Pepe Coin (PEPE) has captured traders’ attention as a volatile memecoin riding 2025’s market waves. In mid-2025, investors are assessing whether Pepecoin is a good investment in 2025 or just another speculative ride. This report provides an analytical breakdown – from the current price overview and PEPE technical analysis to whale accumulation, community sentiment, and expert forecasts – to inform your trading decisions on platforms like Phemex. We’ll also examine how broader market trends (Bitcoin rallies, memecoin mania, and regulatory moves) are impacting PEPE. Read on for a structured mid-2025 Pepecoin analysis that balances the bullish signals against the significant risks.

Pepecoin Price Overview: Where We Stand in Mid-2025

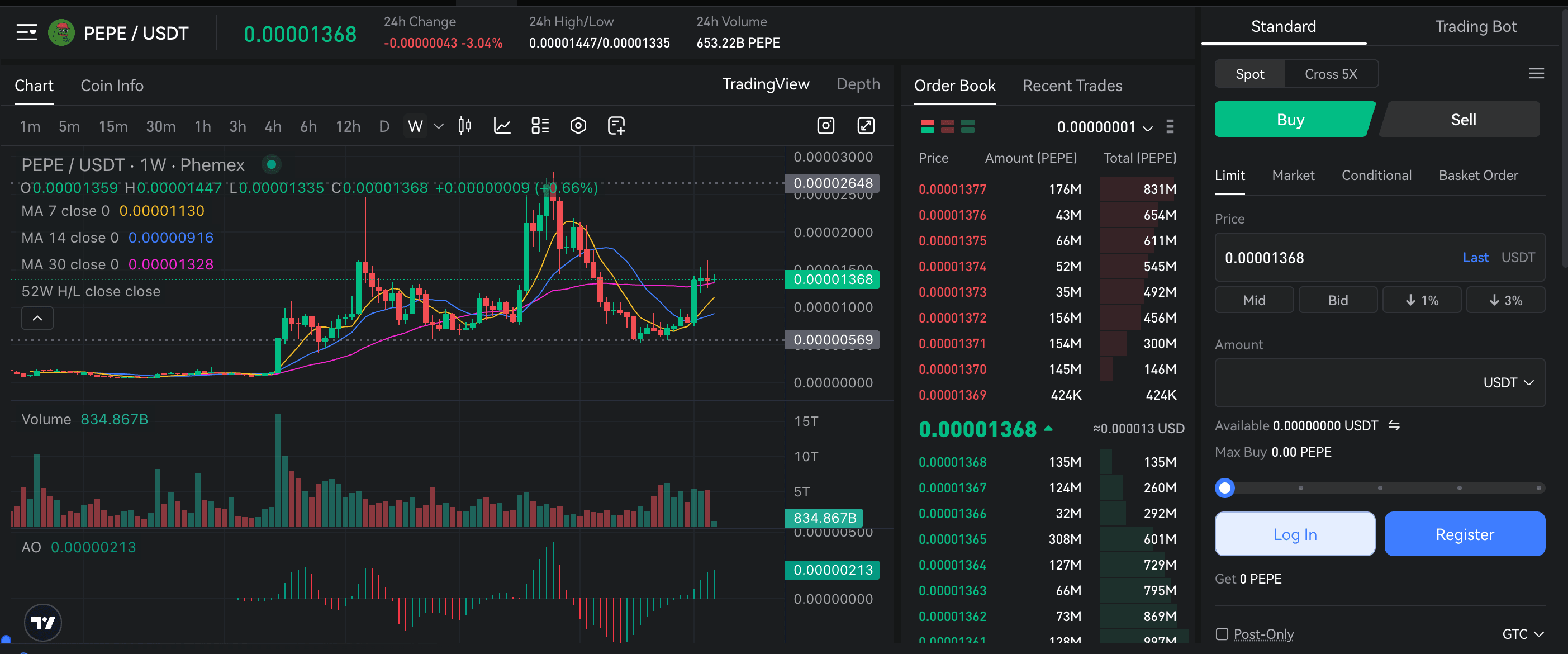

Pepe Coin’s price in May 2025 is rebounding from a sharp correction earlier in the year. After peaking near $0.000019 in January, PEPE saw a brutal 50% drop to around $0.0000096 by late Q1. However, the memecoin mounted a comeback in April–May. In fact, PEPE surged nearly 40% in a single day to hit about $0.000014 on May 9, 2025, following a 35% jump the day prior. This explosive rally pushed the coin above key technical levels (surpassing the 38.2% Fibonacci retracement at $0.0000133) and reignited bullish momentum.

