Introduction

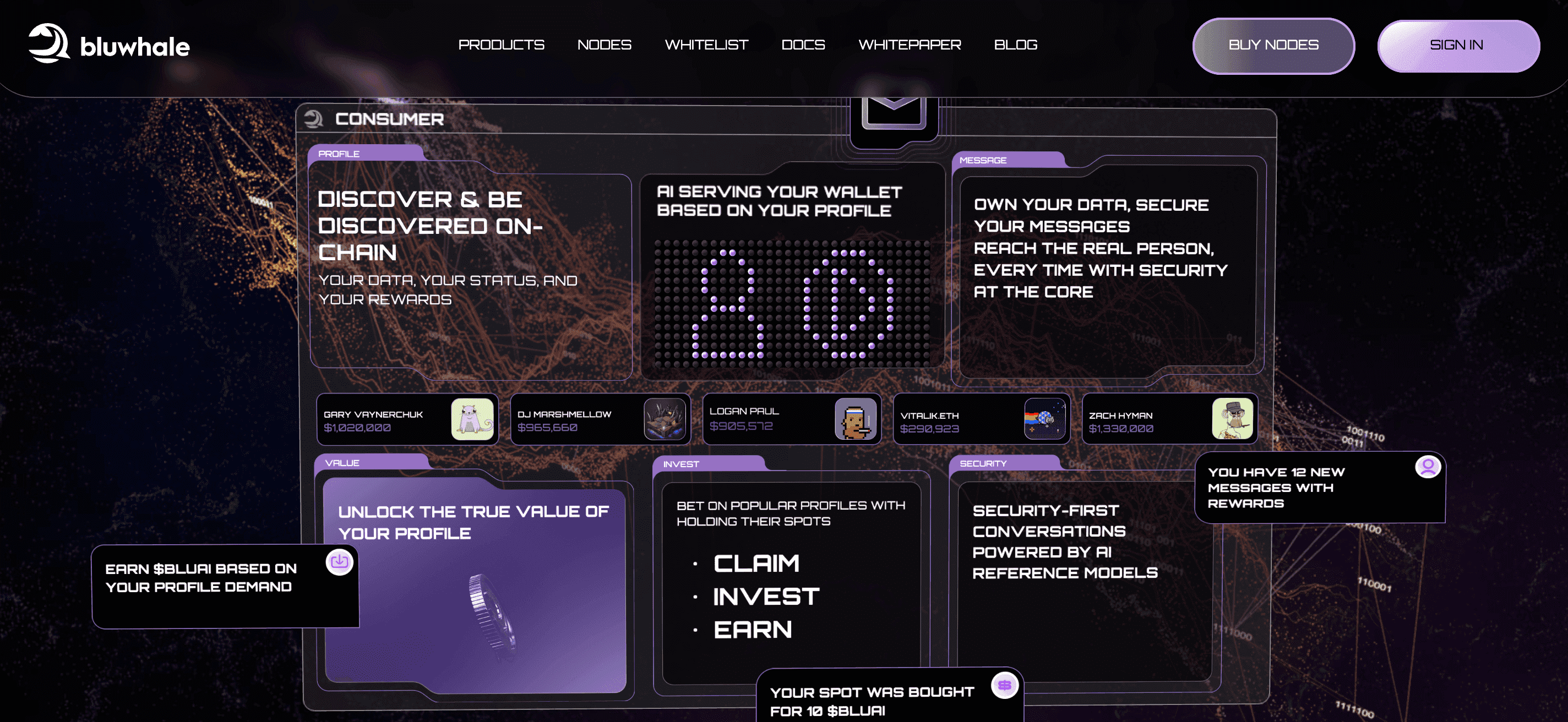

In an era of fragmented financial data, connecting traditional banking with blockchain assets for personalized AI-driven services remains elusive. BLUAI powers BluWhale, a Web3 platform that deploys AI agents to analyze multi-chain user behavior, transforming complex profiles into insights, services, and transactions. As a BEP-20 utility token on Binance Smart Chain, BLUAI incentivizes participation through node rewards and gas fees, promoting user-owned financial intelligence. Unlike centralized data silos, BluWhale emphasizes privacy and decentralization, backed by global institutions. With AI finance surging in 2025, BLUAI enables accessible, secure financial tools via mobile. This guide explains the BLUAI token, its role in BluWhale's decentralized intelligence layer, and how to trade it on Phemex.

