Summary Box (Quick Facts)

-

Ticker Symbol: IKA

-

Chain: Sui Network

-

Contract Address: 0x7262fb2f7a3a14c888c438a3cd9b912469a58cf60f367352c46584262e8299aa::ika::IKA

-

Circulating Supply: 3,000,000,000 (at launch)

-

Max Supply: 10,000,000,000 (initial supply, subject to governance)

-

Primary Use Case: Powering a sub-second MPC network for payments, security, and governance.

-

Current Market Cap: $87,960,745 (as of July 30, 2025)

-

Availability on Phemex: At 10:00 UTC on July 30, 2025, Phemex will list the new spot trading pairs and IKA/USDT.

What Is Ika (IKA)?

Ika (IKA) is the native token that powers the first sub-second Multi-Party Computation (MPC) network, a revolutionary protocol designed to solve the challenge of true multi-chain interoperability. In simple terms, Ika explained, it's the engine for dWallets—programmable, decentralized signing mechanisms. This technology enables developers to control native assets on other blockchains, like Bitcoin, directly from their smart contracts without relying on risky bridges or wrapped tokens.

Ika delivers record-breaking scalability, capable of processing up to 10,000 signatures per second (TPS) across hundreds or even thousands of nodes. This performance, combined with its zero-trust security model, makes Ika a foundational layer for building a more unified, secure, and efficient Web3. Explore the Phemex Academy to learn more about core blockchain concepts.

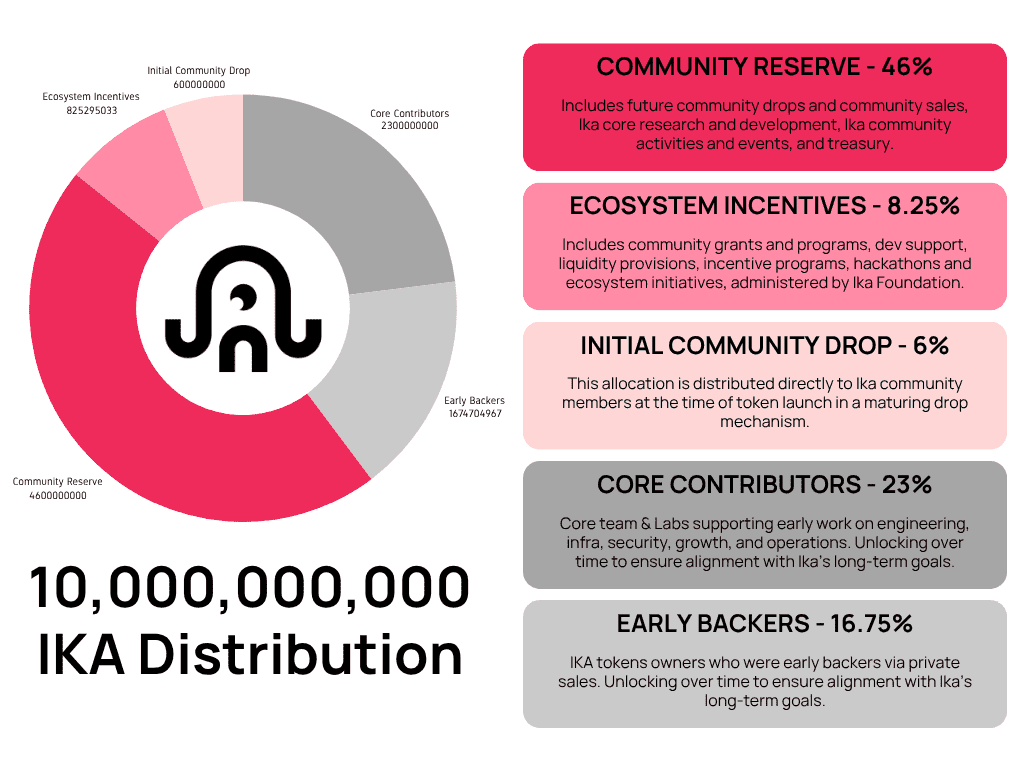

How Many IKA Tokens Are There?

As a community-driven protocol, Ika’s token distribution is structured to align all participants—from developers to users—toward its long-term success.

