Reddio (RDO) is a groundbreaking Layer 2 blockchain solution designed to enhance Ethereum's scalability and performance. By leveraging parallel execution, GPU acceleration, and zero-knowledge proofs, Reddio aims to provide a high-throughput, low-latency environment for decentralized applications (dApps), particularly in the realms of gaming, DeFi, and AI.

Summary Box: Reddio (RDO) Quick Facts

-

Ticker Symbol: RDO

-

Chain: Ethereum

-

Contract Address: 0x57240C3E140f98abe315CA8E0213c7a77F34A334

-

Circulating Supply: Data not yet available

-

Max Supply: 10,000,000,000 RDO

-

Primary Use Case: Gas fees, staking, governance on Reddio Layer 2

-

Current Market Cap: Data not yet available

-

Availability on Phemex: NO(as of writing)

❓ What Is Reddio?

Reddio is a high-performance Layer 2 blockchain solution designed to enhance Ethereum's scalability and computational capabilities. By leveraging parallel execution and GPU acceleration, Reddio aims to provide a robust infrastructure for decentralized applications (dApps) in sectors like DeFi, gaming, and AI. The native token, RDO, serves as the backbone of the Reddio ecosystem, facilitating transactions, staking, and governance.

How Many RDO Tokens Are There?

-

Max Supply: 10,000,000,000 RDO

-

Circulating Supply: 0 RDO (as of May 29, 2025)

