Tokenized real-world assets (RWAs) have now surpassed $35 billion in on-chain value, marking continued progress in bridging traditional finance with blockchain. This week brings notable advancements, including JPMorgan's tokenization of its first private equity fund, Tether Gold exceeding $2 billion, and sustained leadership from BlackRock’s BUIDL fund at $2.9 billion.

Across stablecoins, treasuries, and emerging sectors like real estate, RWAs are transitioning from pilot projects to core components of global finance. This edition covers the week's key metrics, updates, and forward-looking events to help you navigate the evolving landscape.

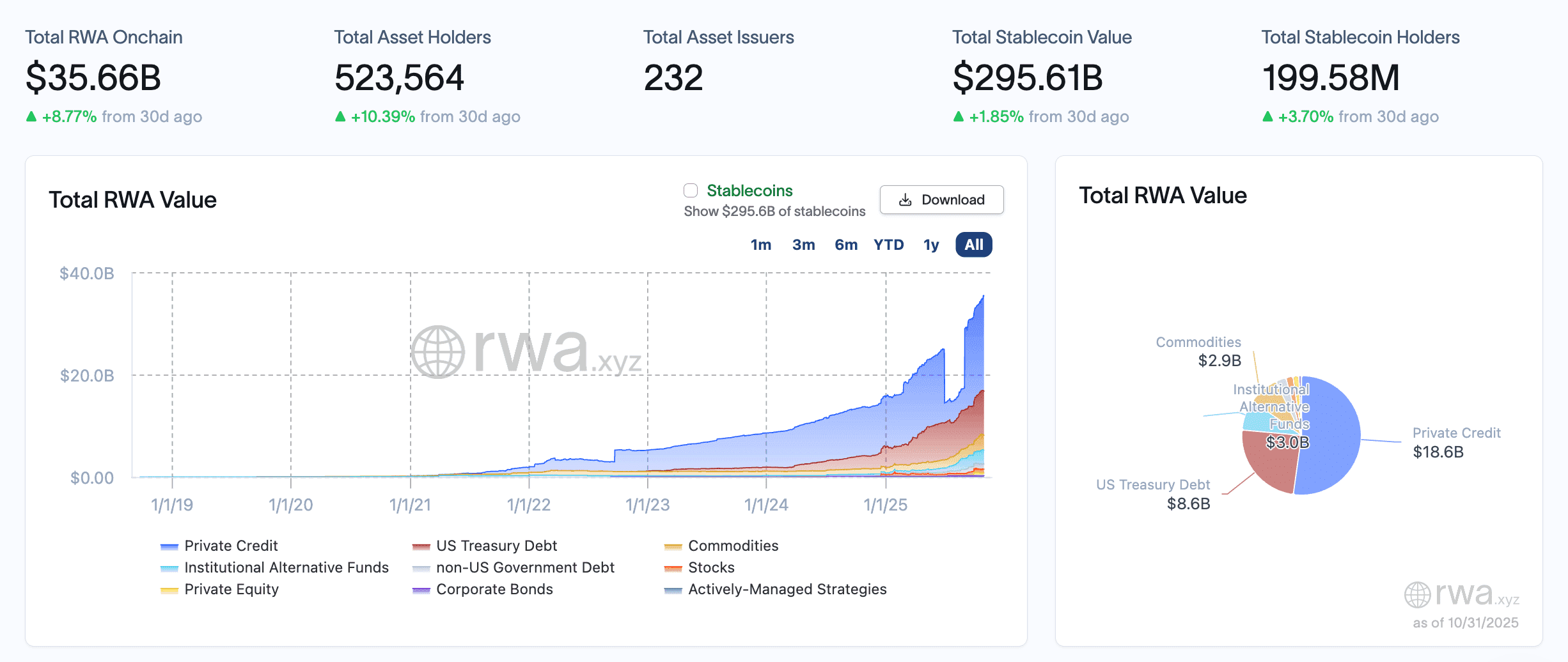

RWA Market Overview: Total Value, Top Assets & Stablecoin Trends

The RWA ecosystem continues its measured expansion, with tokenized assets (excluding stablecoins) reaching $35.66 billion in on-chain Total Value as of October 31, 2025. This reflects an 8.77% rise over the past 30 days.

Supporting this growth are 523,564 unique holders (up 6.89%) and 232 active issuers (up 5 from last week), including established names like BlackRock, Tether, and Ondo Finance. Stablecoins, essential for RWA settlement and yield flow, hold a separate market value of $295.61 billion.

