Key Takeaways

-

Comprehensive Automation Suite: Built-in Trading Bots, one-click Copy Trading, and robust API access enable traders of all levels to automate strategies with ease. Phemex’s Bot Marketplace hosts thousands of user-proven strategies ready to deploy, and its copy trading system lets you mirror experts without hassle.

-

Top-Tier Execution & Liquidity: Phemex delivers deep liquidity and lightning-fast order execution as it’s able to handle 300,000 transactions per second. Innovations like the Phemex RPI (Retail Price Improvement) keep spreads ultra-tight, often within 1 tick, and slippage minimal for better trade fills.

-

Superior User Experience: Despite its advanced capabilities, Phemex is user-friendly. The platform interface is intuitive and feature-rich, and non-coders can easily launch an automated strategy in minutes. Crucial risk controls like stop-loss orders, take-profit and mock trading simulations are built-in to help manage and practice strategies, catering to both beginners and pros.

Cryptocurrency markets never sleep, and in 2026 the edge increasingly belongs to traders who leverage automation for speed, consistency, and efficiency. High-performance automated trading means using algorithms, bots, and advanced tools to execute strategies 24/7 with minimal latency and error, essentially trading smarter and faster than any human could. Phemex has emerged as the premier platform for this style of trading, offering a blend of powerful automation features and top-tier trading infrastructure. This article explains why Phemex stands out for automated crypto trading in 2026, especially for a broad audience looking to maximize their trading performance without needing an advanced technical background.

What Is Automated Crypto Trading in 2026?

High-performance automated trading refers to using software and algorithms to trade assets at high speed and efficiency, leveraging the best technology and market access available. In the crypto context of 2026, this means traders widely deploy bots across spot and futures markets to ensure consistent execution, enforce risk rules, and maintain 24/7 market presence. Rather than manually clicking buttons, you predefine strategies or follow signals, and let the system do the work in real time. This approach eliminates human emotion – no more panic selling or FOMO buying – and exploits even split-second opportunities that a human might miss.

But “high performance” is about more than just running a bot. It implies that your trading platform provides the speed, liquidity, and reliability needed for these algorithms to perform optimally. Automated strategies’ success depends on factors like fees, liquidity, and exchange infrastructure quality. A slow or unreliable exchange can cause bots to lag or slip, turning a winning strategy into a losing one. That’s why choosing Phemex makes a difference. It offers an execution environment built for high performance, so your automated strategies can truly shine.

Phemex’s Automation Suite: Tools for Every Trader

Phemex has invested heavily in features that empower users to automate trades, whether you’re a coding guru or a complete beginner. The platform’s automation suite includes:

-

Trading Bots: Fully integrated automated trading strategies you can customize or copy from others.

-

Copy Trading: A social trading feature where you mirror the trades of top-performing traders in real time.

-

API Access: Robust REST and WebSocket APIs for those who want to code their own trading algorithms or connect external trading systems.

Let’s break down each of these and see why they make Phemex ideal for high-performance algo trading.

