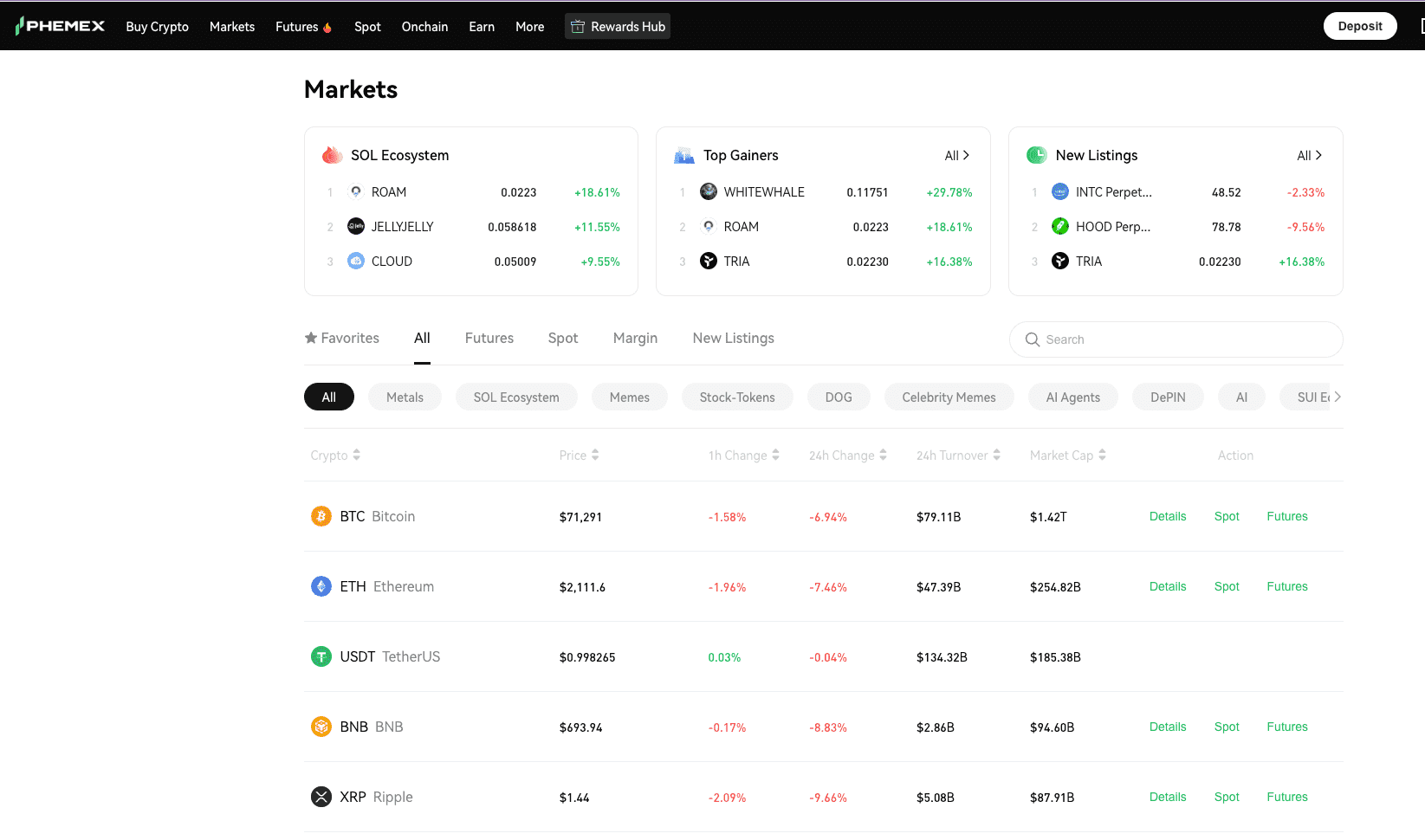

The cryptocurrency market is characterized by its dynamic nature, which often results in periods of heightened market volatility. During a significant market correction, prices can move rapidly. For instance, it is not uncommon to see Bitcoin (BTC) or Ethereum undergo single-day adjustments of 5% to 10%, while smaller-cap altcoins may experience even greater fluctuations.

In these high-stakes moments, efficient execution becomes a priority for participants looking to manage their risk management exposure. For many, the instinctive reaction is to use the standard spot trading interface. However, during periods of rapid price discovery, the traditional order book—while effective for daily trading—presents specific technical challenges that can impact execution efficiency.

This guide examines the operational hurdles of order book trading during volatility and explores how Phemex Convert functions as a streamlined, zero-fee alternative for risk management and capital preservation.

1. The Impact of Latency and Liquidity during Market Volatility

In a highly volatile market, liquidity can become fragmented. As asset prices move toward support or resistance levels, institutional algorithms and automated market makers may adjust their buy/sell quotes to reflect new data. This can lead to a "thinning" of the order book.

In such scenarios, every second counts. A delay in order entry or a multi-step execution process in the spot market can result in a filled price that differs from the initial target. For participants managing significant positions, these marginal differences in execution can impact the overall valuation of a portfolio rebalancing. Professional market participants prioritize certainty and streamlined workflows to mitigate the risks associated with manual order entry.

