Key Takeaways

- Fogo (FOGO) is a specialized SVM-based Layer 1 blockchain built for low-latency DeFi and real-time on-chain trading, optimized via a pure Firedancer client.

- The FOGO token powers gas fees, staking, and ecosystem incentives under a community-first model emphasizing airdrops and long-term vesting.

- Trade FOGO now on Phemex futures/spot + join the Token Fiesta (Jan 15–22, 2026) to share 30,000 USDT in rewards!

Introduction

Fogo is a high-performance Layer 1 blockchain powered by the Solana Virtual Machine (SVM) and optimized with a pure Firedancer client for sub-40 ms block times and deterministic execution.

It’s engineered to bring exchange-grade performance to on-chain DeFi, focusing on fairness and throughput rather than general-purpose smart contracts.

By leveraging trading-optimized architecture and curated validator participation, Fogo aims to bridge the gap between centralized exchanges and decentralized protocols, enabling real-time institutional-grade markets.

Quick Facts About FOGO Token

| Metric | Detail |

|---|---|

| Ticker | FOGO |

| Blockchain | Fogo Layer 1 (SVM-compatible, Firedancer-optimized) |

| Genesis / Total Supply | 10,000,000,000 FOGO |

| Circulating Supply (around TGE) | 3.75B FOGO (reflects pre-/early-launch unlocked portion) |

| Primary Use Cases | Gas fees, staking yield, DeFi incentives, governance alignment |

Quick Trading Links

- Spot Trading: You can trade FOGO/USDT on the spot market.

- Futures Trading: You can trade FOGO/USDT on the futures market.

What Is Fogo Blockchain?

Fogo is a trading‑optimized SVM Layer 1 engineered for decentralized finance (DeFi) and high-frequency on-chain trading. Unlike general-purpose chains, it prioritizes ultra-low latency and execution fairness through curated validators, native price feeds, enshrined DEX primitives, and co-located liquidity—targeting professional-grade markets running fully on-chain.

Key features

-

SVM + pure Firedancer client: Parallel execution plus an optimized networking stack for high throughput and resilient performance, while remaining compatible with much of the Solana tooling ecosystem.

-

Sub‑40ms block times and fast finality: A consensus and networking design that aims for highly responsive confirmations suitable for HFT, derivatives, and real‑time financial applications.

-

Gas-free sessions (Fogo Sessions): Users can interact with dApps in session mode, reducing friction from constant fee prompts and improving UX for active traders.

-

DeFi-centric primitives: Built‑in support for on-chain order books (CLOBs), batch auctions, and liquidation logic designed to minimize unfair MEV and improve execution quality.

-

Community-first launch model: Emphasis on airdrops and vested allocations over large early sales, aligning long-term contributors and reducing concentrated presale supply.

FOGO Token Utility

Core utilities

-

Gas and fees: FOGO pays for transactions and smart contract execution on the Fogo chain.

-

Staking and security: Validators and delegators stake FOGO to help secure the network and earn rewards, aligning token holders with chain uptime and performance.

-

Incentives and growth: Ecosystem incentives, grants, and potential partner revenue-sharing models can direct value back to builders, dApps, and liquidity providers, creating a growth flywheel linked to on-chain activity.

