Exchange traded products (ETPs) have grown in popularity in recent years due to their flexibility, high levels of liquidity, and relative affordability. Bitcoin ETP and other crypto ETP products are also emerging as viable investment options.

However, there is still a lot of confusion with regard to the ETP meaning and precise definition. Many people are also using ETP and ETF (exchange traded fund) as synonyms, although the latter is a sub-type of the former.

What Is ETP?

An ETP is a financial product that tracks the value of some other underlying asset or product, such as a market index, commodity, or stock. As their name suggests, ETPs are traded on exchanges. They come in three main forms:

- Exchange traded funds (ETFs): This is the most popular type of ETPs. ETFs track an underlying market index or other security or a basket of securities. They are similar to mutual funds but have more liquidity and are typically more affordable.

- Exchange traded notes (ETNs): This is a much less often used ETP product. ETNs track some underlying financial product or products, similar to ETFs. However, their difference from ETFs is that ETNs do not provide ownership of the underlying securities included in the ETN.

By owning an ETF, you become a part-owner of the security or securities represented by this product. This is similar to becoming a part-owner of a company when you buy its stock.

On the other hand, in the case of an ETN, your purchase of this product represents a bond, i.e., a debt obligation to you by the issuer of the underlying security. This is similar to how a debt obligation to you arises when you purchase bond products such as treasury notes, bills, or bonds.

It should be noted that, unlike standard bond products, ETNs do not provide any fixed regular repayments while you hold this product. You may only profit from an ETN if it appreciates in value between the time you bought it and the time of sale.

- Exchange traded commodities (ETCs): These products use a commodity or a basket of commodities as the underlying tracked asset. Similar to ETFs and ETNs, ETCs are freely traded on exchanges. Thus, unlike some commodities, ETCs may provide higher levels of immediate liquidity.

Are ETPs Considered Derivatives?

Since ETPs track some other underlying asset or a combination of assets, some investors believe that ETPs are a form of derivatives. However, technically speaking, ETPs are not necessarily a derivative product.

In most cases, derivatives, in addition to being based on another asset or assets, also involve leverage and/or complex structuring. Derivatives are considered relatively risky investment products, particularly due to the use of leverage.

On the other hand, ETPs are often based on low-risk market indices and do not necessarily involve leverage. Thus, they are not viewed as derivatives by default. However, some ETPs do involve leverage and complex structuring. These leveraged ETP products may be considered exchange-traded derivatives products.

What Are ETFs and How Do They Differ From Mutual Funds?

As noted earlier, ETFs are simply a sub-type of ETPs. Since ETFs are the most commonly used ETP product, the terms ETF and ETP are often used interchangeably by some people. However, being aware of the difference between the two is important. While in most cases, you will encounter ETFs when researching about ETPs, do take into account the existence of other ETP products – ETNs and ETCs.

ETFs have very similar structuring to mutual fund products. Similar to mutual funds, ETFs often track some market index or another composite security product. Many investors considering lower-risk passive investment strategies evaluate ETFs and mutual funds as key alternatives.

ETFs vs. Mutual Funds

There are a number of differences between the two. The primary differences include:

- Mutual funds are typically more actively managed by fund managers compared to ETFs. Many ETFs passively track a low-risk market index. Portfolio re-allocations happen rarely, and the goal is to keep tracking the index in a stable way. In contrast, many mutual fund managers actively re-arrange assets in the fund to improve returns. Naturally, with the increased potential returns from such a strategy comes increased risk potential.

- Primarily due to the more active fund management, mutual funds have higher fees for investors to join. ETFs normally charge lower fees compared to mutual funds.

- ETFs have higher liquidity than mutual funds. They can be traded during the day on the exchange and are considered a highly liquid product. In contrast, mutual funds are not a day trading product. However, mutual funds are not far behind ETFs in terms of liquidity. They may easily be bought at the trading day’s closure. Mutual funds are widely available from stock exchange-connected brokerages.

What Are the Advantages and Disadvantages of ETPs?

