Introduction

Bless Network (BLESS) is an innovative decentralized platform that converts unused computing capacity from everyday devices—such as laptops, desktops, and smartphones—into a worldwide, user-driven computing ecosystem. Established in 2022 as Blockless in San Francisco, it tackles the rising need for AI-powered computing by offering a scalable alternative to centralized cloud systems. Boasting over 5 million testnet nodes and collaborations with entities like Space and Time for trusted AI solutions, Bless facilitates fast, efficient applications in AI, gaming, and DeFi while compensating contributors. This Phemex Academy guide examines Bless's technology, community role, and prospects within the growing DePIN (Decentralized Physical Infrastructure Networks) market.

Summary Box (Quick Facts)

-

Token Name: Bless

-

Ticker: BLESS

-

Contract Address: 0x7C8217517ed4711fe2DECCdFefFE8d906b9Ae11F

-

Total Supply: 10 billion BLESS

-

Circulating Supply: 1.84 billion BLESS (18.4%)

-

Current Market Cap: $136M

-

Type: Utility Token

-

Chain: Custom Layer-1 with Solana testnet integration

- Availability on Phemex: Spot, Futures

What Is Bless?

The $BLESS token powers the Bless Network, a decentralized system that taps into idle device resources globally to create a cost-effective computing solution. Unlike traditional data centers that face high costs and frequent disruptions, Bless provides a scalable infrastructure with up to 90% savings over conventional clouds. Developers leverage the network-neutral application (nnApp) framework to create applications, while users earn rewards by contributing CPU or GPU capacity. This approach supports diverse use cases like AI development, gaming, and DeFi, promoting a more inclusive digital landscape.

What Is the Bless Network?

The Bless Network operates as a distributed computing framework powered by user devices. Its core elements include:

-

Community Nodes: Participants share resources through easy-to-use browser extensions, ensuring secure contributions.

-

nnApp Framework: Allows applications to utilize device power directly, expanding with network growth.

-

Intelligent Task Allocation: Algorithms match tasks to devices based on location, performance, and availability.

-

Protected Execution: WebAssembly (WASM) sandboxes provide isolated, safe environments for tasks.

With 4.1 million daily active nodes and rapid failover capabilities, it delivers high-speed performance for edge-based applications.

Mission

Bless seeks to make computing accessible to all by reducing dependence on centralized providers that inflate costs and widen digital gaps. By allowing individuals to share idle device power and receive rewards, it fosters a sustainable, equitable digital environment, aligning with its vision to empower users globally, as noted in official updates.

Why Bless Stands Out

Bless distinguishes itself in the DePIN space by utilizing common household devices, needing only a reliable internet connection. It achieves up to 90% cost reduction, ensures user privacy with WASM isolation, and optimizes task distribution. Supported by over 5 million testnet nodes and partnerships like Space and Time for AI enhancements, it offers faster, user-proximate computing compared to traditional cloud services.