As of late May 2025, Pepecoin trades around the $0.000012–$0.000013 range – a slight pullback of 7% from its early-May local high. At this price, PEPE’s market capitalization is roughly $5.4 billion, with a 24-hour trading volume in the ballpark of $1.4 billion. Such high turnover reflects sustained interest from traders, though it’s still a ways off from January’s peak levels. In context, PEPE is currently about 30% below its YTD high but remains well above its Q1 lows, indicating a recovery of confidence. The coin’s wild swings underscore its nature: Pepecoin’s price prediction (May 2025) depends less on fundamentals and more on speculation and momentum. Traders should note that, unlike blue-chip cryptos, PEPE’s value hinges on market sentiment and viral hype rather than utility – meaning it can rise or fall dramatically in short spans.

Whale Accumulation: The Smart Money Moves

One notable trend in mid-2025 is whale accumulation – large holders (the so-called “smart money”) are making bold moves with PEPE. On-chain data indicates that whales have been buying the dip in recent months. In fact, wallets holding 10–100 trillion PEPE have increased their collective bags by 24 trillion tokens since January, a 20% rise, bringing total whale holdings to ~144.6 trillion PEPE by early May. Such accumulation suggests that big players are positioning for potential upside. A striking example: a single crypto whale withdrew 500 billion PEPE (≈$4.36 million) from Binance in one go – a massive vote of confidence in PEPE’s future prospects. Analysts note that when deep-pocketed investors buy en masse, it’s often a bullish signal, indicating those with insider knowledge or long-term vision anticipate a price increase.

Whale activity in PEPE has indeed reinforced optimism. “Such a large-scale accumulation by deep-pocket investors is a strong vote of confidence… the smart money is positioning for a major upward move,” observed analysts at Coingape. This dynamic is evidenced by derivatives data too – open interest in PEPE futures has surged (over $396 million, with >52% of positions long) as of May, reflecting bullish bias and the potential for a short squeeze if price breaks higher.

It’s worth noting that not all whales have been bullish – some have exited, arguably marking turning points. For instance, in early March one whale dumped 262 billion PEPE (for ~$2.12 M) on the market, incurring a $7 million loss and sending shockwaves through the community. That capitulation contributed to the Q1 price drop. However, those coins found eager buyers: other whales snapped up the supply at discount prices. Shortly after, another whale (address qianbaidu.eth) scooped up 506 billion PEPE (≈$4.4 M), having previously profited ~$7.3 M from PEPE trades. This rotation from weaker hands to stronger hands suggests smart money is accumulating on dips, banking on a future PEPE rebound. Such whale confidence has helped stabilize the price and even fueled mini-rallies. The takeaway for traders: monitor whale addresses and exchange outflows. Large withdrawals of PEPE from exchanges (to private wallets) typically signal accumulation and reduced sell-pressure – a potentially bullish indicator. Conversely, whale deposits into exchanges could forewarn of an impending sell-off. In this memecoin rollercoaster, the whales often make the first waves.

Pepecoin Technical Analysis: Chart Patterns & Breakout Levels

Pepe’s price chart has been volatile but is forming intriguing patterns that technical traders are watching closely. After the spring rally, PEPE is trading in a compressing range, building energy for its next big move. Several chart patterns and key levels stand out:

-

Bullish Cup-and-Handle Formation: Analysts have detected a cup & handle pattern on the medium-term chart. The neckline resistance sits around $0.00000900, and a decisive daily close above $0.0000090 would confirm the breakout. If that handle breakout occurs, it projects a measured move to roughly $0.0000145–$0.000015 – about a 60% surge from current levels. This aligns with May’s prior high ($0.000014) and suggests a retest of that zone is plausible upon a breakout.

-

Falling Wedge Breakout: Another perspective highlights a decreasing wedge pattern. A push above roughly $0.0000076 (the wedge’s upper trendline) was cited as an early breakout trigger that could target $0.0000169–$0.0000190 in the ensuing swing. In April, PEPE did break above ~$0.0000076 and rallied, validating this wedge thesis. The top of that target range ($0.000019) coincides with the January peak – essentially, a full retracement of the Q1 drop if bulls regain control.

-

Support and Resistance Levels: Immediate resistance for PEPE is around $0.000010 (one cent in the fifth decimal place). This psychological zone was a support-turned-resistance from the Q1 sell-off. Above that, the May swing high near $0.000014 is the next major hurdle. Breaking $0.000010 convincingly would be a strong bullish sign, opening the door toward $0.000012 and $0.000014. On the downside, critical support lies at approximately $0.0000070–$0.0000075. Bulls absolutely need to defend the low-$0.000007s; a drop below $0.0000070 would signal fresh bearish momentum and could see PEPE revisiting its early-2025 lows before any recovery. Thus far, that zone has held – indicating accumulation interest there. Traders should also note minor support around $0.0000080 (recent consolidation floor) and resistance around $0.0000086 (recent local top) which mark the short-term trading range.

