Summary Box (Quick Facts)

-

Ticker Symbol: US

-

Chain: Sui

-

Contract Address: 0xee962a61432231c2ede6946515beb02290cb516ad087bb06a731e922b2a5f57a::us::US

-

Circulating Supply: Approx. 2.22 Billion US (at TGE)

-

Total Supply: 10 Billion US (Fixed)

-

Primary Use Case: Powering a composable framework for decentralized AI agents through fees, staking, and governance.

-

Current Market Cap: Approximately $50 million

-

Availability on Phemex: Yes (Spot)

What Is Talus Network (US)?

For years, crypto has lacked the infrastructure to make autonomous AI agents a reality. Blockchains can verify information, but they can’t reason. Smart contracts can execute logic, but they can’t truly act. Talus Network was created to close this gap by giving blockchains, as the project describes it, "both a brain and a hand." What is Talus Network? It is a decentralized protocol that provides a programmable layer for autonomous action, enabling AI agents to execute real-world tasks, coordinate complex workflows, and generate verifiable economic value directly on-chain.

Built on the high-performance Sui Network, Talus introduces the Talus Agentic Framework (TAF), a standard for AI services to interact seamlessly. This solves a major limitation in the space, allowing developers to build sophisticated AI applications with composable, Lego-like modules. The network's native token, US, is the economic vehicle designed to power this entire ecosystem, aligning the incentives of developers, users, and node operators.

How Many US Tokens Are There?

The tokenomics of the US token are designed for long-term sustainability, driven by real network usage rather than inflation.

-

Max Supply and Inflation: The total supply of US is fixed at 10 billion tokens, created at genesis. The model has 0% inflation, meaning no new tokens will be minted.

-

Deflationary Mechanisms: The network incorporates deflationary pressure through its usage. When users pay for workflow execution using SUI, a portion is automatically converted to US on the open market, creating constant buy pressure. Staking mechanisms also lock up supply, increasing scarcity as the ecosystem grows.

