The cryptocurrency market is in a constant state of evolution, relentlessly pushing the boundaries of traditional finance. The journey from a niche, peer-to-peer electronic cash system to a multi-trillion-dollar global asset class has been marked by several key inflection points. Perhaps none have been more significant in recent memory than the integration of digital assets into mainstream investment vehicles. The monumental launch of spot Bitcoin ETFs in early 2024 served as a watershed moment, unlocking unprecedented capital inflows and bestowing a new layer of regulatory legitimacy upon the industry's leading asset.

Now, the market is holding its breath as a new chapter appears to be dawning for another of crypto's most established and debated assets: XRP. A flurry of recent developments, filings, and insider reports suggests that the long-awaited arrival of an XRP Exchange-Traded Fund (ETF) may be closer than ever.

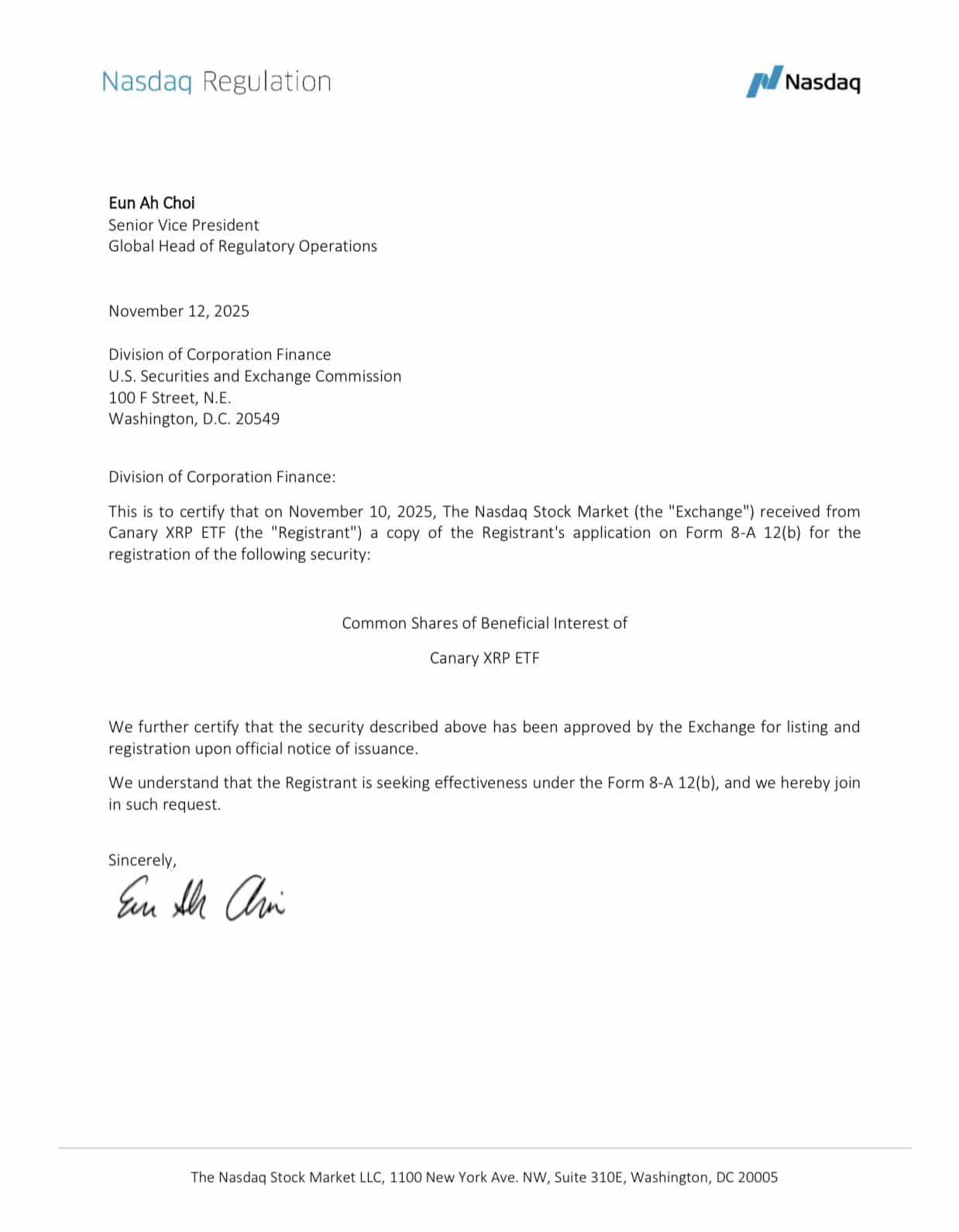

Leading the charge is the Canary XRP ETF. According to multiple media outlets and live reporting from crypto journalist Eleanor Terrett, the fund has achieved a critical milestone. As of late afternoon on November 12th, 2025, the fund, which will trade under the ticker XRPC, reportedly became effective after completing its listing certification with Nasdaq. This pivotal step has, according to these reports, cleared the path for XRPC to commence trading as early as the next market open. While this represents a significant operational step forward, it is crucial to note that final effectiveness remains subject to the procedural risk of potential SEC intervention.