-

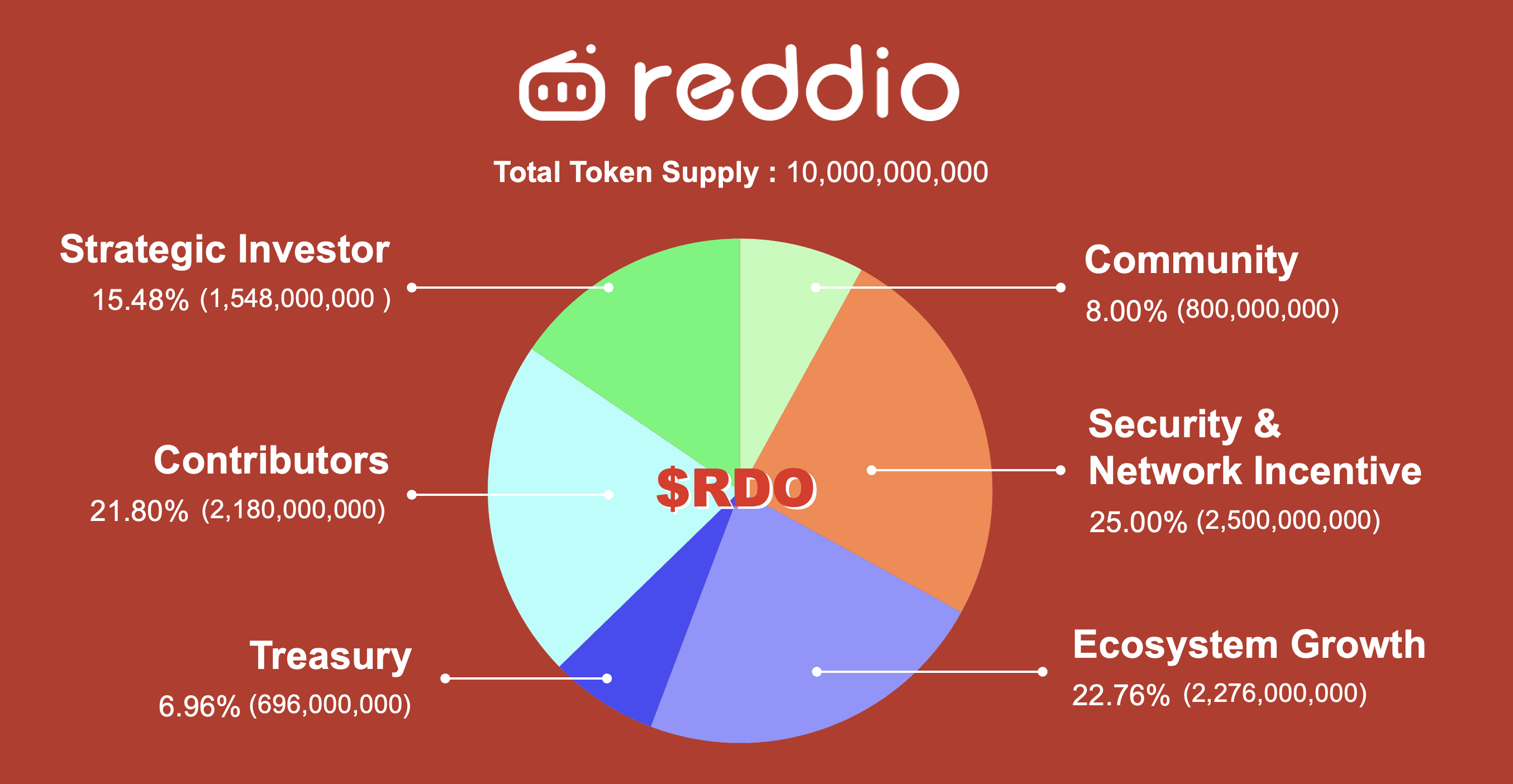

Token Distribution:

-

Community: 8%

-

Security & Network Incentive: 25%

-

Ecosystem Growth: 22.76%

-

Treasury: 6.96%

-

Contributors: 21.8%

-

Strategic Investors: 15.48%

-

Reddio's tokenomics are designed to ensure network decentralization, incentivize early adopters, and support long-term sustainability.

Vesting Plan

Reddio’s tokenomics are structured to promote stability and long-term engagement. With an initial circulating supply of just 19.00% at the Token Generation Event (TGE), the project aims to reduce early market volatility. Vesting schedules incorporate cliff periods to ensure team commitment, while linear unlocks help align incentives with sustained ecosystem growth.

? What Does RDO Do?

Utility

RDO plays a multi-dimensional role in the Reddio ecosystem, powering essential functions that drive network utility, security, and growth. Here’s a closer look at the core RDO use cases:

-

Transaction Fees

RDO is required as the base currency for all transactions on the Reddio network—whether it’s deploying smart contracts or transferring tokens. This ensures a steady demand for RDO as network activity scales. -

Staking for Rewards

Users can stake RDO to earn a share of transaction fee revenues generated on the network. This incentivizes long-term participation and aligns user engagement with the platform’s success. -

Boosting Ecosystem Health

Staking also helps increase key metrics like Total Value Locked (TVL) and trading volume. A higher TVL signals trust and adoption, attracting more users and developers to the Reddio platform. -

Validator Participation

Validators are required to stake RDO to participate in Reddio’s Proof-of-Authority (PoA) consensus mechanism. This ensures that only trusted, identifiable parties can validate blocks, enhancing network security and integrity. -

Network Security

Validators who stake RDO are financially invested in the network’s success. Misbehavior could lead to reputational damage and loss of staked assets, incentivizing honest participation and reliable operation. -

