Summary Box (Quick Facts)

-

Ticker Symbol: TRADOOR

-

Chain: TON (The Open Network), BNB Chain

-

Contract Address: 0x9123400446a56176eb1b6be9ee5cf703e409f492

-

Circulating Supply: 14.35 Million TRADOOR.

-

Total Supply: 60 Million TRADOOR.

-

Primary Use Case: Decentralized leverage trading for options and perpetual contracts.

-

Current Market Cap: $18.55 Million.

What Is Tradoor?

Tradoor is a decentralized finance (DeFi) platform designed for trading crypto options and perpetual contracts with leverage. What is Tradoor? It provides a simple and efficient way to trade with up to 100x leverage on assets like Bitcoin and Ethereum. The platform is accessible across web, mobile, and directly through the Telegram app, aiming to onboard Telegram's large user base into DeFi. Tradoor explained, is a system focused on user-friendliness, transparent pricing, and security. It is also developing a premium AI-powered trading assistant, "Quant AI," designed to help users automate their trading strategies.

How Many TRADOOR Are There?

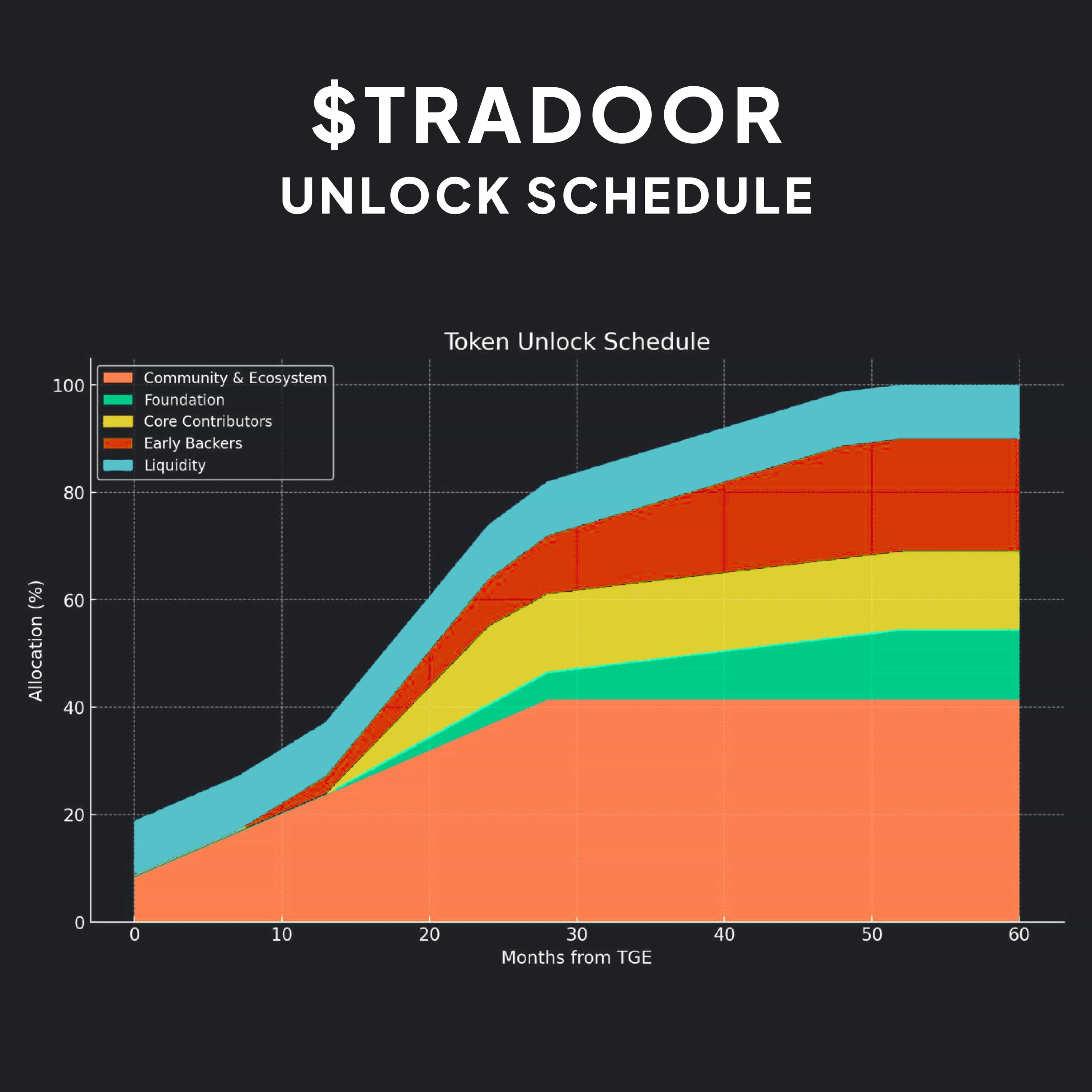

Tradoor has a maximum supply of 60 million TRADOOR tokens. Of this total, the current circulating supply is 14.35 million. The distribution of the tokens is allocated across several key areas to support the project's long-term growth and development:

-

Community & Ecosystem: 41.4%

-

Early Backers: 21.0%

-

Core Contributors: 14.6%

-

Foundation: 13.0%

-

Liquidity: 10.0%

The project has a structured token unlock schedule to ensure a gradual release of tokens into the market over 60 months. The Community & Ecosystem allocation begins unlocking first, with a continuous "airdrip" starting from month three to reward community members and contributors. Tokens for Early Backers begin to unlock gradually after month six, while allocations for Core Contributors and the Foundation start a slower unlock schedule after the first year.

What Does TRADOOR Do?

