Bitcoin futures are derivative contracts that allow traders to speculate on the future price of Bitcoin without directly holding the cryptocurrency. In a Bitcoin futures contract, two parties agree to buy or sell a specific amount of BTC at a predetermined price on a set future date. This gives traders exposure to Bitcoin’s price movements with added flexibility – including the ability to use leverage and to go long or short on BTC. Unlike spot trading (where you buy and sell actual bitcoins on the spot market), BTC futures trading involves contracts that track Bitcoin’s price. This means traders can benefit from price changes without ever owning the underlying coins. Bitcoin futures have become increasingly popular and important, because they enable hedging against price volatility and attract institutional investors who prefer regulated contract markets over handling digital assets directly. Bitcoin futures contracts are one of the most traded cryptocurrency derivatives, and traders can find them on exchanges like Phemex. They give the Bitcoin ecosystem transparency, liquidity and price efficiency.

What Are Futures Contracts?

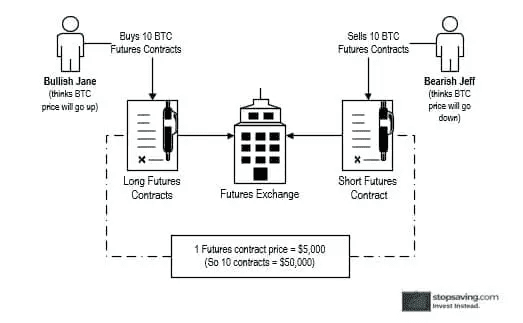

Financial futures are contracts that specify the buying or selling of an underlying asset at a predetermined price on a precise date in the future. Counter parties are obligated to fulfill the terms of the contract upon expiration, either buying or selling the asset at the price once the contract expires. Parties can take two positions in a futures contract; long or short. Long means that the party agrees to buy the underlying asset in the future at a specific price, while short means the party agrees to sell the underlying asset at a specific price upon the contract’s expiration in the future. Futures contracts are traded on regulated exchanges and are regulated by the Commodity Futures Trading Commission.

What Are Bitcoin futures?

In a nutshell, Bitcoin futures contracts allow traders to trade on the value of Bitcoin without owning the Bitcoin. Most Bitcoin futures contracts are cash-settled, meaning that the trader receives returns in terms of fiat currencies. However, there are some Bitcoin futures exchanges that have introduced physical settlements, where the traders receive real Bitcoins once their contracts close.

Contrary to the spot market where buyers and sellers dictate the market prices of cryptocurrencies through over-the-counter (OTC) contracts, in Bitcoin futures trading, the exchanges standardizes the contracts. The Bitcoin futures contracts have standardized sizes depending on the exchange. In some exchanges, a single Bitcoin futures contract could be worth $1 while in another exchange the contract could be worth $10.

Bitcoin Futures Explainer (source)

What Are The Benefits Of Bitcoin Futures?

Price Transparency

Regulation

Leverage Trading

Short Selling

Risks and Considerations of Bitcoin Futures

Bitcoin futures present significant opportunities but also come with considerable risks:

-

Liquidation and Leverage Risks: High leverage can lead to rapid liquidation if the market moves against you. Sudden swings in the crypto market can result in large liquidation events, like the one in August 2025, where over $922 million of positions were liquidated amid a sharp price drop. Traders should practice prudent position sizing and use stop-loss orders to manage this risk.

-

Volatility and Price Spikes: Bitcoin's inherent volatility is heightened in futures markets, potentially resulting in slippage during rapid price movements. Events like the March 2020 "Black Thursday" crash, which saw a 50% decline in a day, highlight the need for readiness in volatile conditions.

-

Funding Rate and Carry Costs: Holding perpetual futures contracts incurs funding fees based on the balance of long and short positions. In bullish markets, longs may face carrying costs. Traders need to consider these fees when assessing long-term positions.

-

Basis Risk and Convergence: The basis - the difference between futures and spot prices - can fluctuate. While they converge near expiry, discrepancies can introduce risks for hedgers. Active arbitrage usually keeps the basis manageable.

-

Exchange/Credit Risk: Trading on unregulated exchanges poses risks, as demonstrated by the collapse of FTX in 2022. Regulated exchanges like CME minimize counterparty risk, but trading on margin still carries some risk.

-

Regulatory and Legal Risks: The regulatory environment for crypto futures varies by region. Some places restrict retail trading on offshore platforms, and regulations can change, impacting existing traders. Always ensure compliance with local laws and consider tax implications.

In summary, trading Bitcoin futures requires careful risk management due to high volatility and leverage, and traders should only use a fraction of their capital for such activities.