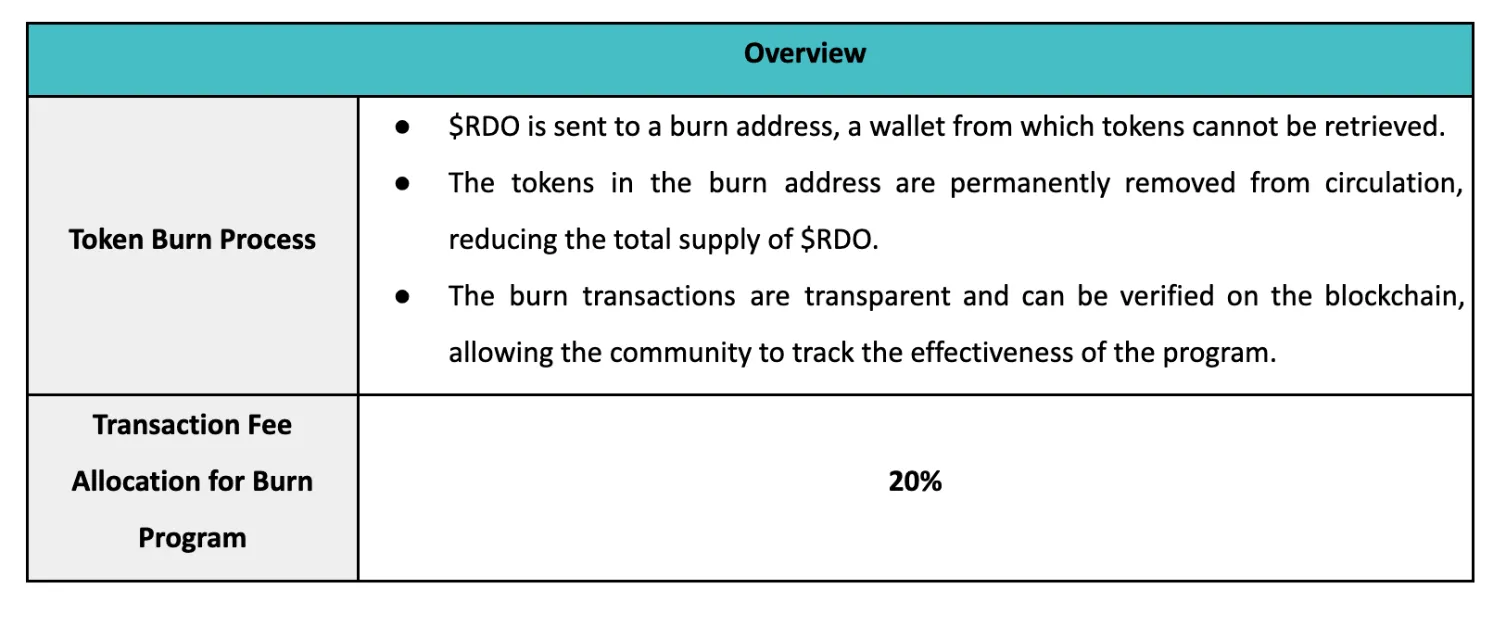

Deflationary Burn Mechanism

Up to 20% of transaction fees are allocated for periodic token burns, gradually reducing RDO’s circulating supply over time. This burn program is designed to support long-term token value by introducing deflationary pressure.

RDO Token Value Flow: The Engine Behind Reddio’s Economy

RDO’s value flow is carefully structured to power the Reddio network’s operations, incentivize stakeholders, and sustain long-term growth. Here’s how it works:

-

Inflow Sources

RDO enters the ecosystem through key stakeholders—holders, validators, and dApp partners—who use the token for staking, paying transaction fees, and participating in network activities.-

Transaction Fees: Collected from user and dApp interactions; a portion is routed to the Treasury for reinvestment.

-

Staking Contributions: Validators and partners stake RDO to participate in consensus and secure the network.

-

-

Treasury Allocations

The Treasury distributes collected RDO across strategic channels to fuel the ecosystem:-

Mining Reward Pool: Rewards validators for block production and verification.

-

Revenue Sharing: Distributed to stakers as rewards, incentivizing participation.

-

Ecosystem Growth: Funds grants and incentive programs for developers and partners.

-

Burn Program: Periodically removes RDO from circulation to create deflationary pressure.

-

-

Outflows & Incentives

-

Validators earn RDO from the Mining Reward Pool as compensation for securing the network.

-

Holders and dApp developers receive RDO via staking rewards or grants, depending on their contributions.

-

The Burn mechanism reinforces token value by reducing supply over time.

-

This comprehensive value flow ensures that RDO is not just a utility token, but a foundational asset that fuels the operational, economic, and governance layers of the Reddio network. Each component is designed to maintain token relevance, strengthen the ecosystem, and reward long-term engagement.