Advantages of ETPs

All three forms of ETPs, ETFs, ETNs, and ETCs offer a number of advantages applicable in general to all of them. These include:

- The ability to access a variety of underlying stock or commodity products via one financial instrument. In many markets, accessing these products individually may not be possible or your choices may be limited. Similar to derivatives, ETPs help you access a diverse range of financial assets. At the same time, your investment risk with most ETPs is lower than with a typical derivative product.

- Low-risk investing in general. Most ETPs passively track established market indices and, thus, are suitable for investors who prefer a hands-off, safe approach to investing.

- The ability to freely trade the product on stock exchanges. Many fund-based products simply cannot be traded on exchanges, while ETPs have no such restriction.

- Investment portfolio diversification. Many retail investors have an over-reliance on stocks in their portfolios. This exposes them to higher investment risk. ETPs are among the options to help you diversify your portfolio from reliance on stocks alone. Naturally, you need to carefully examine the ETP product’s composition. If it is heavily based on a few key stocks on the market, you are not diversifying away from stocks by buying such a product.

Limitations of ETPs

Along with their advantages, ETP products also have some disadvantages or limitations. The main ones include:

- A lack of clarity and complexity: Some ETP products may be too complex in terms of their composition. This may easily confuse less experienced investors. This may create particular issues in the case of higher-risk ETP products, such as some ETCs. The commodities market is known for its volatility, and many ETC products may inherit the volatility. A trader who is inexperienced in commodities trading may, thus, suffer losses by committing to an ETC product they do not fully understand.

- Limited returns: Since most ETPs passively track a low-risk index, they may offer only limited return potential. As noted above, this may not apply to higher-risk ETP products such as some ETCs.

- Less active management: ETPs are typically less actively managed by fund managers compared to mutual fund products. As such, their performance may be less responsive to adverse market changes.

Are There Bitcoin ETPs?

Bitcoin ETPs are new products that have only recently entered the market. As cryptocurrency in general gains appreciation as a viable financial asset class, expect a wider choice of Bitcoin and other crypto ETPS to be offered in the future.

However, at the moment, there is a limited choice of Bitcoin and crypto ETP products. Examples of these products include:

- The Physical Bitcoin ETP (BTIC) offered by Invesco, one of the largest ETF product providers in the world. This product tracks the Bitcoin Hourly Reference Index, an index that tracks Bitcoin prices on an hourly basis using the proprietary methodology of CoinShares, an investment firm specializing in digital asset investments.

