Key Takeaways

-

What is Meteora (MET)?: Meteora is a decentralized finance (DeFi) protocol on the Solana blockchain, designed to provide deep and dynamic liquidity for the entire ecosystem. It evolved from the project Mercurial Finance.

-

Core Technology: The protocol’s main innovation is its Dynamic Liquidity Market Maker (DLMM), which allows for concentrated liquidity and adjusts fees based on market volatility to maximize returns for liquidity providers (LPs).

-

Tokenomics: MET has a fixed total supply of 1 billion tokens. A significant portion was distributed to the community via an airdrop to encourage participation and decentralize governance.

-

Primary Use Case: MET is used to power its liquidity pools, facilitate fair token launches for new projects, and enable efficient asset swaps with minimal price impact for traders.

-

Availability: You can learn how to buy MET and trade MET on Phemex, which supports both Spot and Futures markets for the token.

Introduction to Meteora: Powering Solana's DeFi Engine

In the fast-paced world of decentralized finance (DeFi), liquidity is the essential fuel that powers all activity. Without a deep and accessible pool of assets, trading platforms cannot function, new projects cannot launch, and the ecosystem cannot grow. The Solana blockchain, known for its high speed and low transaction costs, has become a major hub for DeFi innovation, but it requires robust infrastructure to manage liquidity effectively. This is precisely where Meteora (MET) comes in.

Meteora is a sophisticated liquidity protocol designed to serve as the foundational liquidity layer for the Solana ecosystem. Think of it as a smart, adaptable reservoir of capital that other applications, traders, and institutions can tap into. The project aims to solve some of the most persistent challenges in DeFi, including inefficient capital usage, high slippage (the difference between the expected price of a trade and the price at which it is executed), and unfair token launches that are often exploited by bots.

By providing advanced tools for liquidity providers and a seamless experience for traders, Meteora positions itself as a critical building block for the future of finance on Solana. This guide offers a comprehensive look into the Meteora protocol, its native MET token, its underlying technology, and its potential role in the broader crypto market. Explore this guide to understand the MET investment potential and make informed decisions.

Summary Box (Quick Facts)

-

Ticker Symbol: MET

-

Chain: Solana

-

Contract Address: METvsvVRapdj9cFLzq4Tr43xK4tAjQfwX76z3n6mWQL

-

Circulating Supply: Approximately 480 million

-

Total Supply: 1 billion

-

Primary Use Case: A decentralized protocol for dynamic and efficient liquidity on Solana.

-

Current Market Cap: Approximately $271 million (as of October 23, 2025).