Trading Bots: Built-In Automation Made Easy and Safe

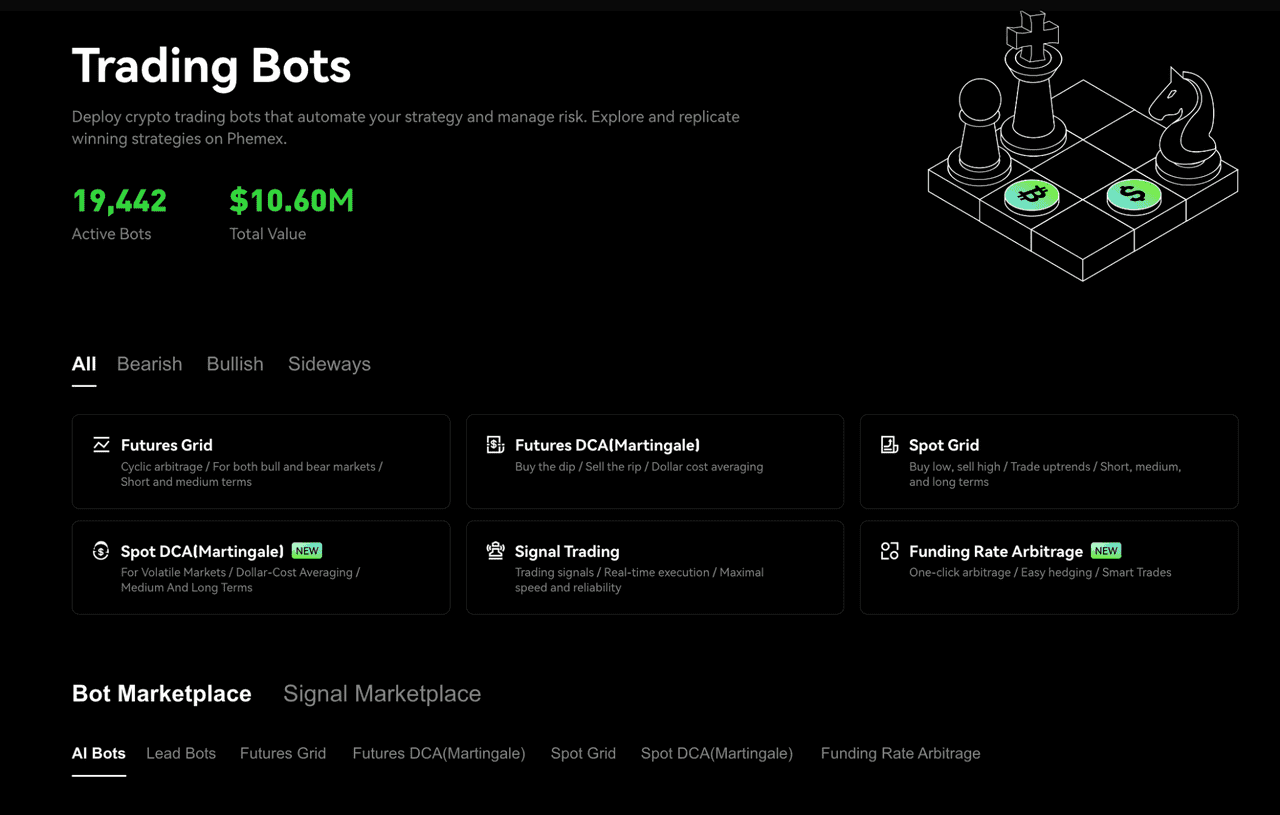

Phemex offers a range of built-in crypto trading bots that users can deploy directly on the exchange with no extra software or coding required. These bots cover various strategies (at least six types, from grid trading to dollar-cost averaging to arbitrage) so that you can find one that fits your needs. Importantly, using Phemex’s native bots is extremely simple:

-

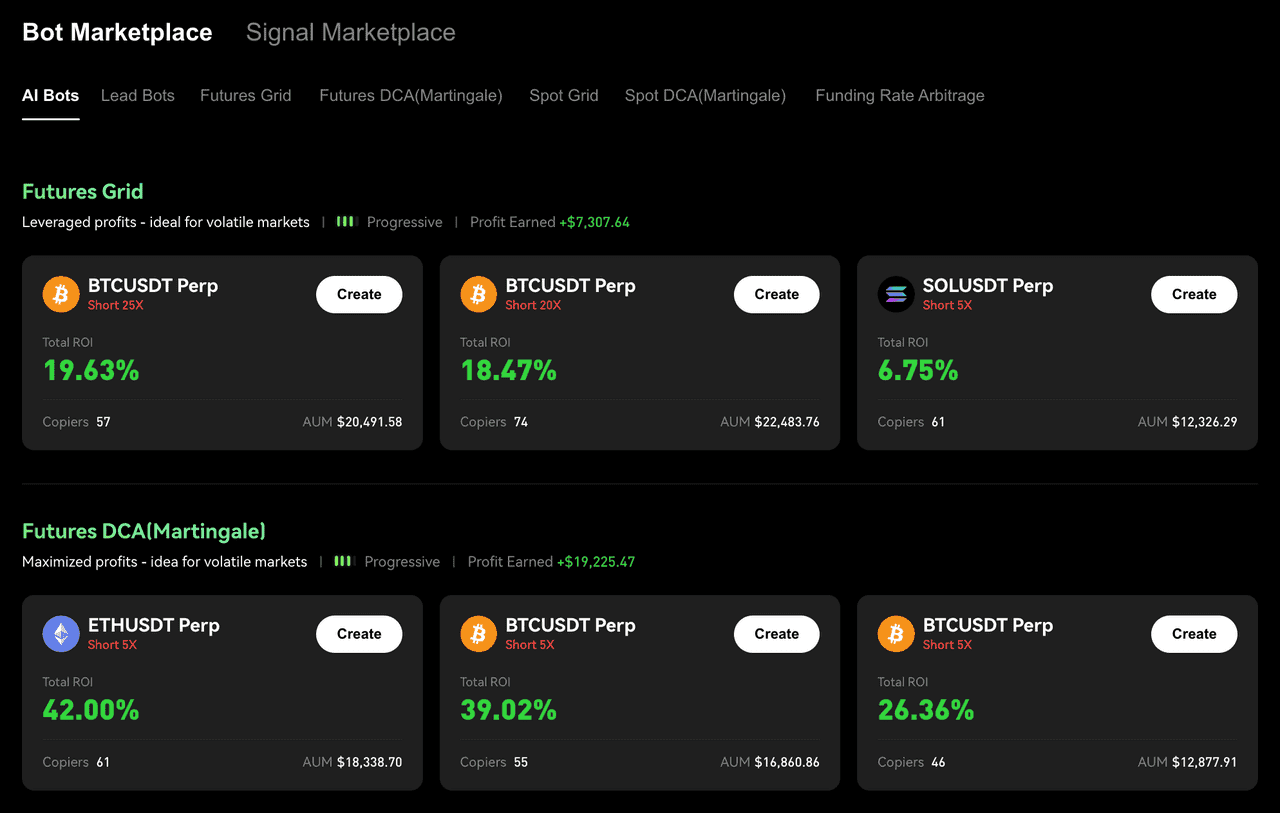

One-Click Deployment: Through the Phemex Bot Marketplace, you can literally launch a bot in a few clicks. Browse the marketplace to see over 22,000 active bots managing nearly $14 million in value (as of late 2025). Each bot listing shows key metrics like ROI, runtime, and strategy type. If you find one you like, click Create, set your investment amount, and the bot is up and running with preset parameters copied from the original. It’s as easy as copy-paste for trading strategies.

-

No API Keys Needed (Zero Friction): Unlike third-party bot platforms where you must connect via API keys which can be a security risk, Phemex bots run natively on the exchange. This means zero API key risk and instant execution since commands are sent internally within Phemex’s system. Your bot trades directly on your account without any lag or exposure of credentials.

-

Free to Use: Phemex provides all these bots completely free of charge. Many popular bot services or exchanges charge subscription fees or take a cut of your profits, but on Phemex, every dollar of profit your bot earns is yours to keep. There’s no monthly bot fee eating into your returns, which lowers the barrier to entry. You can experiment with small amounts without worrying about covering subscription costs – perfect for learning and iterating on strategies.

Phemex Trading Bots (source)

-

Variety and Community Strategies: Whether you want a simple Grid Bot that buys low/sells high in a range or a more complex Signal Bot that ties into TradingView alerts, Phemex has you covered. The Bot Marketplace is a community hub. You can see what strategies are working for others in real time, learn from top-performing bots, and even share your own for others to copy. This community aspect means the platform is always updating with new ideas, and you have a “library” of proven strategies at your fingertips.

-

Safety and Control: Because these bots are part of Phemex, they benefit from the platform’s security infrastructure. There’s no need to hand your money to an external bot provider so funds stay in your Phemex account under the exchange’s institutional-grade security protections. You can also monitor and stop bots anytime. And since bots follow predefined rules, they help remove emotional trading errors, sticking strictly to strategy logic.

Phemex trading bots make high-performance algorithmic trading accessible to everyone. You get the speed and precision of automated trading, backed by Phemex’s tech and liquidity, without the typical hassles of setting up a third-party bot.

