Tokenized real-world assets (RWA) have reached $35.83 billion in on-chain value, reflecting ongoing growth in the integration of blockchain and traditional finance. This week, Kyrgyzstan debuted the world’s first gold-backed government stablecoin, alongside significant developments from Franklin Templeton, Chainlink, and other key players in the RWA space.

Across various asset classes, RWAs are gaining traction. This edition provides key metrics, recent updates, and upcoming events to keep you updated.

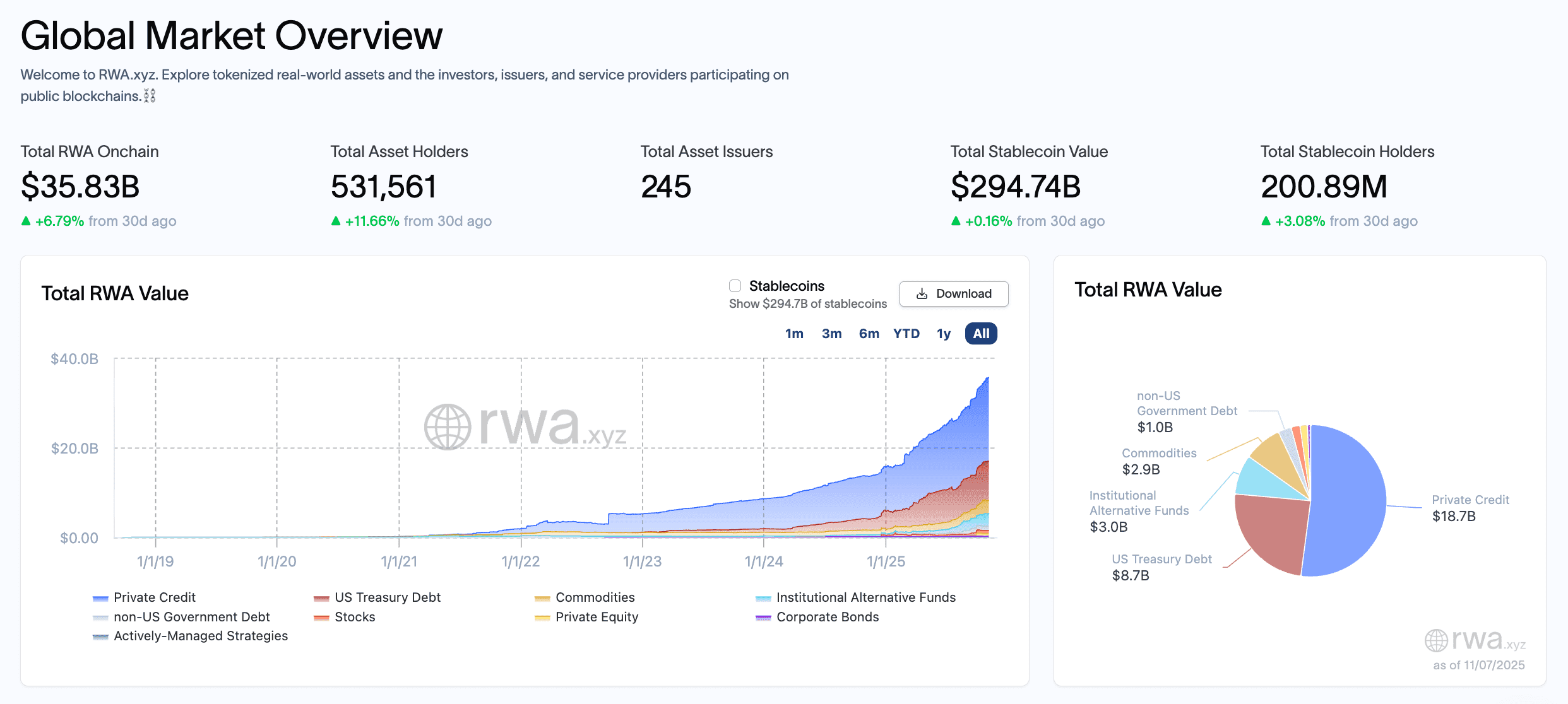

RWA Market Overview: Total Value, Top Assets & Stablecoin Trends

The RWA ecosystem recorded a total value of $35.83 billion for tokenized assets (excluding stablecoins) as of November 6, 2025, according to RWA.xyz. This represents a 6.79% increase over the past 30 days.

The market includes 531,561 unique holders (+11.66% in 30 days) and 245 issuers (+13 from last month), featuring entities like BlackRock, Tether, and Franklin Templeton. Stablecoins, essential for RWA transactions, maintain a separate market value of $294.74 billion.