Market Snapshot

Source: rwa.xyz

Top RWA Assets by Total Value (Weekly)

U.S. Treasuries remain the dominant category, led by BlackRock's BUIDL fund at $2.85 billion. Commodities, particularly tokenized gold, have seen notable volume amid rising physical prices. The following table highlights the top performers by total value:

| Rank | Asset | Total Value | 7D % | 30D % | Asset Class |

|---|---|---|---|---|---|

| 1 | BlackRock's Fund (BUIDL) | $2.85B | +0.06% | +5.74% | U.S. Treasuries |

| 2 | Tether Gold (XAUT) | $1.55B | -3.98% | +46.78% | Commodities |

| 3 |

Syrup USDC (syrupUSDC) |

$1.34B | +1.75% | +18.15% | Private Credit |

| 4 |

Paxos Gold (PAXG) |

$1.31B | -3.86% | +1.34% | Commodities |

| 5 |

Janus Henderson’s Fund (JAAA) |

$1.01B | +0.06% | +27.8% | Institutional Funds |

RWA Protocol Tokens by Market Cap:

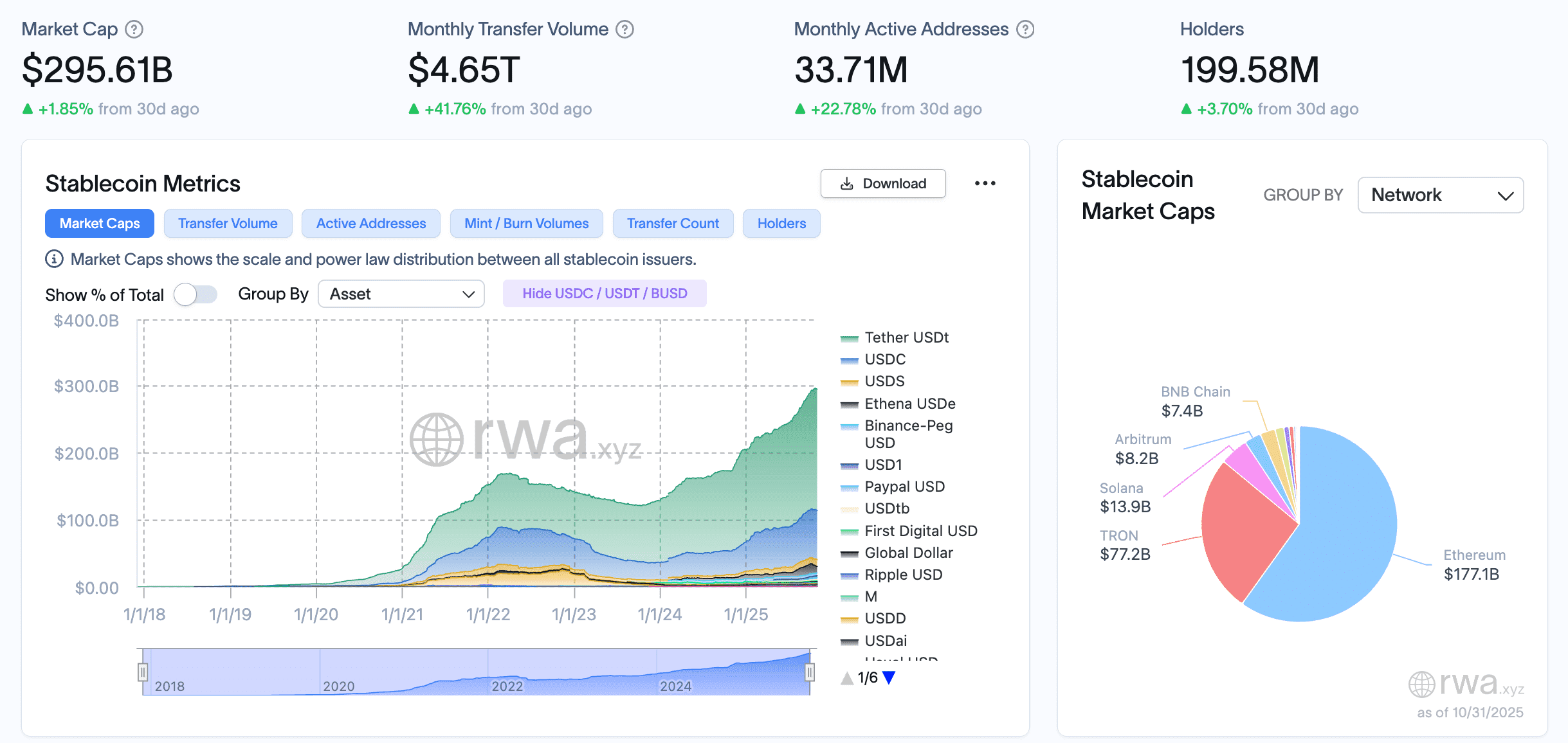

Stablecoin Trends

Stablecoins serve as the infrastructure layer for RWAs, enabling instant transfers and yield distribution.