This is not an isolated event. It is the culmination of growing institutional interest, increasing regulatory clarity, and a strategic push to bring XRP into the fold of regulated financial products. This article will provide a deep, professional, and neutral analysis of these groundbreaking developments. We will deconstruct the different types of XRP ETFs being proposed, explore the critical context of XRP's legal journey, and examine the profound potential implications for XRP, its investors, and the broader digital asset landscape.

Deconstructing the News: A Flurry of Institutional Activity

The developments surrounding a potential XRP ETF have accelerated rapidly, moving from speculative chatter to concrete filings on the ledgers of the world's most important financial infrastructure providers.

Canary's XRPC ETF Takes Center Stage

The most immediate and impactful news centers on the Canary XRP ETF. According to extensive reporting from journalist Eleanor Terrett, supported by the Nasdaq certification process, Canary reported the completion of its 8-A/listing certification on November 12, 2025, with an expectation of trading availability for the following market open. This move from a theoretical filing to an actionable trading vehicle is a significant leap forward, signaling that both the issuer and the exchange are confident in the product's legal and operational standing—though the final, permanent approval rests with the SEC.

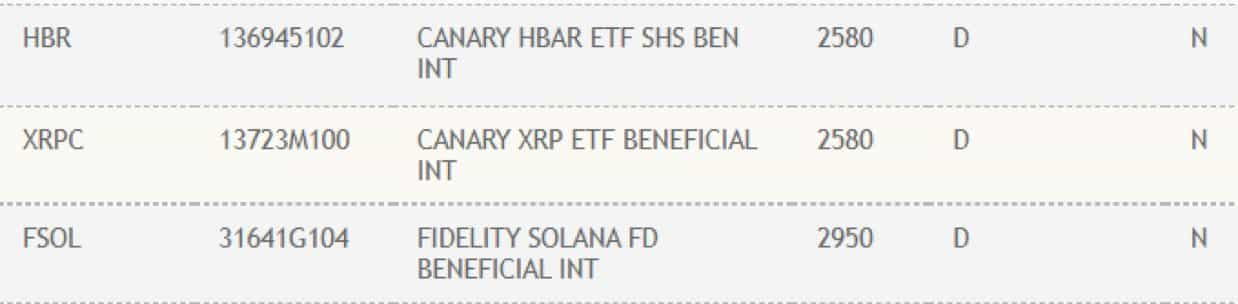

The DTCC Listing Spree: The Financial Plumbing is in Place

Further fueling the optimism is the appearance of no fewer than 11 different XRP ETF products on the website of the Depository Trust & Clearing Corporation (DTCC). The DTCC is a critical, albeit often unseen, piece of the U.S. financial market infrastructure. It provides the clearing and settlement services for the vast majority of securities transactions.

A DTCC listing is not the same as an SEC approval. It is important to note that a listing on the DTCC represents operational readiness for clearing and settlement, and should not be misconstrued as an SEC endorsement or a final, permanent exchange listing decision. However, it is an essential prerequisite. The sheer number of listed products indicates a broad and competitive interest in bringing an XRP ETF to market.

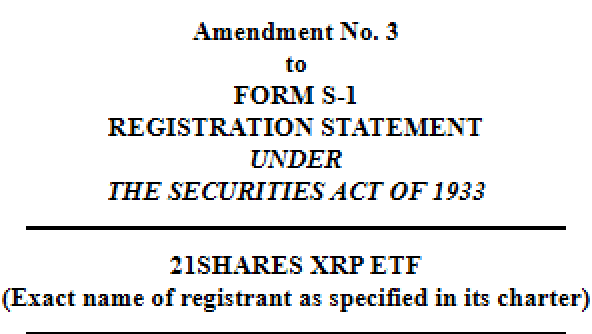

21Shares Adds to the Momentum

Adding to the institutional credibility, Bloomberg ETF analyst Eric Balchunas reported that 21Shares, a prominent issuer of crypto ETPs, has filed a Form 8-A for its own spot XRP ETF. Industry observers often view such a filing as a step that initiates a standard procedural timeline, sometimes referred to as a "20-day clock" under which a registration can become effective automatically, though this remains subject to the possibility of SEC intervention. The involvement of a seasoned player like 21Shares signals a high level of institutional seriousness and a belief in the viability of such a product.

