Founded in 2019, Phemex is a user-first crypto exchange trusted by over 10 million traders worldwide, offering spot and derivatives trading, copy trading, and wealth management products. To maintain a secure and compliant trading environment for this global user base, Phemex implements a mandatory Identity Verification (KYC) process that unlocks full platform features and higher withdrawal limits.

Why Does Phemex Require KYC?

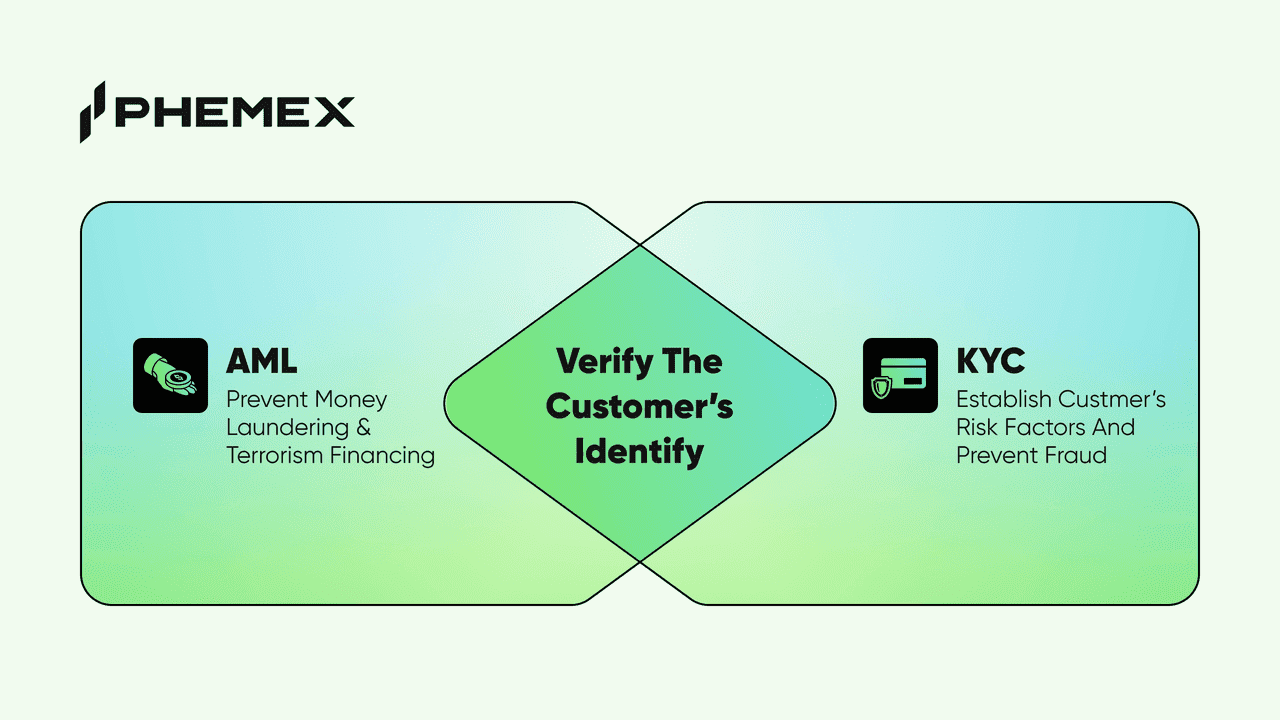

As a user-first crypto exchange trusted by over 10 million users, Phemex implements Know Your Customer/Client to ensure a professional, secure, and compliant trading environment, which counts as a very important part in our AML/CTF Framework. Our AML/CTF framework serves three fundamental purposes for global asset protection:

Enhanced User Account Security: Identity verification is a critical defense against fraud and account takeovers. By confirming user identities, Phemex ensures that only the rightful owner can access funds and perform high-value transactions, significantly reducing the risk of unauthorized access.

International AML/C****TF Compliance: As a global platform, Phemex strictly adheres to International AML/CTF standards. This ensures the ecosystem remains clean and protected from illicit financial activities, maintaining the long-term integrity of the platform.

Global Regulatory Adherence: Phemex operates within multi-jurisdictional compliance frameworks aligned with top-tier financial standards. Requiring KYC allows the platform to maintain proactive relationships with oversight bodies worldwide, ensuring uninterrupted services and institutional-grade stability for all retail and professional traders.

Phemex KYC Verification Levels & Withdrawal Limits

To provide a secure and efficient crypto trading experience for over 10 million users, Phemex utilizes a tiered identity verification system. This structure ensures the highest standards of account security while providing professional-grade withdrawal liquidity for global traders.

|

Verification Level

|

24-Hour Withdrawal Limit

|

Verification Requirements

|

Core Benefits

|

|

Non-KYC

|

0 USDT

|

-

|

|

|

KYC Verified

|

2,000,000 USDT

|

Identification + Facial Recognition

|

Full Trading Ecosystem: Unlock Spot and Futures trading, crypto withdrawals, and access to exclusive upcoming rewards.

Note: Fiat deposits are available with or without KYC, subject to payment method and regional availability.

|

Why Choose Higher Verification Levels?

-

Unrestricted Capital Flow: Phemex offers high withdrawal limits that reset every 24 hours, giving users full control over their assets.

-

Institutional Onboarding: Our KYC is designed to meet the strict compliance needs of Institutional Traders and hedge funds, providing a secure and transparent environment for high-value operations.