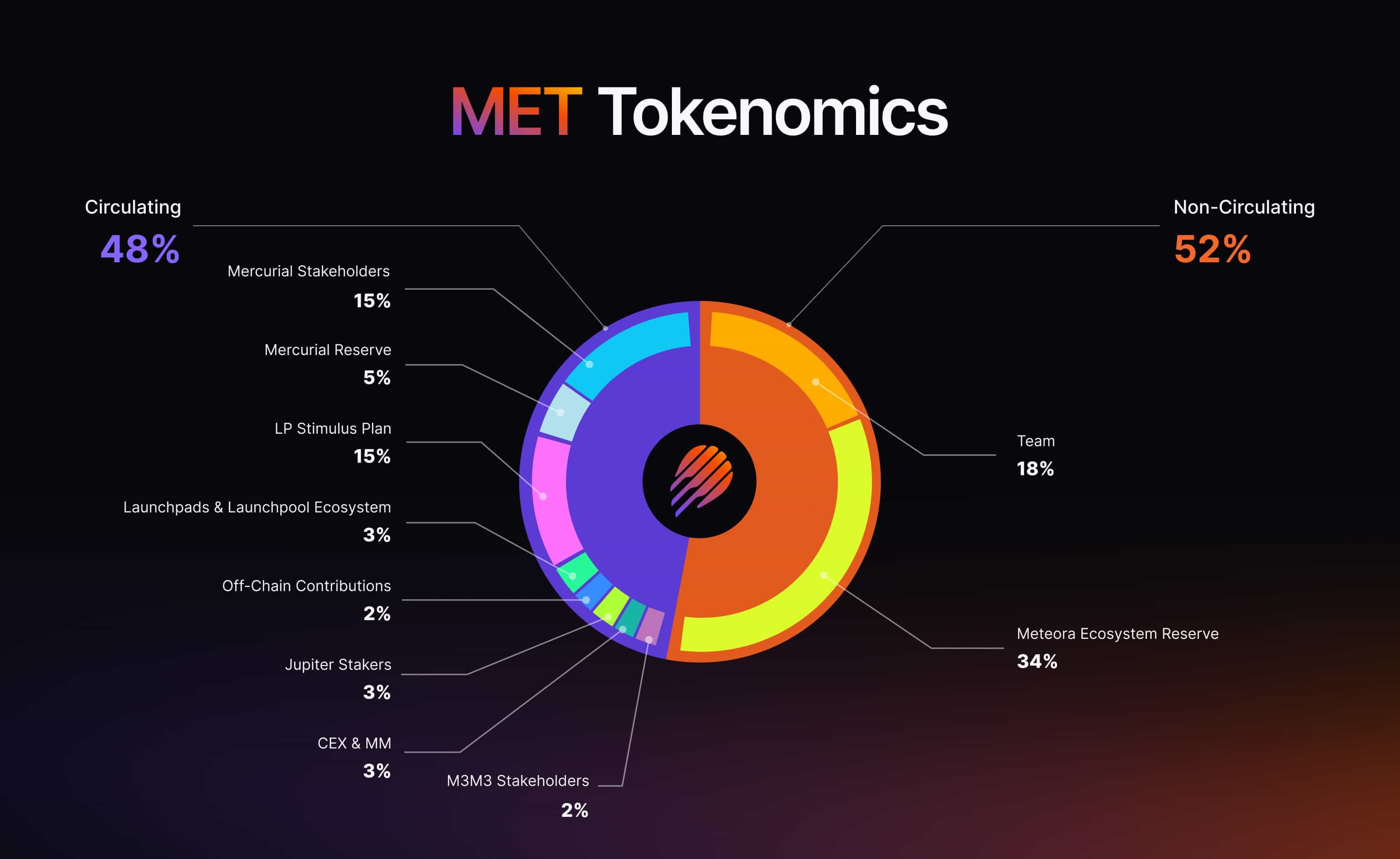

How Many MET Are There? A Look at Tokenomics and Distribution

The tokenomics of a project are crucial as they define the supply, distribution, and potential economic incentives. For Meteora, the structure is designed to foster a wide, community-driven user base from the outset.

Max vs. Circulating Supply

Meteora has a fixed maximum supply of 1 billion MET tokens, meaning no more tokens can ever be created. This makes the token deflationary by design, as a finite supply can lead to scarcity if demand grows over time.

On its Token Generation Event (TGE) on October 23, 2025, the project introduced approximately 480 million MET into circulation, representing 48% of the total supply. This unusually large initial float is a deliberate strategy to decentralize the protocol quickly. The tokens were allocated to various stakeholders, including early users of its predecessor (Mercurial Finance), ecosystem partners, liquidity providers who contributed to the platform's success, and the development team.

The MET Airdrop and Its Terms

The primary mechanism for this initial distribution was a large-scale airdrop. However, participating in such distributions comes with important considerations. The Meteora team provided an airdrop eligibility checker as an informational tool, but emphasized that the results were preliminary and did not guarantee a right to receive tokens. The foundation reserved the right to modify eligibility criteria and disqualify participants suspected of fraudulent activities or those residing in restricted jurisdictions.

Users interacting with the airdrop were required to accept terms of use, acknowledging that the process was subject to both specific Airdrop Terms and the General Terms of Meteora's website. This is a standard practice to ensure legal and regulatory compliance. It also underscores a key principle for users: always ensure you are interacting with official platforms and understand the terms you are agreeing to. Furthermore, the foundation made it clear that acquiring tokens from third-party sources, such as other holders or exchanges, does not establish a formal relationship with the Meteora entity. This places the responsibility on the user to conduct their own due diligence.

The airdrop also highlighted the importance of user security. The project reminded participants that they are solely responsible for the security of their wallets and private keys. Official projects will never ask for seed phrases or sensitive information.

What Does MET Do? Exploring the Token's Utility

The MET token is the lifeblood of the Meteora protocol, designed to be deeply integrated into its ecosystem and provide utility to its holders and users. Its functions extend beyond being a simple tradable asset.

Real-World and Network Use Cases

The primary MET use case is to facilitate and govern the dynamic liquidity pools that form the core of the protocol. Its infrastructure serves three key user groups:

-

Liquidity Providers (LPs): Users who deposit their assets into Meteora's pools to earn rewards. The protocol's technology, particularly the DLMM, allows LPs to maximize their earnings by adapting to market conditions.

