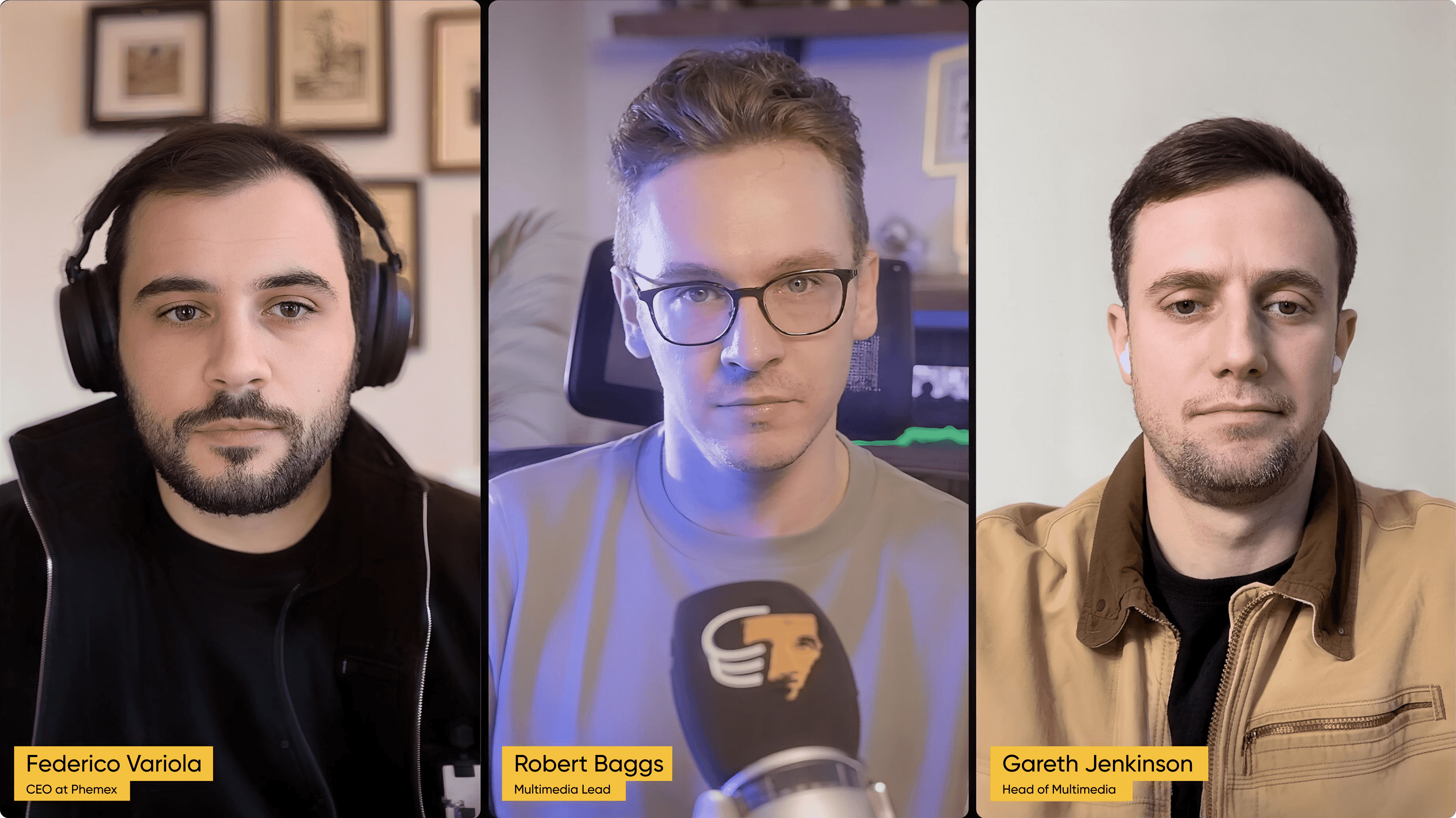

Federico joined CoinTelegraph's Chain Reaction to share where Phemex is headed, what the rebrand represents, and why the next six years will look very different from the last.

Phemex turns six this year. Two market cycles, a global pandemic, the collapse of major competitors, and an industry that reinvents itself constantly. Through all of it, one principle has stayed consistent: build for traders, not around them.

The anniversary comes with a brand refresh. But this is not just a new look. It reflects a strategic shift in how we think about the future of trading and what Phemex needs to become to stay ahead.

CEO Federico Variola joined CoinTelegraph's Chain Reaction podcast to talk through that shift. The conversation covered the rapid rise of on-chain trading platforms, the wave of high profile exchange breaches in 2025, and the evolving regulatory environment. The thread connecting all of it was clear: exchanges need to adapt. That is exactly what we have been doing.