-

Momentum Indicators: Technical indicators are painting a cautiously optimistic picture. The Relative Strength Index (RSI), which was languishing in oversold territory during the March lows, has climbed back toward neutral (~45–55) by May. This mid-range RSI implies neither overbought nor oversold conditions, leaving room for a strong move in either direction. Notably, during the May price spike the RSI did not hit extreme overbought levels, suggesting the rally wasn’t exhausted by sentiment – a constructive sign if buying resumes. The Moving Average Convergence Divergence (MACD) on daily charts has also flashed bullish signals: earlier in Q2, the MACD line crossed above the signal line, indicating positive momentum. As of mid-May, MACD remains above zero, reflecting an upswing in trend strength.

-

Golden Cross & Averages: In late March, PEPE’s chart even formed a “Golden Cross” – when a short-term moving average (like the 50-day MA) crosses above a long-term moving average (200-day MA). This pattern historically precedes strong uptrends. Indeed, analysts pointed out that around the golden cross, other indicators like On-Balance Volume (OBV) were also rising, confirming increasing capital inflows to PEPE. A crypto strategist noted that PEPE was “primed for a massive surge” with bullish MACD, rising OBV, strong RSI, and key EMAs all lining up in the bulls’ favor. The result was the April/May rally. Going forward, traders will watch if the 50-day and 200-day MAs continue to diverge positively, and if volume sustains on up-days versus down-days (for which OBV is a handy gauge).

In summary, PEPE’s technical analysis suggests a market at a crossroads. A confirmed breakout above ~$0.000010 and $0.000014 would signal that memecoin bulls are running again – potentially targeting new highs for 2025. Conversely, failure to break resistance, coupled with a loss of support at $0.000007, would tilt the bias back to bearish (or at best sideways) and could invite further consolidation. Traders should keep an eye on trading volume during any breakout attempt: a volume spike alongside price thrust would add confidence that the move is real. Given the chart patterns and indicators, cautious optimism is warranted – but as always with PEPE, volatility is the norm. Setting clear stop-loss levels (e.g. just below support zones) is prudent in case the technical picture deteriorates unexpectedly.

Pepecoin (PEPE) Price Prediction Table 2025–2030

Curious about "How high will Pepecoin (PEPE) rise in the coming years?" Below is a speculative price prediction table for Pepecoin from 2025 to 2030, based on market trends, community-driven hype, and potential catalysts like new exchange listings, social media virality, and broader crypto market growth. Meme coins are inherently volatile, so these forecasts are highly speculative. Always conduct thorough research before investing.

|

Year |

Minimum Price (USD) |

Average Price (USD) |

Maximum Price (USD) |

Key Drivers |

|---|---|---|---|---|

|

2025 |

0.000008 |

0.000015 |

0.000030 |

Social media hype, new exchange listings, and post-Bitcoin halving market rally. |

|

2026 |

0.000010 |

0.000020 |

0.000045 |

Growing meme coin community, potential NFT integrations, and retail investor interest. |

|

2027 |

0.000012 |

0.000025 |

0.000060 |

Viral marketing campaigns, partnerships with influencers, and broader DeFi adoption. |

|

2028 |

0.000015 |

0.000035 |

0.000080 |

Increased token utility, meme coin market expansion, and Bitcoin halving momentum. |

|

2029 |

0.000020 |

0.000050 |

0.000100 |

Mainstream meme coin acceptance, potential metaverse integrations, and community-driven initiatives. |

|

2030 |

0.000030 |

0.000080 |

0.000150 |

Speculative bull run, cross-chain compatibility, and sustained retail and community support. |

Sources: Projections are speculative, aggregated from analyses of meme coin trends on platforms like CoinMarketCap, CoinGecko, and community sentiment on X, combined with insights from crypto market reports.

Disclaimer: These predictions are for informational purposes only and should not be considered financial advice. Meme coin investments, including Pepecoin, carry significant risks due to extreme market volatility. Always consult a financial advisor and conduct thorough research before making investment decisions.

Trading Strategy Insights from Phemex

Trading Pepecoin (PEPE) can be exhilarating and risky. Here are strategy insights – particularly relevant for traders on platforms like Phemex, which offers PEPE on both spot and futures markets – to navigate this memecoin’s ups and downs:

-

Use Short Time Frames in Volatile Conditions: When an asset is swinging wildly (as PEPE often does), zoom in on lower time-frame charts (1H, 15M) to fine-tune entry and exit points. Short-term charts can reveal micro trend reversals or breakouts that daily charts might obscure. For example, after a news-driven pump, a 15-minute chart could show a consolidation pattern or flag that signals the next move. Scalpers on Phemex often monitor these small intervals to ride intraday momentum while keeping tight risk controls.

-

Range-Bound Trading Strategy: If PEPE isn’t in a clear trend, it often chops within a range. Identify key support and resistance levels (for instance, those outlined in the technical analysis section above) and consider a range trading approach. This means buying near support and selling near resistance. For PEPE, one might accumulate near a proven floor (say around $0.0000080) and take profits as it nears an upper ceiling (say $0.000010). Given PEPE’s tendency for abrupt spikes, it can also help to set limit orders in advance at target levels. Avoid chasing after a big green candle; instead, wait for pullbacks to support in a ranging market.

