Summary

-

Cross trading in cryptocurrency is where an investor buys and sells the same asset (token/coin) at essentially the same time.

-

Cross trading is often used to help manage, or offset, the risk of the first transaction.

-

Cross trade market manipulation in crypto usually either refers to deliberately inflating the market to sell off coins/tokens, or deflating it to buy up a large amount of those same coins/tokens.

What Is a Cross Trade in Cryptocurrency?

To those new to cryptocurrency trading, or even trading and investing in general, terms like “cross trade,” “margin”, or “leverage” can often seem unnecessarily confusing and even slightly obtuse. This is perfectly understandable; for any newcomer entering the crypto world its vast array of previously unheard terminology can be enough to baffle the brain. Here, an attempt is made to break down these terms in simple language, so that one can better understand what they mean when they are used later in the article:

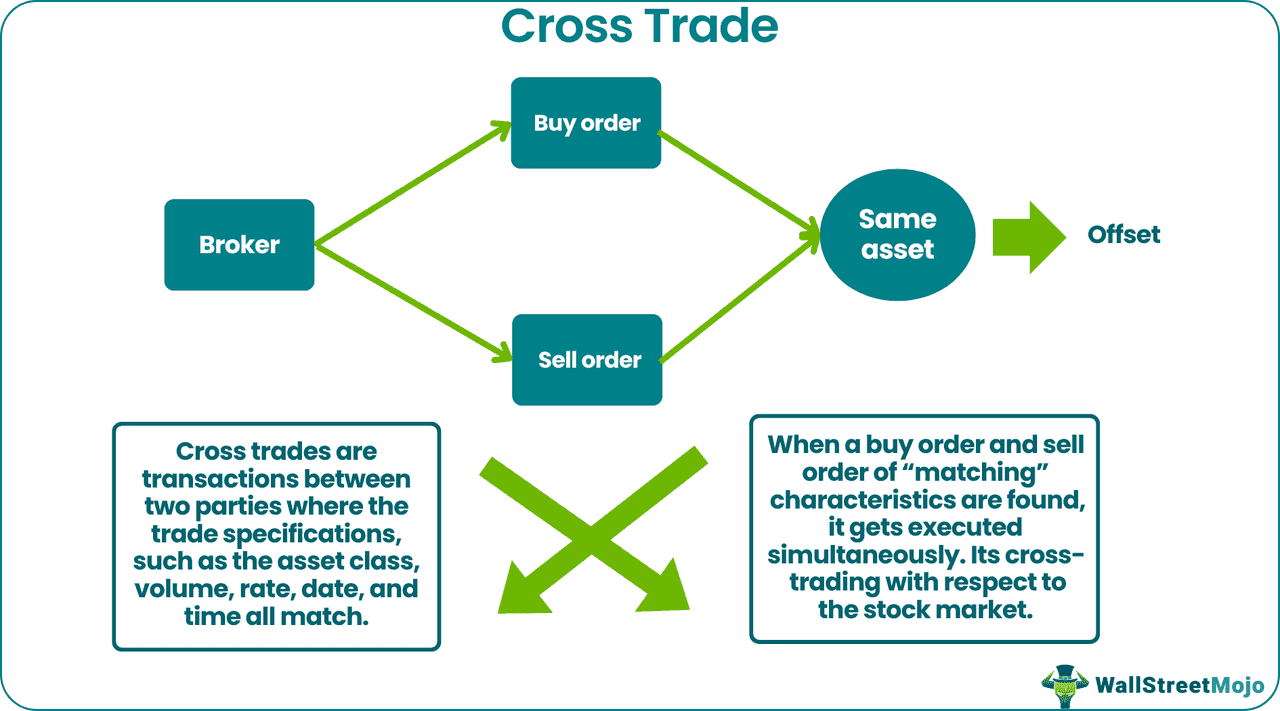

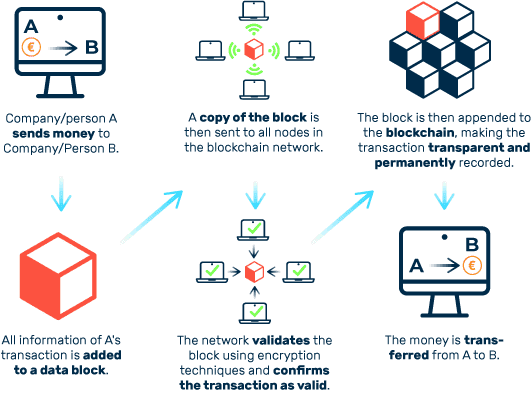

- Cross trade: Cross trading in cryptocurrency is where an investor buys and sells the same asset (token/coin) at essentially the same time. Rather than recording this as two separate transactions, as would be normal, the transaction is then recorded on the exchange platform’s blockchain as a single piece of data. As the purpose of a blockchain is to provide security, and the accuracy of the data presented to that network is paramount, cross trading can effectively undermine overall network trust. This is because cross trades usually match buy and sell orders automatically, without the need for direct interaction from the investor actually making the trade. Due to network block time delays and high market volatility, this unfortunately means an investor can lose value on their cross trade or even incur losses when they believed they would be making profit.

- Margin: Margin refers to the amount someone deposits with an exchange that allows said person to trade as though they possess more capital than they currently have deposited. To offset the risk of future trades failing, the exchange platform utilized will usually require that person to keep a certain amount as collateral in their balance. As long as that amount (the margin) is maintained, they can perform margin trades, allowing them to use multiples of their original margin to make trades — which is their leverage.

- Leverage: Leverage is quite simply the amount of borrowed capital an investor can use to make trades. This amount is usually expressed in multiples of the potential investor’s margin (so, for example, an exchange offering 5x leverage allows an investor to trade as though their margin is multiplied by five).

Cross Trade diagram (source)

What are Cross Margin trades?