Bitcoin Futures vs. Bitcoin Options

Both Bitcoin futures and options are popular derivatives but differ significantly in their structure and use cases.

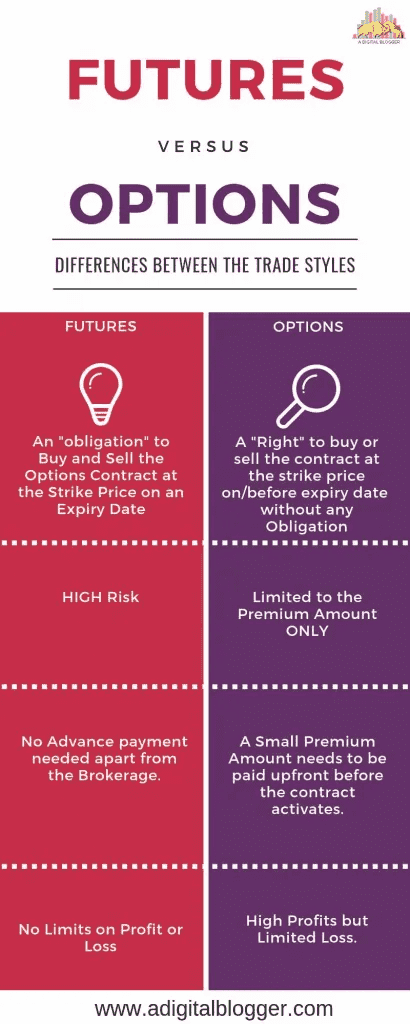

Obligation vs. Right: A Bitcoin futures contract obligates both parties to transact at a set price upon expiry, while a Bitcoin option gives the buyer the right (but not the obligation) to buy or sell Bitcoin at a specific price before or at expiration. If the market price remains below the strike price of a call option, the buyer can let it expire worthless, losing only the premium.

Risk Profile: Futures have a linear risk/reward profile, where profits and losses move directly with the underlying price. In contrast, options have a non-linear payoff; maximum loss is limited to the premium paid, while upside potential is substantial. This makes options attractive for hedging and speculative plays. When selling options, however, the downside risk is greater, necessitating margins.

Complexity and Strategy: Futures are straightforward: it's a matter of choosing long or short. Options are more complex, involving concepts like implied volatility and time decay. They allow for advanced strategies (e.g., spreads, straddles) to bet on volatility as well as direction.

Market Availability: Bitcoin options are mainly traded on platforms like Deribit and CME, with a smaller market compared to futures. In 2025, while options volumes are significant, they generally lag behind futures in open interest.

Bitcoin futures offer certainty and simplicity, making them preferable for short-term trades, whereas options provide flexibility for risk management. New traders might benefit from starting with futures before exploring options.

Futures vs. Options (source)

Opening & Closing Positions In BTC Futures Contracts

In a nutshell, Bitcoin futures entail opening of an account with a crypto derivatives exchange that offers BTC futures, depositing funds in your account and buying Bitcoin futures contracts with the deposited funds. You can choose to open a short or a long BTC futures contract depending on your market prediction.

Short BTC Futures Contracts Positions

This is similar to placing a short (also known as a sell) in the spot market. When a short Bitcoin futures contract is placed, your account balance rises as the Bitcoin prices fall. In short, you enter a contract to sell BTC at a predetermined price predicting that the sport market price of BTC will fall below that price in the future before your contract expires. Therefore you shall be selling the Bitcoins at a higher price than the market price and thus gaining profit.

If your market price prediction turn out to be wrong, and the prices rise instead of falling, then you shall end up making a loss.

Long BTC Futures Contract Positions

This is similar to placing a long (also known as a buy) in the spot market. When a long Bitcoin futures contract is placed, your account balance rises as the BTC prices rise. In short, you enter a contract to buy Bitcoin at a predetermined price predicting that the sport market price of BTC will rise above that price in the future before your contract expires. Therefore you shall be buying Bitcoins at a lower price than the market price and thus gaining profit.

If your market price prediction turn out to be wrong, and the prices drops instead of rising, then you shall end up making a loss.

To learn more, Read our article on How to trade bitcoin Futures.

