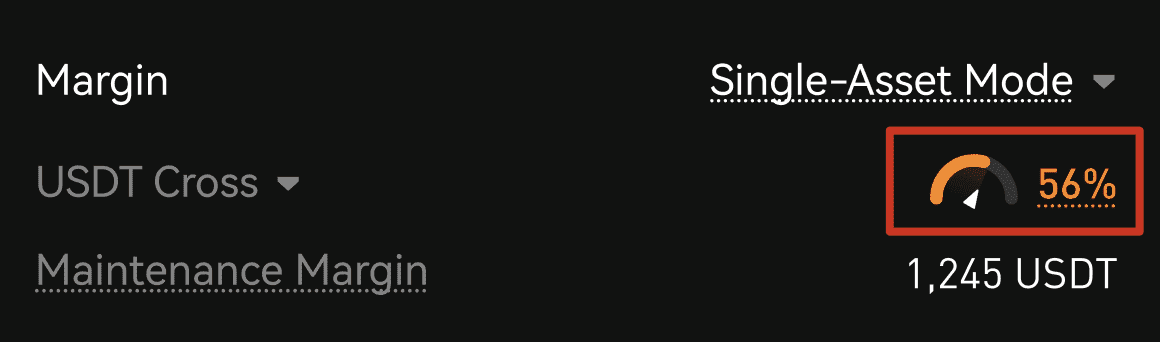

How to View Your Margin Ratio in Multi-Assets Mode

In Multi-Assets Mode, your margin is shared across all USDT-margined positions, so it's crucial to closely monitor your margin ratio. Once the margin ratio reaches 100%, all USDT-margined positions will be liquidated.

You can check your current margin ratio directly on the futures trading page.

How Is the Margin Ratio Calculated?

Margin Ratio = Maintenance Margin / Futures Account Equity

-

Maintenance Margin: The total maintenance margin across all USDT-margined futures in cross-margin mode.

-

Futures Account Equity = sum[(Collateral Asset Balance - Margin used in Inverse futures) × Index Price × Collateral Conversion Rate] × 0.9 + USDT Asset Value

-

Asset Value = Wallet Balance + Unrealized PnL (from cross-margin positions) – Real Debt – Unpaid Interest

-

The 0.9 factor represents the reserved margin ratio, setting aside 10% of funds to hedge against extreme market volatility.

-

Collateral Conversion Rates in Multi-Assets Mode

In Multi-Assets Mode, all supported collateral tokens can be used as margin. Each token's value is converted into USDT based on its conversion rate. These rates are listed under "Rules for Multi-Assets Mode" on the futures trading page.

In Single-Asset Mode, these tokens are not counted as margin (conversion rate = 0), but you can freely transfer them.

| Collateral | Conversion Rate |

|---|---|

| BTC | 98.00% |

| ETH | 95.00% |

| SOL | 90.00% |

| ADA | 90.00% |

| LINK | 90.00% |

| XRP | 85.00% |

| SUI | 85.00% |

Note: Conversion rates are subject to change based on market conditions. Always refer to the latest information on the system.

Example:

If the BTC index price is 100,000 USDT and a user transfers 1 BTC to the futures account:

-

Total value = 100,000 × 1 = 100,000 USDT

-

Usable margin = 100,000 × 0.98 = 98,000 USDT

Auto Conversion in Multi-Assets Mode

To mitigate trading risks, non-USDT collateral in the futures account is subject to automatic USDT conversion, which is fast and low-cost.

Formula:

Auto Converted Amount = Token Quantity × Index Price × Conversion Rate

| Asset | Auto Conversion Threshold | Conversion Rate |

|---|---|---|

| USDT | 600,000 | 100.00% |

| BTC | 1 | 99.90% |

| ETH | 30 | 99.90% |

| SOL | 500 | 98.50% |

| XRP | 20,000 | 98% |

| ADA | 80,000 | 98% |

| SUI | 15,000 | 98% |

| LINK | 3,000 | 98% |

Auto Conversion Use Cases

-

Risk Control on Excessive Debt

When Debt exceed certain thresholds, the system will automatically convert collateral to repay them. Assets with higher conversion rates are prioritized. If multiple tokens have the same rate, those with higher value are used first. Only the amount necessary to repay all Debt will be converted. -

During Forced Liquidation

If Debt remain after liquidation, the system will auto-convert collateral to repay them.