The TRADOOR token is integral to its ecosystem, which is built to deliver a seamless leveraged trading experience. The Tradoor use case centers on several key functions and user benefits:

-

High-Speed Trading: Orders are confirmed in approximately 50 milliseconds, enabling rapid trade execution.

-

Transparent Pricing: The platform operates with no hidden costs, locking in the price at the moment a user places an order.

-

On-Chain Privacy: Trades are executed in a way that prevents front-running, protecting users' strategies from being exploited by others.

-

Robust Security: It incorporates an AI-enhanced liquidity shield to protect against market manipulation and an Auto Deleveraging (ADL) system to manage risk during extreme market volatility.

-

Multi-Chain Access: Initially launching on The Open Network (TON), Tradoor plans to expand to other blockchains in the future.

Tradoor vs. Bitcoin

Tradoor and Bitcoin serve distinct purposes within the cryptocurrency landscape. Their underlying technology and primary functions are fundamentally different.

| Feature | Tradoor | Bitcoin |

| Technology | A DeFi application built on The Open Network (TON) for multi-chain functionality. | Operates on its own pioneering blockchain technology. |

| Speed and Fees | Designed for high-speed trades (50ms confirmation) with minimal gas fees. | Transaction times and fees can vary, becoming slow and costly during peak network usage. |

| Use Case | A decentralized platform for trading leveraged financial instruments like perpetuals and options. | A peer-to-peer digital currency and a recognized store of value. |

| Decentralization and Security | A decentralized application with multiple security layers, including an AI shield and ADL system. | A highly decentralized and secure network with over a decade of proven operational history. |

The Technology Behind Tradoor

Tradoor's technical architecture is built on The Open Network (TON), which facilitates fast, scalable, and low-cost transactions. The platform's engine includes several key components:

-

Normal Distribution-Based AMM (NDMM) Pricing Mechanism: Instead of a traditional order book, Tradoor uses a unique Automated Market Maker model. This system uses a normal distribution-based algorithm to set contract prices based on the balance of long and short positions relative to the total liquidity. In this model, the platform's liquidity pool acts as the direct counterparty to every trade.

-

Tradoor Liquidity Provider (TLP): This is the platform's central liquidity pool. The TLP's funds are sourced from users who deposit assets, and it serves as the counterparty for all trades, absorbing traders' profits and losses. The TLP earns income from a share of trading fees and funding fees.

-

AI-Enhanced Liquidity Shield: This security feature is designed to protect traders and liquidity providers from manipulative trading activities and sudden, adverse market movements.

-

Auto Deleveraging (ADL): This system serves as a crucial risk management tool. During periods of extreme market volatility, the ADL system can automatically reduce traders' leverage to prevent cascading liquidations and ensure the platform remains solvent and free from counterparty risk.

Team & Origins

Detailed information about the founding team of Tradoor is not publicly available in the project's documentation. The project launched in September 2025 and has since attracted a notable following, including influential figures in the DeFi space like Tarun Chitra of Gauntlet and Seraphim Czecker of leftcurve.ai.

Key News & Events

While specific dates are not always available, key milestones for Tradoor include:

-

Platform Launch: Tradoor went live in September 2025.

-

Initial DEX Offering (IDO): The project conducted an IDO on the Solanium launchpad to distribute its tokens.

-

Exchange Listings: The TRADOOR token is available for trading on Phemex and other crypto exchanges.

-

Community Growth: The project has cultivated a large online community, with over 374,000 followers across various social media platforms.

Is TRADOOR a Good Investment?

Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.

The Tradoor investment potential is a subject of discussion. The project has demonstrated strong initial growth, a growing user base, and significant trading volume. Its focus on security, user experience, and integration with Telegram positions it as a noteworthy contender in the DeFi space.

However, potential investors should consider the risks. The DeFi sector is highly competitive, and Tradoor's long-term success will depend on its ability to innovate and retain users. The inherent volatility of the cryptocurrency market and evolving regulatory landscapes are also important factors. In conclusion, Tradoor may present a compelling opportunity for those bullish on the future of decentralized derivatives, but it remains a high-risk, high-reward asset.

Community Perspectives (via Reddit)

On platforms like Reddit, Tradoor has a growing community of enthusiastic users. Discussions often praise the platform's low fees, high leverage options, and intuitive interface. Some members, however, have raised questions regarding the anonymity of the team and the project's long-term roadmap.

How to Buy TRADOOR on Phemex

Phemex offers a comprehensive platform for engaging with TRADOOR. You can easily purchase the token on the spot market. To learn How to buy TRADOOR, follow the detailed instructions in our dedicated guide. For more advanced strategies, you can also Trade TRADOOR perpetual contracts with leverage in our futures market. Get started now on Phemex.

FAQs

What is the primary use case for the TRADOOR token?

The TRADOOR token is the native utility token for the Tradoor ecosystem, a decentralized platform for trading leveraged crypto options and perpetual contracts.

What blockchain is Tradoor built on?

Tradoor is initially built on The Open Network (TON) blockchain, with plans to become accessible on multiple chains in the future.

Is Tradoor a decentralized exchange?

Yes, Tradoor is a decentralized finance (DeFi) application, often referred to as a DEX, that facilitates the peer-to-peer trading of crypto derivatives.

Summary: Why It Matters

Tradoor is a noteworthy project because it seeks to make sophisticated trading tools like leverage and derivatives more accessible to a broad audience. By focusing on a simplified user experience, low costs, and robust security, Tradoor is positioned to attract both novice and experienced traders. Its integration with Telegram also presents a powerful channel for user acquisition. As DeFi continues to expand, platforms like Tradoor that prioritize accessibility and safety will likely play a key role in its evolution.

Ready to explore the future of trading? Join Phemex Academy to sharpen your skills or Trade Now to put your knowledge to the test. For more News about Tradoor and insights on the TRADOOR price, check out the Phemex platform.