Decentralized finance (DeFi) thrives on innovation, and Aerodrome has emerged as a key player on the Base blockchain. Its native token, AERO, powers a sophisticated ecosystem designed to enhance liquidity and trading on Layer-2. With $100 billion in trading volume in 2025, Aerodrome has established itself as a significant force in DeFi. This article explores what AERO is, its role within Aerodrome, and how to trade AERO on Phemex, providing a balanced and comprehensive overview.

Quick Facts: AERO at a Glance

-

Ticker Symbol: AERO

-

Chain: Base (Layer-2 on Ethereum)

-

Contract Address: 0x940181a94A35A4569E4529A3CDfB74e38FD98631

-

Circulating Supply: ~614 million AERO

-

Max Supply: No hard cap (inflationary)

-

Primary Use Case: Governance, liquidity incentives, revenue sharing

-

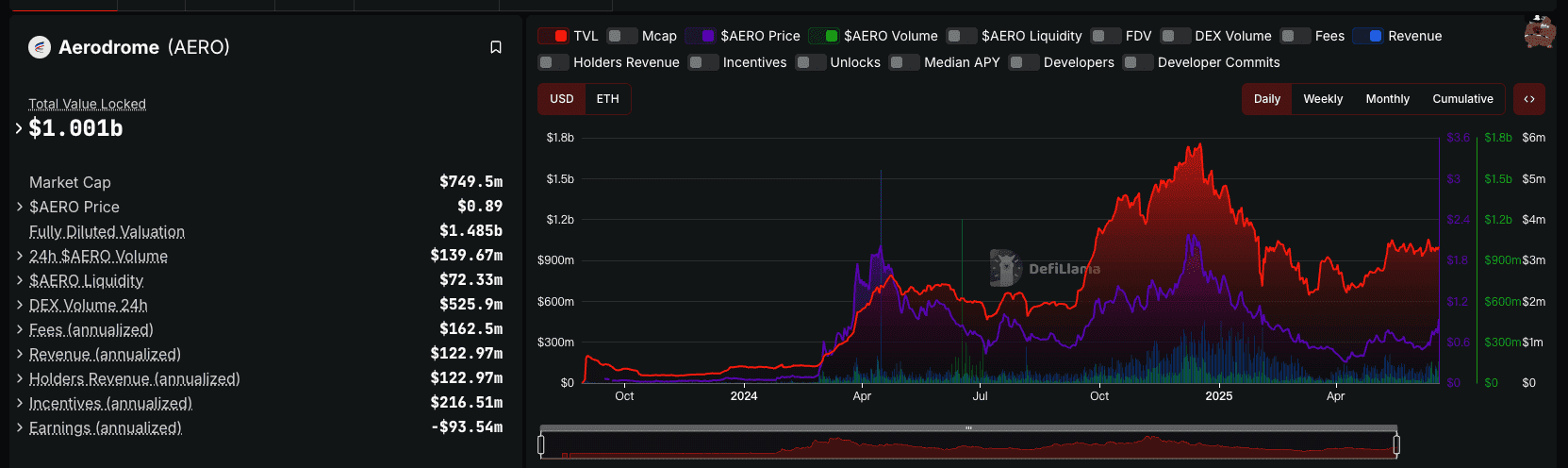

Current Market Cap: ~$1.2 billion (as of June 2025)

What Is AERO?

What is AERO? AERO is the ERC-20 utility token of Aerodrome, a decentralized exchange (DEX) and automated market maker (AMM) on Base, a Layer-2 scaling solution for Ethereum. Launched in August 2023, Aerodrome aims to serve as Base’s central liquidity hub, offering low-cost, high-efficiency trading. AERO explained: it drives the protocol’s operations, incentivizing liquidity provision, enabling governance, and distributing revenue to participants.

