Introduction

Public blockchains expose every transaction, making data analysis straightforward but privacy challenging. Zama addresses this by integrating fully homomorphic encryption (FHE) into smart contracts, enabling confidential balances, amounts, and logic on public chains while preserving composability and programmability. Often described as the "HTTPS layer" for blockchain, Zama's protocol allows encrypted computations on existing L1s and L2s without revealing sensitive data. The $ZAMA token powers the ecosystem through protocol fees, staking rewards, operator incentives, and network security via a burn-and-mint model.

This guide covers what Zama is, how the ZAMA token works, its relevance in 2026, tokenomics, and how to buy ZAMA on Phemex.

Quick Facts About ZAMA

| Metric | Detail |

|---|---|

| Ticker Symbol | ZAMA |

| Blockchain/Network | Multi-chain (primarily Ethereum, also BSC and Solana) |

| Contract Address | Ethereum: 0xa12cc123ba206d4031d1c7f6223d1c2ec249f4f3 |

| Circulating Supply | 2.2 billion ZAMA |

| Total Supply | 11 billion ZAMA |

| Max Supply | 11 billion ZAMA (capped) |

| Primary Use Case | Utility token for protocol fees, staking, operator rewards, and securing the Zama Confidential Blockchain Protocol |

ZAMA Now Available on Phemex

Investors can now trade Zama (ZAMA) on Phemex via the Spot Trading zone. The ZAMA/USDT trading pair went live on February 03, 2026, at 10:00 UTC, providing a secure and convenient way to access this privacy-focused token on a centralized exchange.

What Is ZAMA?

Zama is an open-source cryptography company specializing in fully homomorphic encryption (FHE) to enable confidential smart contracts and applications on any public blockchain. The Zama Confidential Blockchain Protocol (live on mainnet) keeps on-chain data encrypted during computation, using coprocessors for scalability, low fees, and public verifiability. It supports Solidity-based confidential contracts (e.g., via euint types) and programmable compliance for decryption rules.

Key use cases include:

- Confidential DeFi (private swaps, lending, yield farming)

- Encrypted payments and stablecoins

- On-chain banking and RWA tokenization

- Sealed-bid auctions to prevent front-running

- Confidential governance, identity, and vesting

Zama achieves ~20 TPS per chain currently, with goals of 1,000 TPS in 2026 and 10,000+ TPS via FHE ASICs in development.

What Does ZAMA Do?

The $ZAMA token is the native utility asset of the Zama Protocol, enabling:

- Protocol fees — Paid in ZAMA (priced in USD via oracle) for ZKPoK verification, decryption, and ciphertext bridging; 100% of fees are burned.

- Staking and security — Holders stake to operators (coprocessors and KMS nodes) via Delegated Proof-of-Stake to secure the network and earn minted rewards (initial ~5% inflation, adjustable via governance).

- Operator rewards — Minted tokens reward node runners; delegators earn via liquid staking (7-day unbonding).

- Ecosystem incentives — Aligns developers, users, and contributors through fees, rewards, and growth initiatives.

The token launched February 2, 2026, following a successful sealed-bid Dutch auction (January 21–24, 2026) that raised over $118–121 million, oversubscribed significantly.