Quick Facts About BLUAI

|

Ticker |

BLUAI |

|---|---|

|

Chain |

Binance Smart Chain (BEP-20) |

|

Contract Address |

0xed9Ae3DEF8d6F052971Bb8b6d1975FF267Cf9aaD |

|

Circulating Supply |

1.22B |

|

Total Supply |

10B |

|

Max Supply |

10B |

|

Use Case |

Gas for AI queries, node verification, data incentives in financial AI |

|

Availability on Phemex |

Spot (BLUAI/USDT) |

What Is BLUAI? BluWhale Explained

BluWhale is a decentralized AI network acting as Web3's intelligence layer, connecting traditional finance with digital assets via AI agents that analyze user behavior across blockchains. It addresses the problem of captive intelligence in closed platforms by enabling user-controlled data contributions from wallets, banks, and credit cards, powering personalized financial insights and services while maintaining privacy. Serving over 3.6M users and 5,000+ enterprise accounts, BluWhale has processed 800M+ wallets and executes 24M daily queries, with 2.3M monthly active users and 190K daily active users.

What Does BLUAI Do?

BLUAI serves as the primary utility token in BluWhale, functioning as gas for AI model and agent queries. Users earn it by operating Master and Common nodes to verify data inputs/outputs in AI computing environments, while it rewards contributions of data, storage, and computing resources via mobile devices. It supports staking for network security, governance participation, and incentivized adoption, enabling seamless transactions in the financial AI layer.

Key Characteristics of BLUAI

-

Gas Utility: Powers queries and transactions for AI agents analyzing financial profiles.

-

Node Incentives: Rewards verification of AI computations through staking and operations.

-

Data Rewards: Compensates users for secure, anonymized contributions to the intelligence layer.

-

Governance Role: Enables voting on protocol upgrades and ecosystem decisions.

-

Deflationary Design: Fixed supply promotes scarcity amid growing adoption.

BLUAI Tokenomics

BLUAI features a fixed max supply of 10B tokens, with 12.28% (1.228B) circulating at genesis for controlled liquidity. Allocations emphasize network security (25% for nodes) and sustainability (21% foundation), with vesting schedules unlocking gradually to align incentives and prevent volatility—e.g., T+3M for marketing, followed by 1.2–1.6% monthly emissions from T+13M, reaching ~74% circulation by month 48.

|

Category |

Percentage |

Amount (Millions) |

Purpose |

Vesting Schedule |

|---|---|---|---|---|

|

Nodes |

25% |

2,500 |

Network security & decentralization |

Gradual emissions |

|

Foundation/Treasury |

21% |

2,100 |

Governance, grants, R&D |

Locked with phased releases |

|

Ecosystem Use |

8.8% |

880 |

Growth initiatives & partnerships |

T+3M to T+12M unlocks |

|

Team & Advisors |

7% |

700 |

Aligned long-term development |

Vested over time |

|

Marketing & Community (incl. Airdrops) |

10.2% |

1,020 |

Adoption & engagement |

Immediate/phased |

|

Fundraising Rounds (Pre-Seed to Public) |

22.99% |

2,299 |

Capital for expansion |

Phased unlocks |

|

Liquidity & Market Making |

5% |

500 |

Trading stability |

Initial liquidity provision |

BLUAI vs. RECALL

BLUAI and RECALL both advance AI in crypto, but BLUAI focuses on financial data orchestration across chains for personalized services, while RECALL emphasizes skill-based competitions for AI agent ranking.