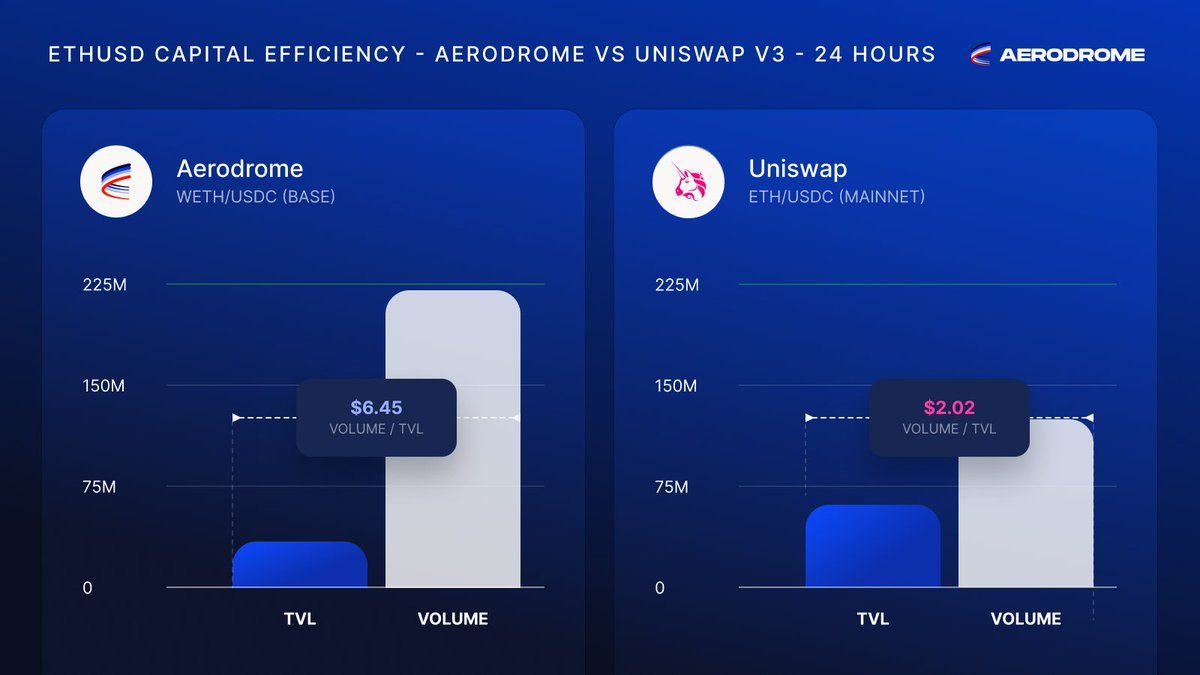

Aerodrome addresses DeFi’s liquidity fragmentation by consolidating assets into efficient pools, leveraging Base’s scalability for fast, affordable transactions. Its Slipstream feature, a concentrated liquidity AMM, handles 85% of trading volume, optimizing returns for liquidity providers. AERO’s integration into this ecosystem positions it as a cornerstone of Base’s DeFi landscape, appealing to traders and developers seeking performance-driven solutions.

How Many AERO Are There?

