In the electrifying realm of cryptocurrency, where innovation surges like a cosmic tide, one project is redefining how blockchains come to life. Meet Tanssi Network, a groundbreaking protocol that makes launching decentralized appchains as seamless as deploying a smart contract. Powered by its native token, $TANSSI, this Ethereum-backed marvel is carving a bold path in the blockchain universe, offering developers and enterprises a plug-and-play solution for scalable, secure, and tailor-made networks. But what is Tanssi Network, and why is it capturing the attention of crypto visionaries? Buckle up as we unravel the brilliance of Tanssi, explore its game-changing potential, and reveal how you can trade Tanssi on Phemex when it lands.

Quick Facts: Tanssi ($TANSSI) at a Glance

- Ticker Symbol: $TANSSI

- Chain: Ethereum

- Contract Address: 0x553f4cb7256d8fc038e91d36cb63fa7c13b624ab

- Circulating Supply: Not publicly disclosed (as of July 2025)

- Max Supply: 1,000,000,000 $TANSSI

- Primary Use Case: Powering appchain deployment and ecosystem incentives

- Current Market Cap: Not yet available (pre-TGE)

- Availability on Phemex: Coming Soon

What Is Tanssi ($TANSSI)? A Beginner’s Guide

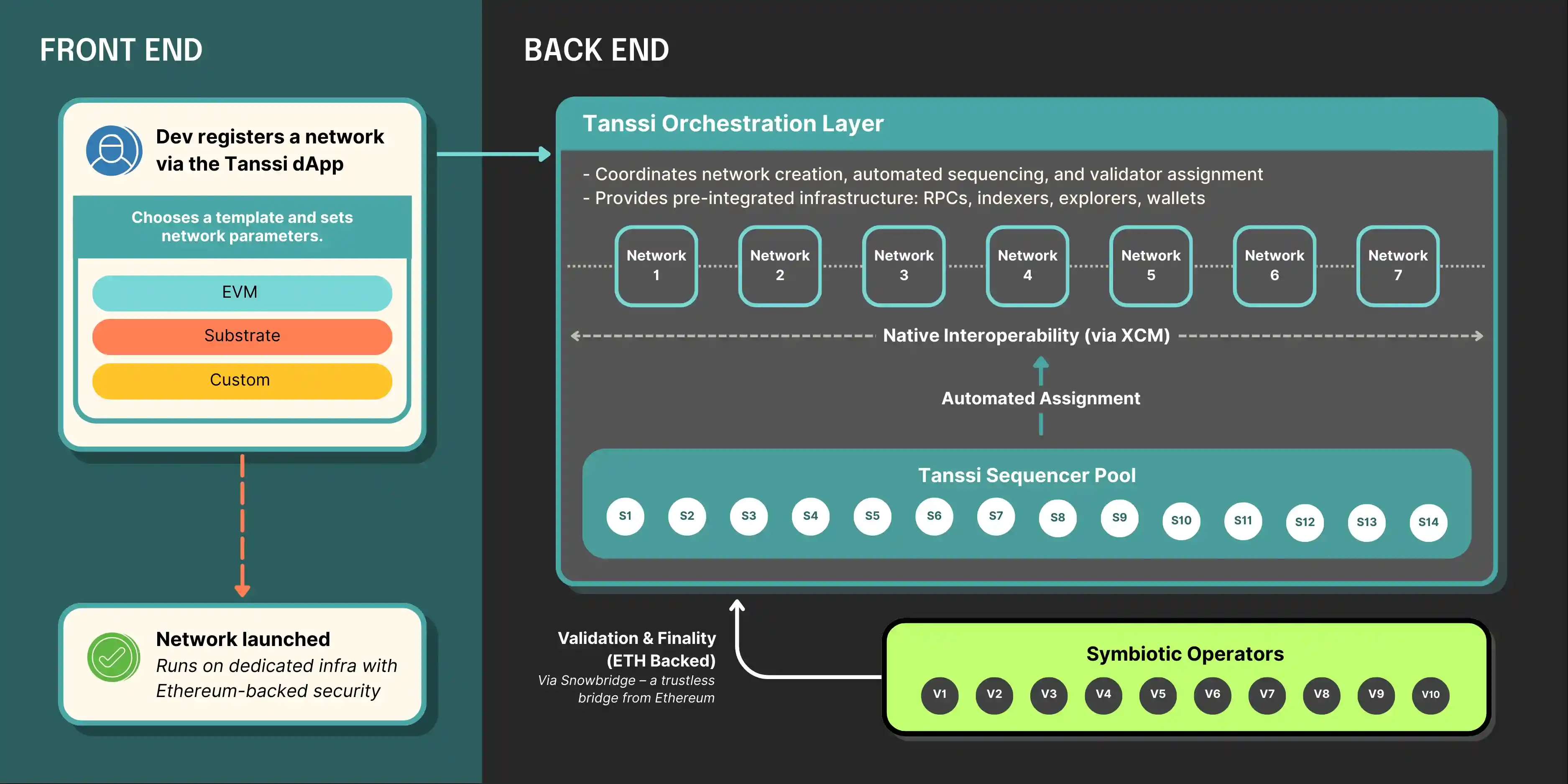

Tanssi Network explained: it’s a Layer-1.5 protocol that simplifies the creation of application-specific blockchains, or appchains, with the ease of launching a smart contract. Built on Ethereum and leveraging Symbiotic’s restaking mechanism, Tanssi empowers developers to craft custom, decentralized networks without wrestling with the complexities of validator setups or consensus protocols. Think of it as a blockchain-building toolkit—scalable, secure, and ready for action.

So, what is Tanssi solving? Traditional blockchain development is a labyrinth of technical hurdles, from securing validators to ensuring cross-chain compatibility. Tanssi dismantles these barriers, offering a plug-and-play framework for appchains tailored to industries like DeFi, tokenized real-world assets (RWAs), or gaming. In a crypto ecosystem buzzing with over 10,000 tokens, Tanssi’s ability to deliver bespoke blockchains without compromising decentralization or security makes it a standout. Its relevance in DeFi, RWAs, and beyond positions it as a linchpin for the next wave of blockchain innovation. Curious about its role in the crypto world? Let’s explore the Tanssi use case and why it’s a game-changer.

How Many Tanssi ($TANSSI) Are There?