-

Traders: Individuals and applications can use Meteora's deep liquidity to swap tokens with minimal slippage and competitive fees.

-

New Projects: Projects launching on Solana can use Meteora's Dynamic Bonding Curve to conduct fair and transparent token launches, preventing bot-driven price manipulation and ensuring wider distribution.

The Role of the Airdrop in Building the Ecosystem

The distribution of MET via an airdrop was not just about giving away tokens; it was a strategic move to build a vibrant and engaged community. By distributing a significant portion of the supply to early users and contributors, the project aimed to place the protocol's future in the hands of its community.

This approach also serves to clarify the relationship between the user and the protocol. The terms associated with the airdrop specified that the Meteora Foundation itself was not a party to the airdrop terms and was not responsible for matters relating to the tokens. The legal entity responsible was designated as Meteora Comet Limited. This distinction is important for legal clarity and helps users understand the organizational structure behind the protocol. By participating, users consented to the project's privacy policy, which outlined how data such as wallet addresses and on-chain interactions were used to determine eligibility. This process, while technical, is fundamental to how decentralized networks establish a user base and distribute ownership.

MET vs. ZEROBASE: A Comparison

While both Meteora and ZEROBASE are innovative Web3 projects, they operate in different domains and solve different problems. Meteora is focused on providing a foundational liquidity layer for the Solana DeFi ecosystem, whereas ZEROBASE is building a cross-chain infrastructure for privacy and trust using Zero-Knowledge (ZK) proofs.

| Feature | Meteora (MET) | ZEROBASE (ZBT) |

| Technology | Built on Solana, using a Dynamic Liquidity Market Maker (DLMM) to optimize liquidity and trading fees. | A decentralized ZK-proving network that is blockchain-agnostic. It uses a HUB-Prover model and Trusted Execution Environments (TEE) for privacy. |

| Speed and Fees | Inherits Solana's high speed and low transaction fees, enabling efficient trading and liquidity provision. | Optimized for real-time ZK proof generation, completing proofs in milliseconds for less than one cent each. |

| Primary Use Case | To provide a foundational liquidity layer for the Solana ecosystem, enabling efficient token swaps, fair launches, and yield generation. | To offer a trustless, privacy-preserving infrastructure for various applications, including compliant finance (zkCEX, zkDarkPool) and identity (zkLogin). |

| Decentralization & Security | Security is tied to the Solana network's Proof-of-Stake consensus. Its ecosystem is focused specifically on Solana. | Operates a decentralized network of Prover Nodes that must stake stablecoins as collateral, ensuring performance and security through economic incentives. |

In summary, Meteora provides the capital efficiency needed for a thriving DeFi ecosystem on a specific blockchain (Solana), while ZEROBASE provides the privacy and trust infrastructure needed for a wide range of applications across multiple blockchains.

The Technology Behind MET

Meteora’s technical architecture is its main differentiator. It moves beyond traditional Automated Market Makers (AMMs) to create a more capital-efficient and flexible system. Its foundation rests on the high-performance Solana blockchain and a suite of specialized liquidity management tools.

Dynamic Liquidity Market Maker (DLMM)

The DLMM is Meteora's flagship innovation. Unlike standard AMMs that spread liquidity thinly across an entire price curve (from zero to infinity), the DLMM allows LPs to concentrate their capital within specific, active price ranges. This means their capital is used more efficiently, generating more fees. Furthermore, the DLMM dynamically adjusts trading fees based on market volatility—increasing them during turbulent periods to compensate LPs for risk and decreasing them in stable markets to attract more trading volume. This gives LPs the flexibility to choose a volatility strategy that aligns with their risk appetite.

Dynamic Automated Market Makers (DAMM v1 & v2)

Meteora also offers more traditional, constant-product AMMs, but with added features.

-

DAMM v1: This model supports token prices across the full range, similar to a classic AMM. However, it enhances returns by allowing LPs to earn additional yield from integrated lending sources alongside standard swap fees.

-

DAMM v2: This is not an upgrade but a distinct program that offers greater flexibility. It includes features like optional concentrated liquidity and the use of position NFTs, which represent an LP's specific share and price range in a pool.