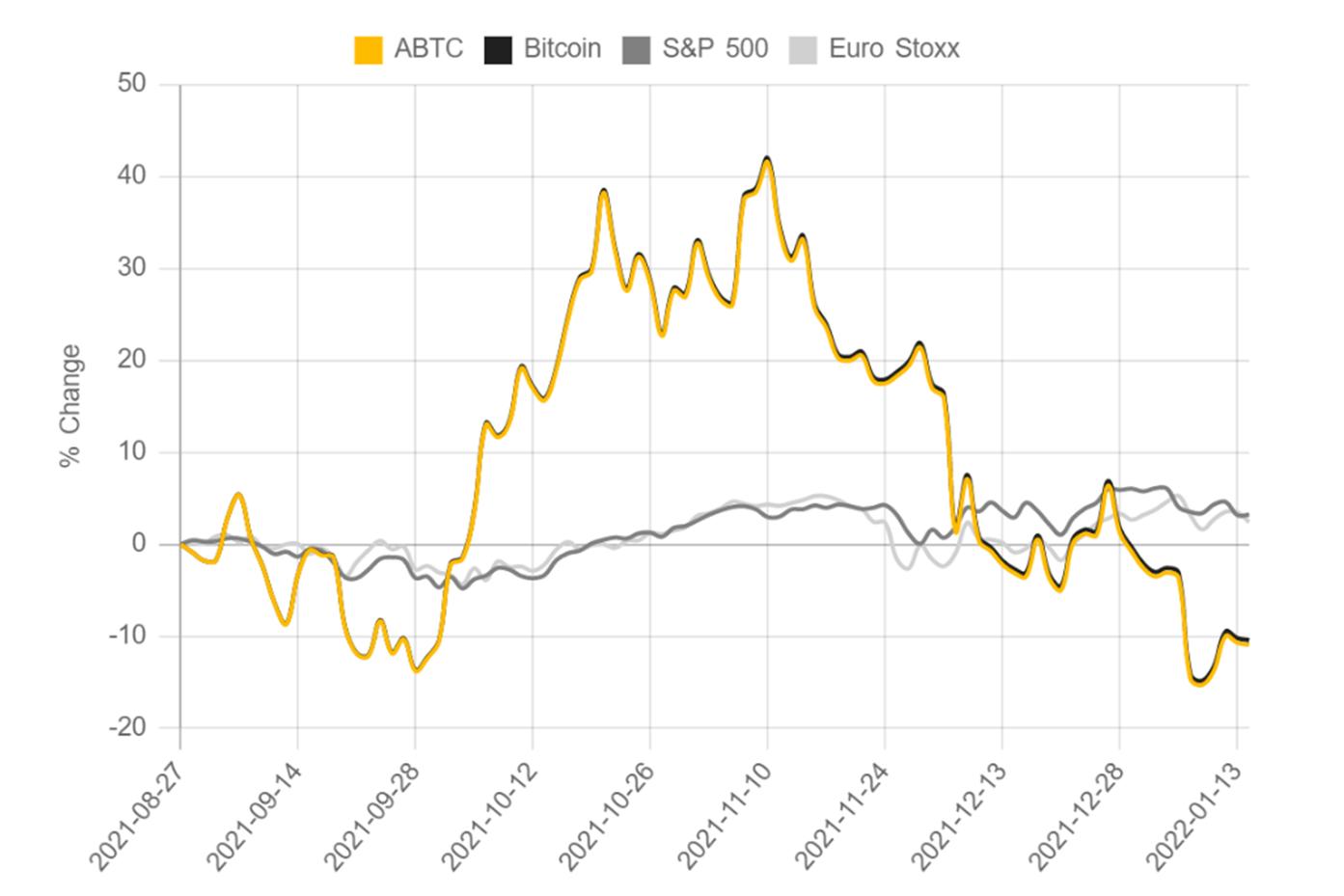

- The 21 Shares Bitcoin ETP (ABTC) by 21 Shares, another investment firm specializing in crypto assets. This product is based on the price of Bitcoin collated from eight exchanges.

Market performance of the ABTC ETP product by 21 Shares compared to Bitcoin, S&P 500, and Euro Stoxx over the last 6 months (Source: 21Shares.com)

- Vectors Bitcoin ETN by VanEck, another investment management firm. While the two Bitcoin ETP products above are ETFs, the product by VanEck is a Bitcoin-based ETN. It is based on the MVIS CryptoCompare Bitcoin VWAP Close Index.

Conclusion

ETPs are financial products freely traded on stock exchanges that track some other underlying asset. There are a variety of assets that ETPs may be based on. The three ETP types are ETFs, ETNs, and ETCs.

Normally, ETPs are based on lower-risk market indices. ETPs are often compared to mutual funds as a sound alternative. Compared to mutual funds, ETPs have lower fees, and higher liquidity, but are also less actively managed by fund managers.

Bitcoin ETPs are an emerging financial product. They mostly come in the form of Bitcoin ETFs. However, Bitcoin ETNs are also starting to hit the market. As crypto and Bitcoin gain wider appreciation in the investment community, it is likely that we will see growth in the number of Bitcoin and other crypto ETP products in the near future.

Read More

- What is a Bitcoin ETF?

- What are ETFs & How do they Work?

- What are Eth ETFs & How do they Work?

- What would an Ethereum ETF Mean for Crypto?

- What is Etherscan: Ethereum Blockchain Explorer

- Bitcoin vs. Ethereum: Which is a Better Investment?

- Crypto Trading vs. Investing: Key Differences Explained

- What Are Non-Fungible Tokens (NFTs): Introduction to NFTs