Building for the On-Chain Future

The rise of platforms like HyperLiquid and Aster proved something the industry debated for years. Serious trading can happen fully on-chain. No KYC. No centralized custody. Just connect a wallet and trade.

Federico did not sidestep the question of whether this threatens centralized exchanges. "Yes, they are a threat for our business," he said.

But we see it differently. Instead of resisting the trend, we are building into it.

"Every centralized exchange will over time abandon the centralized model in favor of more on-chain, self-custody direction," Federico explained.

We are already allocating resources toward an on-chain project that mirrors what we offer today as a centralized exchange. The regulatory shift in the United States makes this possible. A few years ago, decentralized platforms felt compelled to geo-block American users to stay out of trouble. That is changing. Federico sees US users as potential on-chain customers in a way that was not realistic before.

This does not mean abandoning traders who prefer centralized platforms. Many do not want to manage private keys, and that is fine. But for those who want self-custody with professional trading tools, we intend to be there.

This is the core of the rebrand: not choosing one model over another, but meeting traders wherever they want to be.

Staying Close to Users

Federico emphasized one point repeatedly. The exchanges that win are the ones that listen.

He noted that some major players have slowed down. Slow to refine interfaces, slow to respond to user needs, slow to adapt to new realities. Comfort creates inertia.

Phemex operates differently. "There is constant feedback between users and the exchange," Federico said. "And we act very fast on this."

Agility over scale. That has shaped the company from the beginning and remains central to our direction. Ship quickly, listen closely, adapt early. The exchanges stuck in bureaucracy will not keep pace.

Market Realities: What Traders Need to Understand

Federico shared direct views on the market, and traders should pay attention.

On altseason: stop waiting for it. "If you are still waiting for altseason, you are like the Japanese soldiers still waiting on a desert island for the war to end," he said. "It is over. Altseason is not coming back. Not as you remember from 2020."

The math has changed. There are millions of tokens now, with thousands launching daily. Bitcoin ETF inflows stay in Bitcoin. The tide that once lifted everything no longer works the same way.

So where is the opportunity? Federico points to strong teams that are quietly building while being overlooked. Solana at fifteen dollars is the example he gave. Those who recognized it early did extremely well. These opportunities appear during downturns, not euphoric rallies.

On meme coins: treat them as a warning. "Meme coins are more like a top signal than a bottom signal." When they are everywhere, caution is usually the right instinct.

On 2026: expect a reset. Federico looks at cycles historically. Election years often lean bullish, which points toward 2028. Somewhere between now and then, a correction is likely. But corrections are not something to fear. The best trades of the past few years, from Pepe to HyperLiquid to Bittensor, all emerged in bear market conditions.

This is exactly why Phemex focuses on giving traders tools that work in any market environment. Volatility moves both ways, and platforms must be built for that.

How We Rebuilt Security After Getting Tested

Earlier this year, we faced a security incident. Federico addressed it directly on the podcast.

The challenge is one every centralized exchange faces. Hot wallets must remain online for quick withdrawals. Online means exposed. Federico compared it to the BitMex era, when withdrawals happened once per day. Today traders expect funds in thirty seconds. That pressure creates risk.

"Our error was trying to appease users who have become more and more demanding," Federico said.

So we rebuilt the system from the ground up. The new architecture introduces a warm wallet layer between hot and cold storage. This makes attacks significantly harder without hurting user experience. Hardware security modules now separate key components. The entire system assumes attackers will try to get in and is designed to limit what they can do.

We also expanded security training across the company. Nation-state groups like Lazarus do not just target executives. A single compromised device from any employee can become a foothold. Every employee now receives advanced phishing training.

Federico had specific advice for users too. Keep your 2FA device offline. Use a dedicated phone for authentication. Store seed phrases physically. Pause before approving transactions. In the Bybit breach, comparing the hash on the hardware device to what appeared on screen would have prevented the attack.

This rebuild is part of what the rebrand represents: a renewed commitment to security backed by engineering, not just messaging.

What Comes Next

Federico will be speaking at Longitude, CoinTelegraph's event in Abu Dhabi on December 11th. Anthony Scaramucci will attend, along with leaders from Solana Policy Institute and StarkNet. The event lands between Bitcoin MENA and Solana Breakpoint. Details will be shared on CoinTelegraph's social channels.

Watch the full Chain Reaction conversation here: CoinTelegraph on X

Six years of building taught us what traders need. The next six are about delivering it across every market cycle, whether on-chain or off. This rebrand is not a new coat of paint. It is a new chapter.