Not All ETFs Are Created Equal: '33 Act vs. '40 Act Explained

As the details of these proposed funds emerge, a critical distinction has come to light—one that has profound implications for the structure, efficiency, and market impact of these products. The difference lies in the U.S. securities laws under which they are registered: the Securities Act of 1933 versus the Investment Company Act of 1940.

The Investment Company Act of 1940 ('40 Act)

The '40 Act is a robust piece of legislation that governs investment companies. The REX-Osprey XRPR fund, which has been filed and operational since September 2025, is structured under this act. According to its prospectus and Nasdaq filings, this fund utilizes a hybrid, subsidiary structure to compliantly hold XRP. This means it is not the "pure spot" model. Therefore, while Canary is not the first XRP-linked ETF in the market, its proposed structure positions it as the first to be marketed as a "pure spot" product under the 1933 Act.

The Securities Act of 1933 ('33 Act): The Gold Standard for Spot ETFs

The '33 Act is the same act under which spot commodity ETFs, such as those for gold and the approved spot Bitcoin ETFs, are structured. A fund filed under this act is typically a grantor trust that holds 100% of a single underlying commodity.

According to its S-1 prospectus filing and widespread media reporting, the Canary XRPC ETF is positioned to be the first of this kind for XRP, structured to hold 100% physical XRP. This "pure spot" model is what many market participants consider the gold standard, as it creates the most direct link between the ETF's shares and the underlying asset.

The Broader Context: XRP’s Long and Winding Road

To fully appreciate the significance of a potential XRP ETF, one must understand the unique journey of XRP, particularly its protracted legal battle with the U.S. Securities and Exchange Commission (SEC).

The Landmark Ruling: A Turning Point for XRP

The narrative shifted dramatically on July 13, 2023. In a landmark summary judgment, Judge Analisa Torres of the Southern District of New York delivered a nuanced ruling. Critically, the ruling distinguished between different types of transactions. It concluded that Ripple's direct institutional sales of XRP constituted investment contracts in certain circumstances, while ruling that programmatic sales of XRP on public exchanges to retail buyers did not qualify as such.

This ruling provided a significant measure of legal clarity. It's important to note that the ruling did not declare XRP a "non-security" in all contexts, but its specific finding regarding secondary market sales was the catalyst that unlocked the current wave of ETF filings by mitigating a key legal risk for issuers.

Potential Implications of an Approved XRP ETF

The successful launch of a spot XRP ETF, particularly a '33 Act vehicle like XRPC, could have a series of cascading effects.

1. Unlocking Unprecedented Accessibility and Liquidity

An ETF allows millions of investors to gain exposure to XRP through their existing brokerage accounts. This radical simplification of the investment process could open the door to a vast new pool of capital.

2. The Potential for Significant Buying Pressure

It is reasonable to infer from market mechanics that a spot ETF could generate significant buying pressure. To create shares, the issuer must acquire and custody a corresponding amount of real XRP. However, the specific impact will depend on the scale of capital inflows, the custody arrangements, and the available liquidity in the market. While a price increase is a possible outcome, it should not be viewed as a certainty. The launch of the spot Bitcoin ETFs did demonstrate a clear correlation between inflows and market dynamics.

3. Setting a Precedent for Other Digital Assets

The approval of an XRP ETF would be a monumental event for the entire altcoin market. If an asset with XRP's complex legal history can achieve this milestone, it could create a viable pathway for other established, large-cap digital assets.

Challenges and Hurdles on the Road Ahead

Despite the overwhelmingly positive news, it is essential to maintain a professional and balanced perspective.

-

Final SEC Approval is Not Guaranteed: While procedural milestones are being met, the final, non-revocable approval rests with the SEC. The commission could still raise objections.

-

Fierce Market Competition: The presence of multiple potential XRP ETF products points to a highly competitive market where success will be determined by fees, liquidity, and brand recognition.

-

Underlying Investor Demand: The actual, realized demand for an XRP ETF is still an unknown variable and will ultimately determine its success.

Conclusion: A Pivotal Moment for XRP

The series of recent developments, spearheaded by the effective listing of the Canary XRP ETF (XRPC), represents a pivotal moment in the history of XRP. This is the culmination of a long journey from regulatory uncertainty to the threshold of mainstream financial acceptance.

The distinction between the emerging '33 Act "pure spot" ETFs and the existing '40 Act structures will be a critical factor to watch. While the final hurdles of permanent SEC approval and market adoption remain, the direction of travel is clear. The groundwork is being laid for XRP to establish itself not just as a digital asset for crypto enthusiasts, but as a recognized, investable instrument within the global financial system.

The coming weeks and months will be crucial. The potential launch of XRPC and other XRP ETFs could redefine the asset's role in investment portfolios and set a powerful new precedent for the entire digital asset class.

As these significant market events develop, traders and investors require a reliable and secure platform. You can monitor the price of XRP and access deep liquidity for your trading strategies on the XRP/USDT spot market on Phemex.