Automate with Phemex Trading Bots

Copy Trading: Mirror Top Traders with Confidence

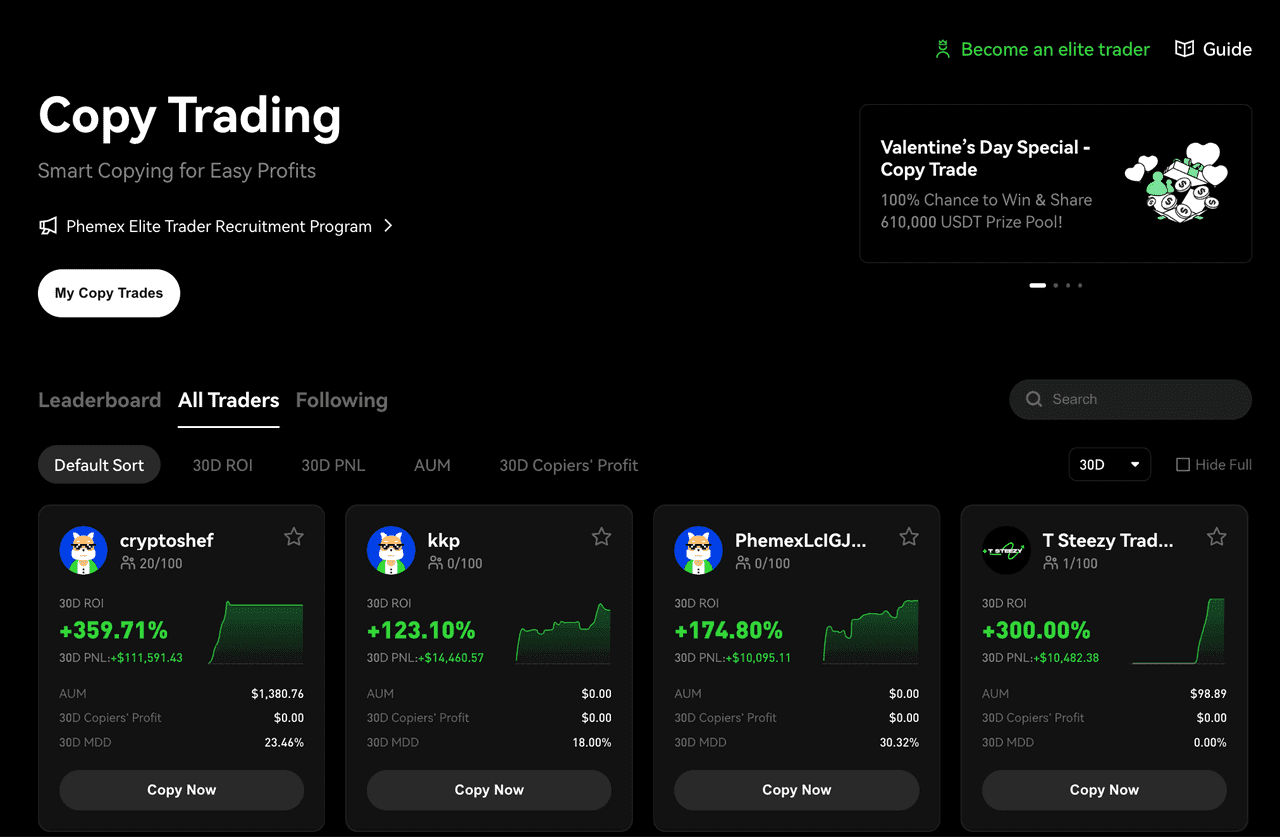

If you prefer to lean on human expertise rather than preset algorithms, Phemex Copy Trading is the ideal feature. This allows you to automatically copy the trades of experienced traders on the platform, essentially piggybacking on their strategies. For a wide audience, copy trading is a friendly gateway into automated trading since you don’t have to design a strategy at all, you can follow someone who’s already proven successful.

Here’s why Phemex’s copy trading shines:

-

Learn and Earn Effortlessly: With copy trading, even users with minimal trading knowledge can potentially profit by following top traders. It’s a futures-based system where you allocate funds to a chosen lead trader, and then every buy or sell they execute is replicated in your account. This means you can learn viable strategies and earn from crypto without much trading experience. As the pro makes moves, your portfolio mirrors them.

-

New “Portfolio Firewall” – Risk Isolation: In 2026, Phemex introduced a game-changing update to copy trading. Previously, if you copied multiple traders, they shared one margin pool in your account, which could lead to conflicts or missed trades. Now, Phemex uses independent sub-accounts for each copied trader, like watertight compartments in a ship. This creates a firewall between strategies. The benefit is two-fold:

-

1. No Contagion Risk: If one lead trader you follow has a bad day or even gets liquidated, it only affects the funds you allotted to that trader. Your other copied strategies remain untouched and keep running. This caps your risk per strategy and protects your overall portfolio.

