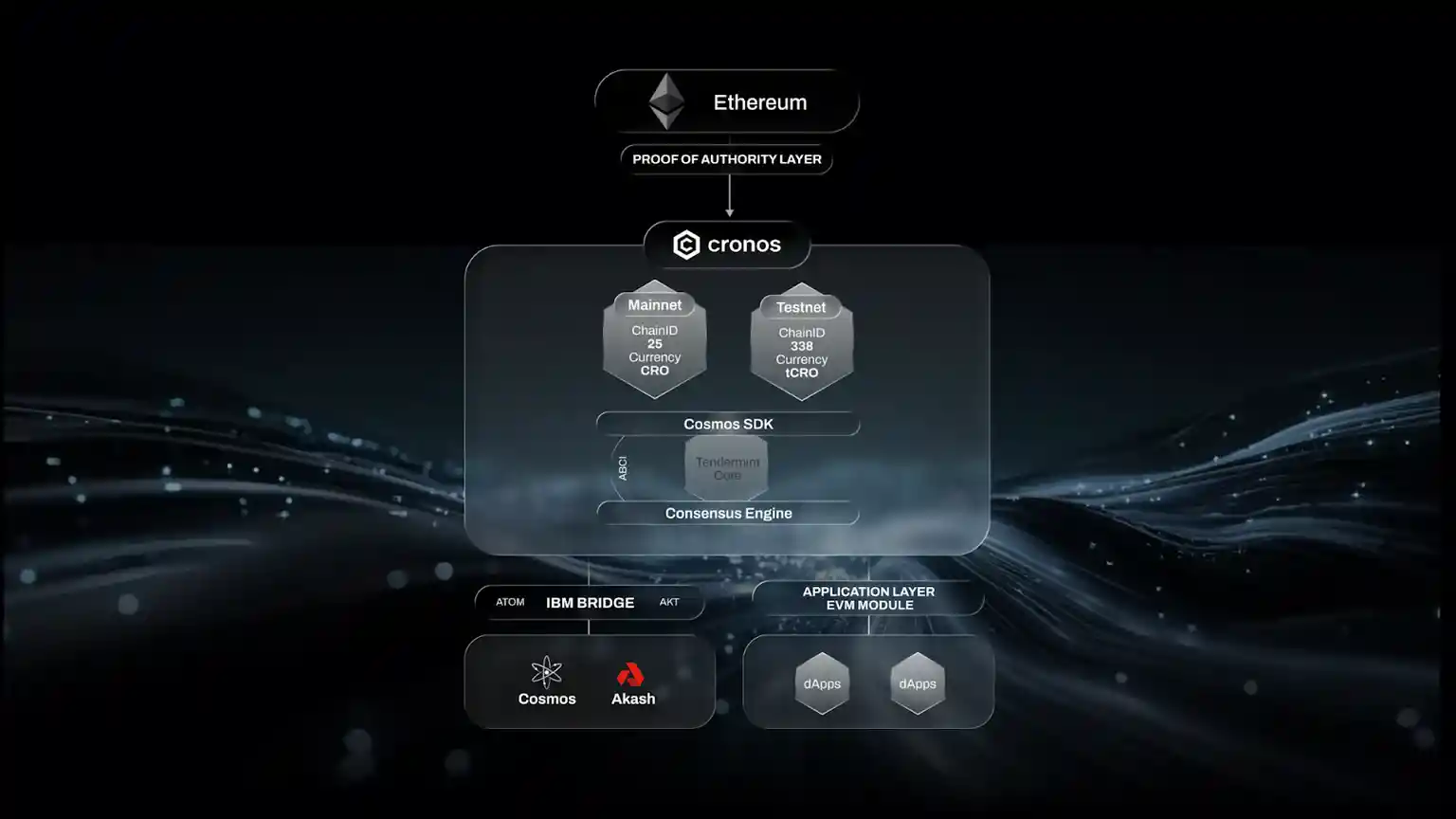

Cronos (CRO) is the native token of the Cronos ecosystem, a project distinguished by its position at the confluence of the Ethereum and Cosmos blockchains. As an Ethereum Virtual Machine (EVM) compatible chain built on the Cosmos SDK, Cronos merges Ethereum’s smart contract capabilities with Cosmos's interoperable architecture. This design aims to provide a scalable, low-cost environment for developers to build decentralized applications (dApps) and accelerate the global adoption of Web3, DeFi, and GameFi.

