Markets do not always trend. In crypto especially, price often moves sideways, bouncing between support and resistance without choosing a clear direction. Many traders hate this environment. They call it chop, noise, or junk time because directional strategies struggle to perform.

Grid trading bots exist specifically for this situation.

They automate the classic "buy low, sell high" approach within a defined price range, capturing many small profits from repeated price swings. The bot keeps executing even while you sleep, work, or focus on other trades.

This guide explains how grid trading works on Phemex, when to use it, how to set it up, and how to manage risk correctly.

What Is Grid Trading?

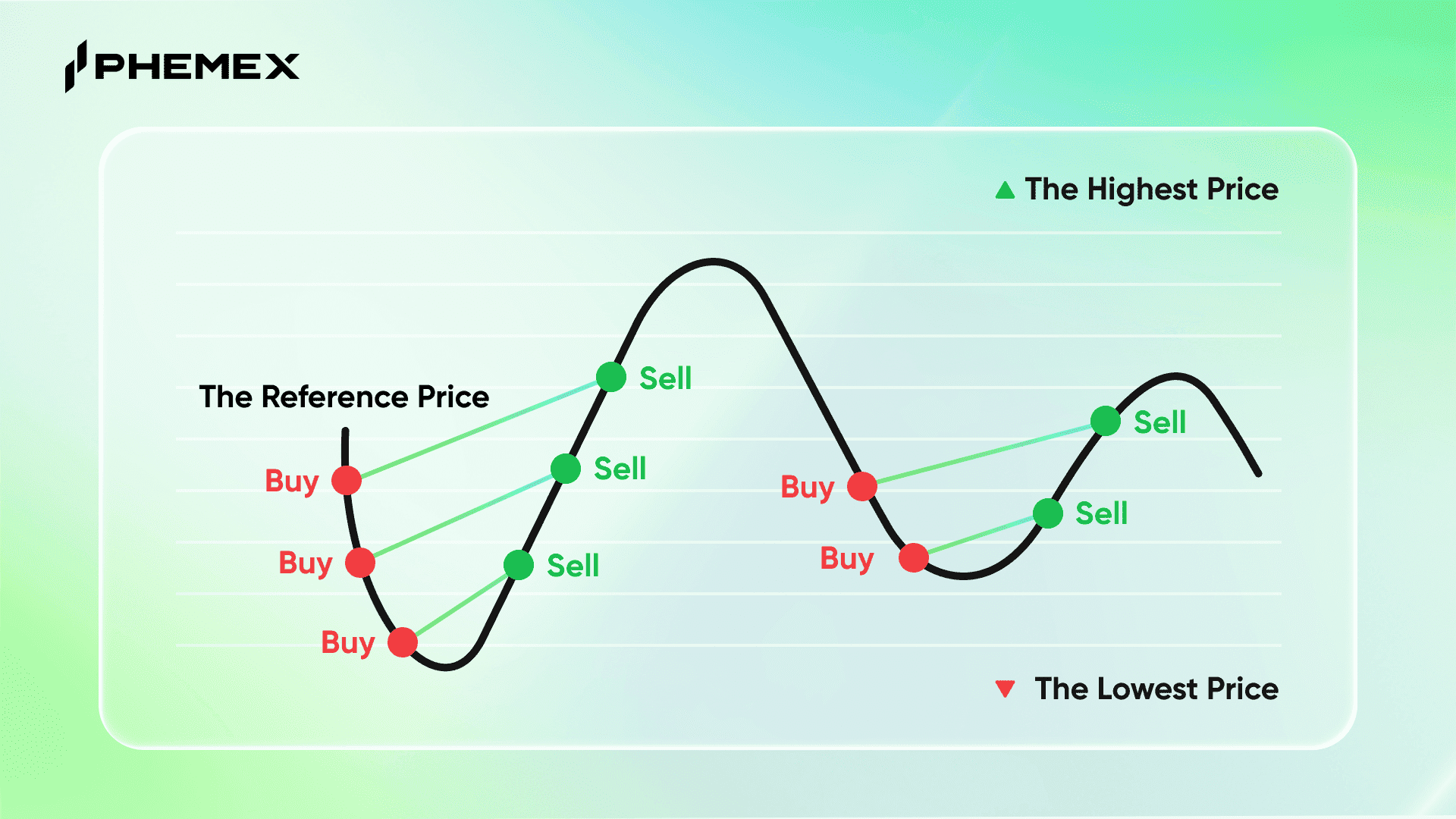

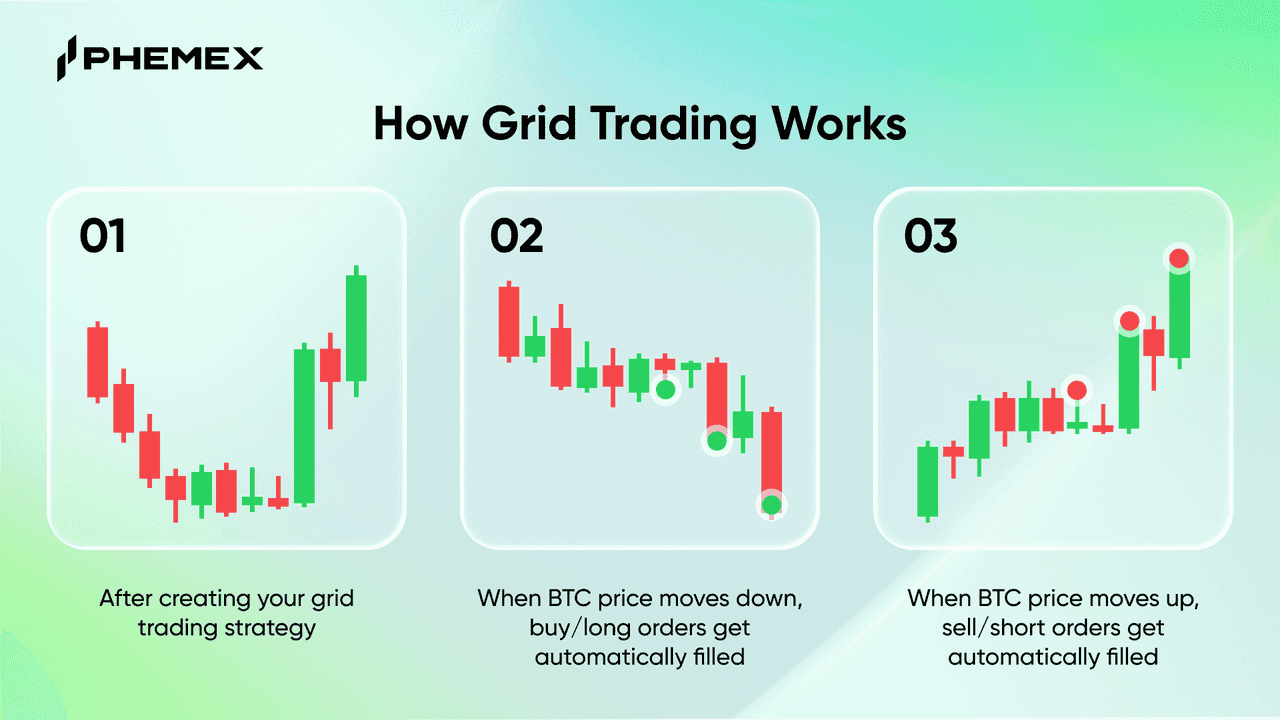

Grid trading is a systematic strategy that places multiple buy and sell orders at preset price intervals, creating a "grid" of orders across a defined range.

Here's the concept:

You define a price range (upper and lower limits)

The bot divides this range into multiple grid levels

Buy orders are placed below the current price

Sell orders are placed above the current price

As price oscillates, the bot automatically buys low and sells high

Think of it like casting a fishing net across a price range. Every time the price moves through your grid, the bot catches a small profit.

Why Grid Trading Works in Sideways Markets

Most trading strategies require you to predict direction. Grid trading doesn't.

Market Condition | Traditional Trading | Grid Trading |