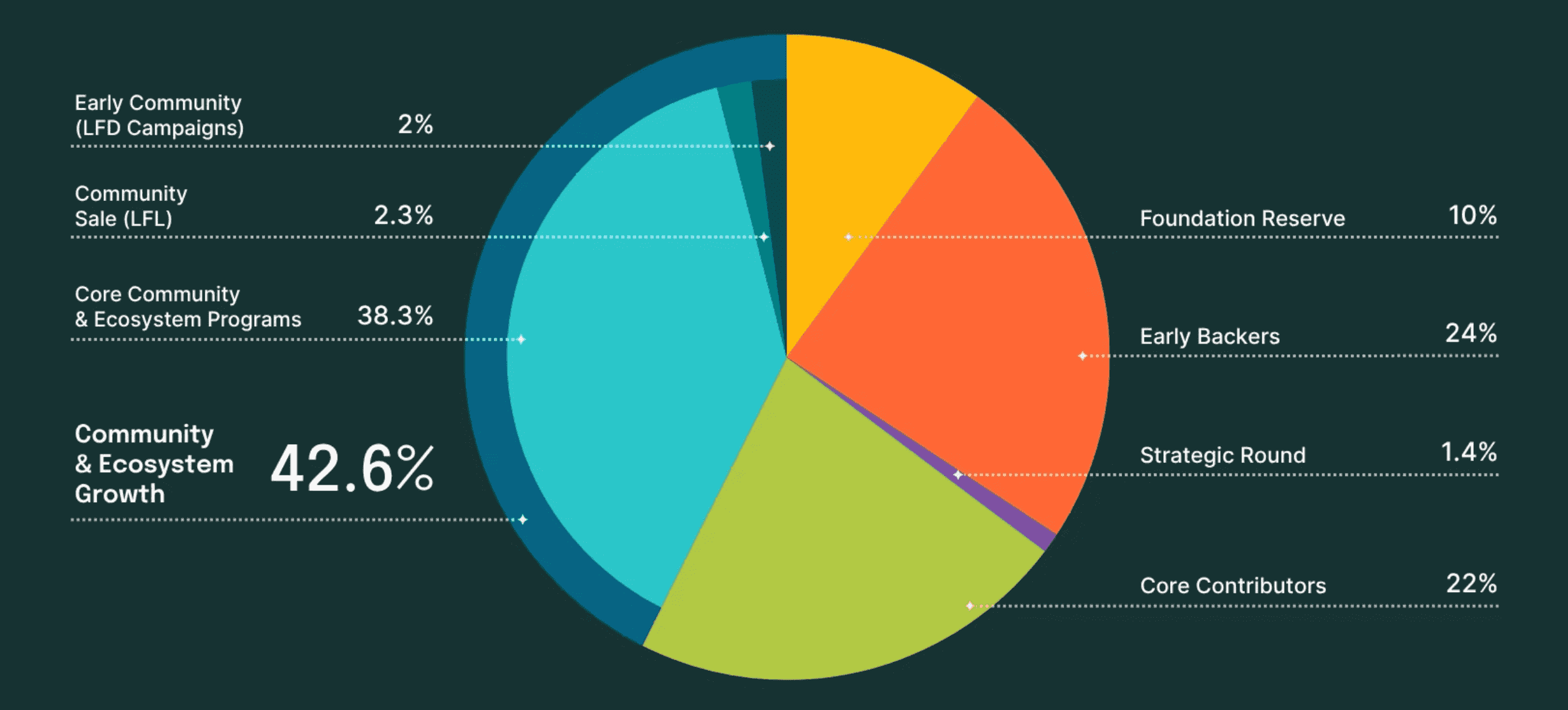

Token supply is the lifeblood of any cryptocurrency, shaping its scarcity, value, and economic incentives. For Tanssi Network, the $TANSSI token operates within a meticulously crafted framework to fuel community growth and long-term sustainability. Here’s the breakdown:

-

Max vs Circulating Supply: Tanssi boasts a maximum supply of 1,000,000,000 $TANSSI tokens. As of July 2025, the circulating supply is undisclosed, pending the Token Generation Event (TGE). The Tanssi Foundation has allocated 38.3% (383 million tokens) to Core Community & Ecosystem Programs, including airdrops like Journey to Mainnet and the Let’s Forkin’ Dance (LFL) bonus. Another 2.3% (23 million tokens) is reserved for the Community Sale (LFL), and 2% (20 million tokens) for early contributors via LFD Campaigns. This suggests up to 426 million tokens may enter circulation post-TGE, subject to vesting schedules.

-

Inflationary or Deflationary?: Tanssi leans toward a deflationary model. The whitepaper hints at token burns tied to network activity, such as transaction fees, to reduce supply over time, potentially boosting scarcity as appchain adoption grows. The fixed 1 billion token cap reinforces this approach.

-

Burning/Minting Mechanisms: While specific burn details are sparse, Tanssi emphasizes burns to stabilize value, likely tied to appchain fees or validator rewards. No minting beyond the initial supply is planned, ensuring predictability.

-

Allocation Breakdown: The 1 billion $TANSSI tokens are strategically allocated:

- Core Community & Ecosystem Programs (38.3%): Funds airdrops, liquidity incentives, R&D, grants, and collaborations.