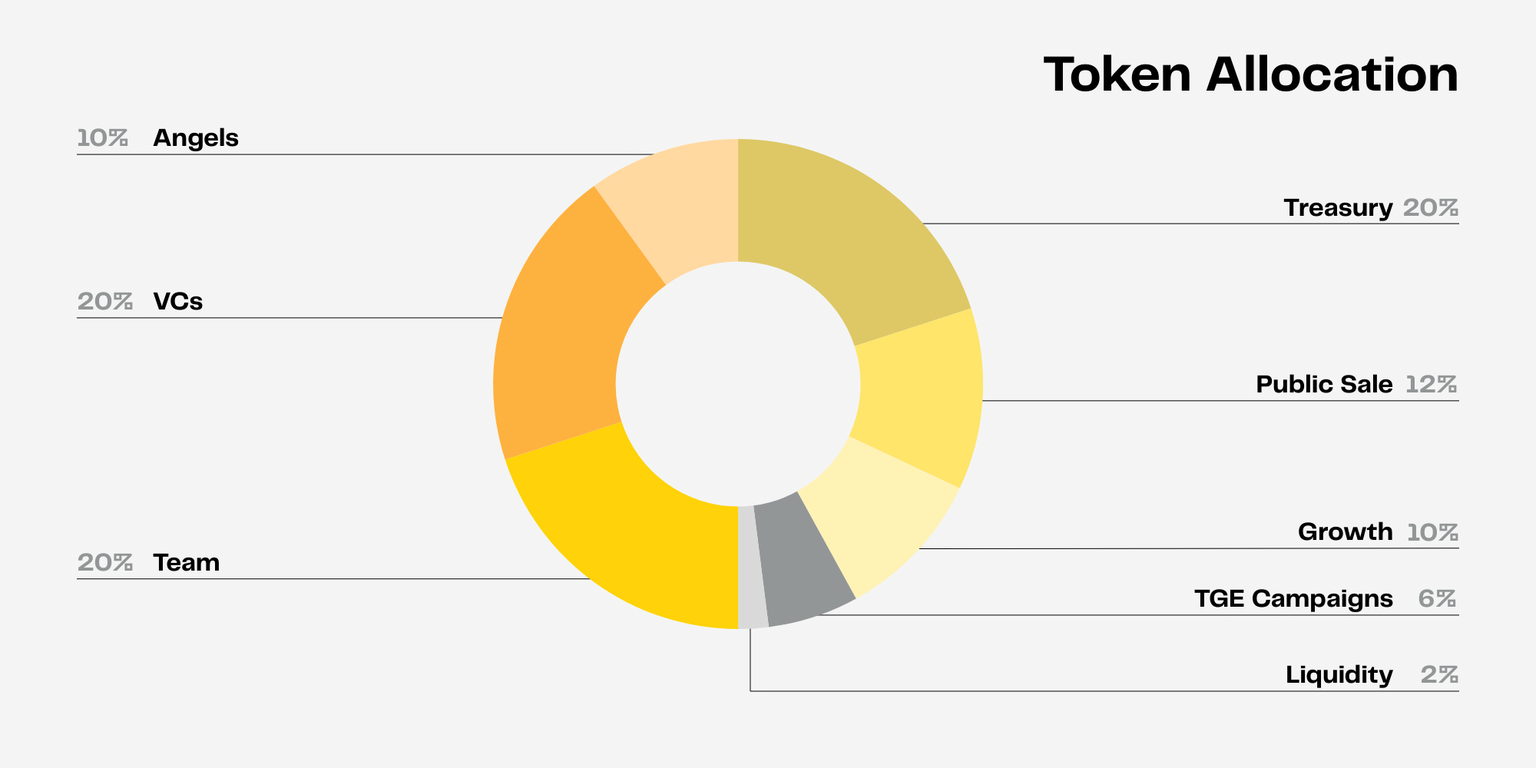

ZAMA Tokenomics

| Category | Allocation (%) | Approximate Amount | Vesting / Lockup Details | Notes |

|---|---|---|---|---|

| Total Supply | 100% | 11 billion ZAMA | Capped (fixed) | Confirmed max/total supply across sources. |

| Circulating Supply at Launch (TGE) | ~20% | ~2.2 billion ZAMA | Fully unlocked at TGE | Immediate liquidity post-launch (February 2, 2026). |

| Public Sale / Auction | ~12% | ~1.32 billion ZAMA | No lockup (fully unlocked) | Includes ~8–10% via sealed-bid Dutch auction + community sale. |

| TGE Campaigns / Community | ~6% | ~660 million ZAMA | No lockup | Rewards for early contributors, OG NFTs, etc. |

| Liquidity | ~2% | ~220 million ZAMA | No lockup | For exchange listings and DEX pools. |

| Treasury | ~20% | ~2.2 billion ZAMA | 2-year linear vesting, no cliff | For protocol development and reserves. |

| Growth / Ecosystem | ~10% | ~1.1 billion ZAMA | 4-year vesting, no cliff | Incentives for developers, partnerships, and adoption. |

| Team | ~20% | ~2.2 billion ZAMA | 4-year vesting, 1-year cliff, then linear unlocks | Aligned long-term incentives. |

| VCs (Investors) | ~20% | ~2.2 billion ZAMA | 2-year vesting, 1-year cliff, then linear unlocks | Series A/B rounds. |

| Angels | ~10% | ~1.1 billion ZAMA | 2-year vesting, 1-year cliff, then linear unlocks | Early backers. |

Additional Mechanics:

- Burn-and-Mint Model: 100% of protocol fees (paid in ZAMA, priced via oracle) are burned, creating deflationary pressure. New tokens are minted to reward operators (coprocessors, KMS nodes) and stakers.

- Inflation: Initial staking rewards set at ~5% annual inflation (adjustable via governance). No fixed maximum inflation beyond this initial rate.