Strong uptrend | ✅ Long positions profit | ⚠️ Sells too early |

Strong downtrend | ✅ Short positions profit | ⚠️ Buys into falling price |

Sideways/Choppy | ❌ Frustrating, losses | ✅ Profits from every swing |

In ranging markets, price repeatedly visits the same levels. Each visit is an opportunity to buy or sell. Grid bots exploit this pattern automatically.

Historical data shows crypto markets spend roughly 70% of the time in consolidation phases. Grid trading turns this "dead time" into consistent profit accumulation.

Grid Trading Bots on Phemex

Phemex offers two types of grid bots:

1. Spot Grid Bot

The Spot Grid Bot automates buying and selling on the spot market. No leverage, no liquidation risk — just systematic accumulation of profits.

How it works:

Places buy orders below current price

Places sell orders above current price

When a buy fills, a new sell order is placed above it

When a sell fills, a new buy order is placed below it

Best for: Conservative traders who want to accumulate profits without leverage risk. Ideal for major pairs like BTC/USDT and ETH/USDT.

2. Futures Grid Bot

The Futures Grid Bot operates on perpetual contracts with three strategy modes:

Mode | Market Outlook | How It Works |

Long | Bullish bias | Opens initial long position, then trades the grid |

Short | Bearish bias | Opens initial short position, then trades the grid |

Neutral | Pure sideways | No initial position — just buys low and sells high |

Best for: Experienced traders who understand futures mechanics and want to amplify returns (and risks) with leverage.

