Trading bots can be powerful tools, but only when you understand what they do and when to use them.

This guide breaks down every bot strategy available on Phemex, explains when each one works best, and helps you pick the right one for your situation.

What Are Trading Bots, and Why Use Them?

A trading bot is automated software that executes trades based on rules you define. Instead of watching charts all day or reacting emotionally, the bot carries out your plan with consistency.

Why traders use bots:

No more missed opportunities. They run 24/7, so you do not miss setups while sleeping or busy.

Emotionless execution. They remove emotional bias from trading.

Consistency. They follow your rules exactly, without hesitation or fatigue.

What bots cannot do:

Predict the future or guarantee profits.

Replace your judgment. You still choose the strategy and parameters.

Bots are tools, not shortcuts. The results depend on the strategy behind them.

The Four Bot Categories on Phemex

Phemex offers several bot types grouped into four major categories:

Category | Bot Types | Best For |

Grid Bots | Futures Grid, Spot Grid | Sideways or volatile markets |

DCA Bots (Martingale) | Futures DCA, Spot DCA | Building positions over time |

Signal Trading | Signal Trading | Automating existing strategies |

Arbitrage | Lower-risk, steady yield |

Below is a breakdown of how each works and when to use them.

Grid Bots: Profit from Price Swings

What It Does

Grid Bot places buy and sell orders at preset intervals. When price dips, it buys; when price rises, it sells. Each completed cycle locks in a small profit.

A simple way to think about it: you cast multiple fishing lines across a price range, catching many small moves instead of waiting for one big trend.

Two Versions

Futures Grid

Works in both rising and falling markets.

Can go long or short.

Best for short to medium-term trading.

Uses leverage, which increases both risk and reward.

Spot Grid

Buy low and sell high using actual assets.

Ideal in uptrends or stable sideways markets.

No leverage.

When Grid Bot Works Well

Grid Bots thrive when price moves within a defined range.

Example: BTC trades between 80k and 100k for several weeks. Your bot places buys at the lower end and sells at the upper end. Every swing generates small profits.

When Grid Bot Struggles

If the market breaks out of your range in a strong trend, Grid Bot can get stuck:

Price moons: Your bot sold too early and missed the run-up.

Price dumps: Your bot keeps buying, and now you're holding bags below your range.

The takeaway: Grid Bot is not a "set and forget" strategy. You need to monitor whether price is staying within your range.

Who Should Use Grid Bot?