-

Utilize Trading Tools (Grid Bots, OCO Orders): Phemex provides advanced tools that can be advantageous for a volatile asset like PEPE. For example, grid trading bots can automate the range strategy by placing incremental buy and sell orders within a predefined price channel. This allows you to systematically “buy low, sell high” in a choppy market without constant monitoring. Similarly, using OCO (One-Cancels-the-Other) orders can help – you can set a take-profit sell order and a stop-loss order simultaneously, so that one order automatically cancels if the other executes. Such tools enforce discipline, locking in gains and limiting downside.

-

Risk Management – Stops and Position Sizing: No matter how confident you are in Pepe’s price prediction for May 2025, always manage your risk. The memecoin’s volatility means overnight 20–30% swings are possible. Place stop-loss orders below key support levels to cap potential losses. For instance, if entering at $0.000009 on a breakout, you might put a stop around $0.000008 (below the breakout level) in case it’s a fake-out. Additionally, size your positions conservatively. On Phemex, PEPE is available in a 1000PEPE/USDT perpetual contract, meaning you can use leverage – but high leverage on a highly volatile coin can be a recipe for liquidation. Many experienced traders use only modest leverage (or none) for PEPE, given its inherent volatility. A good guideline is never to risk more than a small percentage of your capital on a single PEPE trade. That way, even if PEPE has an extreme pullback, your portfolio won’t be devastated.

-

Follow Social Trading Insights: On Phemex, features like Phemex Pulse (social trading) let you see what top traders are saying or doing regarding PEPE. Engaging with the community’s trade ideas can provide early tips on sentiment shifts or technical patterns forming. However, always do your own analysis before following someone else’s trade – use community insights as one input, not a guarantee.

By applying these strategies, traders can tactically engage with PEPE while mitigating some of the chaos. Phemex’s listing of PEPE (both on spot markets and as a perpetual futures contract) in May 2023 means the platform has robust liquidity for the coin. This liquidity, combined with careful strategy, allows for effective trading – whether you’re scalping quick moves or swing trading the larger trend. In essence, treat PEPE as a high-risk, short-term trading vehicle rather than a buy-and-hold investment. Plan your trade, trade your plan, and let the tools and risk management strategies do their job.

Sentiment Analysis: Social Media and Community Trends

Pepe Coin was born from internet culture, so it’s no surprise that social media sentiment and community trends have an outsized influence on its price. In mid-2025, the PEPE community remains vibrant, but sentiment can flip quickly with the tides of meme hype. Monitoring Twitter (X), Reddit, Telegram, and other social channels is crucial for gauging the next move in this coin.

On X (formerly Twitter), PEPE is a frequent topic in crypto circles. At the height of the May rally, bullish sentiment flooded social feeds – memes of Pepe the Frog rocketing to the moon, traders boasting about gains, and influencers issuing lofty predictions. Some users have shared extraordinarily bold targets: for instance, one viral tweet envisioned a $300 billion market cap for PEPE, and another predicted a price between $0.00009 and $0.0002 by the end of 2025. (For context, $0.0002 would imply roughly a 15x gain and a market cap rivaling top 3 cryptocurrencies – an extreme scenario.) Yet, the fact such posts gain traction highlights the euphoric optimism present in the community during upswings. Similarly, on Telegram channels and TikTok crypto content, PEPE has trended with hashtags like #PEPEArmy and #PepeCoin, indicating strong grassroots engagement. Short-term social media buzz directly impacts PEPE’s price – spikes in tweet volume or Google searches often correspond to price pumps, as a rush of new buyers pile in on hype.

However, sentiment isn’t uniformly rosy. The community has its skeptics and fatigued holders as well. After large corrections, forums see a rise in cautionary posts (or memes of “dead Pepe” humorously signaling a cooldown). Market sentiment can fade as fast as it rises; if the social buzz and community activity diminish, PEPE’s price often follows suit. For example, when the Q1 2025 crash happened, the tone on social media shifted from “when Lambo?” to “is PEPE over?” virtually overnight. Memecoin traders are quick to jump ship to the next trending token, so PEPE must continuously fight for attention in the meme arena.

In terms of community size, Pepe’s following, while large, is still catching up to the giants. The official PEPE account on X has under 800,000 followers, which is significant but far below Shiba Inu’s ~3.9 million followers or Dogecoin’s even larger base. This indicates both a challenge and an opportunity. The challenge: PEPE doesn’t yet have the same reach or recognition as those older memecoins – which can limit its staying power. The opportunity: if PEPE’s community continues to grow (for instance, a 4–5× increase in followers, as some experts suggest), that expanded audience could dramatically boost its meme visibility and investor base. Essentially, meme coins thrive on culture and scale of community; PEPE has the meme-worthy charm, but it’s pushing to achieve the critical mass of followers that Doge and Shib enjoy.