The initial total supply of IKA is 10,000,000,000 tokens. The distribution heavily favors the community:

-

Community Allocation (over 60%):

-

Community Drop (6%): 600,000,000 tokens distributed at mainnet launch.

-

Ecosystem Incentives (8.25%+): Over 825 million tokens reserved for builders and ecosystem growth.

-

Community Treasury (46%): 4.6 billion tokens for future community-led initiatives.

-

-

Early Contributors (23%): Allocated to the core team that developed the protocol.

-

Early Backers (under 16.75%): Allocated to the initial investors who supported the project.

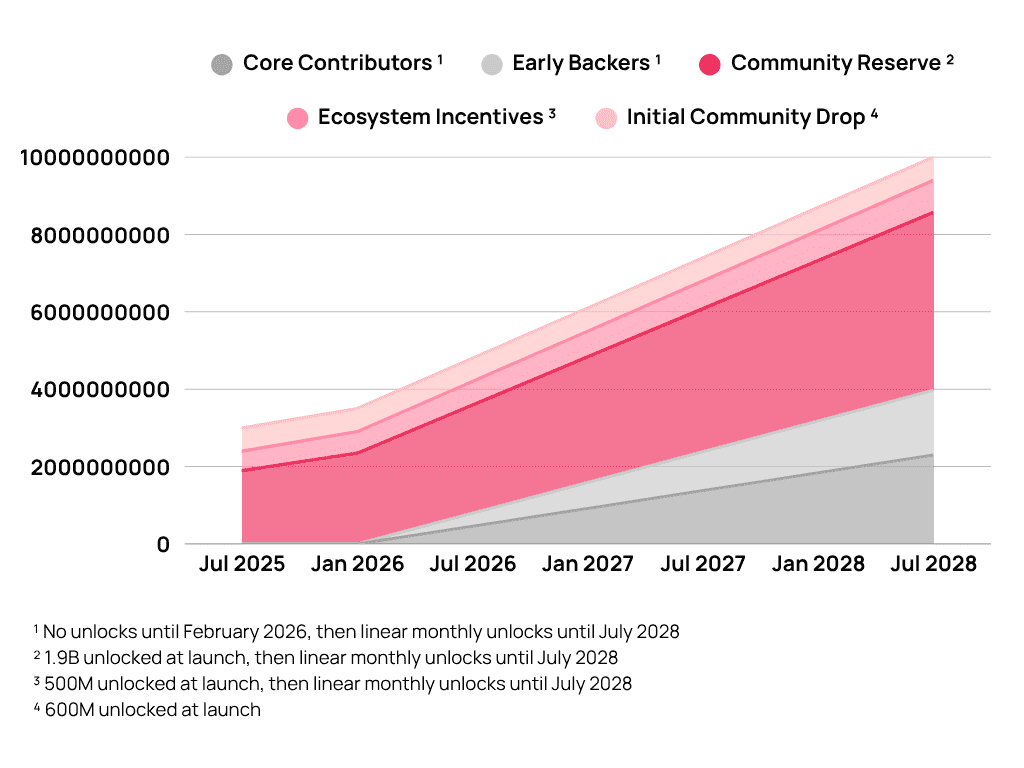

Release Schedule and Inflation

The release schedule is designed to promote long-term stability. Insiders (Early Contributors and Backers) have a three-year lockup period, with no tokens unlocking in the first six months after launch.

The total supply of IKA is not fixed and can increase over time. New tokens may be minted by the protocol as staking rewards or for other purposes determined by the decentralized governance process.

What Does Ika Do?

The IKA token is the lifeblood of the Ika ecosystem, serving three primary functions: enabling payments, securing the network through staking, and facilitating decentralized governance. The core IKA use case is to create a self-sustaining economy for secure cross-chain computation.

Payment

Users pay fees in IKA to the MPC network nodes for their computational work. This creates a robust economic system that rewards participants and ensures network reliability. Fees are charged for operations such as:

-

Generating a new dWallet.

-

Requesting a transaction signature from a dWallet.

-

Reconfiguring or updating a dWallet's security.

Security

Ika uses a permissionless delegated proof-of-stake (DPoS) mechanism to secure the network. This system rewards honest participants and penalizes malicious behavior. Users can participate in securing the network by staking their IKA tokens with network authorities (validators), contributing to the network's overall security and earning staking rewards in return.

