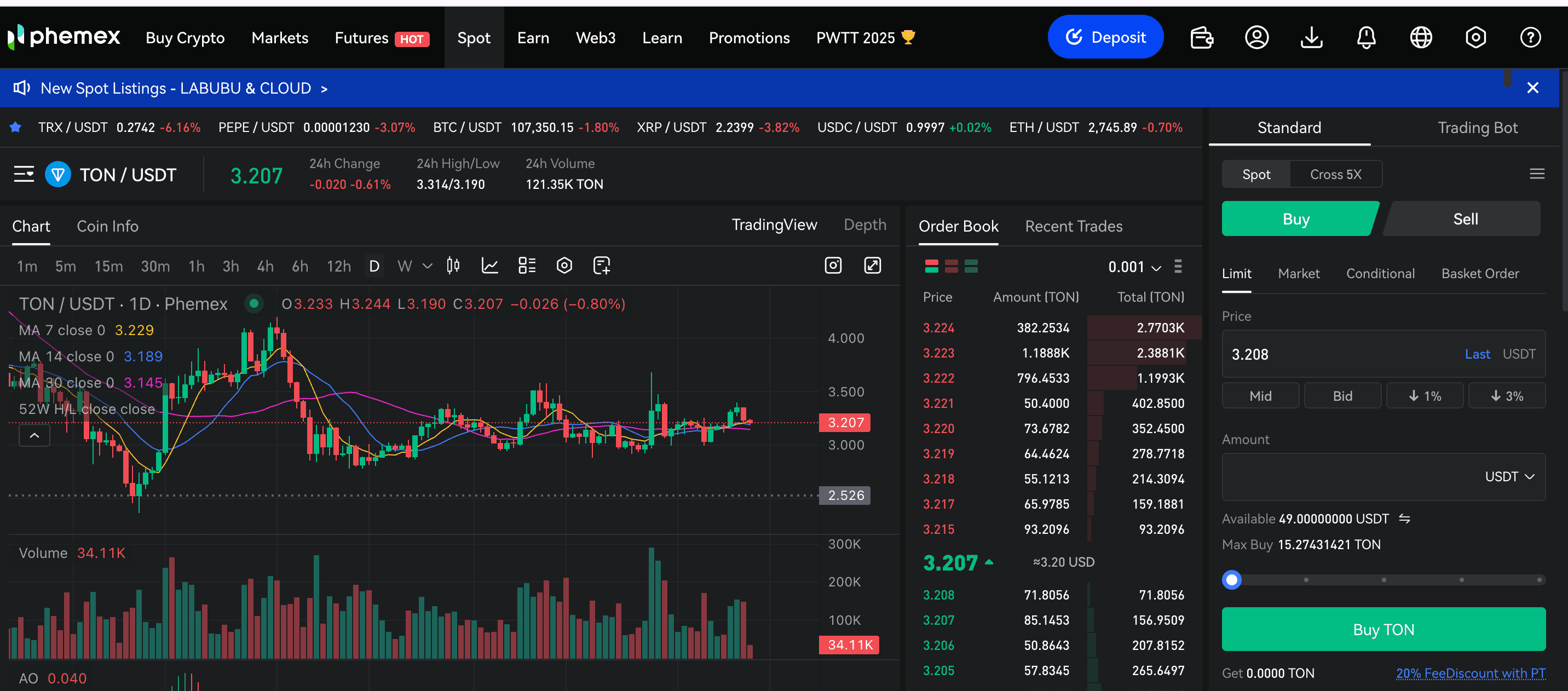

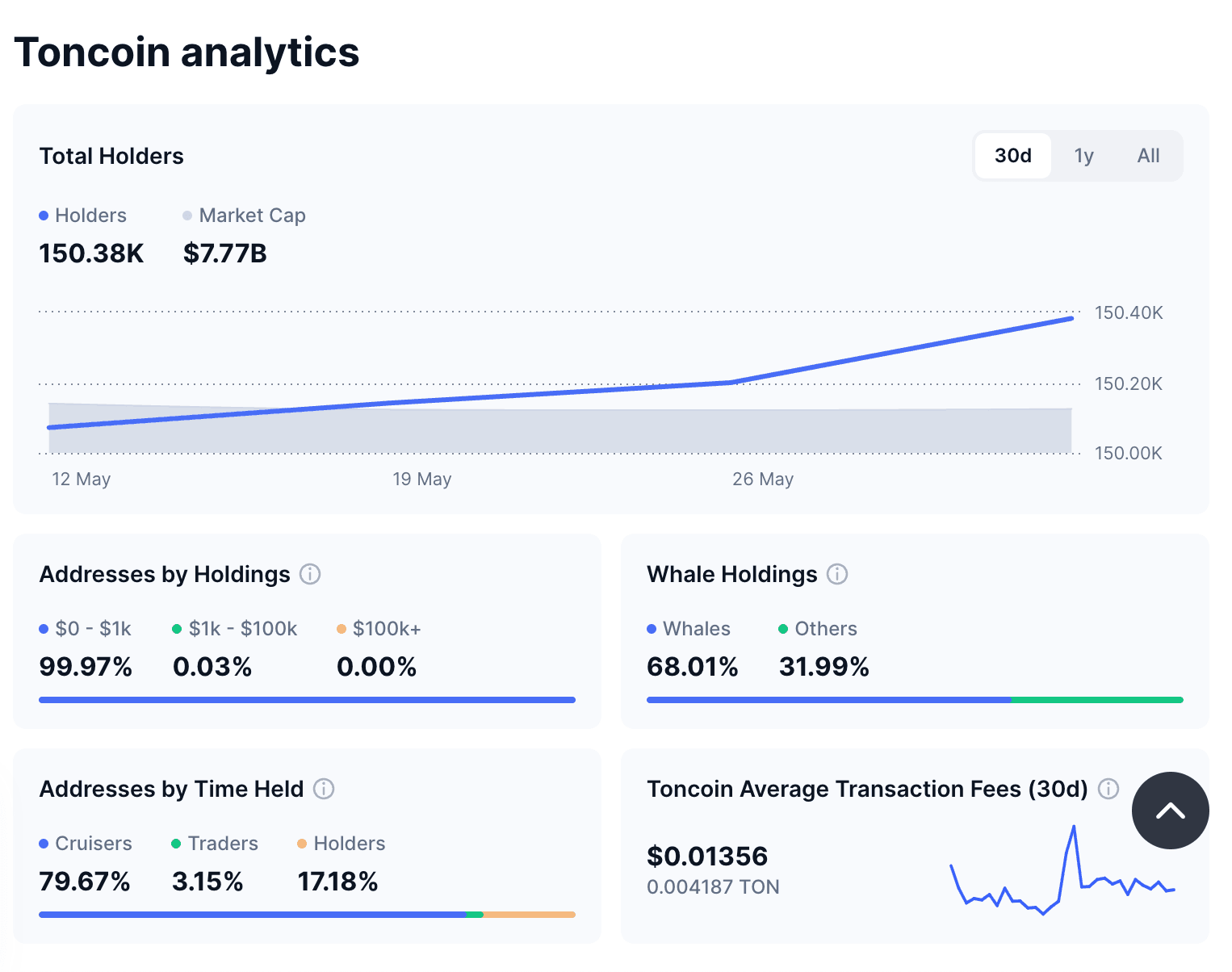

Toncoin (TON) has experienced a significant pullback, currently trading at $3.22 as of June 12, 2025, reflecting a 60% decline from its all-time high of $8.28 in June 2024. Despite this correction, TON’s fundamentals are strengthening, with growing adoption and ecosystem development signaling long-term potential. The price has been consolidating tightly between $2.88 and $3.50 over the past month, a pattern often described as the “calm before the storm.” This raises a critical question: Is TON poised for a breakout or a breakdown? In this analysis, we explore TON’s price action, key technical levels, and trading strategies to navigate its next move.

TON Price Analysis: Current Market Dynamics

Recent Price Action

TON’s price has stabilized within a narrow range of $2.88 to $3.50 since mid-May 2025, following a sharp decline from its 2024 peak. This consolidation suggests indecision in the market, with bulls and bears vying for control. The tightening range, combined with increasing on-chain activity and ecosystem growth, points to a potential catalyst-driven move.

Key Technical Indicators

-

Support and Resistance Levels: The $2.88 level acts as strong support, tested multiple times in recent weeks, while $3.50 serves as a critical resistance. A break above or below these levels could dictate TON’s short-term direction.

-

Moving Averages: The 50-day moving average (currently at $3.10) is converging with the 200-day moving average ($3.40), forming a potential “golden cross” if bullish momentum builds. However, a drop below the 50-day MA could signal bearish pressure.

-

Relative Strength Index (RSI): The RSI is hovering around 45, indicating neutral momentum. A move above 50 could confirm bullish strength, while a drop below 40 may signal further downside.

-

Volume Trends: Trading volume has been declining during consolidation, a common precursor to a significant breakout or breakdown. A surge in volume will likely confirm the next move.

TON Price Predictions: Three Scenarios

1. Bullish Breakout to $4.21 and Beyond

If TON breaks above $3.50 with strong volume, it could signal the end of consolidation and the start of a bullish rally. The next key resistance lies at $4.21, a 30% gain from current levels. Sustained momentum could push TON toward $5.36 or even $6.00, levels aligned with previous highs from early 2024.