Another aspect of sentiment is engagement quality. Pepe’s community is highly creative – producing memes, parody songs, NFT art, and inside jokes that reinforce a sense of identity (the “PEPE Army”). This cultural resonance can sustain interest during flat price periods better than a generic altcoin community might. It’s not just about price talk; it’s also about shared humor. On the flip side, because PEPE was launched without a serious roadmap or utility, virtually all positive sentiment is speculation-driven. Should a negative narrative take hold (e.g., a rumor of developer issues or a whale rug-pull), sentiment could sour quickly and there are no fundamentals to act as a backstop.

Overall, current sentiment as of May 2025 is cautiously optimistic. Social feeds reflect excitement about recent gains and “FOMO” from those who missed the last run, but also some wariness with users recalling how quickly the coin tanked earlier. Tracking sentiment indicators like Twitter mention volumes, Telegram group growth, and even meme frequency can give an edge in anticipating PEPE’s next move. In the memecoin world, community is king – and Pepe’s fate is tied to whether its meme magic can keep the crowds laughing and buying.

Broader Market Correlations: Bitcoin, Memecoins, and Regulatory Themes

Pepe Coin does not trade in isolation. Its pumps and dumps are often interlinked with the wider crypto market and thematic trends. Here’s how broader market correlations and regulatory themes are influencing PEPE in 2025:

-

Memecoin Sector Movements: PEPE is part of the memecoin microcosm that includes Dogecoin, Shiba Inu, and a rotating cast of viral tokens. These coins often move as a pack. When sentiment towards memecoins as a whole is strong, capital flows into the sector and lifts all boats. For instance, if Dogecoin or Shiba Inu stage a major rally, Pepe Coin tends to follow suit with sympathy gains. We saw this dynamic in late 2024 when DOGE’s Elon Musk-fueled spike helped spark interest in “the next big meme,” benefiting PEPE. Conversely, if the leading meme names falter, PEPE may struggle to attract attention. It’s valuable to watch a “memecoin index” of sorts: on days when multiple meme tokens are green, PEPE likely has a tailwind. If the meme complex is bleeding red, PEPE could face headwinds even if it has independent good news.

-

Correlation with Bitcoin and Macro Trends: As a high-beta altcoin, PEPE is sensitive to the overall crypto market cycle. In risk-on environments where Bitcoin is climbing and investor confidence is high, speculative assets like PEPE often see disproportionate inflows (people are more willing to take gambles). For example, earlier this year when Bitcoin surged toward a local high, PEPE enjoyed a surge of speculative demand riding on the bullish sentiment. There’s also an interesting rotational effect: if Bitcoin or Ethereum stagnate or pull back modestly, some traders rotate into smaller coins seeking higher returns. Gate.io analysts noted that when major coins underperform, funds sometimes shift to meme coins as short-term opportunities – essentially, boredom or profit-taking in BTC/ETH can lead thrill-seekers into PEPE. However, this only holds to a point; in a severe bear market or liquidity crunch, memecoins are usually the first to be sold off. It’s a fine line – a mildly bullish or neutral macro crypto environment can be ideal for memecoins (enough overall optimism combined with desire for outsized gains), whereas a strongly bearish environment is brutal for them.

-

Regulatory and Policy Impacts: Regulatory themes in 2025 are an important wild card for all crypto, PEPE included. Thus far, memecoins have largely flown under regulators’ radar (they’ve been more focused on stablecoins, DeFi, and major tokens). But this could change, especially if a memecoin’s frenzy grows big enough to affect retail investors broadly. Meme coins, often viewed as high-risk speculative assets, could face scrutiny. There is a risk that authorities may decide to crack down on the trading of tokens lacking fundamental value, citing consumer protection. Regulatory crackdowns on exchanges – for example, pressure to delist certain high-risk altcoins or stricter KYC/AML enforcement – could severely limit where PEPE can be traded and thus choke off liquidity. On a more positive note, any official clarification that meme tokens are not securities (since they typically claim no expectation of profit) would remove a legal overhang. In the U.S., for instance, some legal analysts have argued that meme coins likely do not qualify as securities under Howey Test criteria (given their lack of promised utility or revenue), which if embraced by regulators would mean PEPE might avoid the fate of being labeled and regulated like stocks. Still, the regulatory landscape is evolving, with Europe’s MiCA and other frameworks potentially requiring exchanges to provide risk warnings or impose limitations on high-volatility assets. Traders should keep an eye on news like SEC statements, exchange policy changes, or even bans in certain countries – these can cause abrupt sentiment shifts for memecoins.