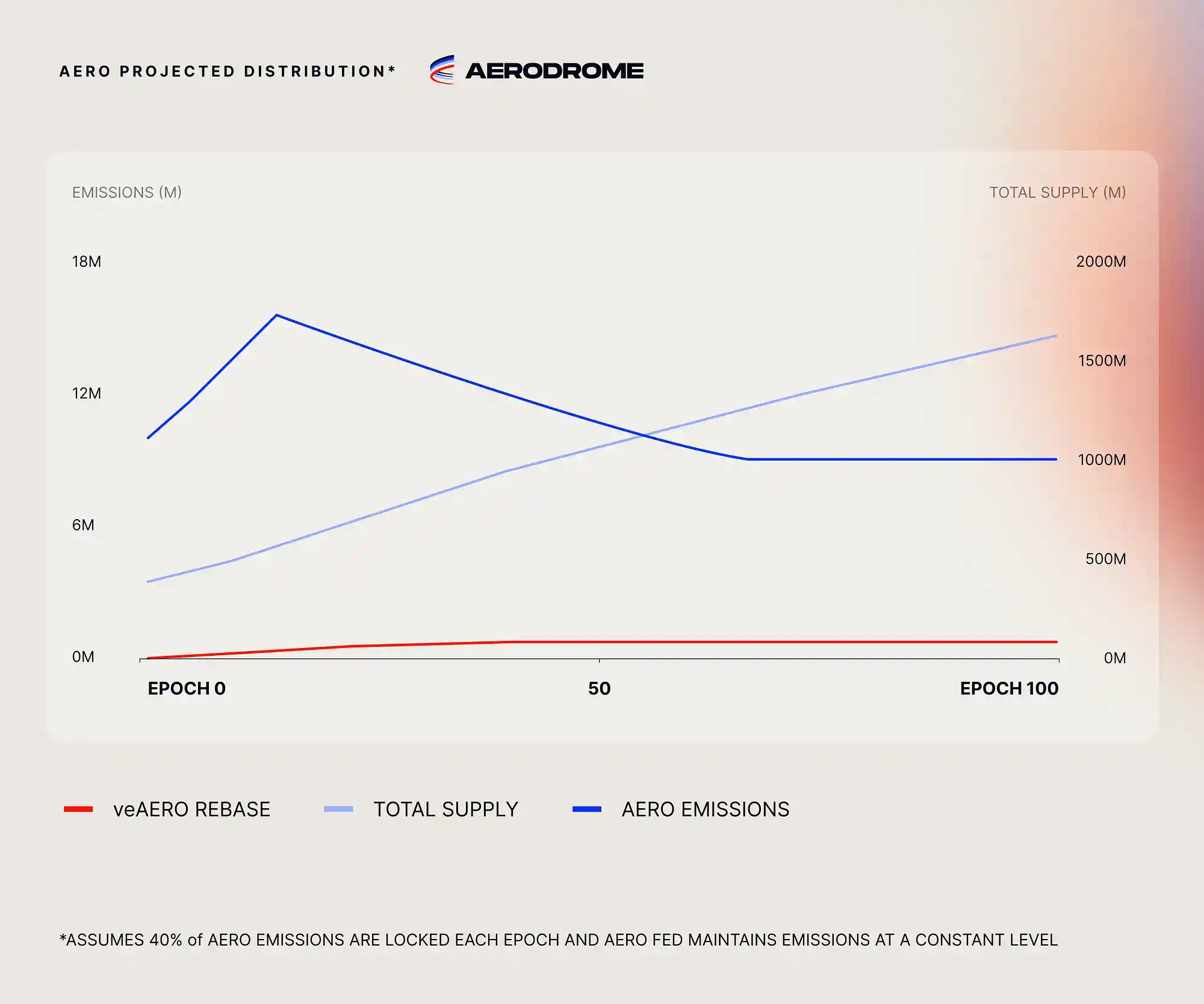

AERO’s token supply is inflationary, with a circulating supply of ~614 million as of June 2025 and no maximum cap. The initial supply was 500 million AERO, with 440 million distributed as vote-escrowed (veAERO) tokens and 60 million allocated for voter and liquidity incentives. Weekly emissions began at 10 million AERO (2% of initial supply), following a three-phase schedule:

-

Take-off (Weeks 1–14): Emissions increase by 3% weekly to boost early activity.

-

Cruise (Post-Week 14): Emissions decay by 1% per epoch, moderating inflation.

-

Aero Fed (~Week 67+): veAERO holders vote to adjust emissions (increase, decrease, or maintain) within a range of 0.01%–1% of total supply.

To manage inflation, 30% of Aerodrome’s $285 million annual revenue funds AERO buybacks, reducing circulating supply. No token burns occur, and the absence of VC or team unlocks minimizes sell pressure. Additionally, veAERO holders receive a rebase proportional to emissions and the veAERO-to-AERO supply ratio, calculated as:

rebase = weeklyEmissions × (1 - veAERO.totalSupply ÷ AERO.totalSupply)² × 0.5This mechanism rewards locking when participation decreases, incentivizing long-term commitment. AERO’s supply dynamics balance growth and stability, though inflation remains a consideration.

What Does AERO Do?

AERO’s use case is integral to Aerodrome’s ecosystem, serving three primary functions:

-

Governance: AERO holders can lock tokens to receive veAERO (an ERC-721 NFT), granting voting power on protocol decisions, such as emission allocation to liquidity pools. Locking periods range up to 4 years, with 100 AERO locked for 4 years yielding 100 veAERO, while 1 year yields 25 veAERO. Auto-Max Lock treats veAERO as permanently locked for maximum voting power.

-

Liquidity Incentives: AERO emissions reward liquidity providers (LPs) based on pool voting power, distributed proportionally to staked LP positions throughout each epoch.