Governance

Decentralized governance is at the heart of Ika. The protocol's MPC nodes vote on important adjustments and updates, ensuring that control over the protocol’s functionality and economics remains in the hands of its participants.

A Dynamic Economic Model

Beyond its core utilities, the IKA token underpins a sophisticated economic model that handles the varying costs of cryptographic operations. Different functions, like generating a dWallet using different algorithms (ECDSA, EdDSA, etc.) or reconfiguring the node committee, have different computational demands.

Ika uses a dynamic, market-driven pricing mechanism to balance these costs. This model ensures that nodes are fairly compensated for their work while keeping fees competitive and predictable for users. This fosters a self-regulating economy that adapts to demand and complexity, ensuring the long-term sustainability of the network.

Ika vs. Ethereum(ETH)

| Feature | Ika (IKA) | Ethereum (ETH) |

| Core Technology | A specialized MPC (Multi-Party Computation) network that acts as a composable, modular signature layer. It is not a general-purpose smart contract platform itself. | A global, decentralized Layer-1 blockchain that supports Turing-complete smart contracts and the development of decentralized applications (dApps). |

| Primary Use Case | To enable native cross-chain interoperability. It allows a smart contract on one chain (e.g., Sui) to securely control native assets on another chain (e.g., Bitcoin). | To serve as a general-purpose platform for dApps, supporting DeFi, NFTs, DAOs, and thousands of other application types. |

| Transaction Speed & Throughput | Engineered for high-performance signing, capable of scaling to 10,000 signatures per second (TPS) with sub-second latency. | Transaction speed varies with network congestion. Layer-1 TPS is typically between 15-30. Layer-2 solutions significantly increase throughput. |

| Fee Structure | Fees (paid in IKA) are for the computational work of MPC nodes, such as generating a dWallet or executing a signature. Fees are tied to specific cryptographic operations. | Gas fees (paid in ETH) are for all computations on the Ethereum Virtual Machine (EVM), from simple transfers to complex smart contract interactions. |

| Decentralization & Security Model | Achieves massive decentralization by scaling to hundreds or even thousands of signer nodes via its novel 2PC-MPC protocol. Its 'zero-trust' security model cryptographically ensures user control. | Security is guaranteed by a global, decentralized network of validators through a Proof-of-Stake consensus mechanism. Its security has been battle-tested over many years. |

| Interoperability Approach | Provides native interoperability. It directly controls native assets on other chains via dWallets, eliminating the need for bridges or asset wrapping. | Typically relies on third-party bridges, sidechains, or 'wrapped' tokens (like WBTC) for interoperability with other blockchains, which can introduce additional security risks. |

The Technology Behind Ika

At the heart of Ika's innovation are dWallets, a groundbreaking Web3 building block for multi-chain interoperability. A dWallet is a non-collusive, massively decentralized, programmable, and transferable signing mechanism that has an address on any other blockchain and can sign transactions on those networks.

Attributes of dWallets

-

Non-collusive: This feature guarantees user ownership. A signature can never be generated without the user's explicit consent, a security assurance achieved through Ika's novel 2PC-MPC protocol.

-

Massively Decentralized: The 2PC-MPC protocol allows hundreds or even thousands of permissionless nodes to participate in the signature generation process, removing single points of failure and enhancing security.

-

Programmable: Developers building on networks like Sui can define specific logic that governs when and how a transaction is signed. This logic is enforced by the Ika protocol, enabling complex rules and applications that span all of Web3 without cross-chain risks.

-

Transferable: Ownership of a dWallet can be transferred, which opens up advanced access control features and new possibilities like a marketplace for dWallets or future user claims.

-

Universal Signing Mechanism: dWallets are designed to be chain-agnostic. They can sign transactions for virtually any blockchain by supporting common cryptographic algorithms like ECDSA, with plans to support EdDSA and Schnorr in the future.

Use Cases and Impact on Web3

dWallets serve as a foundational tool for developers aiming to build secure, native multi-chain applications. For example, a developer on Sui could create a smart contract that directly generates a Bitcoin or Ethereum signature. This unlocks a vast array of use cases:

-

Decentralized Custody: Creating secure, multi-chain vaults controlled by code.