⚔️ RDO vs Bitcoin

| Feature | RDO (Reddio) | Bitcoin |

|---|---|---|

| Consensus | Proof-of-Authority (PoA) | Proof-of-Work (PoW) |

| Transaction Speed | High (parallel execution) | Low (sequential processing) |

| Use Case | DeFi, gaming, AI applications | Digital currency, store of value |

| Scalability | High (Layer 2 solution) | Limited (Layer 1) |

| Energy Efficiency | High (GPU-accelerated) | Low (energy-intensive mining) |

he Technology Behind RDO

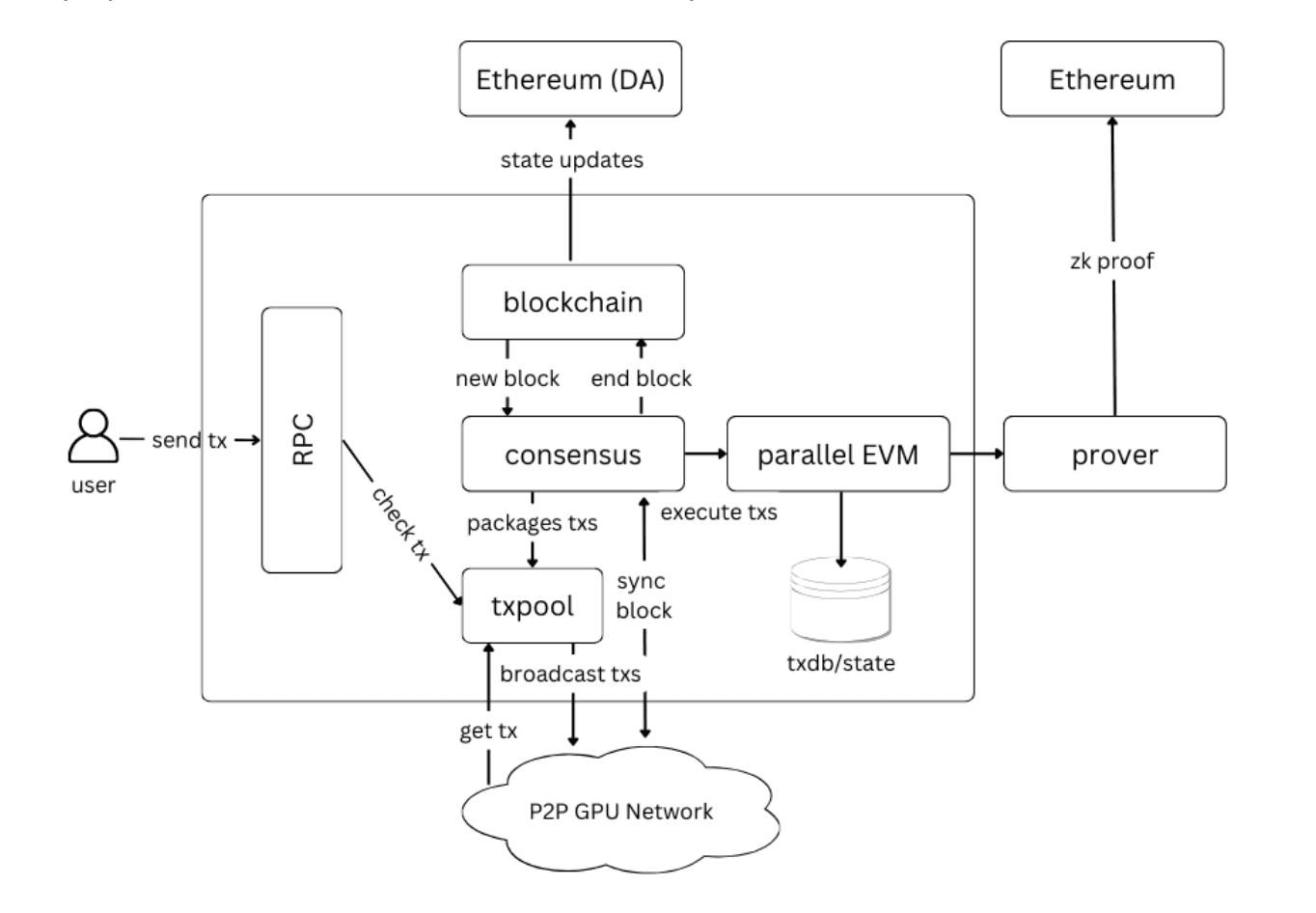

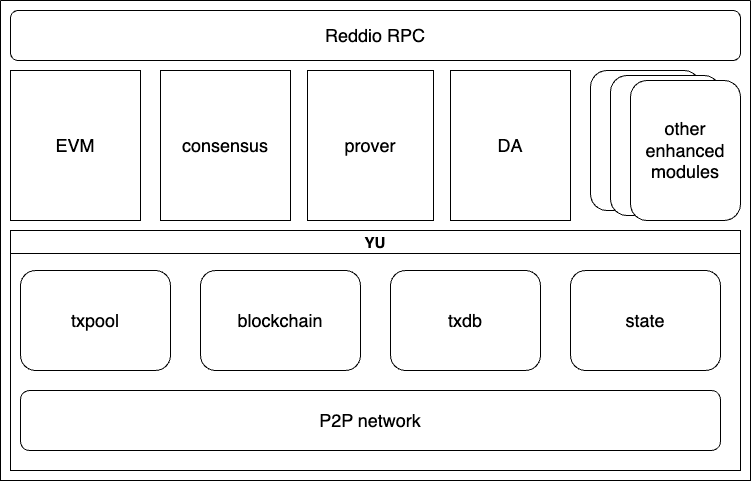

Reddio's architecture is built upon several innovative technologies:

Parallel EVM Execution: Powering Scalable Smart Contracts

At the core of Reddio’s technology is the Parallel EVM—an enhanced version of the Ethereum Virtual Machine (EVM) designed to tackle the limitations of sequential transaction processing. Unlike the standard EVM, which processes transactions in a linear, one-by-one sequence (similar to a single checkout lane in a crowded store), the Parallel EVM introduces concurrent execution. This allows multiple transactions and smart contracts to be processed simultaneously, improving network efficiency and reducing congestion during high activity periods.

The Parallel EVM builds upon the principles outlined in the Block-STM research paper, enabling independent transactions—those without dependencies on other operations—to be handled in parallel. For example, within a decentralized exchange (DEX), multiple trades can be executed at the same time, vastly improving throughput compared to a standard EVM environment. Transactions that are interdependent, such as those requiring a prior transaction to complete, still follow a sequential order to maintain consistency.

The advantages of Parallel EVM are notable:

-

