The cryptocurrency market of 2026 continues to be a theater of the unexpected, where high-frequency volatility and sentiment-driven assets often dominate social discourse. While institutional capital provides stability to major assets, the decentralized finance (DeFi) sector frequently sees the emergence of tokens like "Bad Bunny Coin" (BADBUNNY).

As of February 10, 2026, Bad Bunny Coin has triggered multiple volatility alerts due to a reported 91.91% price increase. However, beneath the green candles on the chart lies a complex and highly irregular on-chain structure. For traders navigating the Phemex ecosystem, understanding the discrepancy between "price" and realizable liquidity is essential for capital preservation.

In this report, we break down the current market snapshot, the alarming concentration of supply, and how to utilize professional tools to identify potential liquidity trap.

Market Data Snapshot: Bad Bunny Coin (BADBUNNY)

The following data, captured directly from on-chain explorers on February 10, 2026, highlights the current technical state of the asset:

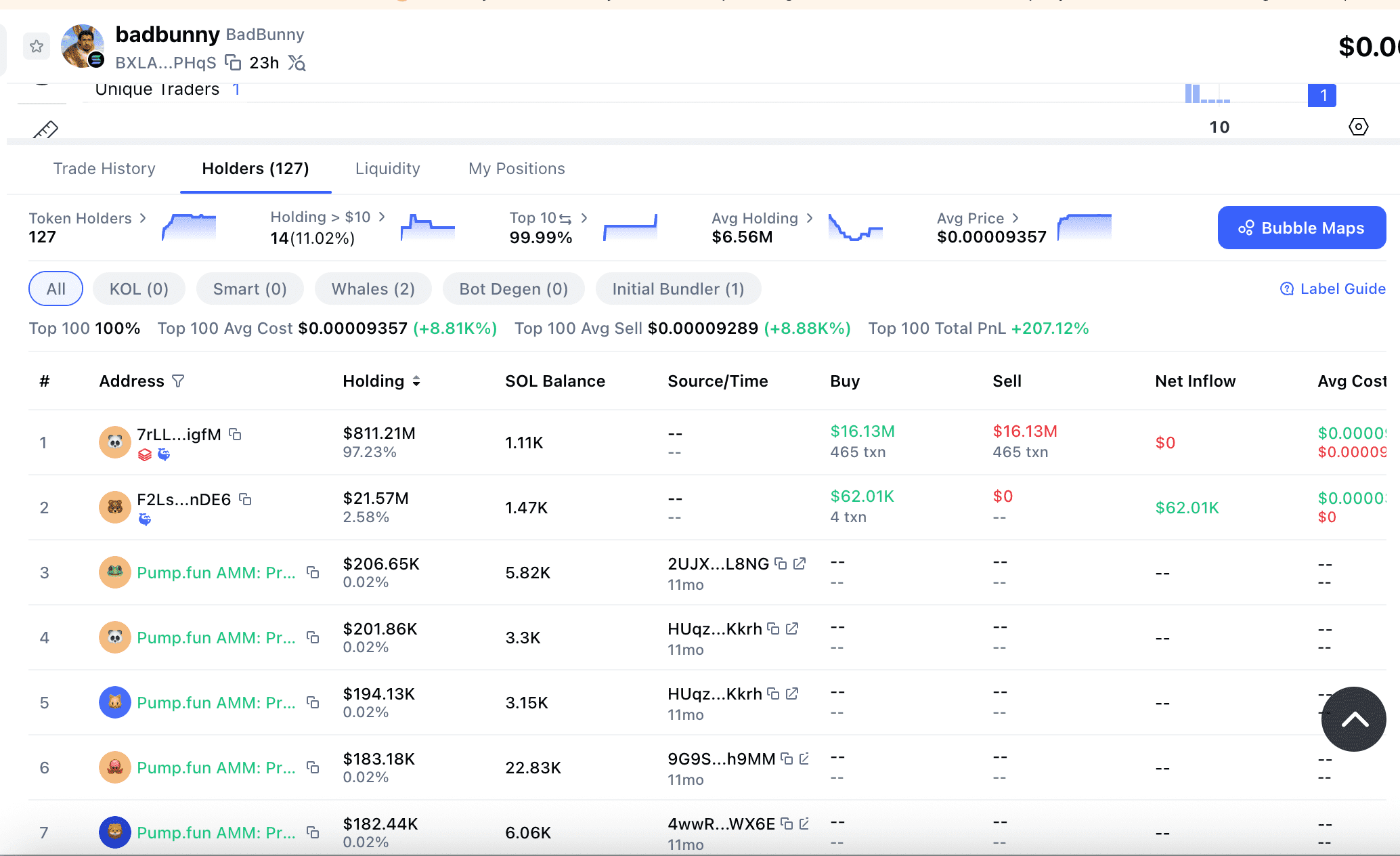

| Category | On-chain Metric | Compliance/Risk Assessment |

| Current Price | $0.008342 | +91.91% (24h change) |

| Fully Diluted Valuation (FDV) | $834,200,000 | Disproportionately high relative to liquidity |

| Total Liquidity (Liq) | $0.00000435 | CRITICAL: Virtually zero exit liquidity |

| 24h Trading Volume | $32.3 Million | High probability of automated wash trading |

| Unique Traders | 1 | Indicates total lack of organic market depth |

| Supply Concentration | 97.23% (Top Holder) | Extreme centralization risk (Wallet: 7rLL...igfM) |

| Security Scan | High Risk | Flagged for structural anomalies |

Trade Trending Tokens with Speed. Access Phemex Onchain Today.