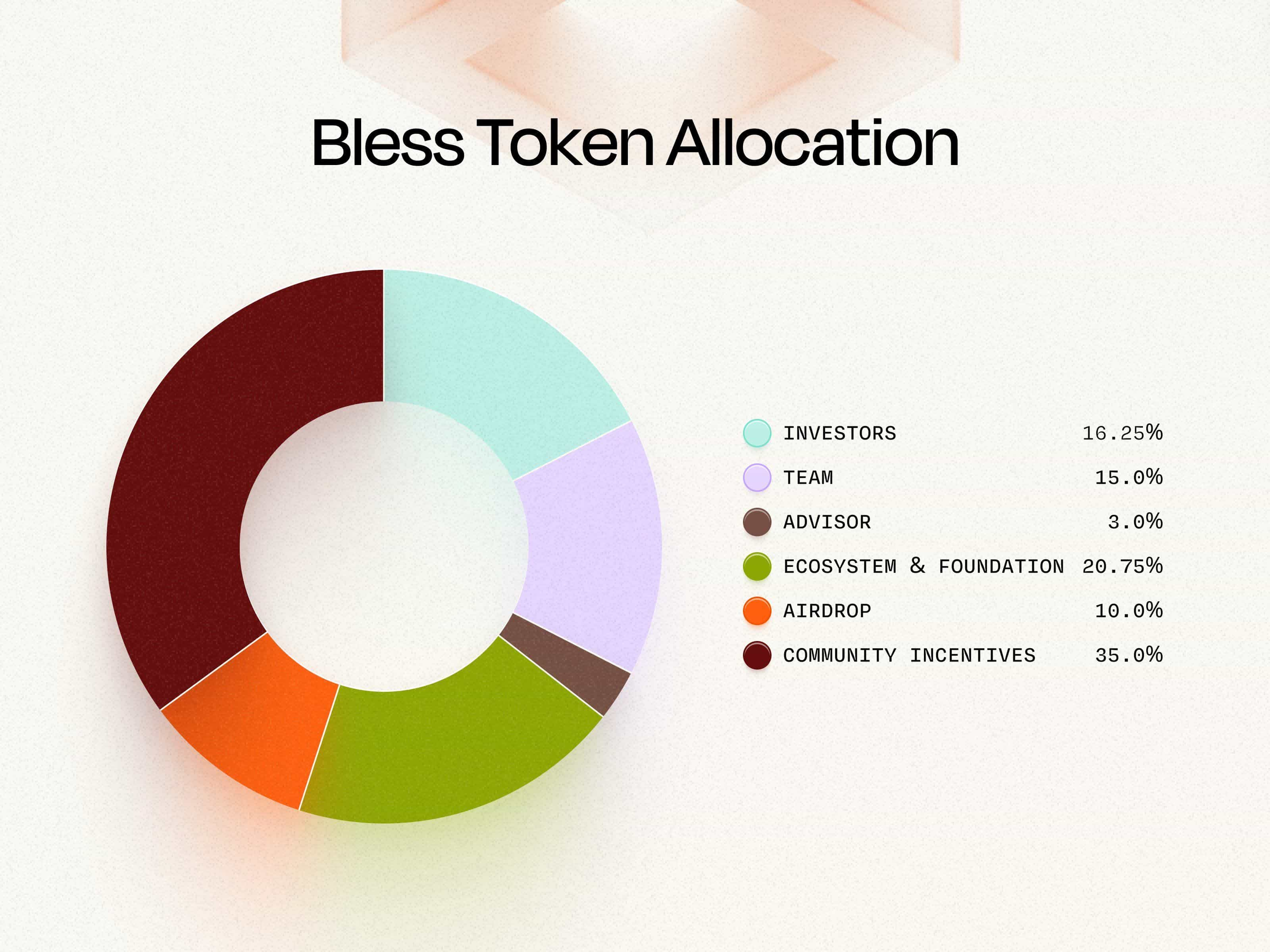

BLESS Tokens Allocation and Distribution

Bless employs a dual-token system:

-

TIME Tokens: Distributed every epoch to reward node operators and contributors; redeemable for BLESS or burned if unused.

-

BLESS Tokens: 90% of app revenue buys back and burns BLESS to reduce supply, while 10% supports the treasury.

|

Category |

Percentage |

Purpose |

|---|---|---|

|

BLESS Buyback |

90% |

Reduces circulating supply |

|

Treasury (BLESS) |

10% |

Funds growth and development |

Key Token Highlights

-

Dual Economy: TIME incentivizes participation; BLESS governs and captures value.

-

Redemption Mechanism: Lockups of TIME for BLESS offer higher rewards; unredeemed TIME is burned.

-

Sustainability: Buyback-and-burn reduces BLESS supply, aligning with network growth.

What Does BLESS Do?

The $BLESS token facilitates:

-

Payments: Covers compute services; operators earn TIME, convertible to BLESS.

-

Governance: Community votes on network upgrades, such as security enhancements.

-

Staking: Secures the network and boosts earnings on the mainnet.

-

Access: Unlocks advanced features like priority task processing.

These roles make $BLESS and TIME central to network operations, per roadmap updates.

Bless vs. Akash Network

|

Feature |

Bless (BLESS) (Market Cap: 137M) |

Akash Network (AKT) (Market Cap: 287M) |

|---|---|---|

|

Focus |

Edge compute from idle devices |

Decentralized cloud marketplace |

|

Backing |

NGC Ventures, $8M funding |

Cosmos ecosystem, established |

|

Key Feature |

nnApp, WASM isolation, TIME |

Bid-based GPU leasing |

|

Token Use |

Fees, governance, staking |

AKT for leasing, staking |

|

Node Req. |

Browser extension, low barrier |

Dedicated hardware encouraged |

|

Traction |

5M+ testnet nodes |

$100M+ TVL in deployments |

What Sets Bless Apart

Bless offers a low-entry, browser-based node system with a unique TIME-BLESS economy, contrasting with Akash’s hardware-intensive approach. Its AI-optimized task allocation and revenue-sharing model appeal to a broader user base, per market comparisons.