Dynamic Bonding Curve (DBC)

The DBC is a powerful tool designed for new projects looking to launch a token. It enables a fully customizable pricing curve that controls the token's price dynamics during its initial phase. Tokens first trade in this virtual, controlled environment. Once a pre-set liquidity threshold is reached, the token "graduates" to a standard Meteora DAMM pool. This two-step process helps ensure a more stable and equitable market launch, mitigating the impact of sniper bots and initial price volatility.

Team & Origins

Meteora’s story is one of adaptation and resilience. The project was co-founded by Ben Chow, a prominent figure in the Solana ecosystem who also contributed to Jupiter, Solana's leading DEX aggregator.

The project began its life in 2021 as Mercurial Finance, one of the first stablecoin-focused AMMs on Solana. However, the crypto bear market and the collapse of the FTX exchange in 2022 dealt a significant blow, as a large portion of the project's treasury was trapped on the platform. In response, the team rebranded to Meteora in 2023. This was not just a name change but a strategic pivot to rebuild with a renewed commitment to transparency and a broader vision: to become the core liquidity layer for the entire Solana ecosystem, not just stablecoins. The project is backed by notable venture capital firms, including DeFiance Capital, HTX Ventures, and Signum Capital.

Key News & Events

-

Rebrand from Mercurial Finance (2023): The pivot to Meteora marked a new chapter, broadening the project's scope and ambition.

-

Token Generation Event (October 23, 2025): The MET token was launched via a massive airdrop, distributing 48% of the total supply to community members and early supporters. For the latest news about MET, following official channels is recommended.

-

Post-Launch Price Action: The MET price experienced significant volatility after the TGE. This is a common phenomenon for projects with large airdrops, as some recipients may sell their tokens, creating initial selling pressure.

-

Major Exchange Listings: Following its launch, MET was quickly listed on major trading platforms like Phemex, providing crucial liquidity and accessibility for the new token.

-

Founder Controversy: The project faced some public scrutiny regarding its former CEO, Ben Chow, who resigned in early 2025 due to allegations related to his involvement in other crypto projects. The team has since moved forward under new leadership.

Is MET a Good Investment?

Evaluating whether Meteora (MET) is a suitable investment requires a careful analysis of its potential and its risks.

The Bull Case for Meteora

The primary argument for Meteora lies in its strong fundamentals and strategic position within a growing ecosystem. It already commands a significant portion of Solana's DEX trading volume and has secured over $800 million in Total Value Locked (TVL), a key metric indicating trust and utility. Its technology is genuinely innovative, offering clear advantages over traditional AMMs. As the Solana ecosystem expands, a foundational liquidity layer like Meteora stands to benefit directly from the network's growth.

Risks and Considerations

The most immediate risk is the selling pressure from its large initial supply. With nearly half of all MET tokens in circulation from day one, the market may take time to absorb the supply. Second, competition in the DeFi space is fierce, with many other DEXs and liquidity protocols vying for market share on Solana and other blockchains. Finally, while the founder involved in controversy has resigned, any lingering reputational impact could be a factor for some investors.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves significant risks, and you should only invest what you can afford to lose. The market is highly volatile, and past performance is not indicative of future results.

How to Buy MET on Phemex

Phemex offers a secure and user-friendly platform to trade MET. For a complete step-by-step guide, please visit our dedicated page on how to buy MET. This will provide you with all the information needed to start trading MET on our Spot or Futures markets.

FAQs

What chain is Meteora (MET) on?

Meteora (MET) is a native SPL token built on the Solana blockchain.

Where can I find news about MET?

For the latest updates and news about MET, you can follow official announcements from the Meteora team and explore comprehensive educational content at Phemex Academy.

What is a Dynamic Liquidity Market Maker (DLMM)?

A DLMM is an advanced type of decentralized exchange protocol that allows liquidity providers to concentrate their capital in specific price ranges and earn dynamic fees that adjust to market volatility, making capital usage more efficient.

What problem does Meteora solve?

Meteora addresses key DeFi challenges like inefficient liquidity, high slippage for traders, and unfair token launches by using its innovative DLMM technology and Dynamic Bonding Curves.

Is Meteora fully decentralized?

Like many DeFi protocols, Meteora is on a path to progressive decentralization. While a core team leads development, the large-scale distribution of the MET token via an airdrop is a significant step toward community-based governance.

Ready to continue your crypto journey? Explore Phemex Academy to deepen your understanding of DeFi, learn advanced trading strategies, and build your wealth safely.