-

The Elon Musk / Celebrity Factor: It’s worth noting the role of high-profile figures. Dogecoin’s fortunes have been tied to Elon Musk’s tweets; while PEPE doesn’t have an Elon, any endorsement (or criticism) from a major crypto influencer can move it. In absence of direct celebrity backing, PEPE sometimes reacts to general pop culture or crypto news. For example, crypto-friendly political developments – such as discussions of a U.S. Bitcoin ETF or a politician advocating crypto adoption – often create a risk-on wave that trickles down to memecoins. Earlier this year, optimism around a proposal (floated in certain circles) for a government strategic reserve of Bitcoin/crypto coincided with a PEPE uptick, showing how even tangential policy news can boost speculative coins.

In essence, Pepe’s trajectory is intertwined with market mood and external factors. If Bitcoin continues climbing and mainstream interest in crypto returns, PEPE could thrive as part of the renewed speculative fever. If the crypto market turns fearful (say, due to a stock market downturn or crypto scandal), PEPE will likely be one of the harder-hit tokens as people flee to safety. Regulatory actions remain an overhanging risk: any hint of bans or restrictions on memecoin trading could send prices tumbling fast. On the flip side, clear permissibility or simply a lack of interference allows the frenzy to continue unchecked. Traders of PEPE should thus stay informed not only on the coin’s own news, but also on the big-picture crypto developments – from Bitcoin’s price trend to legislative updates – as these macro factors often set the stage for the next Pepe boom or bust.

Expert Forecasts: What Analysts Are Saying

What do market analysts and prediction models forecast for Pepe Coin’s future? Opinions diverge widely, reflecting the uncertainty of this speculative asset. Here’s a roundup of expert forecasts for PEPE in 2025:

-

Forbes Advisor India (Bullish Case): In a November 2024 outlook, Forbes Advisor projected that PEPE could reach $0.00002 in early 2025, and potentially $0.00005 by the end of 2025, assuming favorable market conditions. This forecast essentially anticipated a steady uptrend for PEPE riding on a broader crypto bull market. Notably, by May 2025 PEPE already hit $0.000014 (on May 9), coming close to that Q1 target. Should the bullish momentum return in the second half of the year, Forbes’ year-end target of $0.00005 is not outlandish – though it would require new all-time highs and sustained hype. A price of $0.00005 would equate to roughly a $21 billion market cap given the supply, implying PEPE would need to become one of the top altcoins. It’s an optimistic scenario tied to a strong crypto rally and continuous community fervor.

-

CoinCodex (Bearish Near-Term): On the other end of the spectrum, algorithmic models like CoinCodex have issued more cautious predictions. CoinCodex’s model, based on technical indicators and trend analysis, expects PEPE to pull back in the coming weeks – potentially dropping to around $0.0000076 by late June 2025. That would be roughly a 40–45% decline from current levels. This forecast likely factors in the idea that PEPE’s recent pump was overextended and that waning momentum or a market correction could drag it down. Indeed, after the big May rally, a healthy correction would not be unusual. CoinCodex’s take underscores that volatility cuts both ways; traders should be prepared for significant dips even amidst an overall uptrend. (It’s worth noting such models update frequently, so a subsequent rally or drop can change the algorithm’s outlook on short notice.)

-

Coingape / Technical Analysts (Upside Potential): Some crypto analysts, focusing on chart patterns, see considerable upside if certain breakouts occur. One analyst highlighted a bullish fractal pattern in PEPE that could spur a 100%+ rally, eyeing a move to about $0.0000283 – essentially a new all-time high – in the coming weeks. This kind of forecast often assumes that PEPE will repeat a past parabolic move (hence the term “fractal”) now that it has consolidated. A target of $0.000028 would exceed the January peak and push market cap toward ~$12 billion. While ambitious, it’s not outside the realm of possibility if another wave of meme mania hits. Technical traders often use such targets as what’s possible on a blow-off top scenario. For credibility, they point to factors like increasing whale accumulation and strengthening technical indicators as aligning with this bullish outcome. Still, this is a best-case scenario in many respects – requiring near-perfect bullish conditions.

-

Community and Other Predictions: Beyond formal analysis, the PEPE community itself has put forth wild predictions (as mentioned in the sentiment section). Some community figures mused that Pepe could ultimately hit $0.001 or even 1 cent, which borders on fantasy without massive token burns or a fundamental revolution. A 1 cent PEPE would mean a market cap in the trillions of dollars given the 420 trillion supply – highly implausible. Even hitting one-tenth of a cent would require a market cap larger than Bitcoin’s at current prices. Realistically, for PEPE to approach even a fraction of a cent, some combination of significant token burn, mainstream adoption, and an unprecedented crypto bubble would have to occur. Analysts generally dismiss the 1 cent target as an internet meme rather than a viable 2025 forecast, noting that such a milestone would demand a “multiply significantly” of the market cap and faces huge challenge. In plainer terms, PEPE reaching $0.01 is exceedingly unlikely – the numbers simply don’t add up, despite the whale purchases and optimism.