Pro Tips:

-

Entry: Initiate long positions on a confirmed breakout above $3.50, ideally with volume exceeding the 7-day average.

-

Targets: Aim for $4.21 as the primary target, with secondary targets at $5.36 and $6.00 for short-term gains.

-

Risk Management: Place stop-losses below $3.30 to protect against false breakouts.

2. Bearish Breakdown to $2.36

A decisive break below $2.88 with elevated volume could trigger a bearish reversal, potentially driving TON toward $2.36 or lower. This level aligns with the 61.8% Fibonacci retracement from the 2024 rally, making it a critical support zone.

Pro Tips:

-

Entry: Consider short positions if $2.88 breaks with significant volume, targeting $2.36.

-

Accumulation Opportunity: For long-term investors, the $2.36–$2.40 zone offers a favorable accumulation range, given TON’s strong fundamentals.

-

Risk Management: Set stop-losses above $3.00 to limit exposure on short trades.

3. Retest of $2.35–$2.40 Support

A third scenario involves a shallow dip to the $2.35–$2.40 range, where stronger support exists, before resuming upward momentum. A low-volume retracement would indicate weak selling pressure, setting the stage for a rebound toward $3.50 or higher.

Pro Tips:

-

Entry: Accumulate gradually near $2.40, especially if volume remains low during the dip.

-

Confirmation: Wait for a bounce with increasing volume to confirm the retracement is complete.

-

Risk Management: Use tight stop-losses below $2.30 to guard against deeper declines.

Strategic Trading Approach

TON’s current consolidation phase offers traders multiple opportunities, depending on the breakout direction. Here’s how to prepare:

-

Monitor Volume: Volume spikes are critical for confirming breakouts above $3.50 or breakdowns below $2.88.

-

Plan Entries: Enter long positions on bullish breakouts or accumulate during low-volume dips near $2.40. Short positions may be viable on confirmed bearish breakdowns.

-

Risk Control: Use stop-losses just outside the consolidation range ($2.88–$3.50) to manage risk effectively.

-

Leverage Tools: Utilize advanced trading platforms like Phemex for real-time market data, scaled USDT-based orders, and iceberg orders for precise execution.

Why Trade TON on Phemex?

Phemex offers a robust trading environment to capitalize on TON’s price movements. Features include:

-

Multiple Watchlists: Track TON alongside other assets for real-time insights.

-

Scaled Orders: Control risk with precise position sizing.

-

Iceberg Orders: Execute large trades discreetly to minimize market impact.

-

Real-Time Strategy Adjustments: Adapt quickly to TON’s volatile price action.

Key Takeaways

-

Consolidation Phase: Toncoin (TON) is trading at $3.22, stuck in a tight range between $2.88 and $3.50, signaling a potential breakout or breakdown soon.

-

Bullish Breakout Potential: A strong move above $3.50 with high volume could drive TON to $4.21, $5.36, or even $6.00, offering up to 40% upside.

-

Bearish Risk: A break below $2.88 may push TON toward $2.36, a key support level, presenting a shorting or accumulation opportunity.

-

Retest Scenario: A low-volume dip to $2.35–$2.40 could set the stage for a rebound, ideal for long-term investors.

-

Technical Indicators: RSI at 45 shows neutral momentum, while converging 50-day and 200-day moving averages hint at a potential golden cross.

-

Trading Strategy: Monitor volume for breakout confirmation, use stop-losses outside the $2.88–$3.50 range, and leverage Phemex’s tools like scaled and iceberg orders.

-

Fundamental Strength: TON’s growing ecosystem supports long-term optimism despite a 60% drop from its $8.28 all-time high in June 2024.

-

Risk Management: Always conduct your own research (DYOR) and use tight stop-losses to navigate TON’s volatile price action effectively.

Conclusion

Toncoin (TON) is at a pivotal moment, with its price consolidating tightly between $2.88 and $3.50. Backed by strong fundamentals, TON is poised for a significant move—either a bullish breakout toward $4.21–$6.00 or a bearish dip to $2.36–$2.40. Traders can position themselves for success by monitoring volume, targeting key levels, and using advanced tools on platforms like Phemex. With disciplined risk management and strategic planning, TON’s next move could offer substantial opportunities.

Disclaimer: This analysis is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency trading carries high risks. Conduct your own research (DYOR) before making trading decisions. Phemex is not liable for any losses incurred from the use of this content. For more details on trading TON, visit Phemex.

Read More:

Toncoin and The Open Network (TON): A Deep Dive into Telegram’s Blockchain and NFT Surge