Summary Box (Quick Facts)

-

Ticker Symbol: LIGHT

-

Chain: BNB Chain

-

Contract Address: 0x477c2c0459004e3354ba427fa285d7c053203c0e

-

Circulating Supply: 43.06M LIGHT

-

Total Supply: 420M LIGHT

-

Primary Use Case: Enabling smart contracts and stablecoin transactions on Bitcoin

-

Current Market Cap: $40.79M

Key Takeaways

-

Bitlight (LIGHT) is a Bitcoin Layer 2 protocol designed to bring smart contracts and high-speed transactions to the Bitcoin network.

-

It utilizes the RGB protocol and the Lightning Network to enable scalable, private, and efficient asset issuance and transfers.

-

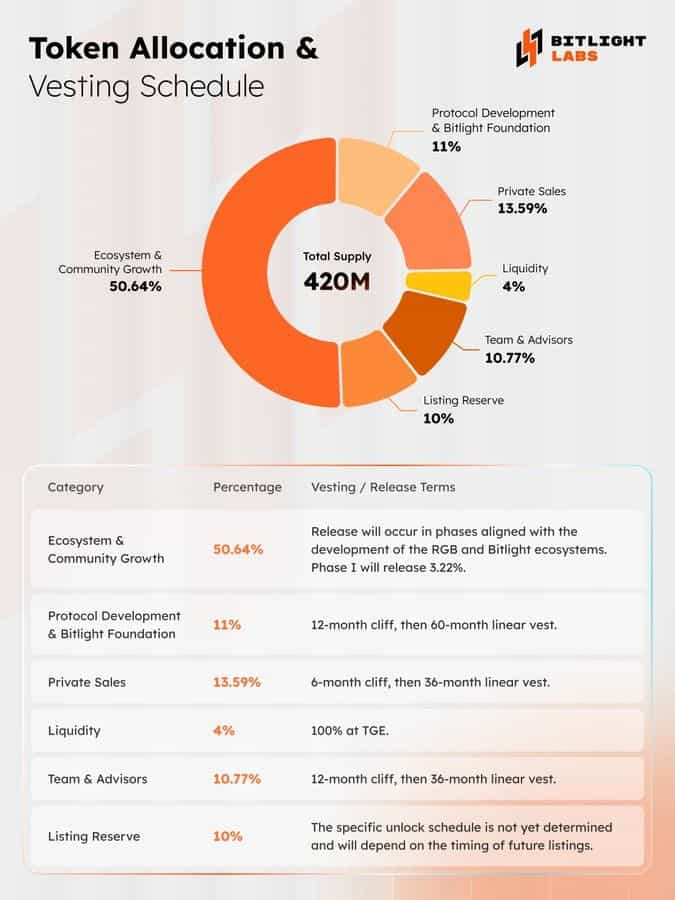

The total supply of LIGHT is fixed at 420 million tokens, with a detailed allocation and long-term vesting schedule designed to ensure market stability and reward long-term commitment.

-

Major allocations are dedicated to ecosystem growth, protocol development, and private sale participants, with multi-year vesting periods to align all stakeholders with the project's long-horizon vision.

-

Users can explore how to buy LIGHT and trade it securely on the Phemex platform, which offers a full suite of tools for informed trading.

Introduction

Bitcoin’s unparalleled security has made it the bedrock of the digital asset world, but its design limitations have hindered its ability to support complex financial applications. This is the challenge Bitlight (LIGHT) is built to solve. As an innovative Bitcoin Layer 2 solution, Bitlight aims to "Make Bitcoin Smart" by layering advanced functionality onto the world's most secure blockchain. This guide provides a comprehensive explanation of what is Bitlight, its foundational technology, its robust tokenomics, and its potential to reshape decentralized finance. Understanding these elements will empower you to make smarter, safer trading decisions. Explore Phemex Academy for more expert insights.

What Is Bitlight?