- Community Sale (LFL) (2.3%): Public sale for community access pre-TGE.

- Early Community (LFD Campaigns) (2%): Rewards early testnet contributors.

- Foundation Reserve (10%): Supports protocol development and operational costs.

- Early Backers (24%): Allocated to initial investors with lockup schedules.

- Core Contributors (22%): Reserved for Tanssi’s core team.

- Strategic Round (1.4%): Fuels post-TGE ecosystem expansion.

What Does Tanssi ($TANSSI) Do? Unpacking Its Power

Tanssi is about empowerment—handing developers the keys to create bespoke blockchains without the usual headaches. The $TANSSI token is the engine driving this ecosystem, with versatile Tanssi use cases:

-

Real-World and Network Applications: Tanssi enables appchains for industries like DeFi, gaming, or RWAs. Imagine a supply chain firm launching a Tanssi appchain to tokenize goods for transparency or a DeFi protocol building a high-throughput chain for microtransactions.

-

Utility for Fees, Staking, Governance: $TANSSI tokens cover appchain transaction fees, enable staking for validator rewards, and facilitate governance, ensuring the token is woven into the network’s fabric.

-

Integration in Apps or Platforms: Tanssi’s appchains sync seamlessly with Ethereum, leveraging Symbiotic’s restaking for security and enabling cross-chain messaging. Projects like Decentral, a real-world asset platform, are already testing Tanssi’s infrastructure for institutional-grade solutions.

By simplifying appchain creation, Tanssi unlocks endless possibilities for developers and enterprises. Want to dive deeper into how to buy Tanssi? Keep an eye on Phemex for updates.