Usually, when someone refers to cross trading in the crypto world, they are in fact talking about cross margin trades of the type used by more savvy and experienced investors, and executed by smart contracts. Just as is the case with traditional certified finance (CeFI), cryptocurrency cross margin trading can allow an investor to achieve much greater profits than trading without any leverage at all. But it comes with its own associated risks, as unexpected market fluctuations are the bane of any cross margin trader, and the cryptocurrency market is highly volatile. Thus, it can fluctuate unexpectedly with far greater regularity than most other forms of traditional finance; potentially putting an investor’s capital and margin at risk. Furthermore, as a general rule, the higher leverage an investor trades with and the more they invest, the greater that risk becomes. This is why one should never trade more than they can afford to lose, regardless of the leverage offered; and should never trade unless they fully understand the mechanisms used.

How Do Cross Trading and Cross Margin Trading Work?

The process of cross trading is fairly simple to explain. When investors take the earnings from one transaction and then use it to place an order for another, without exiting the original order, this is called cross trading. This practice is often used to help manage, or offset, the risk of the first transaction. Here is a very simple example of a cross trade, for reference:

- Yesterday, Bitcoin (BTC) was trading at $50,000 a coin. Since you had the capital, you decided to invest.

- Today, BTC is trading at $60,000 a coin. You decide to sell $10,000 worth of your BTC.

- Instead of pocketing that profit, you immediately buy 2 Ether (ETH) (let’s say ETH is valued at $5,000 a token, for the sake of simplicity).

- You have retained your original $50,000 worth of BTC, and now have 2 ETH as well.

- You have just performed a cross trade.

When an investor performs a cross trade, no record of the two individual transactions are kept on the exchange used; it is instead recorded as a single “cross trade.” Because of the security concerns that emerge from this, cross-trading is not permitted by most major exchanges. This has led to the rise of platforms that deal specifically with cross trading — or more commonly, as mentioned before, cross margin trading. Cross margin trading works in exactly the same manner as the example just provided, except that the trader uses borrowed capital, which is their margin at a certain leverage.

Leverage and Risk in Cross Trading

By using the maximum leverage available, however, risk is also maximized — especially as volatility is potentially increased by having capital spread across multiple crypto assets. This does not stop savvy investors from owning a multitude of different altcoins (used as margin — sometimes called coin-margin in crypto), and then borrowing against their value in BTC, despite technically not owning BTC themselves. These investors can then conceivably sell that BTC at a profit, which allows them to keep that profit — even when they have returned the value of the BTC they borrowed. But if making a profit out of what is essentially thin air sounds too good to be true, that’s because it is. There are dangers involved when crypto cross trading.

Blockchain Transparency (source)

What Are the Dangers Associated with Cryptocurrency Cross Trades?