-

Revenue Sharing: 100% of protocol revenue is redistributed to veAERO holders, aligning incentives for long-term participation.

AERO also facilitates interactions within Base’s DeFi ecosystem, supporting seamless integrations with other protocols. Its utility in high-volume trading, low-fee environments makes it a vital component of Aerodrome’s success.

AERO vs Bitcoin

AERO and Bitcoin serve distinct purposes within the crypto space. The table below outlines key differences:

|

Aspect |

AERO |

|

|---|---|---|

|

Technology |

Base Layer-2 with Optimistic Rollups, tied to Ethereum’s PoS |

Proof-of-Work blockchain, energy-intensive |

|

Speed and Fees |

Near-instant transactions, fees < $0.01 |

~10-minute block time, fees $10–$50 during peaks |

|

Use Case |

Governance, liquidity incentives, DeFi trading |

Store of value, peer-to-peer payments |

|

Decentralization |

Inherits Ethereum’s security, moderately decentralized |

Highly decentralized via global PoW network |

AERO prioritizes speed and utility in DeFi, while Bitcoin emphasizes scarcity and security, catering to different user needs.

The Technology Behind AERO

Aerodrome leverages Base, an Ethereum Layer-2 solution using Optimistic Rollups, to deliver high throughput and low costs while maintaining Ethereum’s security. Its consensus aligns with Ethereum’s proof-of-stake (PoS), ensuring reliable transaction validation.

The protocol’s Slipstream AMM, inspired by Uniswap V3, enables concentrated liquidity, allowing LPs to set price ranges for enhanced capital efficiency. Slipstream drives 60%+ of Base’s DEX volume, underscoring its technical edge. Base’s infrastructure, supported by Coinbase, facilitates user onboarding, with integrations like Coinbase Wallet expanding AERO’s accessibility.

Future enhancements, such as potential zk-Rollup adoption per Base’s roadmap, could further boost scalability. Aerodrome’s partnerships with Coinbase and Base-native protocols strengthen its position as a DeFi hub.

Team & Origins

Aerodrome was launched in August 2023 by a pseudonymous team, raising no external capital—no VCs, private sales, or team allocations. This community-driven approach aligns incentives with users, avoiding traditional unlock risks. The team’s anonymity is offset by their proven execution: Aerodrome achieved $200 million in total value locked (TVL) within 72 hours and now leads Base’s DeFi ecosystem.