Source: rwa.xyz

Top Tokenized Assets (by Total Value)

The following table presents the top assets by total value according to rwa.xyz as of November 6, 2025:

| Rank | Asset | Issuer | Total Value | 7D Change | 30D Change | Asset Class |

|---|---|---|---|---|---|---|

| 1 | BUIDL (BlackRock USD Institutional Digital Liquidity Fund) | Securitize | $2,822,347,527 | -1.11% | -0.24% | U.S. Treasuries |

| 2 | XAUT (Tether Gold) | Tether Holdings | $1,536,514,707 | -0.62% | +41.96% | Commodities |

| 3 | PAXG (Paxos Gold) | Paxos | $1,310,107,029 | -0.51% | +10.39% | Commodities |

| 4 | syrupUSDC (Syrup USDC) | Maple | $1,201,131,905 | -10.42% | +5.66% | Private Credit |

| 5 | JAAA (Janus Henderson Anemoy AAA CLO Fund) | Centrifuge | $1,012,033,280 | +0.15% | +19.04% | Institutional Funds |

Top RWA Protocol Tokens (by Market Cap)

These tokens support RWA platforms or represent tokenized assets. Data from CoinMarketCap as of November 6, 2025.

| Rank | Token | Price | Market Cap | 7D Change | Role |

|---|---|---|---|---|---|

| 1 | Chainlink (LINK) | $14.65 | $10.21B | +12.45% | Provides oracles for RWA data feeds |

| 2 | Stellar (XLM) | $0.2686 | $8.62B | +9.80% | Supports cross-border RWA settlement |

| 3 | Hedera (HBAR) | $0.1624 | $6.90B | +17.11% | Enables enterprise-grade RWA transactions |

| 4 | Avalanche (AVAX) | $16.03 | $6.85B | +11.16% | Hosts RWA smart contracts |

| 5 | Ondo (ONDO) | $0.5919 | $1.87B | +13.56% | Governs Ondo Finance (treasuries & credit) |

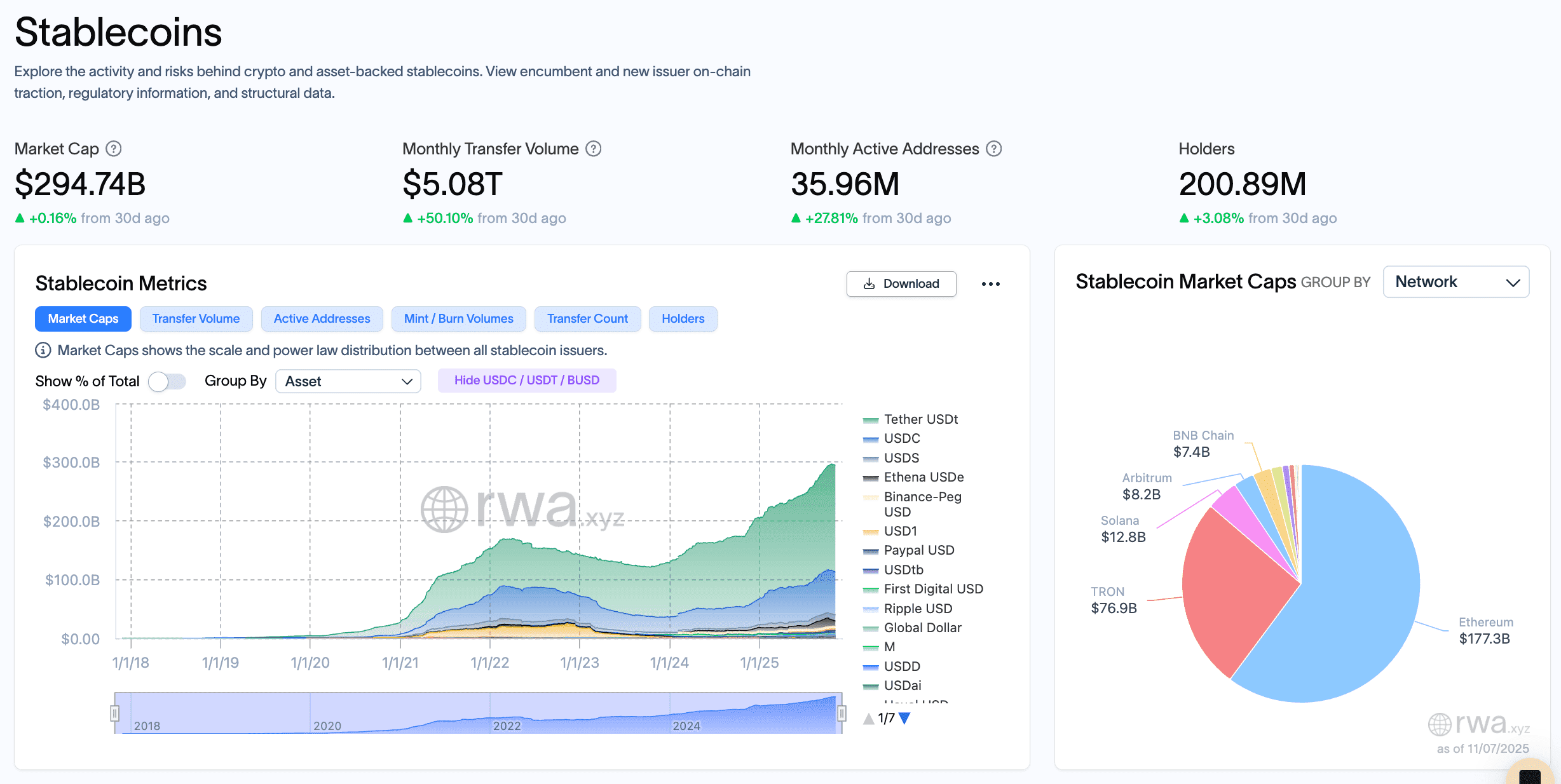

Stablecoin Trends

Stablecoins enable RWA transactions with instant settlement and cross-border functionality.

