Scalability is the foundation of blockchain’s future—and Solana is at the forefront of this challenge. As the ecosystem grows, new solutions like Layer 2 rollups are emerging to enhance performance and support global adoption. This article explores how SOL Layer 2 technologies are shaping Solana’s evolution, unlocking new possibilities for developers, users, and investors alike.

Introduction: Why Scalability Is Critical for Blockchain Success

Scalability is one of the most critical challenges facing blockchain technology today. As blockchains evolve from niche experiments to global platforms supporting financial systems, social applications, and digital ownership, the demand for seamless, high-throughput performance has never been greater. Without scalability, a blockchain risks becoming congested, expensive to use, and unable to serve the millions of users and developers who want to build on it.

At its core, scalability refers to a blockchain’s ability to process a high volume of transactions quickly, securely, and at low cost. It’s what enables a blockchain network to move beyond experimental stages and support real-world applications like decentralized finance (DeFi), gaming, social media, and even tokenized real-world assets (RWAs). A scalable blockchain provides the infrastructure for developers to innovate and for users to transact without friction. Conversely, a blockchain that struggles with scalability can suffer from high fees, long confirmation times, and even network outages—issues that can deter users and developers alike.

Ethereum, the most widely used smart contract platform, has faced these scalability limits head-on. During periods of high demand, transaction fees on Ethereum’s Layer 1 have soared to levels that price out many users. This has driven the rise of Layer 2 solutions like rollups, which process transactions off-chain and submit proofs to the Ethereum mainnet, effectively expanding capacity while maintaining security.

Solana, in contrast, has taken a different approach—prioritizing a high-performance monolithic design that delivers high throughput directly on Layer 1. Solana’s architecture can handle thousands of transactions per second (TPS), making it one of the fastest blockchains in the world. However, even Solana has faced growing pains, including network congestion and outages during times of peak demand. As the ecosystem grows—with more dApps, NFTs, and DeFi projects being built—scalability becomes not just an advantage but a necessity for Solana to compete and thrive in the evolving Web3 landscape.

This article explores how Solana is addressing its scalability challenges, the emerging Layer 2 solutions and rollups built on Solana, and how these efforts compare to other ecosystems like Ethereum. We’ll also examine how scalability influences the value of SOL tokens, what it means for users and developers, and how you can trade SOL on platforms like Phemex to capture opportunities as Solana continues to scale.

Solana’s Scalability Journey

From its inception, Solana has been laser-focused on addressing one of blockchain’s most pressing challenges: scalability. The network was designed from the ground up to process transactions at high speed with low fees, positioning itself as a next-generation Layer 1 solution capable of supporting mass adoption. But as with any ambitious project, Solana’s scalability journey has been marked by both impressive achievements and hard-learned lessons.

High TPS and Architectural Innovations

Solana’s claim to fame is its theoretical 65,000 transactions per second (TPS) capability, far exceeding Ethereum’s approximate 15 TPS on Layer 1. This staggering throughput is made possible by a unique consensus design that combines Proof of Stake (PoS) with Proof of History (PoH)—a cryptographic time-stamping mechanism that orders transactions efficiently. By pre-ordering transactions and reducing redundant communication between nodes, PoH allows Solana to achieve parallel processing at a scale few blockchains can match.

In addition, Solana’s Sealevel runtime enables parallel smart contract execution, which contrasts with Ethereum’s single-threaded model. This allows thousands of smart contracts to run simultaneously, a critical factor for supporting high-volume applications like decentralized exchanges (DEXs), NFT marketplaces, and on-chain games.

The design is bold, but it comes with trade-offs. Solana's architecture requires more powerful hardware for validators (high-performance machines with significant memory and bandwidth), which has led to concerns about decentralization and accessibility. Despite these concerns, Solana has grown to include over 3,000 active validators globally, showing robust participation and improving network security over time.