To sum up the expert outlook: expectations for PEPE in 2025 range from cautious to exuberant. Some see it advancing moderately if the crypto market cooperates (e.g., mid-$0.00002s by year-end), others foresee a deeper correction before any further gains, and a few bold technical calls imagine new highs on the horizon. This wide divergence is typical for a speculative asset – there is scant consensus. For traders, it reinforces the need to form your own view and strategy. Pepe Coin could indeed have more explosive rallies, but those will likely be punctuated by steep drawdowns. As one analysis phrased it, PEPE’s story is “huge highs, steep lows, and a lot of question marks”. Weigh the evidence, stay agile, and don’t bet more than you can afford to lose on this frog-themed wild ride.

Risk Factors to Watch

Before you consider jumping on the PEPE bandwagon, it’s critical to understand the risk factors. Pepe Coin may offer high reward potential, but it carries equally high risk. Here are key risks traders and investors should watch:

-

Extreme Volatility: PEPE’s price movements are notoriously wild. It can soar or plummet by double-digit percentages within days or even hours. Such rapid price swings mean you could incur substantial losses in a short time if the market turns. For example, after its huge run-up in 2024, PEPE suffered a 50% crash in early 2025t. Sharp corrections like this are not anomalies for memecoins; they are the norm. If you cannot tolerate seeing your investment drop 60%+ at times, PEPE is likely too risky. Always be mentally prepared for high volatility – and use stop-loss tools to mitigate downside.

-

Lack of Intrinsic Utility: Unlike major crypto projects, Pepe Coin has no intrinsic value or underlying utility. The token’s official stance is that it’s a meme with “no intrinsic value or expectation of financial return... completely useless and for entertainment purposes only”. While that humor is part of the charm, it also means from an investment standpoint there are no fundamentals propping up the price. PEPE generates no cash flows, doesn’t power a DeFi protocol, nor provide a tech service. This lack of utility may deter serious institutional investors and makes long-term sustainability questionable. If the community’s attention shifts or the joke gets old, nothing is left to catch the fall.

-

Speculative Hype Dependence: The PEPE phenomenon is driven purely by speculation and social media hype, not use-case or adoption. Its valuation is essentially a reflection of collective belief and memetic fervor. This means the price is highly sensitive to sentiment. If the social buzz fades – say, fewer memes, declining tweet volumes, or a new meme coin stealing the spotlight – PEPE’s price can implode quickly. We’ve seen many meme coins enjoy a burst of popularity and then vanish into obscurity. PEPE has had more staying power than most, but the risk of becoming “yesterday’s meme” is ever-present. Investors must realize they are betting on the continuation of a trend that by nature can be fickle and fleeting.

-

Whale and Concentration Risk: A relatively small number of whale addresses hold a large portion of PEPE’s supply. This introduces the risk of market manipulation or sudden dumps. As discussed, whales accumulating can pump the price, but if any of these big holders decide to sell off, it could flood the market with supply and crash the price. In fact, one whale’s sell-off did trigger a significant downturn in March (with that whale taking a multi-million dollar loss as they cashed out). Such events could happen again. There’s also smart-contract risk: although PEPE’s contract has no developer mint functions (and the liquidity pool is supposedly burnt), in young projects sometimes undiscovered bugs or incidents (like the dev team suddenly selling their tokens) can occur. Always consider that forces outside your control (whales, insiders) can significantly move the market.

-

Regulatory Uncertainty: Regulatory scrutiny of cryptocurrencies is intensifying worldwide, and meme coins are not exempt. Authorities could view PEPE and similar tokens as facilitators of pure speculation and consider measures to protect investors. There’s a risk that exchanges might be pressured to delist high-risk meme coins or restrict trading for certain user groups. Any headlines about governments banning memecoins or classifying them as scams would likely tank the price. Even lacking direct action, broad crypto regulatory crackdowns (e.g., stricter exchange regulations, higher taxes on crypto trading) could dampen the speculative enthusiasm that fuels PEPE. On the flip side, if regulatory guidance emerges stating meme coins are largely unregulated commodities, it could remove some fear – but until clarity is certain, this overhang persists.

-

Market Competition and Saturation: The meme coin arena has low barriers to entry – new coins pop up literally every week, inspired by the latest viral jokes or trends. PEPE faces stiff competition from both established and emerging meme coins. There is a risk of market saturation: with so many options (Doge, Shib, and newer ones like Floki, BabyDoge, etc.), investor attention and capital can get fragmented. We’ve already seen rotation – when PEPE’s hype cooled in mid-2023, traders flocked to the next meme (e.g., SHIB had another moment, or completely new coins got hyped on Reddit). If a new “Pepe 2.0” or some other meme catches fire, it could draw liquidity away from PEPE. In addition, copycat tokens or scams could harm the brand (there have been numerous Pepe-named tokens which are unrelated; newcomers could be confused or burned, affecting sentiment on the real PEPE).