- Staking & Rewards: Holders delegate/stake ZAMA to operators for network security; rewards distributed pro-rata (with 7-day unbonding period).

ZAMA vs. Similar Tokens

Zama competes in the FHE-blockchain privacy space, notably with Fhenix (another FHE-focused protocol for private smart contracts on Ethereum-like environments).

| Feature | ZAMA (Zama Protocol) | Fhenix |

|---|---|---|

| Use Case | Utility for confidential tokens, payroll, sealed auctions, cross-chain privacy layer | Generalized FHE for private dApps and smart contracts |

| Technology | FHE coprocessors on any L1/L2; encrypted composability | FHE rollup/L2 focus for Ethereum-compatible privacy |

| Key Differentiator | Live mainnet, sealed-bid auction distribution, high TPS goals, confidential payroll demos | Broad developer tooling for encrypted computation |

| Advantages | Proven auction (encrypted bids), community NFTs, burn-mint economics | Strong emphasis on Ethereum ecosystem integration |

Both advance beyond transparent chains, but Zama highlights production privacy use cases and fair token distribution.

Technology Behind ZAMA

Zama's core is fully homomorphic encryption (FHE), enabling computations on encrypted data without decryption. This powers:

- Confidential tokens — Hidden balances/amounts with standard asset behavior

- Encrypted logic — Private payroll, auctions (bids hidden, outcomes computed), and compliance rules

Coprocessors handle heavy FHE ops off-chain for efficiency, with ZK proofs for verifiability.

Team and Origins

Zama is a Paris-based open-source cryptography company founded to make FHE practical for blockchain and AI. It emphasizes research in homomorphic encryption and confidential computing, with milestones including mainnet launch, first encrypted payroll on Ethereum, and the ZAMA token auction. Community programs like OG NFTs (5,500 total, granting community sale access) reward early contributors.

ZAMA News and Milestones (2025–2026)

- December 30–31, 2025: Zama Confidential Blockchain Protocol launched on mainnet with the first confidential stablecoin transfer and staking live on Ethereum.

- January 5, 2026: Zama OG NFT collection (5,500 NFTs) introduced, rewarding early contributors and granting access to a community token sale.

- January 21–24, 2026: Sealed-bid Dutch auction for $ZAMA raised $118–121M, oversubscribed 218%, clearing at ~$0.05.

- Late January–February 2, 2026: Total Value Shielded (TVS) privacy metric introduced, surpassing $121M in encrypted on-chain value shortly after the auction.

- February 2, 2026: $ZAMA Token Generation Event occurred, with claims opening at Noon UTC and trading starting on major exchanges around 1:00 PM UTC.

- February 3, 2026: ZAMA/USDT spot trading pair went live on Phemex at 10:00 UTC.

Is ZAMA a Good Investment?

ZAMA provides exposure to the growing confidential blockchain sector via FHE, with real utility in fees and staking. Its fair launch (encrypted auction), mainnet traction, and scalability roadmap position it well for institutional/DeFi privacy adoption. However, success hinges on technical execution, ecosystem growth, and navigating competition/regulation. As with any crypto, assess development activity, TVS metrics, and integrations before investing.

How to Buy ZAMA on Phemex

- Sign Up: Register at https://phemex.com/register and complete verification.

- Fund Account: Deposit via credit card, bank transfer, or crypto.

- Buy ZAMA: Trade the ZAMA/USDT spot pair

Frequently Asked Questions (FAQ)

Q: What is ZAMA? A: The native utility token of the Zama Protocol, powering fees, staking, and security for confidential blockchain applications using FHE.

Q: How does Zama work? A: FHE enables encrypted computations in smart contracts on public chains, supporting private balances, logic, and composability via coprocessors.

Q: What are the main use cases of ZAMA? A: Paying fees, staking for rewards, securing operators, and participating in confidential DeFi, payments, auctions, and more.

Q: Where can I buy ZAMA? A: On Phemex (ZAMA/USDT spot).

Q: What makes ZAMA different? A: Focus on practical FHE for confidential tokens/payroll/auctions, cross-chain compatibility, and a privacy-first launch.

Q: What are the main risks? A: Technical/crypto risks, competition, regulation, and market volatility.

Summary: Why It Matters

ZAMA bridges advanced cryptography and on-chain finance, making confidentiality native to public blockchains via FHE. With live mainnet, successful token launch, and expanding use cases like encrypted DeFi and RWAs, Zama aims to redefine blockchain privacy. Explore and trade ZAMA on Phemex today.