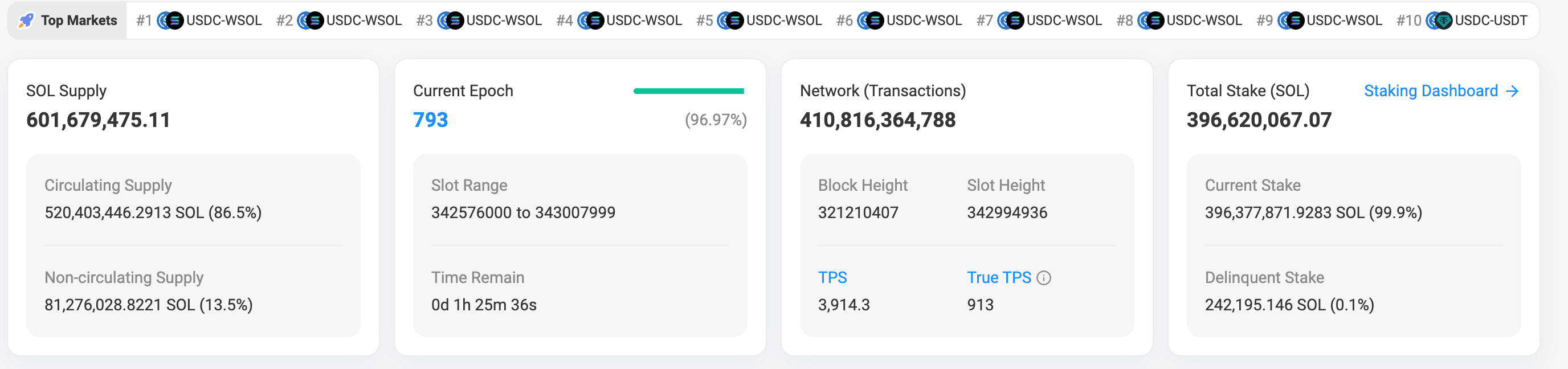

Source:SolScan

Network Congestion Challenges and Outages

For all its architectural brilliance, Solana has faced scalability growing pains—especially during periods of peak demand. Starting in 2021 and persisting into 2022, Solana experienced multiple network outages and slowdowns. These incidents often coincided with high-profile NFT mints, spam attacks, or sudden spikes in on-chain activity. In some cases, the network was offline for several hours, leading to criticism and questions about Solana’s reliability.

For instance, during a bot-driven NFT mint in April 2022, Solana suffered a seven-hour outage, highlighting how transaction floods could overwhelm the network. Similarly, in September 2021, Solana went offline for 17 hours due to resource exhaustion from a DEX launch that saw hundreds of thousands of transactions per second flood the network.

These episodes revealed that while Solana’s theoretical TPS was impressive, real-world scalability requires more than raw speed—it demands resilience, congestion management, and robust spam protection.

Evolution and Resilience

To address these challenges, Solana’s core developers and community have been proactive. The introduction of fee markets was a major milestone, allowing users to pay higher fees to prioritize their transactions during periods of congestion. This mechanism, implemented in 2022, helped prevent the entire network from stalling during sudden surges in demand—ensuring that critical transactions could still go through.

Another important step was the development of Firedancer, a new validator client built by Jump Crypto. Firedancer is designed to significantly improve Solana’s throughput, reduce latency, and enhance network resilience by adding diversity to the validator infrastructure. This diversification helps protect Solana against software bugs that could otherwise bring the network down. Firedancer is expected to go live in 2025, and early benchmarks suggest it could push Solana’s practical TPS even higher while fortifying the network against outages.