Debt in Multi-Assets Mode

-

Debt & Interest

-

All realized PnL, trading fees, and funding fees are settled in USDT. If there is insufficient USDT, Debt will be generated.

-

Debt Amount = |min(0, USDT Wallet Balance)|

-

Interest Calculation

-

Interest is calculated on an hourly simple interest basis.

-

Formula: Interest = Loan Amount × Hourly Interest Rate × Hours Borrowed

-

Interest accrues immediately upon borrowing and is rounded up to full hours.

Forced Liquidation Process in Multi-Assets Mode

Liquidation Warning

You will receive alerts when your margin ratio hits 50% and 67%. Please top up margin promptly.

Forced Liquidation Steps

When the margin ratio reaches or exceeds 100%, forced liquidation will be triggered for all USDT cross-margin positions and collateral assets, in the following steps:

Step 1: Auto Cancellation

-

Cancel all open orders for USDT futures.

Step 2: Liquidation Takeover

-

The system takes over all USDT futures positions and force-closes them. USDT asset balance is updated.

Step 3: Auto Conversion for Debt Repayment

- If Debt remain after Step 2, the system auto-converts eligible collateral assets to USDT to repay them.

Multi-Asset Mode Repayment

When trading under Multi-Asset Mode, if there is no available USDT balance, the system may generate a debt.

Scenarios in which debt may occur:

-

Opening fees required to initiate a position

-

Closing fees required to close a position

-

Funding fees

-

Realized losses from closing a position

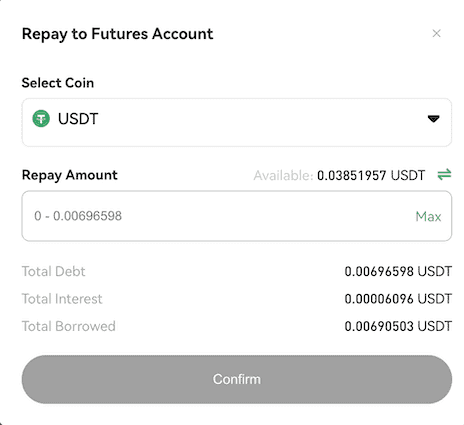

Manual Repayment

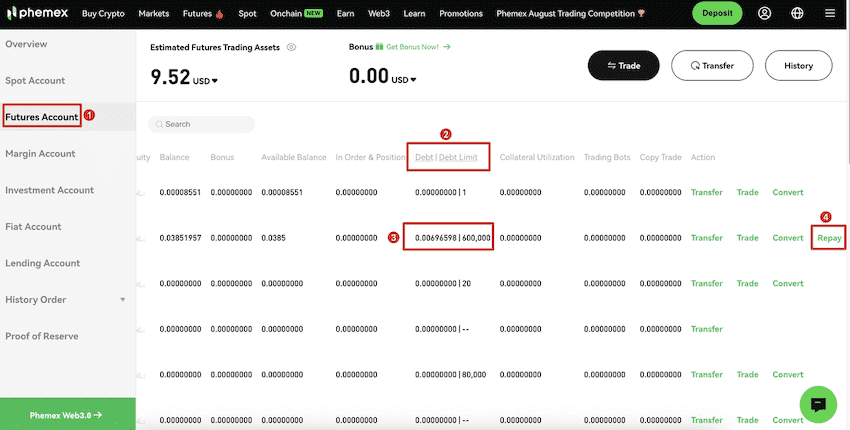

Users can manually repay any debt by navigating to Assets → futures Account, where they can check if any debt exist for specific trading pairs and proceed with repayment.

Automatic Repayment

Phemex also supports an automatic repayment mechanism. When a position is closed with realized profits, if there is an existing debt in the corresponding currency, the system will automatically use the profit to repay it.

Additionally, whenever funding fees are received, the system will also trigger automatic repayment.