Increased Scalability: By enabling parallel processing, Reddio can handle higher transaction volumes and support a broader range of applications.

-

Faster Performance: Reduced latency leads to quicker transaction finality and an improved user experience.

-

Enhanced Security: By alleviating network bottlenecks, Parallel EVM reduces risks associated with congestion and system overloads.

-

Wider Application Support: The network’s improved efficiency allows it to power diverse use cases, including DeFi protocols, gaming applications, and AI integrations.

GPU Acceleration: Unlocking High-Performance Smart Contract Execution

Reddio integrates GPU acceleration to enhance the speed and scalability of smart contract processing on Ethereum-compatible Layer 2 networks. By collaborating with the National University of Singapore and contributing to the CuEVM project, Reddio leverages NVIDIA’s CUDA (Compute Unified Device Architecture) platform to translate Ethereum Virtual Machine (EVM) opcodes into GPU-executable instructions.

Here’s how it works:

-

Opcode Translation: EVM bytecode is parsed, and individual opcodes (instructions like arithmetic, memory access, control flow) are mapped to equivalent CUDA kernels.

-

Parallel Execution: CUDA kernels enable thousands of simultaneous threads to process transactions and smart contracts, significantly boosting throughput compared to traditional CPU-based systems.

-

Optimized Memory Management: Efficient data handling between CPU and GPU minimizes latency and maximizes the performance gains from GPU acceleration.

By offloading intensive computations to GPUs, Reddio can process transactions faster, support more complex applications, and reduce operational costs. This approach positions Reddio as a high-performance, scalable solution for the growing demands of DeFi, gaming, and AI-driven dApps.