Traders who believe the market will stay range-bound

Those who want steady, incremental gains rather than big swings

People comfortable adjusting settings if market conditions change

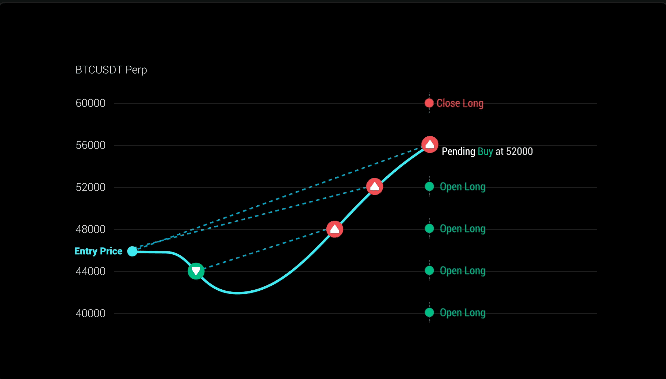

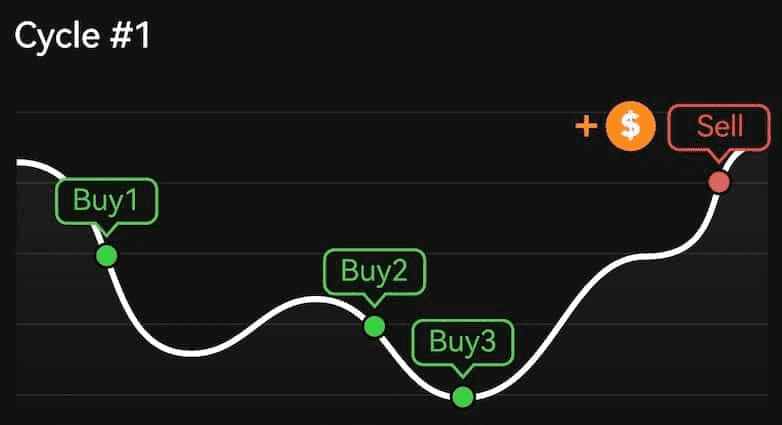

DCA Bots (Martingale): Build Your Position Over Time

What It Does

DCA stands for Dollar-Cost Averaging. The bot buys consistently over time, spreading your entry across multiple price points instead of going all-in at once.

Phemex's DCA Bot uses a Martingale approach — it increases position size as price moves against you, lowering your average entry. When price recovers, you hit profit faster.

Two Versions

Futures DCA (Martingale)

Buy the dip, sell the rip

Uses leverage

Aims to profit from price recovery after dips

Spot DCA (Martingale)

For volatile markets

No leverage — you accumulate actual coins

Best for medium to long-term positions

When DCA Bot Works Well

When you believe in an asset’s long-term value and want to build exposure without guessing the bottom.

Example: You expect ETH to rise over months but unsure if it will drop first. A Spot DCA Bot buys incrementally each time price falls a certain percentage.

⚠️ The Risk: This Is a High-Risk Strategy

In a persistent downtrend, the bot keeps buying more while price keeps falling. Your position grows large while your capital shrinks.

Example: A DCA Bot keeps buying an asset from 10 dollars down to 4 dollars. If price does not recover, you are left with a heavily underwater position.

This strategy requires conviction and risk tolerance. Never deploy capital you cannot afford to lose.

Who Should Use DCA Bot?

Long-term believers in an asset who want to accumulate

Traders comfortable with significant drawdowns

Those who understand the Martingale risk and accept it

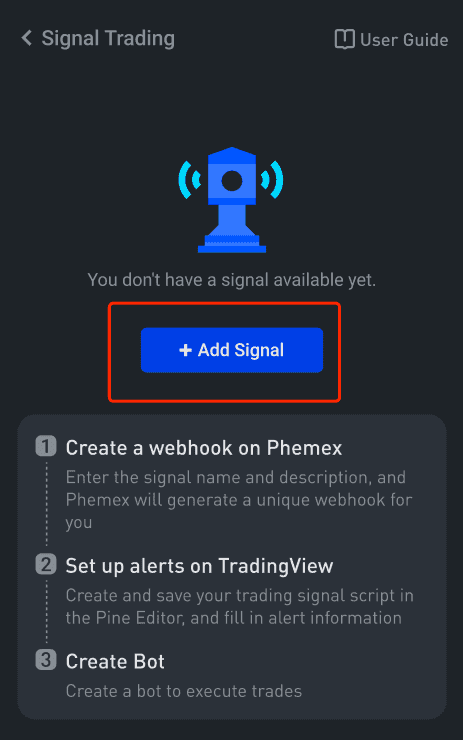

Signal Trading: Speed and Precision

What It Does

Signal Trading Bots execute trades instantly when your external signals fire. This is ideal for traders with established systems who want fast, reliable execution.

Key Features

Real-time execution: Minimal delay between signal and trade

Maximal speed and reliability: Built for traders who need precision

Flexible integration: Works with various signal sources

When Signal Trading Works Well

If you use technical indicators (RSI, MACD, moving averages) or subscribe to a signal service, this bot removes the execution burden. You focus on strategy; the bot handles the trades.

Example: Your strategy says "buy when RSI drops below 30 and sell when it hits 70." Instead of watching charts all day, you connect a Signal Trading Bot that executes automatically when those conditions hit.

When Signal Trading Struggles

The bot is only as good as the signals you feed it. Poor signals equal poor results.

Who Should Use Signal Trading?

Traders with existing technical strategies.

Those who want automation without building code.