The Tech Behind Bless

Bless relies on four key technologies: Intelligent Task Allocation for efficient device matching, Randomized Distribution to deter malicious actions, WASM Secure Environments for task isolation, and Adaptive Verification with modular consensus (e.g., zero-knowledge proofs). Built on Solana for testnet performance, it delivers 90% cost savings and supports varied devices, per the whitepaper.

Team & Origins

Launched in 2022 in San Francisco as Blockless, Bless was founded by Butian Li, Michael Chen, Liam Zhang, and Derek Anderson. The team brings expertise from Binance Labs, Akash Network, and NGC Ventures, focusing on decentralized computing and blockchain innovation. With $8M in funding, they aim to redefine edge computing, per project announcements.

Roadmap and Key Milestones

-

2022: Originated as Blockless, laying the foundation for decentralized computing.

-

2024: Raised $8M in funding; testnet launched with over 5M nodes.

-

July 2025: Collaborated with Space and Time for AI verification on edge devices.

-

September 23, 2025: Mainnet and TGE launched, with listings on Binance, Kraken, Gate, and MEXC; 250% price surge.

-

Phase 1 (Post-Launch): Introduces Bless Desktop Nodes for GPU sharing and an anti-sybil campaign to ensure fair rewards.

-

Phase 2 (2026): Enhances developer tools with Docker support and automated scaling for seamless app deployment.

-

Phase 3 (2027): Adds fiat payment options and dynamic rewards based on node performance and demand.

Is Bless Worth Exploring?

Bless operates in the DePIN sector, forecasted to grow to $3.5 trillion by 2028, with its mainnet debut sparking a 250% token rise to $0.07254, a $133M market cap, and $311M in 24-hour volume. Here are the opportunities, challenges, and considerations as of September.

Positive Momentum

-

Robust Support: Raised $8M from NGC Ventures and others; partnerships like Space and Time enhance AI credibility.

-

Network Growth: Over 5 million testnet nodes demonstrate scalability; low-barrier entry fosters adoption in AI and gaming.

Potential Risks

-

Market Fluctuations: New token listings can experience significant price swings; buying at peak prices may lead to losses if selling occurs during a downturn.

-

Competition: Rivals like Akash hold larger TVL; DePIN saturation and regulatory hurdles for edge compute.

-

Early Stage Challenges: A limited initial token supply could lead to price volatility due to future releases; reliance on community participation may affect network stability.

Key Considerations

-

Token Utilities: Pays for compute, rewards nodes (90% fees via TIME), enables staking—suits DePIN enthusiasts.

-

Market Context: DePIN boom offers upside, but diversify; watch AI regulations and adoption metrics.

-

Next Steps: Analyze on-chain data, roadmap; seek advisor input before involvement.

How to Trade BLESS on Phemex

0G is now available on Phemex Spot and Futures, you can easily trade BLESS on Phemex by following these steps:

-

Create a Phemex account if you don't already have one.

-

Deposit funds (like USDT) into your Phemex wallet.

-

Navigate to the BLESS/USDT spot trading page/ perpetuals trading page.

-

Enter the amount you wish to buy and place your order. You can then trade BLESS.

FAQ

-

What is Bless? A DePIN platform sharing idle device compute for AI and apps.

-

How does it differ from Akash? Browser-based, low-barrier nodes with TIME-BLESS system vs. server leasing.

-

Is Bless secure? Yes, via WASM sandboxes and adaptive verification.

-

What's Bless's roadmap? Mainnet phases include GPU nodes, Docker support, and fiat payments through 2027.

-

How to earn? Run nodes via extension for TIME rewards, convertible to BLESS.

Conclusion

Bless redefines computing by leveraging idle devices into a decentralized, cost-effective network, empowering users in the DePIN space. Its innovative tech and strong launch momentum are promising, though early volatility suggests caution. Stay updated with Phemex Academy for the latest on DePIN trends.