-

2. Effective Capital Allocation: Because each lead trader has dedicated funds, you won’t miss out on a trade signal because of another strategy hogging your capital. In the old shared model, sometimes a trade couldn’t execute if your balance was tied up elsewhere. Now, as long as the specific sub-account has funds, every signal from the lead trader will execute successfully.

-

Phemex Copy Trading (source)

-

Transparency and Trust: Phemex’s copy trading dashboard provides rich data to help you choose and monitor masters. You can compare stats like each trader’s profit/loss history, win rate, number of followers, and even see unrealized P&L on open positions in real time. This is another upgrade – many platforms only showed realized profits (hiding ongoing losses), but Phemex now shows floating P&L as well, so you aren’t blindsided by a strategy that is hiding a big unrealized drawdown.

-

Incentivized Experts: Copy trading isn’t just great for copiers as Phemex makes it attractive for the lead traders as well. They can set a profit share percentage to earn a cut of the profits made by their followers. Importantly, they only earn from profitable trades (they do not get a share of any follower losses). This aligns their incentives with yours since they’re motivated to manage risk and perform well because their income depends on their followers winning. This structure fosters a win-win scenario.

-

Diversification: Phemex allows you to diversify your approach by following multiple strategies at once. In fact, you can copy up to 20 different Lead Traders simultaneously with the new system. This opens the door to a “portfolio of strategies” much like a hedge fund would have. For example, you might allocate portions of your capital to 5 different day-traders, 5 swing traders, some algorithmic bot traders, etc., each in their own silo.

In summary, Phemex Copy Trading lets you tap into top trading talent and strategies from around the world, while controlling your risk and ensuring smooth execution.