Lack of Transparency and Fair Pricing

Market Manipulation and Wash Trading

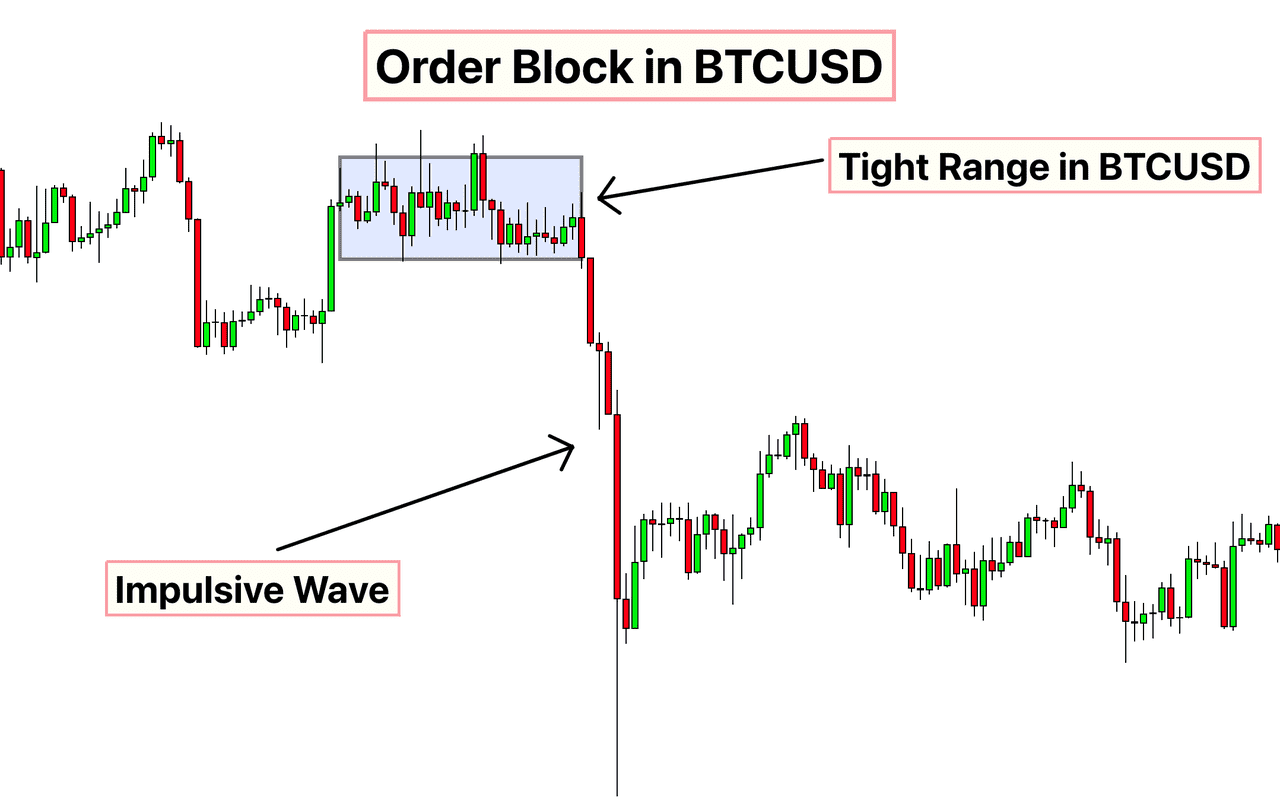

Perhaps the biggest concern is that cross trades can facilitate market manipulation. By executing trades with oneself or an accomplice, a bad actor can create the illusion of demand or supply. This was a known issue even in earlier years of crypto – studies found that significant portions of trading volume on some unregulated exchanges were likely fake, generated by automated wash trades. In fact, on some small exchanges or with certain low-cap coins, wash trading (including self-cross trades) made up over half of reported volume. Such manipulation can lure in investors by making a project seem more popular or liquid than it is. It can also artificially move the price: repeated buying of one’s own sell orders at higher and higher prices can push a price upward (until real buyers join or the scheme stops).

Regulators consider wash trading illegal because it misleads investors and distorts markets. In the U.S., for example, agencies like the SEC and CFTC have pursued cases against crypto firms and traders for allegedly using fake trades to pump up volumes. As of 2025, with crypto markets under closer scrutiny, exchanges have implemented stricter surveillance for such patterns. Many top exchanges claim to automatically prevent one account from filling its own orders. However, clever manipulators may still find ways, such as using networks of linked accounts or decentralized platforms. The bottom line is that cross trading used for manipulation erodes trust and can lead to heavy losses for those who are fooled by the false market signals.