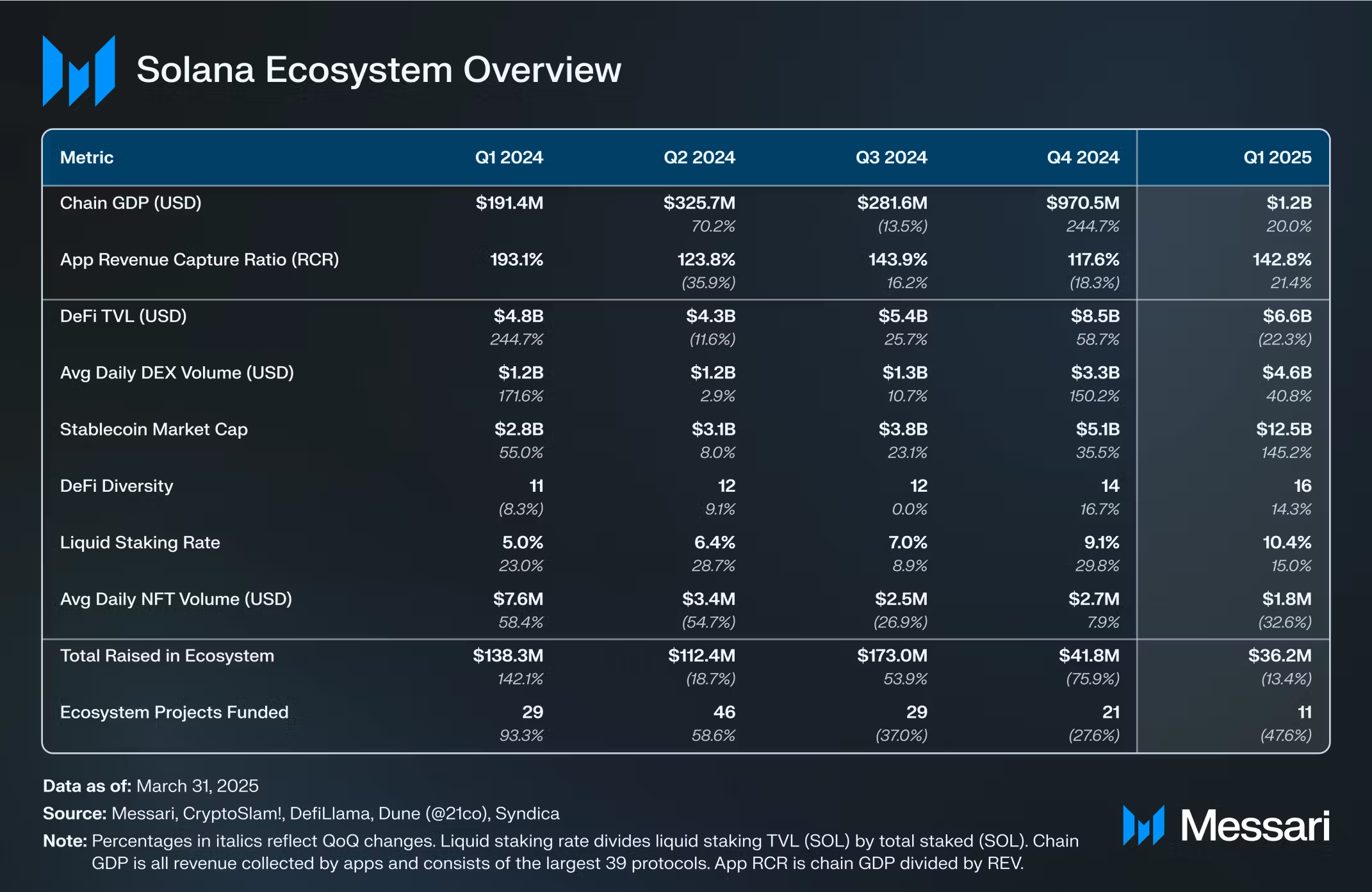

By 2024, Solana had not only stabilized its network performance but also expanded its ecosystem dramatically. Daily active users surged past 3 million, and the network handled over 35 million daily transactions, making it one of the most active blockchains globally. The recovery from the 2022–2023 downturn has been a testament to Solana’s resilience, with the community rallying to fix issues and innovate.

The Road Ahead

Solana’s scalability journey is ongoing. The network has learned that scalability isn’t just about speed—it’s about stability, fairness in resource allocation, and the ability to handle diverse workloads. With ongoing upgrades like Firedancer and the emergence of Layer 2 solutions such as Solaxy and SOON, Solana is evolving into a more mature, robust, and scalable blockchain ecosystem.