1. Technical Analysis: The Anatomy of a "Zero-Liquidity" Surge

The 91% breakout observed today appears to be a technical anomaly rather than a result of organic market demand. To understand what is happening with Bad Bunny Coin, we must look at the "Liquidity-to-Value" ratio.

The Liquidity Trap

With a reported Liquidity of only $0.00000435, the current price of $0.008342 is functionally "untradeable" for the public. In a standard market environment, liquidity supports the ability to enter and exit positions. In this case, there is no liquidity pool of assets (SOL or USDC) to facilitate a sale.

- Audit Note: Even a sell order of $1.00 would likely result in a 99.9% price slippage. This is a characteristic often associated with "honeypots" or "liquidity traps," where the price can go up, but participants cannot realize profits.

Source:CoinMartketCap

Identifying Wash Trading

The data shows a 24h Trading Volume of $32.3M but only 1 Unique Trader.

- The Verdict: This confirms that the price action is being generated by a single entity (or script) trading the token with itself to create the illusion of high activity and momentum. In the 2026 market, these "ghost volumes" are used to lure retail FOMO into assets that have no fundamental backing.

2. Critical Warning: The "97% Whale" and Centralization

While the price chart may look attractive to speculative scanners, the internal distribution of Bad Bunny Coin suggests a high degree of structural vulnerability.

The Single-Point-of-Failure: A single wallet address (7rLL...igfM) currently holds 97.23% of the total supply, valued at a theoretical $811 million.

The Rug Pull Risk: Because the top holder effectively is the market, any decision by this entity to stop trading or withdraw the remaining negligible liquidity would result in an immediate and total loss for any other holder.

The Illusion of Holders: Although there are 127 unique holder addresses listed, the "Top 10" concentration is 99.99%. This suggests that the majority of "holders" are likely dust accounts created by the deployer to simulate a community.

Source:CoinMartketCap

3. The Evolution of Risk Management in 2026

By 2026, the complexity of meme coin manipulation has forced a fundamental change in how retail participants must trade. The traditional method of connecting a Web3 wallet to an unverified DEX and "hoping for the best" is now considered a high-risk behavior.

When a token like Bad Bunny Coin exhibits "High Risk" security scans, speed and safety are the only defenses. This is where Phemex Onchain provides a critical advantage for users analyzing trending but unverified assets.

4. How to Analyze Speculative Assets via Phemex Onchain

For traders who recognize the volatility of tokens like Bad Bunny Coin but want to avoid the pitfalls of low liquidity, Phemex Onchain offers a professional-grade execution layer.

The Phemex Onchain Advantage:

Real-Time Liquidity Verification: Unlike generic price aggregators, Phemex Onchain provides direct visibility into the "Depth" of a pool. It allows you to see if a +91% move is backed by millions in liquidity or, as in the case of BADBUNNY, just a few cents.

Managed Execution & Slippage Control: When dealing with tokens that have extreme concentration, setting a "Slippage" limit is vital. Phemex’s engine can automatically block trades where the price impact would be too severe, protecting users from the $0.00000435 liquidity trap.

Gas-Efficient Swaps: Phemex handles the backend complexity of Solana and Ethereum gas, allowing for faster exits if a "whale" starts moving funds from a top-heavy wallet like 7rLL...igfM.

5. Step-by-Step: Due Diligence Workflow

If you are investigating Bad Bunny Coin, use this workflow to ensure you are not interacting with a malicious contract:

Verify the Contract (CA): Use the CA BXLA...PHqS (Solana) as seen on the official CMC page to avoid copycats.

Paste into Phemex Onchain: Search for the specific CA within the Phemex Web3 portal.

Check the "Unique Traders" Count: If the volume is high but the unique trader count is near zero, it is a signal to remain cautious and avoid the trade.

Monitor Top Holders: Keep an eye on the 7rLL...igfM address. If you see this wallet transferring tokens to an exchange or a new DEX pool, it often signals an impending exit.

6. Risk Management for High-Concentration Scenarios

The "Golden Rules" for February 10, 2026, are more relevant than ever:

Liquidity First, Price Second: A price increase of 91% is meaningless if the liquidity pool cannot support a $10 withdrawal.

The "Honeypot" Test: If a token has "Security Scan: High Risk" on its dashboard, assume that you may not be able to sell once you have bought.

Exposure Limits: Speculative assets with >90% supply concentration should never constitute a significant portion of a professional portfolio.

Conclusion: Data-Driven Safety

The "Bad Bunny Coin" surge is a textbook example of the 2026 "Liquidity Illusion." While the headline numbers suggest a viral breakout, the on-chain data—specifically the $0.00000435 liquidity and the single unique trader—tells a story of extreme risk and manipulation.

In a market where one wallet can control the entire price floor, speed and data transparency are your only safety. By using Phemex Onchain, you can look past the "God Candle" and make informed decisions based on real, tradeable liquidity.

Technical Summary (Feb 10, 2026):

Ticker: BADBUNNY

Price: $0.008342

Real Liquidity: $0.00000435 (Critical Risk)

Holder Health: Poor (97.23% Concentration)

Navigate Market Volatility Securely. Explore Onchain Trading on Phemex.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves a high risk of loss. Meme coins with low liquidity are extremely speculative and may result in a 100% loss of capital. Always perform your own due diligence (DYOR) and use secure trading platforms like Phemex.