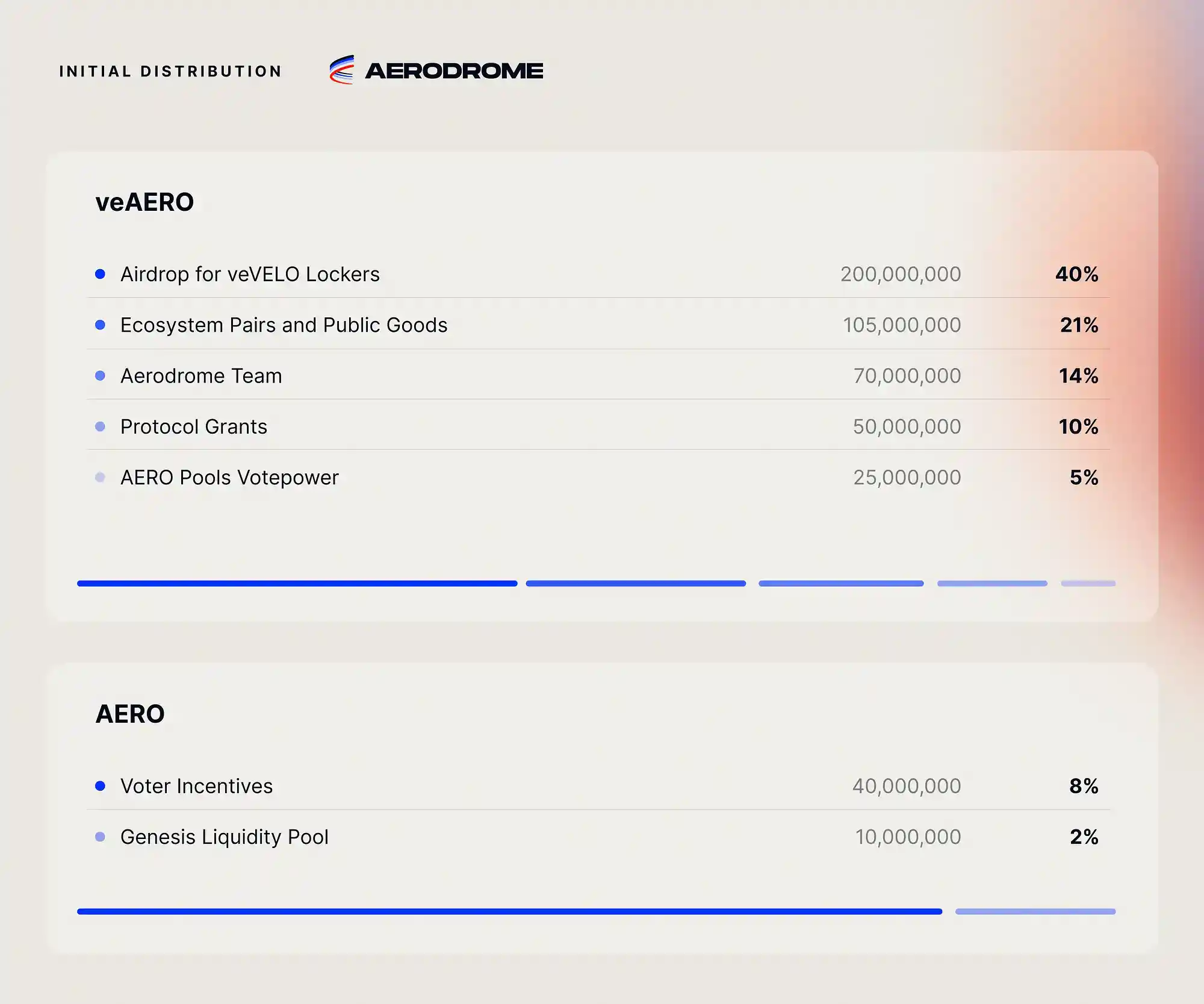

Inspired by Velodrome on Optimism, Aerodrome tailors its model to Base, emphasizing Slipstream and organic growth. Initial token distribution included:

-

AERO: 40M (8%) for voter incentives, 10M (2%) for genesis liquidity.

-

veAERO: 200M (40%) airdropped to veVELO lockers, 105M (21%) for public goods, 95M (19%) for the foundation, and 50M (10%) for Flight School, all Auto-Max Locked.

This structure prioritizes community and protocol development, fostering trust and sustainability.

Key News & Events

Aerodrome’s milestones reflect its rapid growth:

-

August 2023: Launched on Base, hitting $200 million TVL in 72 hours.

-

March 2024: Surpassed $1 billion in trading volume, no VC unlocks.

-

June 2024: Slipstream drove 85% of $10 billion total volume.

-

June 2025: Reached $100 billion in volume, leading Base DeFi.

-

June 2025: Coinbase Wallet integrated AERO pools, enhancing accessibility.

-

Ongoing: No reported SEC or regulatory issues, suggesting compliance focus.