Critical Warning: Futures grid bots use leverage. If price moves aggressively outside your range, you risk liquidation. Always use stop-losses and start with low leverage (2-3x).

Key Parameters Explained

When setting up a grid bot, you'll configure these parameters:

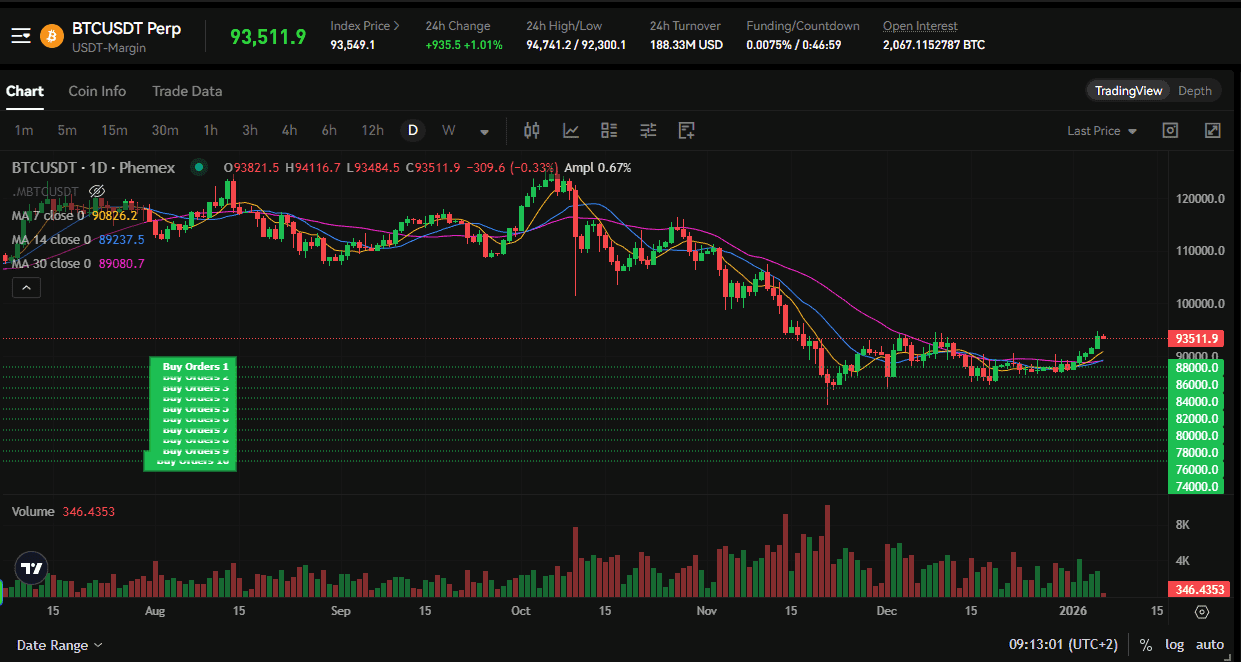

Price Range (Upper & Lower Limits)

The boundaries within which your grid operates.

Too narrow: More trades, but price easily breaks out of range

Too wide: Fewer trades, capital spread thin

Best practice: Use recent support/resistance levels. Look at the 7-day or 30-day price range for guidance.

Number of Grids

How many buy/sell levels within your range.

More grids: Frequent trades, smaller profit per trade, higher fees

Fewer grids: Less frequent trades, larger profit per trade, lower fees

General guidance: 10-30 grids for most setups. Start with fewer and adjust based on results.

Grid Type: Arithmetic vs. Geometric

Type | Spacing | Best For |

Arithmetic | Equal dollar intervals ($100, $200, $300) | Stable markets, narrow ranges |

Geometric | Equal percentage intervals (1%, 2%, 3%) | Volatile assets, wider ranges |

Pro tip: Geometric grids are "bottom heavy" — more buy orders at lower prices. This matches how crypto actually moves (in percentages, not dollars). Most experienced traders prefer geometric for volatile assets.

Investment Amount

Total capital allocated to the grid bot.

Best practice: Start small. Allocate 5-10% of your trading capital to a single grid bot until you understand its behavior.