This article explores the fundamentals of Cronos, its multi-chain architecture, its utility, and its evolving position in the broader cryptocurrency market.

Summary Box (Quick Facts)

-

Ticker Symbol: CRO

-

Chain: Cronos, Ethereum

-

Circulating Supply: Approximately 33.5 billion CRO

-

Max Supply: 100 billion CRO

-

Primary Use Case: Transaction fees, staking, and powering dApps across the Cronos ecosystem.

-

Current Market Cap: Approximately $7.7 billion (as of late August 2025)

-

Availability on Phemex: Yes, CRO/USDT spot trading is available.

What Is Cronos (CRO)?

Cronos (CRO) is the native utility token of the Cronos blockchain, an open-source, decentralized network launched by Crypto.com in November 2021. The core mission of Cronos is to support the creator economy by providing a high-speed and low-fee platform for dApps, particularly in the realms of DeFi, NFTs, and the metaverse.

What makes Cronos noteworthy is its unique hybrid architecture. It is the first blockchain to enable interoperability between the Ethereum and Cosmos ecosystems. "What is Cronos?" can be explained as a bridge: for developers, its EVM compatibility allows for the easy porting of smart contracts from Ethereum. For users, its foundation on the Cosmos SDK enables seamless communication and asset transfers with other compatible blockchains. This dual functionality positions Cronos to address scalability limitations and foster a more interconnected Web3.

How Many CRO Are There?

Originally, CRO had a maximum supply of 100 billion tokens. In a significant event in February 2021, Crypto.com announced a massive token burn, which eventually reduced the total supply to 30 billion to increase scarcity and decentralization.

However, in March 2025, a governance proposal was passed to reissue the 70 billion CRO. These tokens are not entering circulation immediately but are held in a "Cronos Strategic Reserve" and are locked for ten years with a monthly vesting schedule. The stated goal is to fund long-term ecosystem growth, such as backing exchange-traded funds (ETFs), expanding validator sets, and integrating AI. As of late 2025, the circulating supply is approximately 33.5 billion CRO.

What Does CRO Do?

The CRO token is a multi-utility asset integral to the entire Cronos ecosystem. The primary Cronos (CRO) use case is to function as the network's gas token, used to pay for transaction fees.

Beyond gas fees, CRO's utility includes:

-

Staking: Users can stake CRO to contribute to the security of the network and earn rewards for doing so.

-

DeFi Applications: CRO is essential for interacting with the DeFi ecosystem on Cronos, where it can be used for yield farming, providing liquidity, and as collateral.

-

Governance: CRO holders can participate in on-chain governance by voting on protocol upgrades and other proposals that shape the future of the network.

-

Payments: The token powers the Crypto.com Pay service, which allows users to pay for goods and services with crypto and receive cashback rewards.

CRO vs. Solana

Cronos and Solana are both high-performance layer-1 blockchains designed for speed and scalability, but they achieve these goals through different architectural trade-offs.

| Feature | Cronos (CRO) | Solana (SOL) |

| Consensus Mechanism | Proof-of-Authority (PoA) built on CometBFT (PoS). | Proof-of-History (PoH) combined with Proof-of-Stake (PoS). |

| Transaction Speed (TPS) | Designed for high throughput, but generally lower than Solana. | Extremely high, capable of 65,000+ TPS theoretically. |

| Transaction Fees | Very low, designed for affordability and predictable costs. | Extremely low, often a fraction of a cent ($0.00025 on average). |

| Smart Contracts | EVM-compatible (Solidity). | Rust, C, and C++. Not EVM-native. |

| Decentralization | Less decentralized, with a smaller, permissioned set of validators. | More decentralized, with a larger, permissionless set of validators. |

| Core Technology | Built on Cosmos SDK, enabling native interoperability via IBC. | Custom-built protocol focused on a single, high-performance global state. |

The Technology Behind CRO

The technical foundation of Cronos is a sophisticated, multi-chain architecture designed for scalability, security, and interoperability.

-

A Hybrid Architecture: At its core, Cronos combines the EVM with the Cosmos SDK. The EVM layer allows developers to build with familiar tools like Solidity, while the Cosmos SDK provides a robust, modular framework.