Bitlight is a Bitcoin Layer 2 protocol engineered to unlock the full potential of the Bitcoin network. At its core, Bitlight explained is a system that enables the issuance and management of digital assets, including stablecoins and other tokens, directly on Bitcoin. It addresses the network's inherent limitations in scalability and programmability, allowing for high-throughput, low-cost transactions without compromising the security inherited from the Bitcoin base layer. By doing so, Bitlight paves the way for sophisticated DeFi applications, micropayments, and enterprise-level settlement solutions to be built on Bitcoin.

How Many LIGHT Are There?

The tokenomics of Bitlight are designed with a long-horizon philosophy, emphasizing stability and sustainable growth. The total supply of LIGHT is hard-capped at 420 million tokens, ensuring scarcity. The distribution and release schedule are structured to align the interests of all participants, from the core team to the community.

Here is the official breakdown of the token allocation:

-

Ecosystem & Community Growth (50.64%): The majority of tokens are reserved for fostering the ecosystem by rewarding early users, developers, and community contributors. Releases are tied to development milestones, with only 3.22% unlocked in the initial phase to encourage long-term participation.

-

Private Sales (13.59%): Allocated to early strategic partners who support the project's long-term vision. These tokens are subject to a 6-month cliff (a lock-up period) followed by a 36-month linear vest (gradual release), minimizing early market pressure.

-

Protocol Development & Bitlight Foundation (11%): Dedicated to funding ongoing development and research through the Bitlight Foundation. This allocation has a strict 12-month cliff and a 60-month linear vest, reflecting a deep commitment to the protocol's future.

-

Team & Advisors (10.77%): To ensure the core team is focused on long-term success, their tokens are locked for 12 months and then vest over 36 months.

-

Listing Reserve (10%): Reserved for future exchange listings and marketing efforts. The unlock schedule for these tokens will be determined based on future listing timelines.

-

Liquidity (4%): This allocation is fully unlocked at the start (TGE) to provide initial trading liquidity on exchanges and ensure a smooth market experience for users.

What Does LIGHT Do?

The LIGHT token is the native utility asset of the Bitlight ecosystem, integral to its operation and governance. The primary LIGHT use case is to facilitate economic activity and secure the network. Its functions include:

-

Network Fees: Users spend LIGHT to pay for transaction fees when transferring assets or executing smart contracts on the Bitlight Layer 2.

-

Staking: Holders can stake LIGHT to contribute to the network's security and operational integrity, earning rewards for their participation.

-

Governance: LIGHT holders will be able to propose and vote on key protocol upgrades and changes, giving the community control over the platform's future.

-

Ecosystem Incentives: The token is used to power the ecosystem and community growth fund, rewarding builders and users who contribute to the network's expansion.

LIGHT vs. Bitcoin

While Bitlight is built on Bitcoin, its function is fundamentally different. The LIGHT vs. Bitcoin comparison is not one of competition but of synergy and enhancement.

| Feature | Bitlight (LIGHT) | Bitcoin (BTC) |

| Technology | Layer 2 protocol for smart contracts and asset issuance | Layer 1 blockchain, the secure settlement layer |

| Speed and Fees | Near-instant and low-cost via the Lightning Network | Slower (10-minute blocks) with higher, variable fees |

| Use Case | DeFi, stablecoins, complex financial instruments | Store of value, peer-to-peer electronic cash |

| Decentralization | Inherits Bitcoin's security and decentralization | The most decentralized and secure crypto network |

In essence, Bitlight extends Bitcoin's utility, allowing it to function as a base layer for a new generation of decentralized applications.

Ready to act on this information? Trade LIGHT Now on Phemex.

The Technology Behind LIGHT

Bitlight's innovative power comes from its unique combination of the RGB protocol and the Lightning Network, which together create a scalable and private environment for smart contracts on Bitcoin.

-

The RGB Protocol: This is a smart contract system built for Bitcoin that allows for the issuance and transfer of highly scalable, private, and secure tokens. It operates using "client-side validation," meaning transaction data is kept private between the parties involved, which drastically reduces the data load on the network.