- USDT leads at $181.9B (+0.03% weekly), while USDC ($72.8B, -0.66%) shows higher on-chain volume, per JPMorgan, due to regulatory compliance.

- RLUSD (Ripple) rose +12.87% to $1B, supported by Mastercard integration.

- USDe (Ethena) declined -6.22% to $9B, reflecting yield adjustments.

- Stablecoin adoption is growing, with new government-backed options like USDKG emerging this week.

Top RWA News: A Week of Innovation and Expansion

Institutional Moves

- Kyrgyzstan Launches USDKG as the First Gold-Backed Government Stablecoin: The government introduced USDKG, a gold-backed stablecoin (1 token = 1g gold) on BNB Chain, aimed at supporting trade and attracting investment.

- Franklin Templeton Launches Tokenized MMF in Hong Kong: A $500M+ tokenized money market fund debuted, enhancing RWA adoption in Asia with multi-chain support.

- Bitso Integrates USDT on Solana: Bitso enabled faster and more affordable USDT transactions on Solana, boosting RWA payment efficiency.

Market Milestones

- EUR Stablecoin Goes Global: Finery Markets Powers Monerium’s Cross-Rates Creation: Monerium’s EUR stablecoin, supported by Finery Markets, now facilitates cross-rate creation, improving global RWA liquidity.

- Securitize Expands VanEck’s Tokenized Fund VBILL to Horizon: VanEck’s VBILL fund extended to the Horizon network, increasing investor accessibility.

- Winvest Group Partners with Greater Bay Area RWA Incubator: A strategic partnership will establish a Southeast Asia headquarters in Malaysia, boosting RWA development.

Regulation & Policy

- Fed’s Waller Says Properly Regulated Stablecoins Can Strengthen Trade and Modernize Finance: Governor Waller highlighted the potential of regulated stablecoins for economic modernization.

- Tokocrypto CEO: National Stablecoins Will Have a Big Impact on Crypto Markets and Digital Economy: The CEO emphasized the transformative potential of national stablecoins.

- Malaysia’s Central Bank Sets Tokenization Roadmap: A three-year plan to pilot asset tokenization was outlined, supporting RWA infrastructure growth.

Tech & Integrations

- Chainlink and FTSE Russell Launch On-Chain Indices: Chainlink’s DataLink brought global indices like the S&P 500 on-chain, supporting $700M+ in tokenized equities.

- Fireblocks, Polygon, Solana, Stellar & TON Form $10T Consortium: The consortium aims to standardize stablecoin payments, targeting a $10T global trade market.

- SBI Digital Markets Adopts Chainlink CCIP: The adoption enhances cross-chain tokenized asset infrastructure with improved pricing and settlement.

Additional Developments

- Circle Submits Comment Letter on GENIUS Act: Circle provided feedback to refine U.S. stablecoin regulations.

- Winvest Group Partners with Greater Bay Area RWA Incubator: A strategic partnership will establish a Southeast Asia headquarters in Malaysia.

- Chainlink Introduces CRE to Fast-Track Institutional Tokenization: A new service aims to accelerate RWA tokenization for institutions.

RWA Events Calendar: What’s Next This Week

| Date | Event | Why It Matters |

|---|---|---|

| Nov 11 | Anticipated FASB stablecoin accounting update | May clarify cash-equivalent status, affecting corporate treasury use. |

| Nov 13 | Ondo tokenized ETF expansion on BNB Chain | Aims for $1B AUM with Chainlink-supported cross-chain functionality. |

| Nov 14 | Standard Chartered Hong Kong custody launch | Early 2026 preview of crypto custody services for RWA growth. |

| Nov 15 | Circle Arc testnet refinements | Prepares 2026 mainnet for enhanced RWA and stablecoin transaction capabilities. |

Note: Event dates are subject to confirmation; monitor official channels.

Summary

The RWA market has reached a total value of $35.83 billion, supported by 245 issuers and 531,561 holders, reflecting the growing integration of blockchain technology with traditional finance. This week, dive into highlights like Kyrgyzstan’s launch of the gold-backed stablecoin USDKG, Franklin Templeton’s bold move with a tokenized MMF in Hong Kong, and Chainlink’s game-changing on-chain indices with FTSE Russell. Ready to join the action? Trade our top RWA tokens on Phemex and explore this thriving market.