-

Multi-Chain DAOs: Allowing Decentralized Autonomous Organizations to manage treasuries across different blockchains.

-

Natively Interoperable DeFi: Building multi-chain lending platforms and order books that include assets like Bitcoin.

By eliminating cross-chain risks, dWallets are paving the way for a future where secure multi-chain interoperability is the standard, breaking down barriers and advancing the core Web3 values of decentralization and user sovereignty.

Team & Origins

Ika was founded in 2022 by a team of cryptography and distributed systems experts at dWallet Labs, an Israel-based cybersecurity company.

The founding team includes:

-

Omer Sadika (Founder & CEO): A seasoned professional in the cybersecurity and tech industries.

-

David Lachmish (Co-Founder and Product): The leader of the project's product vision.

-

Yehonatan Cohen Scaly (CTO): The technical architect behind the protocol.

The project has raised over $21 million in funding from top-tier venture capital firms and investors, including Blockchange Ventures, Node Capital, Lemniscap, and the Sui Foundation.

Key News & Events about IKA

Here are the major milestones for the project. For the latest updates, be sure to monitor News about IKA.

-

April 2025: Ika secured a strategic investment from the Sui Foundation, strengthening its partnership within the Sui ecosystem.

-

September 2024: The project rebranded from dWallet Network to Ika.

-

July 29, 2025: Ika successfully launched its mainnet, enabling native cross-chain asset control and dWallet functionality on the Sui blockchain.

-

July 30, 2025: The IKA token was listed on Phemex, making it available to a global audience of traders.

Is IKA a Good Investment?

Evaluating the IKA investment potential requires a deep look at its groundbreaking technology and robust economic design.

-

Powerful Value Proposition: Ika isn't just another blockchain; it's a specialized solution to one of Web3's biggest problems. Its key strengths are:

-

Unrivaled Performance: Sub-second latency and the ability to handle 10,000 transactions per second make it suitable for institutional-grade applications.

-

Superior Security: Its zero-trust, non-collusive model offers a fundamentally more secure alternative to traditional bridges.

-

Sustainable Economics: A community-focused token distribution and a dynamic fee market create a healthy, self-regulating ecosystem.

-

-

Market Positioning: By enabling native interoperability for assets like Bitcoin, Ika has the potential to unlock trillions of dollars in liquidity for the DeFi ecosystem. The initial IKA price movement and high trading volume suggest strong market confidence. For the latest News about IKA, follow official announcements.

-

Risks: Like all digital assets, IKA is subject to price volatility. Its long-term success depends on widespread adoption by developers. Furthermore, the evolving regulatory landscape for cryptocurrencies remains a potential risk factor.

Conclusion: With its state-of-the-art technology, well-designed tokenomics, and a clear vision for a connected Web3, Ika presents a compelling case. Its potential is linked to its ability to become the go-to secure infrastructure for cross-chain interactions.

How to Buy IKA on Phemex

Ready to be part of the future of interoperability? Trade IKA on Phemex by following these five simple steps:

-

Log in to your Phemex account or register for a new one.

-

Navigate to the Spot Trading section on the platform.

-

In the trading interface, search for the IKA/USDT trading pair.

-

Specify the amount of IKA you want to purchase using a Limit, Market, or Conditional Order.

-

Click “Buy IKA” to finalize your order. For a more detailed guide, check out our article on “How to buy IKA.”

Disclaimer

Crypto trading involves significant risks; only invest what you can afford to lose. This content is for informational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.

FAQ Section

1. What is the main difference between Ika and other cross-chain solutions?

Ika offers native interoperability, not bridging. Instead of locking assets and creating wrapped tokens, Ika's dWallets allow smart contracts to directly control native assets on other chains, eliminating the systemic risks of bridges and wrapped tokens.

2. Why is the IKA token necessary for the network?

The IKA token is essential for creating a self-sustaining economy. It's used to pay nodes for their computational work (securing transactions), to stake for network security, and to participate in the decentralized governance that controls the protocol's future.

3. What does it mean that Ika is a "fork of Sui"?

Ika uses the core consensus technology of the Sui blockchain (Mysticeti) as a secure and high-speed communication layer for its nodes. However, Ika is a specialized network with its own unique purpose (MPC signing) and has disabled general smart contract functionality to optimize for its role.