-

Oversized Supply/Dilution: PEPE’s supply is astronomically large (420 trillion tokens). While deflationary in the sense that no new tokens can be minted, that huge supply means the price per token will always be a tiny fraction of a cent unless the market cap grows to billions. The large supply can psychologically hinder price growth (many traders hold billions of tokens, and even small price moves can tempt profit-taking). We saw profit-taking contribute to peaks and drops. The supply also means reaching certain price milestones (like $0.0001 or higher) requires exponentially more money flowing in. Without continuous strong demand, the sheer supply can act as a cap on price appreciation. In essence, PEPE needs broadening adoption and capital to keep rising; any slowdown and that supply can quickly saturate would-be buyers.

In light of these risks, approach Pepecoin with caution. It can be a lucrative trade but also a fast ticket to losses. Manage your risk by only allocating what you can afford to lose, using protective stops, and staying up-to-date on news. The allure of turning a small sum into a fortune is what drives meme coin mania, but for every person who times it right, many others buy the top of a hype cycle and suffer. By understanding the dangers outlined above – volatility, lack of fundamentals, reliance on hype, whale games, regulatory twists, competition, and supply realities – you’ll be better equipped to navigate PEPE’s unpredictable waters.

Conclusion: Should You Buy Pepecoin in June 2025?

So, is Pepecoin a good investment in 2025? The answer depends on your risk tolerance, investment strategy, and understanding of this unique asset. By mid-2025, PEPE has proven two things: it can generate incredible short-term returns and it can just as easily erase them. It’s the quintessential high-risk, high-reward play.

On the bullish side, Pepe Coin has momentum and a passionate community. Recent price action shows it’s capable of strong rebounds when interest rekindles – whales are accumulating on dips, technical patterns hint at further breakouts, and social media buzz can still ignite viral FOMO. If you believe the crypto market will enter a euphoric phase later in 2025, PEPE could ride that wave and possibly retest or exceed its previous highs. The coin’s meme value and brand recognition (as the iconic Pepe the Frog) give it an edge over countless anonymous altcoins. It has achieved a sort of cultural status as the memecoin of this cycle (much like DOGE and SHIB in prior cycles), and that narrative could carry it higher if the stars align. Traders on platforms like Phemex can capitalize on this by riding the upswings – using leverage carefully to amplify gains – and by staying plugged into the community for early signs of the next rally.

On the bearish side, PEPE remains extremely speculative and volatile. It lacks fundamental anchors; thus its future price is highly uncertain. As detailed, there are significant risks: another large sell-off by whales, a broader crypto downturn, waning public interest, or adverse regulatory news could all crush the price. If the crypto market turns bearish or even flat, PEPE may significantly underperform as attention shifts elsewhere. Long-term investors should be wary – without utility or revenue, there is no clear long-term value proposition aside from “the community might make it valuable.” That’s more akin to betting on a trend than investing in a company or technology. Simply put, Pepe is more of a trade than an investment. It’s something one might allocate a small portion of a portfolio to, almost like buying a lottery ticket, while the bulk of one’s capital goes into more substantiated assets.

For those considering whether to buy Pepecoin in May 2025, a balanced approach could be: participate but don’t overcommit. If you have high risk appetite, you might take a small position – essentially an amount you’re prepared to lose – and join the ride. Treat it as speculative fun with potential upside, rather than a core holding. Utilize the strategies discussed (e.g., set stop-losses, take profits during big spikes, watch whale movements and sentiment closely). If you’re more risk-averse or late to the party (i.e., you missed the early gains), it may be wiser to observe from the sidelines or ensure you’re only trading it with tight risk controls. Timing is everything with memecoins: buying after a huge pump (when everyone is talking about it) can be especially dangerous, while contrarianly buying during a quiet lull (when hype has cooled) and selling into the next hype cycle is the ideal – though easier said than done.

In conclusion, Pepecoin can be part of a trading strategy in 2025, but it’s not for the faint of heart. It offers excitement and the possibility of outsized gains, at the cost of high volatility and risk. The coin’s own creators summed it up humorously but accurately on the official website: PEPE is “completely useless and for entertainment purposes only”. Take that to heart – if you decide to buy, do so with eyes open, a clear exit plan, and the mindset that this is speculative entertainment, not an investment in a productive asset. For those who thrive on risk and meme culture, PEPE is an adventure. For more conservative investors, “investing” in Pepecoin likely isn’t a good idea in 2025 except as a very small punt.

Ultimately, whether you should buy PEPE now comes down to knowing yourself. If you do jump in, stay safe: keep abreast of market updates, engage with the vibrant community for sentiment cues, and never risk more than you can afford to lose. May 2025 finds Pepecoin at an intriguing spot – it has survived a year of hype and crashes, and the next chapters will be written by the community’s fervor and the market’s whims. Approach with caution, but don’t be surprised if this meme of a coin has more surprises in store – welcome to the wild world of memecoins!

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.