Looking forward, Solana aims to become the go-to platform for high-frequency, low-cost, and real-time decentralized applications—whether in DeFi, gaming, or real-world asset tokenization. The scalability challenges of the past have not been swept under the rug; rather, they’ve driven the community to innovate and adapt. If successful, Solana could become not just a high-TPS blockchain but a resilient and modular Web3 infrastructure capable of supporting the next generation of decentralized applications.

Layer 2 and Rollups: Explained

As blockchain adoption accelerates and transaction volumes surge, scalability has emerged as a defining factor for success in the decentralized ecosystem. Layer 2 solutions, particularly rollups, have become a cornerstone of scalability strategies across various blockchain networks, including Ethereum and, more recently, Solana. But what exactly are Layer 2s and rollups, and how do they help blockchain networks scale?

What Are Layer 2 Solutions?

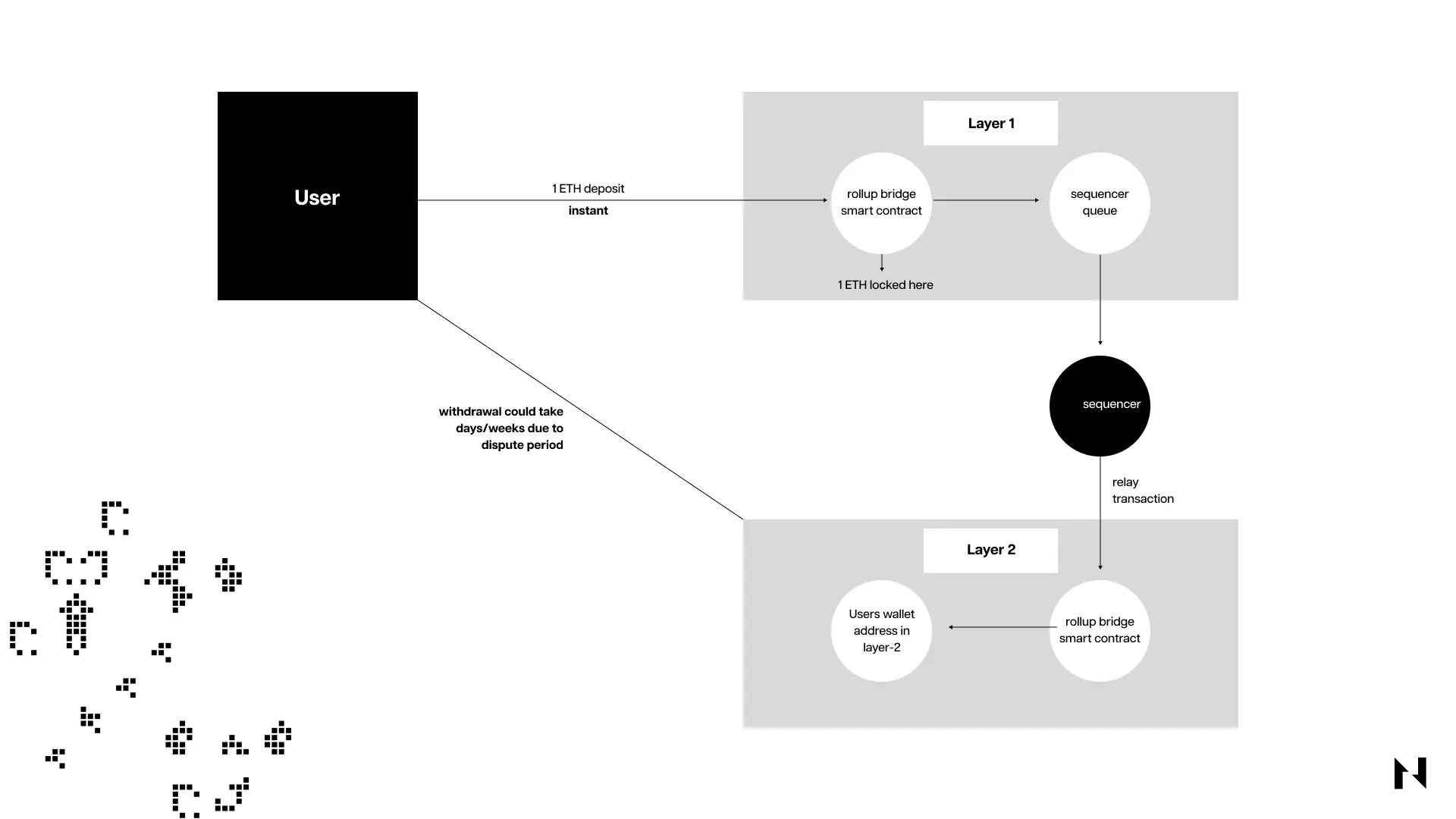

At its core, a Layer 2 solution refers to any protocol or framework built on top of a Layer 1 blockchain (such as Solana or Ethereum) that offloads part of the transaction processing. By handling transactions off-chain (or in a separate environment) and settling only the final results on the main chain, Layer 2s effectively increase a network’s capacity without altering its core consensus mechanisms.

For end users, Layer 2s can deliver faster transaction speeds and lower fees while still leveraging the security of the underlying Layer 1. For developers, Layer 2s offer a way to build applications that can scale to millions of users without clogging the base network.

What Are Rollups?

Rollups are a specific type of Layer 2 solution that packages multiple transactions into a single bundle and submits that bundle to the Layer 1 blockchain. The key idea is compression: instead of writing every transaction directly to the main chain, rollups batch them together and use cryptographic proofs to validate their correctness. This approach significantly reduces the amount of data the main chain needs to process while still maintaining trust and integrity.

There are two main types of rollups:

-

Optimistic Rollups:

Optimistic rollups assume that all transactions are valid unless proven otherwise. They process transactions off-chain and submit a summary to the main chain. If someone notices an invalid transaction, they can submit a fraud proof to challenge it. This design minimizes computation but introduces a potential dispute window. -

Zero-Knowledge (ZK) Rollups:

ZK rollups, on the other hand, use advanced cryptographic proofs (known as zero-knowledge proofs) to mathematically guarantee the validity of transactions before they are posted to the main chain. This method is more secure and faster in finality but often more complex to implement.

The data relayed to Layer 1 by ZK-rollups (left) vs. Optimistic rollups (right)

Both approaches have their trade-offs: Optimistic rollups typically have faster development cycles and lower computational costs, while ZK rollups offer stronger security guarantees but can be more resource-intensive.

Why Does Solana Need Layer 2s and Rollups?

Solana has long prided itself on monolithic scalability, meaning it handles high throughput directly on Layer 1. However, as the ecosystem grows and user demands increase, even Solana’s impressive TPS can face bottlenecks. Past network outages, caused by transaction floods or spam attacks, have highlighted the limits of a purely monolithic architecture.

Integrating Layer 2s and rollups into Solana’s ecosystem allows the network to offload specialized workloads—like high-frequency DeFi trading, gaming transactions, or NFT minting—onto parallel execution layers. This approach helps:

-

Reduce congestion on the mainnet, keeping it smooth for critical transactions.

-

Lower fees for users by distributing demand across multiple layers.

-

Accelerate innovation by allowing developers to experiment on Layer 2s without risking mainnet stability.

-

Enhance modularity by enabling independent scaling for specific use cases.

Moreover, Layer 2 solutions on Solana can leverage its unique Sealevel execution environment, which already allows parallel transaction processing, as well as its fast finality (~400ms block times). This makes Solana’s Layer 2s potentially faster and more efficient than those on networks like Ethereum, where base layer constraints are more rigid.

The Broader Implications

The emergence of rollups and Layer 2s within the Solana ecosystem marks an important evolution in blockchain architecture. It signals that even high-performance chains recognize the value of modular scaling—a concept Ethereum pioneered and is now being adapted for Solana’s unique needs.