- Consensus Engine: Proof of Authority (PoA):

Cronos utilizes a PoA consensus built on CometBFT (formerly Tendermint). In this system, validators are carefully vetted based on their technical capabilities and commitment to the ecosystem. This permissioned model allows for instant finality, meaning transactions are confirmed immediately once they are included in a block. Security is maintained through a Byzantine Fault-Tolerant (BFT) protocol that can withstand up to one-third of nodes failing or acting maliciously.

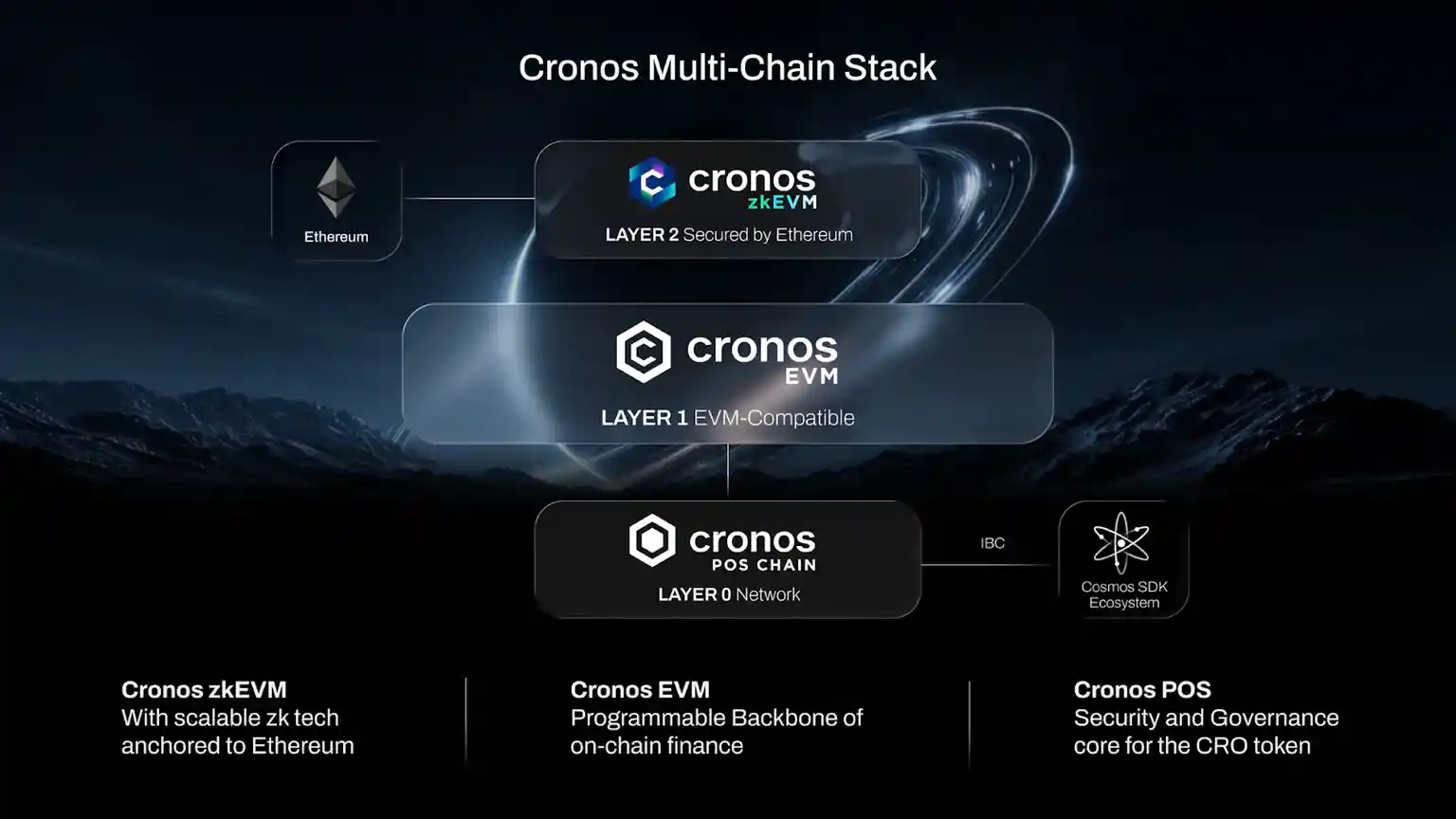

- The Cronos Chain Stack: The ecosystem is comprised of three distinct chains that work in synergy:

-

-

Cronos EVM: The layer-1 programmable backbone where most dApps and smart contracts are deployed.