Lack of cross trade regulation

Cross trade market manipulation

Market manipulation is defined as an intentional attempt to impact an asset’s price en masse, thereby artificially influencing the entire market for short or long term profit. Market manipulation in crypto cross trading is a serious problem, despite attempts having been made to reduce its continued proliferation in recent years. Market manipulation in crypto usually either refers to deliberately inflating the market to sell off coins/tokens, or deflating it to buy up a large amount of those same coins/tokens, with new techniques and methods popping up all the time.

Crypto order blocks (source)

Where Does the Term “Cross Trade” Come From?

Cross trades in the traditional sense (i.e. not using crypto tokens) are actually fairly common practice among brokerages, though they are only permitted in certain situations. For example, when a broker matches a buy and sell order for the same asset across different client accounts and reports them to the broker’s superiors. If the first client is willing to sell and the other wishes to make the purchase, the broker can match both orders without sending the orders to the stock exchange to be filed, instead filing them after the fact as a cross trade. This type of cross trade must also be executed at a price that reflects the current market price at the time the trade is made.

If the reporting of this transaction is in a timely manner, and time-stamped with the time and price of the cross, then on the face of it, this should not cause any problems. However, unfortunately this is only partially true in reality. The problem with these types of cross trades, just as with cryptocurrency cross trades, is that they allow more room for error — deliberate or not. Alongside this, as financial systems, digital or otherwise, are based upon data and the diligence/accuracy of its reporting — this can present clear logistical problems for the entire industry.

Are Cross Trades Becoming Mainstream?

Despite the concerns, one might wonder if cross trading is gaining acceptance as crypto markets mature. The truth is, cross trades remain a marginal practice in legitimate trading. The vast majority of crypto trades still happen via standard exchange order books or automated market makers on DEXs, where transparency is higher. Institutions entering crypto prefer regulated venues and clear rules – they are unlikely to engage in shady cross trades, as the reputational and legal risks are too high.

That said, a form of “cross trade” does occur regularly in the form of OTC trades (over-the-counter). Large investors often execute big buys or sells off the public exchange to avoid slippage. OTC desks essentially arrange private trades between buyers and sellers. This can be seen as analogous to a cross trade, except it’s typically a bona fide transaction transferring assets between two independent parties at a negotiated fair price. OTC trades are usually later reported (at least in aggregate) by firms and don’t aim to deceive the market.

Within exchanges, some have introduced “block trading” or dark pool-like services for large traders, where big orders can be matched internally away from the main order book to avoid spooking the market. These services might match orders internally (which is a kind of cross trade mechanism) but with the intent of facilitating legitimate large transfers, not manipulation.

So, in 2025, direct cross trading is not a mainstream retail strategy. It’s mostly the domain of institutional transfers, sophisticated arbitrage desks, or unfortunately, still by a few bad actors inflating volumes on lesser-known exchanges. Crypto markets are trending toward more transparency, not less. The push for better regulation, exchange audits, and on-chain analysis means suspicious trading patterns are more likely to be detected now than a few years ago.

Conclusion

Some might believe that cross trading goes against the whole idea of cryptocurrency, as it can undermine the security of entire networks and present a bit of a blurred line to regulatory bodies. However, the simple fact is that it is here to stay. It can be a useful financial tool for professional investors, and without their cooperation, the digital currency revolution is almost sure to falter, even if only momentarily.

Crypto cross trades occupy a gray area between clever trading strategy and potentially fraudulent practice. On one hand, arranging a direct offset of trades can be useful for internal portfolio rebalancing or reducing market impact for big moves. On the other hand, the opacity of cross trades goes against the spirit of open markets and the core ethos of cryptocurrency – which values transparency and decentralization. When used maliciously, cross trading (in the form of wash trading) undermines trust by creating a false picture of market activity.

As of 2025, cross trading is not common on reputable exchanges except in controlled forms (like OTC or block trades for large players, done under oversight). Regulators have made it clear that using such techniques to manipulate markets is illegal, and enforcement is increasing. Traders, especially newcomers, should be wary of tokens that suddenly show huge volume spikes or price moves with little explanation – it could be the result of orchestrated cross trades or wash trading. Sticking to well-established platforms and markets with robust volume from diverse participants is the best way to avoid the pitfalls of manipulated markets.

In summary, while the concept of crypto cross trades is important to understand, it remains more of a niche (and sometimes problematic) tactic rather than a mainstream trading approach. The industry’s move toward greater integrity and regulation means transparent trading is winning out, keeping cross trades at the fringes where they belong.