Tanssi ($TANSSI) vs Bitcoin: A Head-to-Head Showdown

In the Tanssi vs Bitcoin arena, it’s a clash of innovation versus legacy. Tanssi is a sleek, modular spaceship built for customization, while Bitcoin is the crypto world’s battle-tested fortress. Here’s how they stack up:

| Aspect | Tanssi ($TANSSI) | Bitcoin (BTC) |

|---|---|---|

| Technology | Proof-of-Stake via Symbiotic restaking on Ethereum, enabling modular appchains | Proof-of-Work, prioritizing immutability and security |

| Speed and Fees | High-throughput appchains with low fees, tailored for specific use cases | ~7 transactions per second, high fees during congestion |

| Use Case | Powers customizable appchains for DeFi, RWAs, and more | Digital gold, primarily a store of value with limited programmability |

| Decentralization | Relies on Ethereum’s validator ecosystem and Symbiotic restaking | Highly decentralized with thousands of nodes globally |

| Security | Secured by Ethereum’s PoS and Symbiotic’s restaking protocol | Battle-tested PoW with unmatched network security |

Bitcoin anchors the crypto market, while Tanssi fuels the future of appchain innovation. Curious about Tanssi price trends? Check Phemex post-TGE for trading insights.

The Technology Behind Tanssi ($TANSSI): A Masterclass in Innovation

Tanssi’s tech stack is a symphony of modular brilliance, blending Ethereum’s security with cutting-edge infrastructure:

-

Consensus Mechanism: Tanssi uses proof-of-stake via Symbiotic’s restaking, where Ethereum validators secure appchains, slashing setup complexity and costs.

-

Unique Technologies: Tanssi’s appchain infrastructure is its secret sauce. Developers can launch customizable blockchains with decentralized sequencing, data availability, and cross-chain messaging, rivaling the simplicity of smart contract deployment.

-

Infrastructure and Partnerships: Tanssi’s Ethereum integration ensures robust security, while $9 million in funding from SNZ and HashKey signals industry confidence. The Decentral project’s testnet adoption highlights Tanssi’s real-world potential.

This technological prowess makes Tanssi a magnet for developers crafting scalable blockchain solutions.

Team & Origins: The Visionaries Behind Tanssi

Tanssi Network was born from a bold vision to democratize blockchain creation. Spearheaded by the Tanssi Foundation, the project is driven by a team of developers and researchers passionate about modular infrastructure. While founder names remain private, the Foundation’s $9 million funding from SNZ and HashKey underscores its credibility.

Key milestones include:

- February 2025: Tanssi unveiled $TANSSI tokenomics, allocating 37% for community airdrops.

- May 2025: Testnet launch showcased decentralized sequencing and Ethereum security.

- July 2025: TGE preparations promise a seamless token rollout.

With transparency and strategic backing, Tanssi is poised to lead the appchain revolution. Stay updated with news about Tanssi on official channels.

Key News & Events: Tanssi’s 2025 Milestones

Tanssi is making waves in 2025. Here’s the latest news about Tanssi:

- February 2025: $TANSSI tokenomics revealed, with 37% for community airdrops.

- March 2025: $9 million raised from SNZ and HashKey, boosting credibility.

- May 2025: Decentral adopted Tanssi’s testnet for RWA solutions.

- July 2025: TGE testing underway for a flawless launch.

No legal hurdles have emerged, and Tanssi’s regulatory focus ensures a smooth path forward.

Is Tanssi ($TANSSI) a Good Investment? Proceed with Caution

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risks, including total loss of capital. Conduct thorough research and consult a financial advisor before investing.

Tanssi investment potential is a hot topic, but it comes with risks. Here’s a balanced look:

-

Past Performance: As of July 2025, $TANSSI is pre-TGE, so no Tanssi price data exists. The $9 million funding and community airdrops signal strong early interest.

-

Community Growth: Tanssi’s community is thriving on X and Telegram, with hype around the TGE and airdrops indicating robust support.

-

Tech and Market Positioning: Tanssi’s appchain infrastructure tackles a key blockchain pain point. Unlike Polkadot or Cosmos, its Ethereum-backed simplicity gives it a unique edge.

-

Risks and Warnings: Cryptocurrencies are highly volatile, and Tanssi’s pre-TGE status adds uncertainty. Regulatory risks, TGE delays, and competition from Layer-1s could impact growth. Market fluctuations can lead to significant losses, and investors should only risk what they can afford to lose.

Tanssi’s innovation and backing make it compelling, but its success depends on TGE execution and market adoption. Interested in how to buy Tanssi? Watch Phemex for trading opportunities post-launch.

Conclusion: Why Tanssi Could Be the Next Big Thing

Tanssi Network isn’t just a cryptocurrency—it’s a launchpad for blockchain’s future. By simplifying appchain creation, harnessing Ethereum’s security, and rallying a vibrant community, Tanssi is redefining decentralized innovation. Whether you’re a developer or an investor, Tanssi demands your attention. As the TGE nears, check Phemex to trade Tanssi and join the appchain revolution. The blockchain future is modular, and Tanssi is at the helm.