-

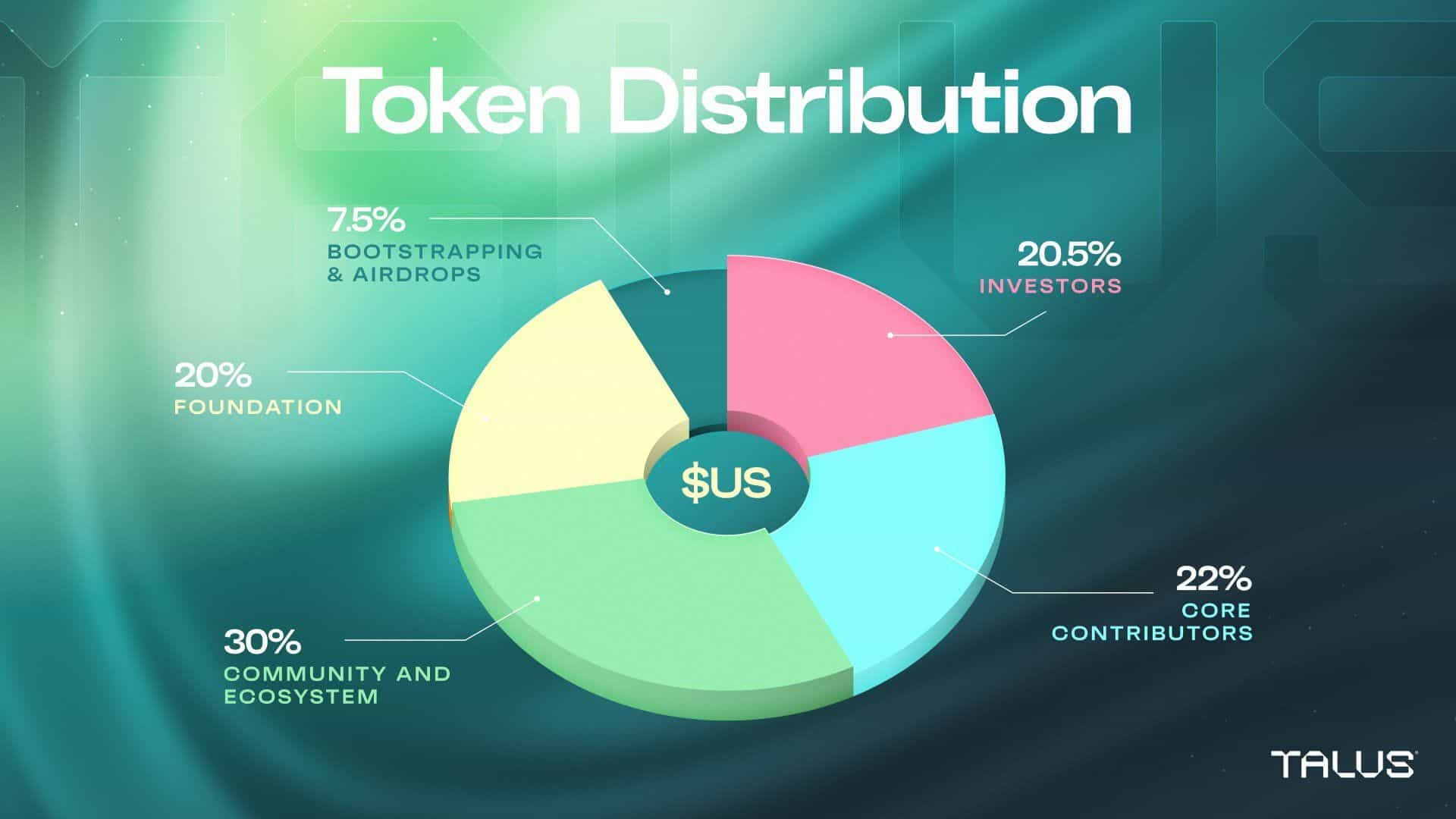

Token Allocation: The distribution is structured for long-term alignment:

-

Community & Ecosystem (30%): The largest portion, reserved for developer grants, user incentives, and DAO initiatives. Unlocks linearly over 36 months.

-

Core Contributors (22%): For the Talus Labs team, with a 12-month cliff and 36-month linear vesting to ensure multi-year commitment.

-

Investors (20.5%): For early backers, with a 12-month cliff and 24-month linear vesting to align them with long-term success.

-

Talus Foundation (20%): Supports research, decentralization, and global expansion. Unlocks linearly over 36 months.

-

Bootstrapping & Airdrop (7.5%): Funds the initial airdrop and early community engagement programs. At the Token Generation Event (TGE), approximately 22.2% of the total supply became circulating.

-

What Does the US Token Do?

The US token is the core economic asset that coordinates and powers the Talus Network. The primary Talus Network use case is multifaceted, making the token essential for nearly every network action.

-

Workflow Execution: All economic activity generated by workflows running on the Nexus engine is paid for in US.

-

Tool & Agent Monetization: Developers can build and register their own AI services as "Talus Tools," earning US every time their tool is used in a workflow.

-

-

Leader Nodes: Operators of the Leader Network (which coordinates workflows) must stake US to participate. They earn fees for good behavior, while malicious activity results in their stake being slashed.

-

Tool Registration: Developers must stake US to list their tools in the marketplace, ensuring a level of quality and preventing malicious modules.

-

-

Execution Priority: Users and applications can spend US to request higher-priority execution from the Leader Network, which becomes more valuable as network activity increases.

-

Loyalty Rewards: Before full network staking is live, users can lock their US in the Loyalty Reward Program (LRP) to earn rewards from a dedicated pool.

-

Governance: US holders will guide the protocol’s future, voting on upgrades, treasury allocations, and the long-term decentralization roadmap.

Talus Network (US) vs. Ethereum

| Feature | Talus Network (US) | Ethereum (ETH) |

| Primary Use Case | Specialized infrastructure for decentralized AI agents and agentic workflows. | A general-purpose platform for decentralized applications (dApps) and smart contracts. |

| Underlying Technology | A protocol layer built on the Sui blockchain. | A standalone Layer-1 blockchain. |

| Transaction Model | Object-centric (on Sui), allowing for parallel transaction processing. | Account-based, which processes transactions sequentially. |

| Performance | High throughput and low fees, designed for real-time AI computation. | Can experience network congestion and high gas fees during peak usage. |

| Programming Language | Move (on Sui), designed for security and formal verification of assets. | Solidity, the most widely adopted smart contract language. |

| AI Integration | Native and standardized through the Talus Agentic Framework (TAF). | No native framework; requires custom, often complex, and non-standardized solutions. |

| Composability | Purpose-built for composing modular AI services ("Talus Tools") into complex "Workflows." | High composability between smart contracts, but not specifically optimized for AI services. |

The Technology Behind Talus Network

The technical foundation of Talus is its innovative Talus Agentic Framework (TAF), a composable system for defining and executing on-chain services.