|

Feature |

BLUAI (BluWhale) |

RECALL (Recall Network) |

|---|---|---|

|

Rewards |

Node ops + data contributions |

Staking + curation earnings |

|

Network Support |

Multi-chain (Sui, Arbitrum, etc.) |

Base (ERC-20) |

|

Yield Focus |

Gas queries & verification |

Competition-based |

|

Value Stability |

Pre-launch vesting |

Post-launch volatile |

|

Ecosystem Options |

Financial AI insights |

AI skill funding/rankings |

Technology Behind BluWhale

BluWhale employs a BEP-20 architecture on Binance Smart Chain for efficient token transfers and gas usage, per contract details. Its orchestration layer integrates data storage, computing, and AI agents for secure, anonymized processing across supported chains like Sui and Arbitrum, enabling WhaleScore—a real-time financial index aggregating assets. Node operations verify computations, ensuring integrity without public audits noted.

BluWhale Team and Origins

Founded in 2022, BluWhale unites a 25-member global team across North America, Europe, and China, evolving from decentralized data pioneers to AI finance innovators. Backed by UOB Venture Management, SBI Holdings, and chains like Cardano and Tezos, plus VCs such as GSR and Primal Capital, it raised $12M+ across rounds up to $100M FDV, emphasizing user-sovereign intelligence.

BLUAI News and Milestones

-

2022: Founded with focus on decentralized AI personalization.

-

Early 2025: Expanded to 3.6M users and 800M+ wallets processed.

-

September 2025: Sold 100K+ nodes for verification, hitting 24M daily queries.

-

Q4 2025: Rollout of enhanced AI agent deployments and WhaleScore integrations.

-

2026: Multi-chain expansions and governance activations for BLUAI holders.

What Will Affect BLUAI’s Price 2025–2030?

BLUAI’s price will depend on AI-finance adoption, network scaling, and market dynamics, with volatility from pre-launch status and emissions. The $4.8T AI sector by 2033 offers upside, but competition and regulatory challenges pose risks.

Factors That May Increase BLUAI’s Price

-

AI Finance Boom: The AI sector’s growth to $4.8T by 2033 could drive BLUAI demand as 3.6M users contribute data, per UN Trade and Development.

-

Platform Milestones: Q4 2025 WhaleScore and multi-chain integrations may boost utility.

-

Node Incentives: 25% allocation for nodes drives staking and security, with strong community support in discussions.

-

Governance Expansion: BLUAI voting on upgrades could increase engagement.

-

Bull Markets: Crypto bull cycles may lift BLUAI via multi-chain ties.

Factors That May Decrease BLUAI’s Price

-

Token Unlocks: 87.72% locked supply with phased releases may increase selling pressure.

-

Launch Volatility: TGE on October 21, 2025, risks initial price dips.

-

Competition: Rivals like Fetch.ai may divert $200B+ AI funds, per UN Trade and Development.

-

Regulatory Hurdles: 2025 AI-finance regulations could raise compliance costs.

-

Adoption Delays: Slow node growth or enterprise onboarding may limit utility.

-

Sentiment Fluctuations: Post-TGE hype fade and privacy concerns may reduce confidence.

How to Buy BLUAI on Phemex

-

Sign Up: Create a Phemex account with email and verify securely.

-

Fund Account: Deposit via one-click buy, credit card, bank transfer, or crypto.

-

Buy BLUAI: Search BLUAI/USDT. Enter your investment amount in your local currency, preview the BLUAI amount, and confirm to receive it instantly in your Phemex wallet.

BLUAI FAQ

-

What is BLUAI? Utility token for BluWhale's AI financial networ.

-

How does BluWhale work? Analyzes multi-chain data for financial insights via agents..

-

What does BLUAI do? Gas for queries, node rewards, and governance.

-

How to use BLUAI? Stake nodes or contribute data for earnings.

-

What is BLUAI’s supply? 10B max, 1.22B circulating.

-

What is BLUAI tokenomics 2025? 12.28% genesis, node-focused allocations.

Conclusion

BLUAI unlocks BluWhale's decentralized AI layer for financial intelligence, blending node rewards, gas utility, and governance. Its 2025 TGE plus 3.6M users, cement its finance-AI role. Trade BLUEAI on Phemex to join this evolution.