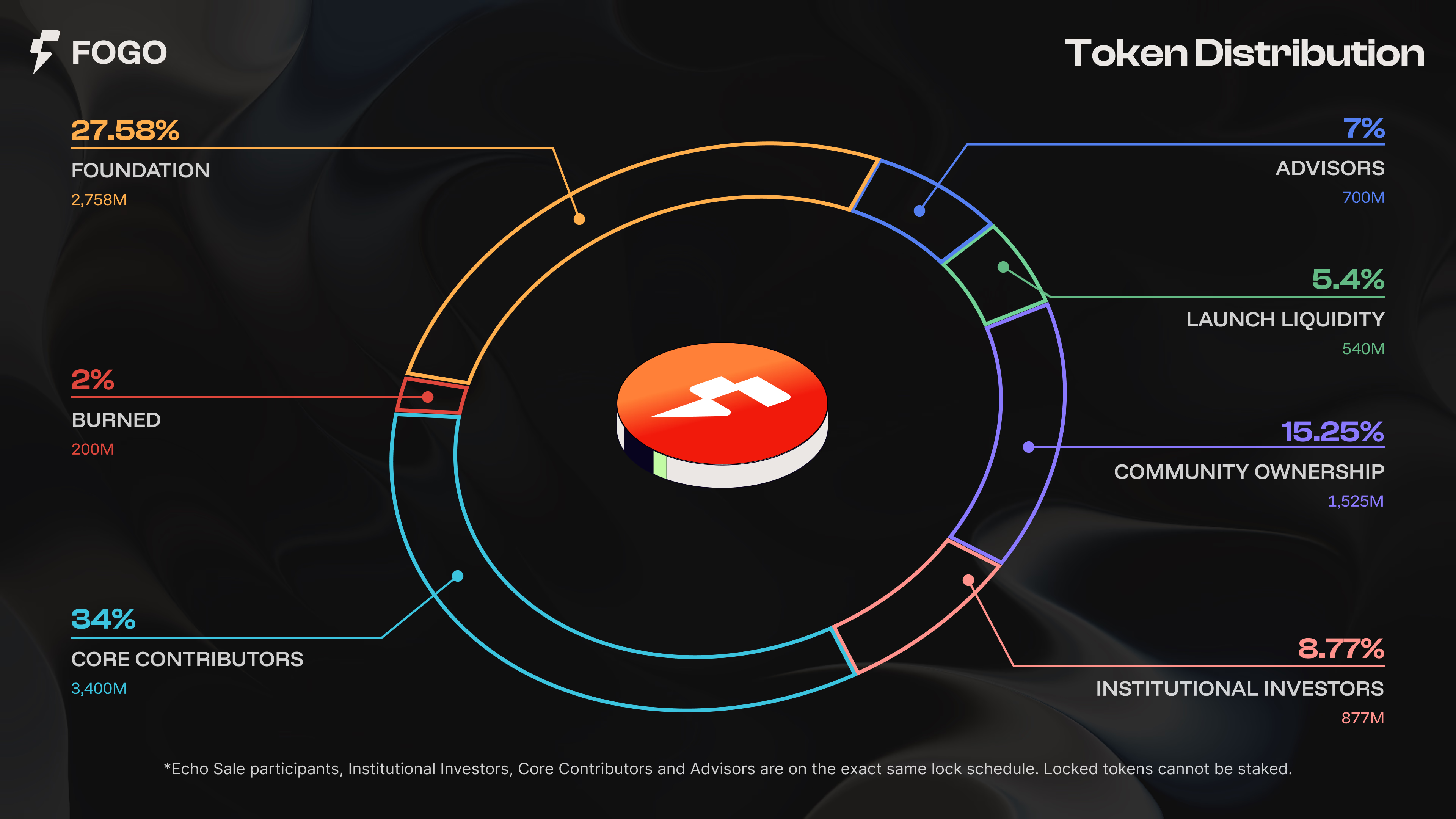

FOGO Token Tokenomics

| Allocation Category | Percentage | Status at TGE (Jan 13, 2026) | Vesting Details | Explanation |

|---|---|---|---|---|

| Community Ownership | 15.25% | Partial (Airdrop unlocked) | Echo: 4-yr / 12-mo cliff | Rewards early users/traders via airdrop + points programs |

| Core Contributors | 34% | Locked | 4-yr / 12-mo cliff | Aligns team long-term; prevents early dumps |

| Foundation | 27.58% | Unlocked | Grants/incentives | Funds ecosystem growth, partnerships |

| Institutional Investors | 8.77% | Locked | 4-yr / 12-mo cliff | Limited early access; vested for stability |

| Advisors | 7% | Locked | 4-yr / 12-mo cliff | Expert guidance vested long-term |

| Launch Liquidity | 5.4% | Unlocked | DEX provisioning | Ensures initial trading depth |

| Burned | 2% | Burned | N/A | Reduces supply permanently |

This structure reduces immediate sell pressure at launch, concentrates early supply in the foundation, liquidity, and airdrop allocations, and ties a majority of tokens to long-term vesting schedules for builders, supporters, and partners.

FOGO vs Solana (SOL): Key Comparison

Fogo is designed as a specialized chain, while Solana remains a more general‑purpose ecosystem.

| Feature | FOGO (Fogo) | SOL (Solana) |

|---|---|---|

| Primary use case | Ultra-low-latency trading & institutional DeFi | General-purpose (DeFi, NFTs, gaming, more) |

| Architecture | SVM + pure Firedancer, curated validators | SVM + PoH/PoS, multiple validator clients |

| Block time / latency | Targeting sub‑40ms block times, ~1.3s finality | ~400ms average block times |

| Key differentiator | Enshrined DEX primitives, colocation, MEV reduction | Larger, mature ecosystem and tooling |

| Token role | Gas, staking, trading-focused incentives | Gas, staking, broad ecosystem incentives |

In short, Fogo deliberately narrows its focus toward speed and deterministic execution for trading, whereas Solana supports a wider variety of applications and already has deeper liquidity and infrastructure.

Fogo Mainnet Launch & Milestones (2025–2026)

-

July 2025: Public testnet launch with early Fogo Sessions.

-

Dec 11, 2025: Tokenomics announcement; shift toward more community‑heavy distribution and airdrop emphasis.

-

Jan 6, 2026: Final airdrop snapshot completion.

-

Jan 13, 2026: Mainnet and TGE (Token Generation Event), with the first 1.5% of the airdrop claimable.

-

Post-launch: Gradual roll‑out of grants, ongoing rewards, and expansion of validators, dApps, and liquidity venues.

Is FOGO a Good Investment in 2026?

FOGO is a high-risk, high-reward play on specialized, trading‑centric infrastructure in DeFi. It may appeal to investors who:

-

Believe low-latency, real-time on-chain trading will attract serious institutional and professional volume.

-

View Fogo’s tokenomics (airdrop-heavy, long vesting for insiders) as a positive alignment mechanism.

-

Are comfortable with the risks of a new L1 competing in a crowded, fast-moving SVM/EVM landscape.