2. Understanding the Challenges of Order Book Trading in Rapid Markets

Standard trading interfaces are robust tools for price discovery, but they possess inherent characteristics that may be suboptimal during a rapid market downturn.

A. The Mechanics of Slippage

Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. In a low-liquidity or high-volatility environment, a large "Market Order" may exhaust the immediate levels of the order book. Phemex Convert addresses this by moving away from the order-matching model to a quote-based model, ensuring the price you accept is the price you get.

B. Execution Gaps and Unfilled Limit Orders

During a "flash" movement, the market price can move so rapidly that it bypasses specific price levels entirely. If a "Limit Order" is placed, the market may "gap" below it before the order can be matched. This often requires the user to manually cancel and resubmit orders at lower prices—a psychological loop that can lead to frozen decision-making.

C. Cognitive Overload

Traditional trading interfaces display a high volume of data, including real-time charts, depth maps, and fast-moving order logs. In a high-stress environment, this complexity can increase the risk of operational errors, such as "fat-finger" mistakes or selecting the wrong order type.

3. Phemex Convert: A Zero-Fee, Quote-Based Risk Management Tool

Phemex Convert is designed as a specialized functional tool for fast, hassle-free asset conversion. Unlike the spot market, it operates on a quote-based model, providing a different layer of efficiency for immediate risk management.

Price Certainty with No Slippage

The standout feature of Phemex Convert is the elimination of slippage. When you select a currency pair, the system provides a real-time quote based on current market conditions. If you are satisfied with the rate and click "Confirm," that exact price is locked in. This provides a level of certainty that is often unavailable in a thinning spot order book during a crash.

Zero Transaction Fees

One of the most significant advantages for active traders is that Phemex Convert offers zero transaction fees. This allows users to rebalance their portfolios or move to stablecoins without incurring the standard trading commissions associated with spot market execution.

Instant Settlement to Spot Account

Phemex Convert does not require an "opposite party" to match your trade manually. Once the quote is accepted, the conversion is executed immediately, and the funds are credited directly to your Spot Account. This "flash" execution allows you to stop the bleeding of a volatile portfolio in milliseconds.

4. Strategic Use Cases: Defensive Rebalancing in Action

How can Phemex Convert be integrated into a defensive strategy? Below are three hypothetical scenarios:

Scenario A: The Altcoin Retreat

Altcoins often exhibit higher volatility than Bitcoin. If the market trend breaks, a user may choose to convert high-risk assets into USDT or USDC. By utilizing Phemex Convert, the user can lock in a value quickly with zero fees, preserving "dry powder" for future opportunities.

Scenario B: Flight to Quality (BTC/ETH Consolidation)

In a downward cycle, participants often move from "weak" assets to market leaders. Phemex Convert is highly flexible, allowing you to swap between most cryptocurrencies listed on the platform (including BTC, ETH, and SOL) in a single click, skipping the two-step process of selling for cash and then rebuying.

Scenario C: Capturing the V-Shape Recovery

Volatility works both ways. After a massive correction, the market often sees a sharp bounce. Since Phemex Convert provides an instant quote and immediate settlement, users can swap back from stablecoins into high-growth assets the moment a reversal is identified, catching the start of the rally without waiting for limit orders to fill.

5. Addressing Common Questions: Costs, Taxes, and Availability

Is the quoted price different from the Spot price?

Yes. While there are no transaction fees, the quoted price may differ slightly from the current Spot market price. This is because the system provides a guaranteed fixed quote that accounts for market volatility and liquidity, ensuring you face no slippage.

What coins can I convert?

Phemex Convert is highly versatile, supporting most cryptocurrencies listed on the Phemex platform. Whether you are converting BTC to USDT, ETH to SOL, or swapping between various stablecoin pairs, the interface provides a competitive quote for almost all supported assets.

Tax Implications of Conversions

In many jurisdictions (such as the US and UK), a crypto-to-crypto conversion is considered a taxable event. However, during a crash, if you are converting at a price lower than your purchase price, you may be realizing a capital loss, which can potentially offset future gains. Users should consult with a tax advisor regarding their local regulations.

Conclusion: Don't Be a Victim of the Order Book

Market volatility is an inevitable part of the crypto cycle. What isn't inevitable is losing a portion of your portfolio to slippage, lag, or execution errors.

Phemex Convert was built for these moments. It strips away the complexity of the professional trading desk and replaces it with a "One-Click" solution that offers zero fees and price certainty. When the screen turns red and the order book thins out, use the tool designed for speed and safety.

Stop the bleed. Secure your assets. Pivot to safety.

FAQ: Quick Answers for Smart Traders

1. Is Phemex Convert the best option for beginners?

Absolutely. Its "One-Click" logic removes the steep learning curve of reading candle charts and order books, making it a safe and simple choice for new investors.

2. Are there really no fees?

Yes, Phemex Convert charges zero transaction fees. The price you see in the quote is the final price you receive in your Spot account.

3. How fast is the conversion?

The conversion is near-instant. Unlike spot trading which relies on matching buyers and sellers, the quote-based system settles the transaction the moment you click confirm.

4. Can I use it on the Phemex App?

Yes. Phemex provides a complete step-by-step guide for both WEB and APP users, ensuring you can manage your portfolio anytime, anywhere.