-

Ecosystem Access: Completing identity verification unlocks premium Web3 features, including exclusive upcoming rewards and advanced Earn products. All platform activities are fully integrated with our transparent 100% Proof of Reserves infrastructure to ensure maximum asset safety.

Institutional & Business Account Verification (KYB)

Phemex provides a dedicated Institutional Program designed for corporate entities, hedge funds, and professional market makers requiring high-volume trading capabilities and enhanced account management.

To ensure rapid market entry, Phemex offers an industry-leading KYB processing time. Provided all required documentation is submitted in full, business verification is typically completed within 24 hours. Verified institutional accounts unlock:

-

Customized Withdrawal Limits: Tailored to meet large-scale liquidity requirements.

-

Exclusive Institutional API: Full access to our low-latency matching engine for professional algorithmic trading.

Required documentation for KYB:

-

Company address

-

Taxpayer ID

-

Director/UBO national ID or passport

-

Business description

-

Asset source description

-

Proof of address (utility bill or bank statement, issued within 3 months)

-

Company website

-

Selfie of directors/UBOs/account holders

-

BSA/AML policy

-

Bank account information and recent statement

Global Service Availability & Restrictions

Phemex is committed to maintaining a compliant Web3 financial ecosystem by adhering to international regulatory standards. While we serve over 10 million users across the globe, access is restricted in specific jurisdictions to ensure platform integrity and user protection.

-

Americas: United States, Québec (Canada), Cuba, Bermuda.

-

EMEA: United Kingdom, Crimea and Sevastopol, Iran, Syria, Sudan.

-

Asia-Pacific: Mainland China, Hong Kong SAR, North Korea, South Korea.

-

Other: Republic of Seychelles.

Note: For the most up-to-date information on jurisdictional availability, please consult our official Phemex Terms of Use__.

How to Complete KYC Verification

Verification usually takes 2–5 minutes. Phemex partners with Jumio, a trusted identity verification provider used by major financial institutions. Your data is encrypted and never shared with unaffiliated third parties.

What You Need

-

Government-issued ID (passport, driver's license, or national ID card)

-

Camera-enabled device (smartphone or computer with webcam)

-

Good lighting for photos

-

Must be 18 years or older

Step-by-Step: Mobile App

-

Open the Phemex app and go to User Center

-

Select Identity Verification

-

Tap Verify Now to begin

-

Select your country and document type

-

Take photos of your ID (front and back for most documents)

-

Complete the selfie verification with liveness detection

-

Wait for processing (typically 2-5 minutes)

Step-by-Step: Desktop Website

-

Log in to Phemex.com

-

Click your profile icon in the top-right corner

-

Select Verification

-

Click Verify Now

-

Choose your verification method:

-

Method 1: Scan QR code with your phone to complete on mobile

-

Method 2: Continue in browser with webcam

-

-

Select your country and document type

-

Follow prompts to photograph your ID

-

Complete selfie verification

-

Wait for processing

Tips for Successful Verification

Document Quality:

-

Use original, valid documents (not expired)

-

Ensure all text is clearly readable

-

Avoid glare, shadows, or reflections

-

Photograph the complete document within the frame

Selfie Verification:

-

Center your face in the frame

-

Use good, even lighting

-

Follow on-screen instructions carefully

-

Don't leave the screen during the process

Technical Requirements:

-

Use Chrome browser for web verification

-

Update Phemex app to the latest version

-

Ensure stable internet connection

-

Don't close windows until prompted

What Documents Are Accepted?

Phemex accepts documents issued by your country of residence that contain:

-

Photo

-

Full name

-

Date of birth

-

Document number

-

Date of issue

Accepted documents:

-

Passport

-

National identity card

-

Driver's license

Not accepted:

-

Residence permits

-

Student visas

-

Work visas

-

Travel visas

-

Domestic passports (for international verification)

Frequently Asked Questions

Is KYC mandatory on Phemex?

KYC is required to enable withdrawals and access the full set of platform features, including higher withdrawal limits and promotional campaigns. Some basic features, such as crypto deposits and limited trading access, may be available without KYC, but withdrawals are not enabled.

How long does KYC verification take?

Processing typically takes 2-5 minutes. If your status shows "processing" for longer, refresh the page or contact support@phemex.com.

Can I verify multiple accounts?

No. Each user can only complete identity verification on one Phemex account. For additional accounts, use the sub-account feature on your verified main account.

What if my verification fails?

You can attempt verification up to 5 times within a 24-hour period. Review the tips above and ensure your documents meet all requirements. If issues persist, contact customer support.

Can I change my KYC information after verification?

You cannot change or delete identification information directly. For corrections or to unverify your account, contact customer service via live chat or email support@phemex.com.

Is my personal information safe?

Phemex partners with Jumio, a secure identity verification platform used by major financial institutions. Your information is encrypted and never shared with unaffiliated third parties.

Do sub-accounts need separate KYC?

No. Sub-accounts do not require additional KYC. Once the main account is verified, all linked sub-accounts are automatically synced with the same verification level and access.

Related Resources

-

How Do I Verify My Account? — Step-by-step verification guide

-

FAQs on Identity Verification — Common KYC questions

-

How to Apply for Entity Verification — Business account guide

-

Phemex Terms of Use — Full terms and restricted territories