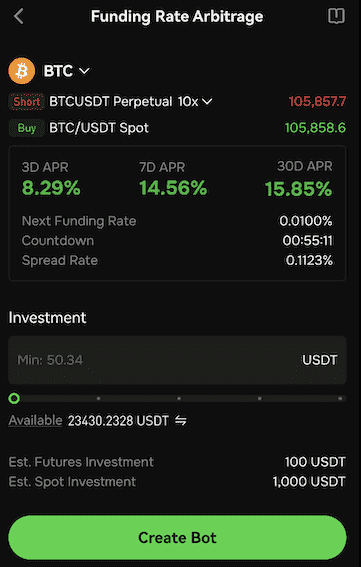

Funding Rate Arbitrage: Steady, Lower-Risk Returns

What It Does

This bot captures recurring funding payments in futures markets by taking offsetting positions to collect fees with minimal directional exposure.

A simple analogy: it is like earning interest. You are not betting on price direction but collecting recurring payments.

Key Features

One-click arbitrage: Simplified setup, no complex configuration

Easy hedging: The bot manages the risk for you

Smart trades: Optimized to collect fees without taking directional bets

When Arbitrage Works Well

When funding payments stay consistent, the bot can generate predictable returns.

Example: The bot sets up positions to collect a small fee every 8 hours. Over a month, those small amounts add up — similar to earning interest on a savings account, but with crypto.

When Arbitrage Struggles

Low fees: When the recurring payments are near zero, there's nothing to collect.

Unpredictable fees: If payments swing positive and negative randomly, profits get eaten.

Capital requirements: You need meaningful capital to see meaningful returns — small accounts won't notice much difference.

Who Should Use Arbitrage?

Conservative traders.

Larger accounts seeking steady yield.

Those who prefer non-directional strategies.

Quick Comparison: Which Bot Should You Choose?

If You Want... | Choose... | But Know That... |

Profit from sideways markets | Grid Bot | Strong trends can hurt you |

Accumulate over time | DCA Bot | Sustained downtrends are dangerous |

Automate your signals | Signal Trading | Only as good as your signals |

Steady, low-risk returns | Arbitrage | Requires more capital, lower yields |

How to Get Started

Go to Phemex Trading Bots

Pick a category based on your market view and risk tolerance

Choose Futures or Spot depending on whether you want leverage

Set your parameters — price range, investment amount, etc.

Monitor and adjust — no bot is truly "set and forget"

For step-by-step setup guides:

Bonus: Earn From Your Bots With Profit Sharing

If you create a successful bot, you can now earn when others copy it. Phemex's Profit Sharing feature lets you set a profit share ratio (10%, 20%, or 30%) when creating a bot. When copiers profit from your strategy, you automatically receive your share.

This is available for all major bot types: Contract Grid, Spot Grid, Contract Martingale, Spot Martingale, and Signal Trading.

Common Questions

Can I lose money with trading bots? Yes. Bots automate execution, not profits. If the market moves against your strategy, you lose money.

Which bot is best for beginners? Spot Grid in a clearly range-bound market is relatively straightforward. Start small, learn how it behaves, then scale up.

Are there fees for using bots? Phemex trading bots are free to use — no subscription or monthly fees. You only pay standard trading fees when the bot executes trades. These are the same fees you'd pay trading manually.

How much capital do I need? Depends on the bot. Grid and DCA can start small ($50-100). Arbitrage typically needs more capital ($1,000+) to generate meaningful returns.

Can I run multiple bots at once? Yes. Many traders run different bots for different market conditions or assets.

What if the market changes? You can stop, adjust, or switch bots anytime. The key is monitoring — don't assume your bot will adapt on its own.

The Bottom Line

There's no single "best" bot. Each strategy fits different market conditions and risk appetites:

Grid for volatility and range-bound markets

DCA for long-term conviction (with high risk tolerance)

Signal for speed and automation of your own strategy

Arbitrage for stability and lower-risk returns

Start small, understand how your bot behaves, and scale gradually. Bots are powerful tools, but success still comes from the strategy behind them.

Trading bots involve risk. Past performance does not guarantee future results. Martingale/DCA strategies carry high risk of significant loss in sustained downtrends. Only trade with capital you can afford to lose. This is not financial advice.