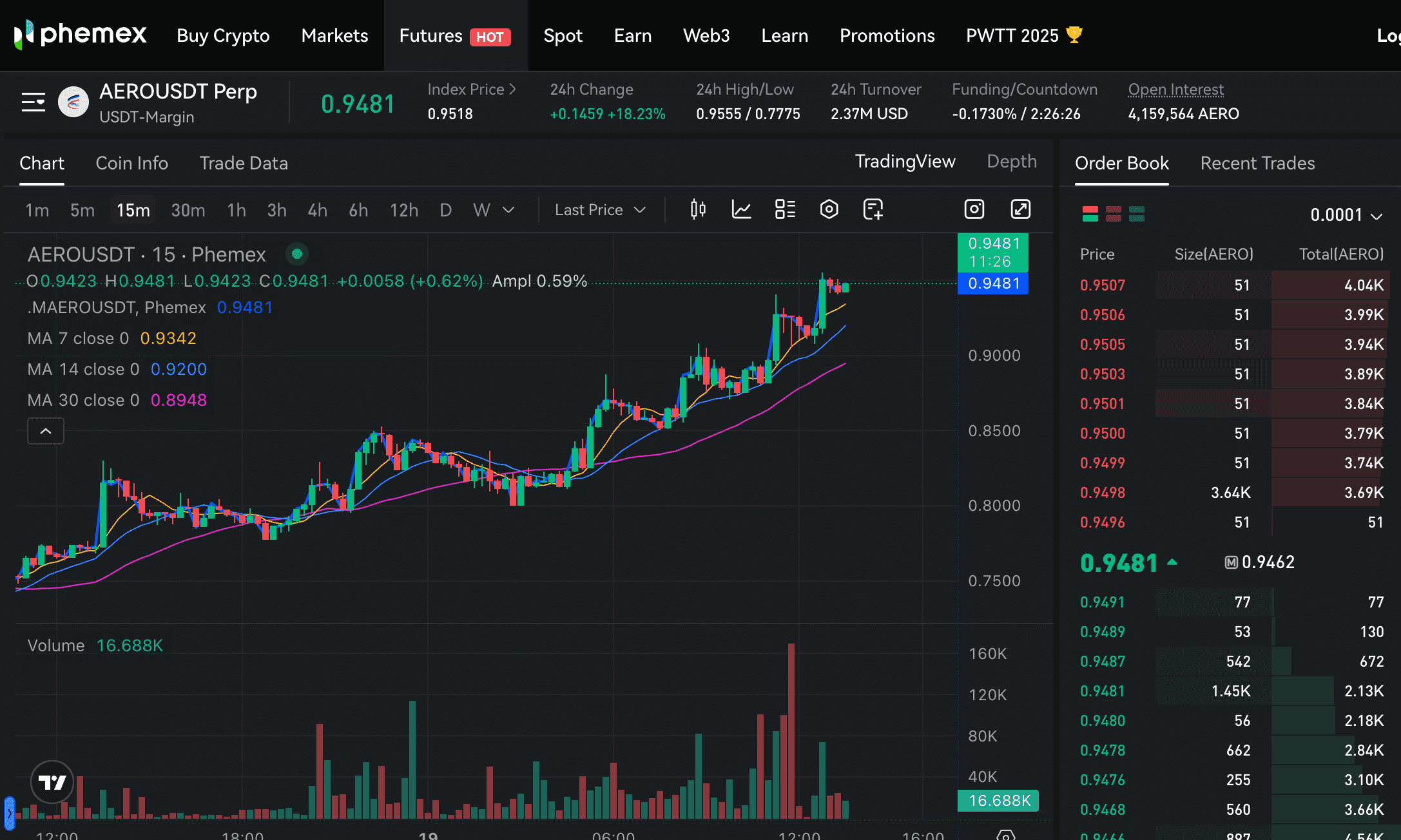

AERO’s Phemex listing supports spot and futures trading, Monitor news about AERO for updates.

Is AERO a Good Investment?

Disclaimer: This is not financial advice. Conduct your own research before investing.

Evaluating AERO’s investment potential requires weighing its strengths and risks:

-

Performance: AERO’s market cap reached $1.2 billion, with 10x volume growth in 2025. Past results don’t predict future outcomes.

-

Community: Strong engagement, with thousands locking veAERO, supported by Coinbase’s Base ecosystem.

-

Positioning: Dominates Base DeFi with 60%+ DEX volume, bolstered by Slipstream and no-FMD model.

-

Risks: 21% annual inflation may dilute value despite buybacks. Regulatory uncertainty and market volatility—track AERO price—pose challenges.

AERO’s robust fundamentals and Base’s scalability are compelling, but inflation and risks warrant caution. Diversification is advisable for prospective investors.

How to Buy AERO on Phemex?

To participate in Aerodrome’s ecosystem, you can buy AERO via Phemex’s dedicated page. Phemex offers spot and futures trading with competitive fees and secure infrastructure. Register, deposit funds, and explore AERO’s trading opportunities.

Aerodrome and AERO represent a compelling evolution in DeFi, blending innovation with community focus. While Base provides a scalable foundation, AERO’s inflationary model and market dynamics require careful consideration. For traders and DeFi enthusiasts, AERO offers a gateway to Base’s ecosystem, accessible through Phemex, but navigating crypto’s volatility demands diligence.