Step-by-Step: Setting Up Your First Grid Bot

Option 1: Copy from Bot Marketplace (Recommended for Beginners)

Log into your Phemex account

Navigate to Trading Bots (under Spot or Futures menu)

Browse the Bot Marketplace for existing strategies

Find a bot with parameters you like (check ROI, runtime, risk level)

Click Copy and enter your investment amount

Click Create to activate

The marketplace shows real performance data from live bots. Look for strategies with:

Positive ROI over 7+ days

Reasonable grid density

Asset pairs you're familiar with

Option 2: Create Manual Grid Bot

Navigate to Trading Bots → Select Manual tab

Choose your trading pair (e.g., BTC/USDT)

Select strategy mode:

Spot Grid: No leverage

Futures Grid: Choose Long/Short/Neutral

Set parameters:

Upper Price: Resistance level

Lower Price: Support level

Number of Grids: Start with 10-20

Investment Amount: Your allocated capital

Configure Advanced Settings (optional):

Arithmetic vs. Geometric grid

Trigger price (bot activates when price reaches this level)

Stop price (bot closes if price hits this level)

Preview the grid on the chart

Click Create to activate

Option 3: AI Strategy (Easiest)

Navigate to Trading Bots

Select Recommended or AI Strategy tab

The system automatically generates parameters based on technical analysis

Choose a strategy based on displayed APR/ROI estimates

Enter investment amount and click Create

For beginners, the AI Strategy option is highly recommended. It removes the guesswork from parameter selection.

Managing Your Grid Bot

Monitoring Performance

To check your active bots:

Go to Trading Bots on the trading page

Scroll to your activity window

Click Details for comprehensive summary

You'll see:

Total returns (realized + unrealized)

Position details

Grid orders and fill history

Individual trade profits

When to Stop Your Bot

Consider stopping when:

Price breaks decisively out of your range

You've hit your profit target (e.g., 5-10% return)

Market conditions change (high-impact news incoming)

The bot shows sustained negative PnL

To stop a bot, click Stop in your activity window. Pending orders cancel and positions close at market price.

Risk Management for Grid Trading

1. Set Stop-Loss Prices

Always configure a stop price in Advanced Settings. If price breaks below your range, the bot closes automatically instead of buying into a deeper crash.

2. Start with Low Leverage (Futures)

If using Futures Grid, start with 2-3x leverage maximum. High leverage amplifies both gains and liquidation risk.

3. Size Your Investment Appropriately

Don't put all your capital in one grid bot. Spread across multiple strategies or keep reserves for other opportunities.

4. Match Grid Range to Market Conditions

If the market range is $90K-$100K, don't set a grid from $80K-$120K. Tighter grids matching actual volatility perform better.

5. Monitor Regularly

Grid bots are "set and forget" but not "set and ignore." Check daily to ensure market conditions still support your strategy.

Common Mistakes to Avoid

Mistake | Why It Hurts | Solution |

Range too narrow | Price breaks out frequently, bot idles | Use 7-30 day price range as guide |

Range too wide | Capital spread thin, trades too infrequent | Focus on realistic support/resistance |

Too many grids | Trading fees eat profits | Start with 10-20 grids |

Too few grids | Missing price movements | Increase grids if volatility is high |

Fighting strong trends | Buying into crashes or selling into rallies | Pause bot during trending markets |

Ignoring fees | Grid profit < trading fees | Ensure profit per grid exceeds fee cost |

High leverage without stops | Liquidation wipes account | Use 2-3x max, always set stop price |

Grid Trading vs. Other Strategies

Strategy | Best Market | Effort Required | Risk Level |

Grid Trading | Sideways | Low (automated) | Medium |

HODL | Long-term bull | None | High (drawdowns) |

Day Trading | Trending | High (manual) | High |

DCA | Any | Low | Medium |

Copy Trading | Any | Low | Varies |

Grid trading fills a unique niche of profiting from markets that most traders find frustrating. When combined with other strategies (grid for sideways, trend-following for directional moves), it creates a more complete trading approach.

Frequently Asked Questions

What's the minimum investment for a grid bot on Phemex?

Depends on the trading pair and number of grids. Generally, $50-100 USDT is sufficient for basic setups.

Can I run multiple grid bots simultaneously?

Yes. You can run multiple bots on different pairs or even the same pair with different parameters.

Do grid bots work 24/7?

Yes. Once activated, they run continuously until you stop them or they hit stop conditions.

What fees do grid bots incur?

Standard Phemex trading fees (maker/taker) apply to each grid trade. Ensure your grid profit exceeds fee costs.

What happens if price breaks out of my range?

The bot stops placing new orders. It resumes when price returns to range. If you have a stop price set, it closes automatically.

Can I modify a running grid bot?

No. You must stop the current bot and create a new one with updated parameters.

Related Resources

Disclaimer

By using Phemex's trading bot services, you recognize that cryptocurrency trading carries inherent risks that may lead to potential loss of capital. Phemex provides crypto trading bots as a tool only, with no guarantee of performance or profitability. Users are responsible for all trading decisions, configurations, and outcomes including any losses incurred.

Risk Warning

Trading cryptocurrency involves financial risk due to market volatility, liquidity fluctuations, and unpredictable price movements. The use of automated crypto trading bots may amplify these risks and lead to gains or losses in short timeframes. Trading bots operate based on predefined parameters and cannot account for sudden market shifts, technical failures, or unforeseen events. Profit is not guaranteed, so never invest more than you can afford to lose.