Key considerations:

-

Upside: If Fogo reliably delivers its performance claims and becomes the go‑to chain for HFT and derivatives, FOGO could benefit from sustained gas, staking, and incentive demand.

-

Downside: Execution, competition, volatility, regulatory risk, and unlock schedules all mean the token can be highly volatile, and losses—including total loss—are possible.

FOGO is generally more appropriate for aggressive, experienced investors rather than conservative, long‑only profiles. Any allocation should be sized cautiously and fit within a diversified portfolio, with close monitoring of real post‑launch metrics such as uptime, throughput under load, TVL, trading volume, and developer traction.

Trade FOGO Now on Phemex

Get started with FOGO spot and futures trading today. Phemex offers seamless access with up to 20× leverage on futures and direct spot pairs. Plus, the Token Fiesta event is live — trade FOGO (and ZAMA) to share 30,000 USDT before Jan 22, 2026 (UTC)!

Quick Start Guide

-

Register & KYC: Sign up at Phemex and complete verification (required for rewards).

-

Deposit USDT: Fund your account via crypto, fiat, or transfer.

-

Trade FOGO:

-

Futures (20× leverage): Trade FOGO/USDT Futures

-

Spot: Trade FOGO/USDT Spot

-

-

Join Token Fiesta: Register Now

Event ends Jan 22, 2026 (rewards by Jan 29). New traders get exclusive bonuses — first come, first served!

Why Fogo Matters in 2026

In 2026, DeFi is shifting from purely retail experimentation to more institutional-grade strategies that demand faster execution, deeper liquidity, and more predictable settlement than most blockchains currently offer. Fogo directly targets this gap by optimizing for sub‑second finality and ultra‑low-latency block production, aiming to make on-chain trading feel closer to centralized exchange performance while retaining transparency and composability.

As on-chain derivatives, HFT strategies, and real‑world asset (RWA) platforms expand, demand grows for infrastructure that can handle bursty, latency-sensitive order flow without congesting or degrading user experience. Fogo’s SVM + Firedancer stack, curated validator design, and trading‑centric primitives position it as a focused competitor in this niche, giving FOGO a clear narrative tied to measurable metrics like TPS, block time, DeFi TVL, and institutional participation.

FOGO FAQ (2026)

Q: What is Fogo (FOGO)?

A: Fogo is a high-performance Layer 1 blockchain built on the Solana Virtual Machine (SVM) and optimized with a pure Firedancer client to deliver ultra-low-latency, high-throughput execution for DeFi and on-chain trading. Its native token, FOGO, powers gas fees, staking, and ecosystem incentives.

Q: What makes Fogo different from other Layer 1 blockchains?

A: Unlike general-purpose chains, Fogo is narrowly focused on low-latency trading and institutional DeFi. It targets sub‑40ms block times, ~1.3s finality, gas-free sessions, and built‑in DEX primitives such as on-chain order books and batch auctions, aiming to provide exchange-like performance fully on-chain.

Q: How is FOGO used on the network?

A: FOGO is used to pay transaction fees, stake to secure the validator set and earn rewards, and participate in ecosystem incentive programs such as grants, liquidity incentives, and partner rewards. Growing on-chain activity and DeFi usage can increase aggregate demand for FOGO as gas and staking collateral.

Q: What is the total supply and tokenomics of FOGO?

A: FOGO has a 10 billion genesis supply, with 2% burned to reduce effective supply, and around 39% unlocked at TGE for the foundation, launch liquidity, and community airdrops. The remaining ~59% is locked and vests over four years with a 12‑month cliff for core contributors, investors, and advisors, designed to limit early sell pressure and align long-term incentives.

Q: How does Fogo compare to Solana (SOL)?

A: Both Fogo and Solana use the SVM, but Solana is a broad, general‑purpose ecosystem, while Fogo is more specialized around ultra-fast trading and DeFi. Solana offers a larger, more mature ecosystem with diverse use cases; Fogo trades some decentralization and breadth for tighter latency targets, curated validators, and trading‑first features.

Q: What are the main risks of investing in FOGO?

A: Key risks include technical execution risk as a new L1, strong competition from Solana and other high-performance chains, volatility around token unlocks, regulatory uncertainty affecting DeFi and derivatives, and the possibility that institutions stick with existing platforms instead of migrating to Fogo.

Q: Is FOGO suitable for conservative investors?

A: FOGO is generally more appropriate for aggressive, risk‑tolerant investors who specifically want exposure to low-latency DeFi infrastructure. Conservative investors may find its new-chain risk, competition, and volatility unsuitable for a core portfolio position.

Q: How can traders get exposure to FOGO on Phemex?

A: Traders can access FOGO through listed FOGOUSDT contracts on Phemex, using linear USDT‑margined perpetual futures to go long or short with adjustable leverage. Also, users can buy and sell the token directly on the spot market.

Q: What on-chain metrics should FOGO holders watch?

A: Important indicators include mainnet uptime and stability, realized block times and finality under load, DeFi total value locked (TVL), on-chain trading volume, the number of active validators and stakers, and growth in applications such as DEXs, lending platforms, and RWAs built on Fogo.