When FTX collapsed in November 2022, users lost access to $10-50 billion in assets overnight. The exchange had secretly used customer deposits to cover its own losses, and nobody knew until it was too late.

This is why Proof of Reserves exists: cryptographic verification that your funds are actually there. At Phemex, we publish real-time proof that our assets exceed our liabilities, and every user can independently verify their own balance using our Merkle Tree verification tool.

What Is Proof of Reserves?

Proof of Reserves (PoR) is a verification method that proves a crypto exchange holds enough assets to cover all user deposits.

When you deposit 1 BTC, the exchange should hold exactly 1 BTC in reserve — not lend it out, not use it for trading, not move it anywhere. PoR proves this is actually happening.

A complete Proof of Reserves shows three things:

|

Verification

|

What It Proves

|

|

Asset Ownership

|

The exchange controls the wallets it claims to own

|

|

1:1 Backing

|

Total reserves ≥ total user deposits

|

|

Your Inclusion

|

Your specific balance is accounted for

|

The challenge is proving all of this without exposing every user's private balance information. This is where Merkle Trees come in.

How It Works: Merkle Trees Explained

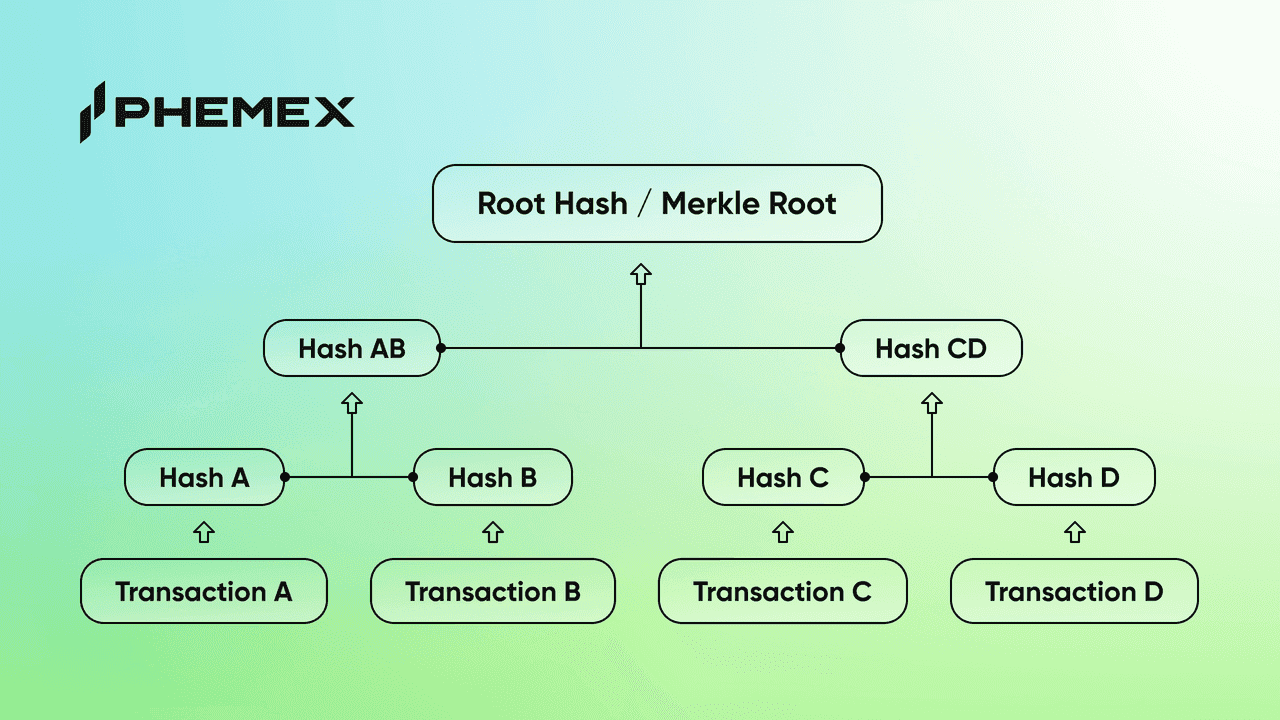

A Merkle Tree is a data structure that allows verification of large datasets without revealing individual details.

Here's how Phemex uses it:

Step 1: Snapshot All Balances

We take a snapshot of every user's balance at a specific moment. Each balance is anonymized using a unique identifier — only you can access your record.

Step 2: Build the Tree

All balances are hashed (converted into unique codes) and organized into a tree structure:

The final output is a single Merkle Root — a cryptographic fingerprint representing ALL user balances combined.

Step 3: Prove Assets Exist

We publish our cold wallet addresses and sign cryptographic messages proving we control them. Anyone can verify these holdings on the blockchain.

Step 4: You Verify

You check that your balance is included in the Merkle Tree. If your data matches the published Merkle Root, your funds are verified.

The key insight: If even one digit changes in any balance, the entire Merkle Root changes. Tampering is mathematically impossible to hide.

Proof of Reserves vs. Proof of Solvency

There's an important distinction:

|

Concept

|

What It Proves

|

Limitation

|

|

Proof of Reserves

|

Exchange holds assets

|

Doesn't show debts

|

|

Proof of Liabilities

|

Total user deposits

|

Doesn't prove assets exist

|

|

Proof of Solvency

|

Assets ≥ Liabilities

|

Complete picture

|

An exchange could have $1 billion in reserves but also owe $2 billion in corporate loans. Basic PoR wouldn't reveal this.

Proof of Solvency = Proof of Reserves + Proof of Liabilities

This is why Phemex publishes both — not just our assets, but our total liabilities. You can download the data and verify yourself that our assets cover all user deposits.

From our official announcement:

"Phemex has not borrowed funds or have any outstanding corporate loans. We are so confident in this claim that if anyone proves that we owe them, we are happy to repay that proved corporate loan amount 10 times over."

How to Verify Your Funds on Phemex

Phemex doesn't ask you to trust third-party auditors. You verify directly.

Step-by-Step:

-

Log in to your Phemex account

-

Find your Hashed Client ID in your dashboard

-

Enter your Hashed Client ID

-

Select the proof date

-

View your balances (BTC, ETH, USDT, USDC, USD)

-

Click "Check" to see your position in the Merkle Tree

-

Compare your leaf hash against the Merkle Root

If your data matches, your funds are verified as part of Phemex's reserves.

For detailed instructions: How to Use the Phemex PoR Tool

What Phemex Provides:

|

Component

|

What You Can Verify

|

|

Merkle Tree

|

Your balance is included in total liabilities

|

|

Cold Wallet Addresses

|

Our assets exist on-chain

|

|

Downloadable Liabilities

|

Total user deposits (anonymized)

|

|

No-Debt Guarantee

|

10x repayment promise if proven wrong

|

Conclusion

After FTX, the crypto industry learned that trust without verification is worthless. Proof of Reserves (powered by Merkle Tree cryptography) gives you the tools to confirm your funds are safe without relying on anyone's word.

At Phemex, we publish both our assets and liabilities. Every user can independently verify their balance is backed 1:1 and ready for withdrawal at any time.

Don't trust. Verify.

Cryptocurrency trading involves risk. This article is for educational purposes only.