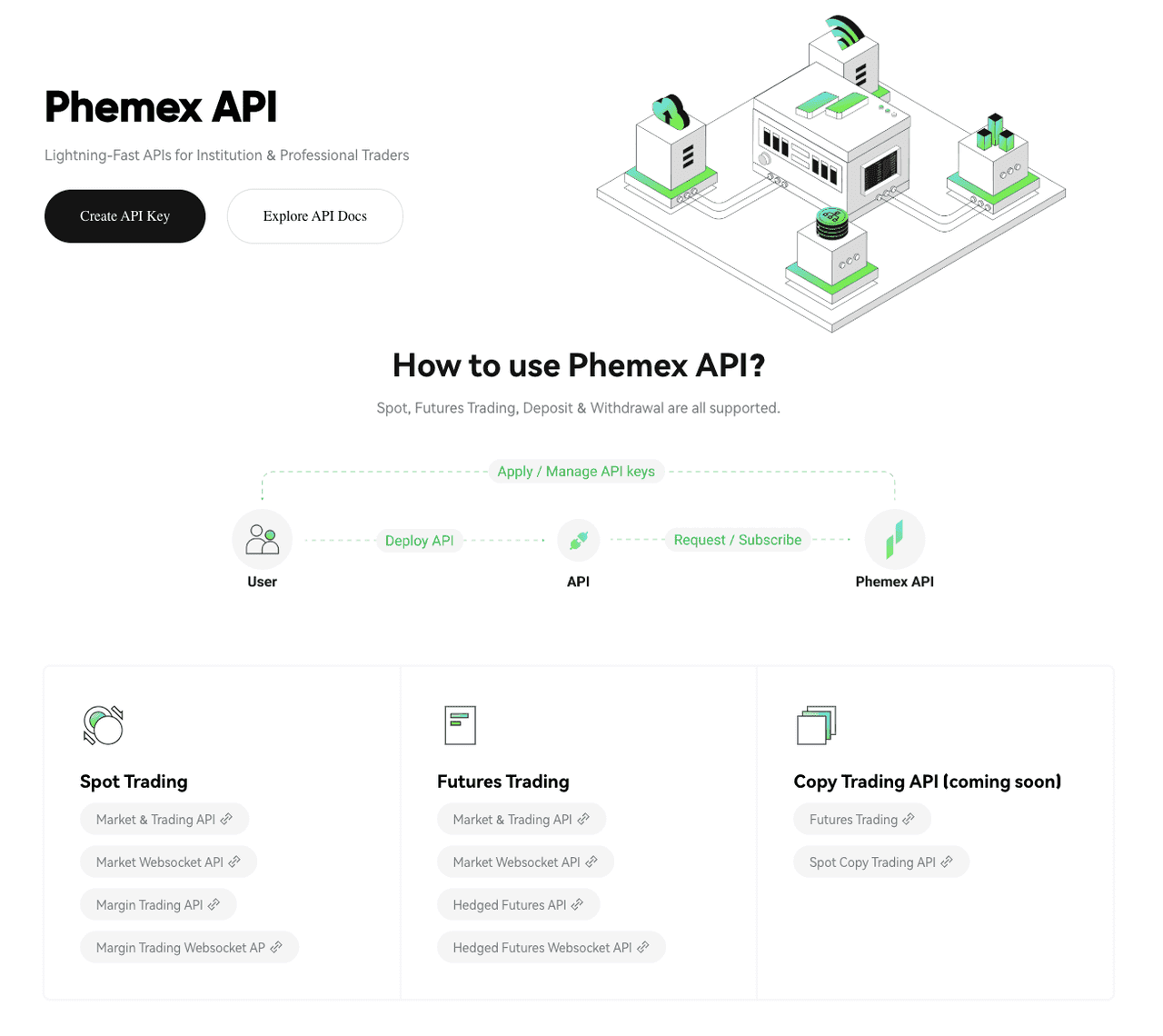

API Access: For Developers and Quants to Build Custom Bots

For technically inclined traders who want full control, Phemex offers a robust API (Application Programming Interface) that lets you connect your own algorithms and trading systems directly to the exchange. This is a critical piece for high-performance trading because it allows for custom strategies, high-frequency trading, and integration with external software.

Key highlights of Phemex API access include:

-

Comprehensive API Endpoints: Phemex offers both REST and WebSocket APIs for trading and market data, allowing actions like order placement and account checks, as well as real-time updates. Everything on the platform can be accessed programmatically, including advanced features like copy trading.

-

High Performance & Low Latency: Built for speed, Phemex’s trading engine supports 300,000 transactions per second, ensuring quick order execution essential for high-frequency trading. VIP API endpoints for institutional clients further enhance performance and reliability.

Phemex API (source)

-

Reliability for 24/7 Trading: Phemex is designed for 24/7 trading, maintaining stability during market volatility. Its hybrid architecture minimizes downtime, and the testnet allows safe strategy testing before going live.

-

Documentation and Support: The well-documented API includes standard conventions and offers code examples and SDKs. Phemex’s support team and community channels assist developers in building trading solutions.

-

Use Cases: API access allows for various applications, from market-making bots to statistical arbitrage and AI-driven trading strategies. With competitive fees, Phemex supports frequent trading without high costs.

In essence, if you have the know-how to code your strategy, Phemex ensures you have the connectivity and throughput to execute it effectively.

Explore Phemex API Capabilities

Execution Quality, Liquidity, and Reliability: The Phemex Edge

Having great tools like bots and copy trading is only half the story. The other half is the trading environment itself – execution quality, market liquidity, and platform reliability. This is where Phemex truly differentiates itself as the best platform for automated trading in 2026, because it provides an institutional-grade environment to all its users:

-

Lightning-Fast Execution: Phemex boasts one of the industry's quickest matching engines, processing up to 300,000 transactions per second. This means your trading bot can execute orders swiftly, allowing you to seize opportunities with minimal latency which is crucial for high-frequency strategies.

-

Tight Spreads & Minimal Slippage: Just recently Phemex introduced RPI (Retail Price Improvement), which narrows bid-ask spreads to as little as 1 tick. This enhancement significantly boosts liquidity, allowing traders to execute orders at expected prices, especially during volatile conditions. As a result, you benefit from tighter spreads and lower slippage, directly improving your profitability.

-

Deep Liquidity Pool: Phemex handles hundreds of millions in daily trading volume, thereby attracting an ample amount of both buyers and sellers. This deep liquidity allows automated traders to enter or exit positions without significant market impact. With thousands of trading pairs available across spot and futures, Phemex ensures effective execution and risk management for all trading strategies.