-

The Lightning Network: As Bitcoin's premier scaling solution, the Lightning Network enables near-instant, low-fee transactions. Bitlight integrates with it to allow for the fast and cheap transfer of RGB-issued assets, overcoming Bitcoin's native latency and cost limitations.

Team & Origins

Bitlight was developed by Bitlight Labs, a focused organization dedicated to making Bitcoin a more programmable and scalable ecosystem. The project is backed by prominent venture capital firms, including Amber Group and Fundamental Labs, who participated in a successful private sale that valued the company at $170 million. The team's long-term commitment is reflected in the tokenomics, which feature extended vesting schedules for both the team and early investors, aligning their incentives with the durable, long-horizon success of the project.

Key News & Events

Bitlight has achieved several significant milestones that have raised its profile in the crypto industry:

-

Launch of Phase I Airdrop: The claiming process for the first phase of the $LIGHT airdrop is now live, allowing early community members and eligible participants to receive their token allocation as a reward for their support.

-

Phemex Listing: The listing of LIGHT on Phemex has provided users with a secure and reliable venue to trade LIGHT.

-

Successful Funding Round: Bitlight Labs raised $9.6 million from top-tier investors, providing a multi-year runway for development and execution.

Is LIGHT a Good Investment?

Evaluating the LIGHT investment potential requires a balanced look at its strengths and the inherent risks of the crypto market.

Potential Strengths:

-

First-Mover Advantage: Bitlight is a pioneer in bringing RGB protocol-based smart contracts to a broader audience on Bitcoin, a largely untapped market.

-

Strong Tokenomics: The long-term vesting schedules for the team and private investors (up to 60 months) significantly reduce the risk of short-term selling pressure and demonstrate a strong belief in the project's future.

-

Robust Technology: By building on Bitcoin's security and leveraging the Lightning Network's speed, Bitlight has a powerful technical foundation.

-

Institutional Backing: Support from major VCs provides both capital and credibility.

Potential Risks:

-

Competition: The Bitcoin Layer 2 space is growing, and Bitlight will face competition from other solutions.

-

Market Volatility: Like all cryptocurrencies, the LIGHT price is subject to high volatility and market fluctuations.

-

Regulatory Environment: The evolving regulatory landscape for cryptocurrencies could pose challenges for DeFi protocols.

(Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.)

How to Buy LIGHT on Phemex

Phemex offers a secure, user-friendly platform to purchase and trade LIGHT. For a detailed walkthrough on how to get started, from creating an account to placing your first order, please visit our dedicated How to buy LIGHT page. Phemex is committed to empowering traders with the tools and educational resources needed for smarter, safer trading.

Closing Thoughts

Bitlight stands at the forefront of a crucial evolution for Bitcoin, transforming it from a passive store of value into an active foundation for a new decentralized economy. With its sophisticated technology, well-structured tokenomics, and clear vision, Bitlight is poised to unlock immense value by enabling scalable and private smart contracts on the world's most secure blockchain. To continue learning about transformative projects, explore the resources at Phemex Academy.

FAQ Section

What is the primary goal of Bitlight?

Bitlight’s main goal is to bring scalable smart contracts and asset issuance to the Bitcoin network. It leverages the RGB protocol and Lightning Network to enable high-speed, low-cost applications like DeFi and stablecoin payments on Bitcoin.

How does Bitlight's vesting schedule benefit investors?

The long vesting schedules for the team, advisors, and private investors (with cliffs of up to 12 months and vesting periods up to 60 months) align all parties with a long-term vision. This reduces the risk of early token dumps and promotes market stability.

Why is Bitlight built on Bitcoin instead of another blockchain?

Bitlight is built on Bitcoin to leverage its unmatched security, decentralization, and liquidity. Instead of creating a new, less secure blockchain, Bitlight enhances the functionality of the existing Bitcoin network, inheriting its core strengths.