Bitcoin Futures Open Interest (source)

Current Market Trends in Bitcoin Futures for 2025

As of late 2025, the Bitcoin futures market has evolved significantly:

-

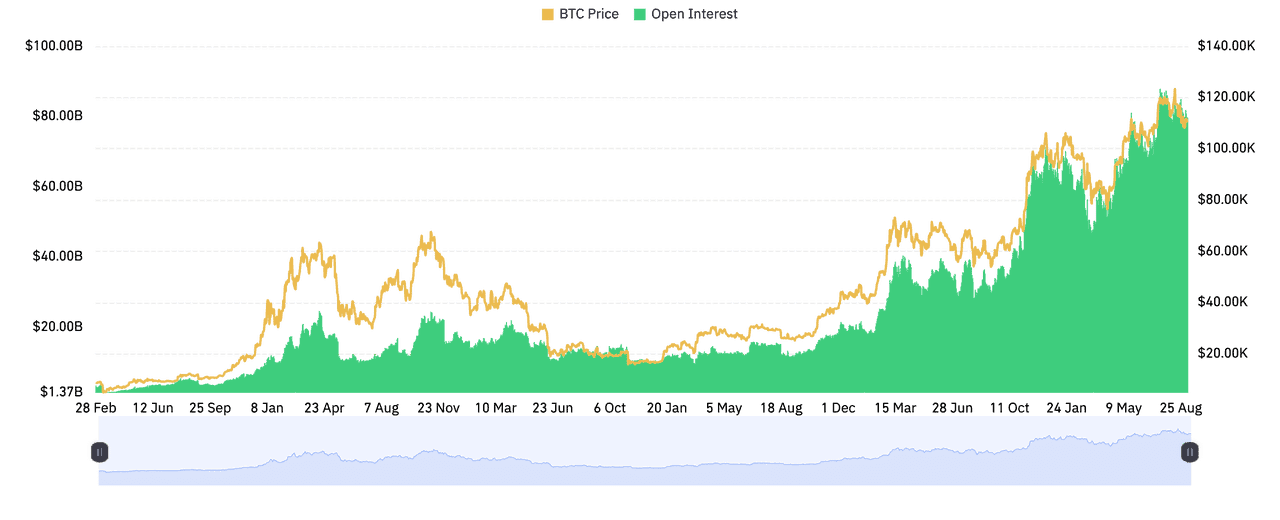

Trading Volumes & Open Interest: Bitcoin futures trading is at unprecedented levels, with open interest around $16 billion globally. Daily trading volumes often exceed $50–100 billion on volatile days, with the CME reporting record metrics in Q2 2025, including 190,000 average daily contracts traded (approximately $9.6 billion notional).

-

Institutional Involvement: Institutional adoption is robust, fueled by the introduction of Bitcoin futures-based ETFs in late 2021 and U.S. spot Bitcoin ETFs in early 2024. BlackRock’s iShares Bitcoin Trust gained substantial assets, illustrating the increasing role of institutional players in the market. Platforms like Paradigm support large trades, enhancing market liquidity.

-

Global Market & Regulatory Landscape: While over 95% of Bitcoin futures volume occurs on unregulated exchanges, there's a gradual regulatory shift. The Asia-Pacific region leads in trading volume, with many jurisdictions adapting regulations to improve risk disclosures rather than banning crypto. Compliance measures, such as identity verification, are now common.

-

Market Structure and Trends: New futures products are emerging, including CME’s “event contracts” and daily expiries. Perpetual swaps remain popular, but traders are exploring alternatives. Futures often signal short-term market sentiment shifts, with funding rates and open interest changes indicating potential market turns.

-

Volatility and Liquidations: As Bitcoin trades between $110k–$120k, liquidation values have risen, with billions of dollars liquidated on significant price moves. However, the market has shown improved resilience, with liquidity rebounding after major sell-offs, highlighting a maturing market.

Where Can You Trade Bitcoin Futures?

Conclusion

Bitcoin futures have evolved from a niche experimental market into a mainstream financial instrument for engaging with the world’s largest cryptocurrency. They offer a powerful way to gain exposure to Bitcoin’s price movements, whether your goal is hedging an existing investment, speculating with leverage, or arbitraging price differences. As outlined, the benefits – flexibility, leverage, hedging ability, and access – make futures attractive, but the risks – especially around volatility and leverage – mean traders must approach with respect and caution.

In the broader crypto trading landscape of 2025, Bitcoin futures play a central role. They contribute to how Bitcoin’s price is discovered globally, and they enable everyone from small retail traders in emerging markets to Wall Street institutions to participate in the market in a tailored way. The increasing volumes and open interest, along with the entry of institutional players, suggest that Bitcoin futures are likely to continue growing and possibly even outshine the spot markets in influence. With more regulatory clarity emerging and products like ETFs bridging the gap for traditional investors, the line between the crypto derivatives market and traditional finance is blurring.