-

Reliability and Uptime: Phemex is known for its reliable performance, even during volatile market conditions. Its robust infrastructure has successfully managed traffic surges without major outages, making it ideal for automated trading. Both the mobile and web platforms are user-friendly, with advanced features praised by users.

-

Risk Management Tools: Phemex provides essential risk management tools, including various order types (market, limit, stop, conditional) and time-in-force settings to help control trades. Features like stop-loss and take-profit levels protect against unfavorable market movements. The platform also offers Simulated Trading for testing strategies without financial risk. Its isolated copy trading account system prevents a single trade from impacting your entire portfolio.

In combination, these qualities ensure that if you’re running automated strategies on Phemex, you’re running them in perhaps the best trading conditions available in crypto. Fast execution, ample liquidity, tight spreads, and solid reliability mean your strategies can do what they’re designed to do without hindrance.

Phemex Bot and Signal Marketplace (source)

FAQ: Frequently Asked Questions

Q1: Is Phemex suitable for beginners who want to use trading bots or automated strategies? A: Yes – Phemex’s automation features are designed to be accessible to a wide range of users. For those new to trading or to bots, Phemex offers one-click solutions like copy trading and the Bot Marketplace. You don’t need to know how to code or set up complex software. For example, a beginner can start with a simple Spot Grid Bot, which is recommended as a newbie-friendly bot due to its straightforward “buy low, sell high” strategy.

Q2: Do I have to pay extra to use Phemex’s trading bots or copy trading? A: No – both trading bots and copy trading are offered as built-in features at no additional cost from Phemex. All six trading bots on Phemex are completely free to use. There are no subscription fees which sets Phemex apart from many third-party bot platforms that charge monthly plans or commissions. Copy trading is similarly accessible to all users on the platform - you can allocate funds to copy traders without any entry fee.

Q3: Can automated trading on Phemex guarantee profits? A: No, there are no guarantees in trading. Automated trading is a powerful tool, but it’s not a magic money machine. The performance of trading bots or copy trading depends on the underlying strategy and market conditions. Phemex provides a solid infrastructure (fast execution, good liquidity, etc.) that can improve the consistency of execution, but it can’t make a fundamentally unprofitable strategy profitable. The platform encourages users to use tools like stop-loss orders and to start with small amounts precisely because losses are possible.

Q4: What makes Phemex “high performance” compared to other exchanges for automated trading? A: Phemex distinguishes itself through a combination of technology, trading conditions, and integrated features. Phemex’s backend is exceptionally fast with a matching engine rated for 300,000 TPS and a platform optimized for low-latency trade execution that can keep up with the fastest algorithms. It also offers advanced order types and an RPI mechanism that keeps trading efficient. Phemex also boasts deep liquidity and competitive fees, meaning automated strategies suffer less slippage and cost. Finally, Phemex is unique in how it integrates automation natively. You don’t need external software or to expose API keys to third parties because Phemex provides built-in bots and copy trading on its secure platform.

Q5: How can I practice or test my automated trading strategy on Phemex without risking real money? A: Phemex offers a couple of ways to practice before going live. The most direct is to use Phemex Simulated Trading. This is essentially a sandbox version of the exchange where you can trade with simulated funds. This is perfect for testing a new bot algorithm or getting a feel for copy trading without actual risk. Copy trading also often allows small allocations per trader. By using small position sizes, you can treat the first period as a “trial run” for your strategy. Phemex’s fee-free bots make this easier because you’re not losing money to subscription fees while testing.

Conclusion

By combining a user-friendly experience with cutting-edge trading technology, Phemex has positioned itself as the go-to platform for high-performance automated crypto trading in 2026. It’s the synergy of features that truly sets it apart: you have the convenience of one-click bots and copy trading for hands-free profits, matched with an institutional-grade engine that ensures those automated strategies execute swiftly and effectively. Traders on Phemex benefit from tight spreads, deep liquidity, and robust risk controls, all of which maximize the chances that an algorithmic strategy will succeed. Whether you’re a casual trader looking to have a bot earn passive income, or a professional quant running sophisticated strategies via API, Phemex provides the reliability and performance to meet your needs.