- USDC has surpassed USDT in on-chain transaction volume for the first time, per JPMorgan, fueled by MiCA compliance and institutional preference.

- USD1 (World Liberty Financial) grew +10.37% to $2.9 billion, targeting low-cost remittances in emerging markets.

- USDe (Ethena) dropped -11.38% to $10.2 billion after rate-based yield recalibration.

- Visa expanded support to four new stablecoins across four blockchains, with spending volume up 4x year-over-year — a sign of mainstream acceptance.

Top RWA News: JPMorgan, Tether Gold, BlackRock BUIDL

Here’s what moved the needle this week — and why it matters for RWAs.

Institutional Moves

- JPMorgan Tokenizes First Private Equity Fund on Onyx: The bank used its Onyx platform — already handling $1B+ in daily settlements — to bring illiquid PE on-chain. This means fractional shares and faster exits for investors, paving the way for $10T in tokenized private markets by 2030.

- Maybank Rolls Out $3.8B Tokenized MMF with BNP Paribas: Southeast Asia’s banking giant launched a Shariah-compliant fund on BNB Chain. It delivers on-chain yield from short-term Islamic paper, opening doors to $500B in regional Islamic finance.

- FINRA Greenlights Ironlight ATS: The regulator approved a hybrid trading system for tokenized + traditional securities. Settlement goes from T+2 to instant, fully SEC-compliant — a big boost for RWA liquidity.

Market Milestones

- Tether Gold (XAUT) Crosses $2B: Fueled by gold’s all-time highs, XAUT’s on-chain value hit $1.59B (total $2B). Paired with PAXG at $1.35B, tokenized commodities now make up over 10% of RWAs — a solid hedge play.

- Standard Chartered: $2T RWAs by 2028: The bank sees 57x growth from today’s $35B. Private credit ($18B potential) and Treasuries ($8.6B now) lead the charge, challenging TradFi head-on.

- Securitize Heads to Public Markets via SPAC: The team behind BlackRock’s BUIDL and $4B+ in tokenized assets is going public. Fresh capital will scale oracles, KYC, and custody — the backbone of RWAs.

Regulation & Policy

- UK FCA Backs Public-Chain Tokenization: Tokenized funds on Ethereum or Solana are now fair game — as long as KYC/AML checks out. This could unlock $240B in property and equities.

- Fed’s Barr Flags Stablecoin Gaps: Post-RFI (300+ replies), the GENIUS Act needs fixes. Ties into FASB’s 6-1 vote to treat stablecoins as cash equivalents — a potential $100B+ treasury unlock.

- Jamie Dimon Warms to Stablecoins: From “pet rock” to “real tech we’ll all use” — a Wall Street pivot that could sway $40T in credit markets.

Tech & Integrations

- Chainlink Powers Ondo’s $700M Tokenized Stocks: CCIP and Data Streams deliver real-time pricing and cross-chain settlement on BNB Chain. This sets up $140B in fixed-income flows via Pendle.

Phemex New RWA Token Listing

PIGGY, the native token of Piggycell — an RWA protocol in the tokenized real-world assets sector — is now officially listed on Phemex. PIGGY is currently trading at $1.92, up 4.25% over the last 24 hours. Learn more about the project: What Is Piggycell (PIGGY)? A Guide to RWA DePIN Token 2025

- Spot Trading: PIGGY/USDT

- Futures Trading: PIGGY/USDT perpetual contracts with up to 20x leverage

Trade it alongside ONDO (tokenized treasuries & credit), XAUT (Tether Gold), and major stablecoins.

RWA Events Calendar: What’s Next This Week

| Date | Event | Why Watch |

|---|---|---|

| Nov 4 | FASB stablecoin accounting update | Cash-equivalent status could open corporate treasuries to USDC. |

| Nov 5 | RWA.xyz monthly report | Full October breakdown: Total Value, holders, issuers. |

| Nov 6 | Ondo tokenized ETF push on BNB | Aiming for $1B AUM with Chainlink cross-chain tech. |

| Nov 7 | Bitwise BSOL ETF check-in | Early look at regulated 7% staking on Solana RWAs. |

| Nov 8 | Circle Arc testnet tweaks | Prepping 2026 mainnet for enterprise RWA flows. |

Note: Event dates are subject to confirmation; monitor official channels for updates.

RWA Outlook: $2T by 2028 & Phemex Trading

RWA Total Value has reached $35 billion, with 230 issuers and over 500,000 holders showing strong participation across blockchain and traditional finance. Developments from JPMorgan, BlackRock, and others — along with regulatory progress — support steady growth. Standard Chartered estimates the market could hit $2 trillion by 2028.

Phemex offers trading access to key assets like ONDO and the newly listed PIGGY. Learn more about RWA and trade RWAs on Phemex today.