-

Talus Tools: These are the basic building blocks—modular on-chain services that perform a specific function, from a simple smart contract to a complex off-chain AI model accessed via a secure on-chain interface.

-

Talus Workflows: These are created by combining multiple Tools into a sequence, represented as a Directed Acyclic Graph (DAG), to perform complex tasks.

-

Talus Agents: An on-chain identity that can own assets and execute Workflows. Its actions are governed by auditable smart contracts, not a private key.

-

Nexus Engine: This is the implementation of the TAF on Sui. It includes on-chain smart contracts and an off-chain Leader Network that acts as an oracle and messenger to coordinate tasks securely.

Team & Origins

Talus Network was launched in December 2025 by Talus Labs, Inc., a Delaware-based technology company. The project is supported by a global team of core contributors and has received over $10 million in funding from prominent venture capital firms, including Polychain Capital, Sui Foundation, and Animoca Brands.

Key News & Events

-

Token Generation Event (TGE): The US token launched in December 2025 and was listed on Phemex and other platforms.

-

Airdrop Program: The TGE included an airdrop for community contributors and holders of "Tallys" (testnet participation rewards) to bootstrap the community.

-

Successful Testnet: The project's testnet saw over 35,000 users complete more than 72,000 AI-driven tasks, validating strong interest in the platform.

-

Strategic Partnerships: Talus has formed key partnerships with the Sui Foundation and Walrus Protocol to enhance its on-chain infrastructure. More news about US can be found on official channels.

Is Talus Network (US) a Good Investment?

Talus Network is positioned at the intersection of AI and crypto, with a tokenomic model designed for long-term, sustainable growth.

-

The Token Flywheel: The project's economy is built on a powerful feedback loop: more apps lead to more workflows, which generates revenue paid in US. This revenue drives token demand and scarcity, which in turn strengthens the token, attracting more builders to create more apps. This usage-driven model avoids artificial yield and inflationary pressures.

-

Long-Term Alignment: The token allocation includes long vesting schedules (12-month cliffs and multi-year unlocks) for the team and investors, ensuring they are committed to the project's long-term success rather than short-term speculation.

-

Market Positioning: The Talus Network investment potential is linked to its unique vision of becoming the foundational layer for the autonomous agent economy. If the "AI x Crypto" narrative continues to grow, Talus is well-positioned to be a leader.

-

Risks: Like any crypto project, Talus faces risks from market volatility and regulatory uncertainty. Its ultimate success depends on its ability to attract a critical mass of developers and users to create a thriving ecosystem of tools and agents.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Crypto trading involves significant risks; only invest what you can afford to lose.

Community Perspectives (via Reddit)

Community discussions praise Talus Network's clear vision and robust tokenomics. Users often highlight the non-inflationary, usage-driven model as a major strength compared to other projects. The detailed vesting schedules for insiders are seen as a strong confidence signal. The "token flywheel" concept is frequently discussed as a sustainable model for long-term value accrual, showing that the team has put significant thought into creating a healthy economic ecosystem.

How to Buy US on Phemex

For a detailed guide, visit Phemex's dedicated page on "How to buy US." Here is a quick summary:

-

Create a Phemex Account: Sign up on the Phemex website or app and complete verification.

-

Fund Your Account: Deposit crypto or purchase it directly on Phemex.

-

Navigate to Spot Trading: Go to the "Spot Trade" section and search for the US/USDT trading pair.

-

Place Your Order: Choose your order type, enter the amount, and click "Buy US." Once filled, you are ready to trade US.

FAQs

What problem does Talus Network solve?

Talus Network solves the challenge of integrating AI with blockchain by providing a standardized protocol (TAF) that allows different AI services to be securely and transparently composed together on-chain, enabling the creation of complex, autonomous AI agents.

What is the US token used for?

The US token is used for all economic activity on the network, including paying for workflow execution, staking to run nodes and register tools, monetizing AI services, prioritizing transactions, and governing the protocol's future.

Is Talus Network inflationary?

No, Talus Network has a fixed total supply of 10 billion US tokens and 0% inflation. Its economic model is deflationary, driven by real network usage that creates sustained demand for the token.

Summary: Why It Matters

Talus Network is building the essential infrastructure for an autonomous, on-chain AI economy. By giving blockchains a "brain and a hand," it empowers developers to create intelligent, decentralized applications that were previously impossible. Its sustainable, usage-driven tokenomics are designed to create a powerful flywheel effect where network growth directly translates to token value. As AI reshapes our world, a transparent and secure platform like Talus will be critical for coordinating a new generation of autonomous agents.