Incorporating GPU acceleration gives Reddio a competitive edge, enabling the platform to handle higher volumes of transactions with lower latency, improved efficiency, and enhanced scalability—all essential traits for a robust Layer 2 network.

Modular Sequencer SDK: A Flexible Toolkit for Scaling dApps

Reddio’s Modular Sequencer SDK is an open-source solution built on the Yu framework and written in Golang, offering developers a highly flexible and customizable toolkit for scaling decentralized applications (dApps). Designed to simplify blockchain development, the SDK allows seamless integration of multiple virtual machines (VMs) and data availability (DA) layers, enabling developers to build tailored solutions with ease.

Key features of the Modular Sequencer SDK include:

-

Support for Multiple VMs: Compatible with EVM, Parallel EVM, CairoVM, zkWASM, RISC0, MoveVM, and more—without resource conflicts.

-

Flexible DA Integration: Easily integrates with Ethereum, Celestia, Avail, and other DA solutions.

-

Advanced Proving and Anti-MEV Protections: Aggregates zk proving systems and provides anti-MEV capabilities to protect users from unfair value extraction.

-

Customizable Consensus: Developers can choose from popular consensus mechanisms like PoW, PoS, PBFT, dBFT, or HotStuff, or even create custom protocols for high-performance use cases.

-

Layer 3 Appchain Support: Helps developers launch custom L3 Appchains when Layer 2 scalability is not enough, supporting real-time, high-throughput applications like gaming or DeFi.

-

Cross-dApp Interoperability: Enables low-latency interactions across different applications, such as triggering actions between a DeFi platform and a blockchain game.

By providing a modular, developer-friendly SDK, Reddio empowers projects to build scalable, high-performance solutions on Layer 2 and beyond. The SDK is available open-source for developers seeking to launch their own app-specific chains or dApps within the Reddio ecosystem.

Team & Origins

Reddio was founded in 2021 by Neil Han, who brings over 15 years of experience in the APAC and EMEA markets, including roles at Twilio and PingCAP. The project is headquartered in Singapore and has received backing from notable investors such as Paradigm, Arena, and Paramita Venture.

Key News & Events

-

May 29, 2025: Reddio (RDO) completed its Token Generation Event (TGE), marking the official launch of the RDO token into the market.

-

May 2025: Reddio introduced a points-based incentive campaign, allowing users to engage with the platform and earn points through various ecosystem activities. These points can potentially be redeemed for future rewards, supporting long-term community participation and engagement.

Is RDO a Good Investment?

? Evaluating RDO’s Investment Potential

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and assess your risk tolerance before making investment decisions.

RDO offers a compelling value proposition within the Layer 2 landscape, but like any crypto asset, it carries both opportunities and risks. Here’s a balanced breakdown:

✅ Pros

-

Innovative Technology Stack

Features like Parallel EVM execution, GPU acceleration, and the Modular Sequencer SDK position Reddio as a highly scalable and developer-friendly platform. -

Deflationary Mechanisms

The burn program, which removes a portion of transaction fees from circulation, may support long-term value by reducing token supply over time. -

Ecosystem Incentives

Staking rewards, validator participation, and points-based campaigns aim to foster community growth and sustained engagement. -

Customizable Infrastructure

Support for multiple VMs, data availability layers, and consensus protocols gives developers flexibility to build diverse applications.

❌ Cons

-

Early-Stage Risks

Reddio is a relatively new project, and its long-term adoption and success are still unproven. -

Market Competition

The Layer 2 space is crowded, with established players and constant innovation that could challenge Reddio’s market position. -

Regulatory Uncertainty

As with all crypto assets, RDO faces potential risks from regulatory shifts, especially in key markets. -

Limited Market Data

Given the recent Token Generation Event (TGE), RDO lacks a long-term price history, making it difficult to assess historical performance.

For those considering an investment, it’s important to monitor news about RDO, track RDO price trends, and understand how to buy RDO and trade RDO on platforms like Phemex. As with any crypto investment, careful research and risk management are essential.