-

Cronos POS: The layer-0 network that secures the ecosystem through staking and governance.

-

Cronos zkEVM: A layer-2 scaling solution that uses zero-knowledge proofs to offer even cheaper and faster transactions, leveraging Ethereum's security.

-

-

Interoperability with IBC: The Inter-Blockchain Communication protocol is a key feature, enabling Cronos to transfer assets and data reliably to and from other IBC-enabled chains, fostering a connected "internet of blockchains."

Team & Origins

Cronos was developed by Crypto.com, a major financial services company founded in 2016 by Kris Marszalek, Rafael Melo, Gary Or, and Bobby Bao. The company was initially named Monaco and rebranded to Crypto.com after acquiring the now-iconic domain name. The CRO token was first created in 2018 as an ERC-20 token on Ethereum before migrating to its own native blockchain. The Cronos mainnet officially launched in November 2021.

Key News & Events

-

August 2025: Trump Media Partnership: In a major development, Trump Media & Technology Group announced a strategic partnership with Crypto.com to launch a CRO treasury company. The deal involves establishing a treasury with over $6 billion in funding and integrating CRO into the Truth Social and Truth+ platforms for rewards and payments. This news caused the Cronos (CRO) price to surge by over 40%.

-

August 2025: SEC Delays ETF Decision: The SEC postponed its decision on a proposed ETF from Trump Media that would include a 5% allocation to CRO. This introduces some regulatory uncertainty but points to long-term institutional interest if eventually approved.

-

July 2025: Mainnet Upgrade: The Cronos POS chain underwent a v6 mainnet upgrade, incorporating enhancements from the Cosmos SDK to deliver faster and more secure transactions.

-

Ongoing ETF Speculation: The market is closely watching various applications for ETFs that include CRO exposure, which could unlock significant institutional capital.

Is CRO a Good Investment?

Evaluating the Cronos (CRO) investment potential requires a balanced look at its strengths and risks. The project's powerful backing by Crypto.com, its advanced, interoperable technology, and a rapidly growing dApp ecosystem are significant advantages. The recent partnership with Trump Media provides unprecedented visibility and potential utility, signaling strong institutional interest.

However, potential risks include the inherent volatility of the crypto market and community concerns regarding its tokenomics and the centralization of its validator set. The price has seen a dramatic increase, and whether this momentum is sustainable will depend on the successful execution of its roadmap and broader market conditions.

This information is for educational purposes and should not be considered financial advice. Always conduct your own research and only invest what you can afford to lose.

How to Buy Cronos (CRO) on Phemex

As of 09:00 UTC on August 28, 2025, you can now trade CRO directly on Phemex. The platform has listed the CRO/USDT spot trading pair, making it easy for users to gain exposure to the Cronos ecosystem.

To get started, simply:

-

Log in to your Phemex account.

-

Navigate to the "Spot" trading section.

-

Search for the CRO/USDT pair.

-

Place your order to buy or sell CRO.

For more details, you can visit the Phemex trading page.

FAQs

1. What is Cronos (CRO) primarily used for?

CRO is the native utility token for the entire Cronos ecosystem. Its main uses include paying for transaction fees on the network, staking to earn rewards and secure the blockchain, and participating in the governance of the protocol.

2. How is Cronos different from other EVM chains?

Cronos stands out by being built on the Cosmos SDK, which enables native interoperability with the Cosmos ecosystem through the Inter-Blockchain Communication (IBC) protocol. It also uses a Proof-of-Authority (PoA) consensus mechanism with vetted validators to achieve higher transaction speeds and lower fees.

3. What is the difference between the Cronos staking token and the CRO token?

In the Cronos PoA consensus mechanism, a dedicated, non-public staking token is used by validators for governance and block validation. The CRO token is the public-facing utility token that end-users utilize to pay for network transaction fees, which are then collected by the validator nodes.

4. Where can I find news about Cronos (CRO)?

You can find the latest news about Cronos (CRO) on major crypto news outlets and by following the official Cronos channels. Recent events include a major partnership with Trump Media and ongoing developments related to ETF applications.