As Solana’s Layer 2 ecosystem matures, users can expect lower fees, faster transactions, and more diverse applications—from complex DeFi protocols to hyper-casual games. This adaptability is crucial as Web3 strives to onboard billions of users and support global-scale financial and social networks.

In the next section, we’ll explore the emerging Layer 2 projects on Solana, such as Solaxy, SOON, and ZX, and how they’re contributing to Solana’s scalability roadmap.

Solana’s Current Layer 2 Landscape

While Solana has long been known for its monolithic, high-throughput architecture, the ecosystem is now embracing the Layer 2 paradigm to enhance scalability, modularity, and flexibility. This shift acknowledges the reality that as usage grows, even the most performant Layer 1 can benefit from offloading specific workloads. Let’s explore the key Layer 2 projects and experiments currently shaping Solana’s scalability future.

Solaxy: Solana’s First Rollup Network

Solaxy stands out as a pioneering Layer 2 rollup within the Solana ecosystem. Designed to alleviate mainnet congestion, Solaxy focuses on high-frequency, high-volume use cases like decentralized finance (DeFi), gaming, and NFT trading.

What makes Solaxy unique is its Igniter Protocol—a system that allows developers and users to launch and bootstrap new tokens directly on the rollup, fostering an ecosystem of native Solaxy tokens without burdening the Solana base layer. This creates a self-sustaining token economy within the rollup, where applications can thrive without competing for Layer 1 blockspace.

To ensure seamless interaction with the broader Solana ecosystem, Solaxy employs the Hyperlane-powered Solaxy–Solana bridge. This bridge allows for native SOL transfers between the mainnet and Solaxy, enabling users to move assets freely while preserving Solana’s core security guarantees. With its focus on user experience, performance, and interoperability, Solaxy is emerging as a key Layer 2 infrastructure layer for Solana’s next phase of growth.

SOON: Solana Optimistic Network

Another ambitious project is SOON (Solana Optimistic Network), an experimental optimistic rollup designed to blend Solana’s Sealevel Virtual Machine (SVM) with Ethereum’s modular design principles.

SOON aims to offer a scalable, secure platform for decentralized applications by creating an execution environment that retains Solana’s speed and parallelization benefits while offloading transaction validation and dispute resolution. This approach mirrors Ethereum’s scaling strategy with optimistic rollups like Arbitrum and Optimism but adapts it to Solana’s unique architecture.

By leveraging modularity, SOON introduces greater flexibility for developers—enabling them to deploy apps that benefit from Solana’s throughput yet are insulated from potential congestion or network instability on the mainnet. For users, this means lower fees and faster execution, especially for high-volume applications like DEXs, NFT marketplaces, or social media platforms.

As of 2025, SOON is still in its early stages, but its development signals Solana’s willingness to explore hybrid scaling approaches that merge the best of monolithic and modular designs.

ZX by Zeta Markets: Pioneering ZK Rollups on Solana

Zeta Markets, a prominent player in Solana’s DeFi ecosystem, has announced ZX, a zero-knowledge (ZK) rollup project that aims to bring trustless, high-speed decentralized trading to Solana.

ZX is designed to handle the growing demand for low-latency, high-frequency trading—a niche where Solana already shines but could benefit from dedicated infrastructure. By leveraging ZK proofs, ZX intends to provide secure and verifiable transaction execution while reducing the computational load on Solana’s base layer.

This is a significant development, as ZK rollups are considered the gold standard of Layer 2 scalability, offering strong security guarantees, fast finality, and reduced data requirements for the main chain. ZX could potentially make Solana an even more attractive destination for sophisticated DeFi users, institutional traders, and market makers seeking an efficient, scalable platform.

Ecosystem Trends and the Road Ahead

Beyond these flagship projects, several other experiments and research efforts are exploring Solana Layer 2 possibilities. Developers are investigating ways to build modular execution environments that can cater to specific application verticals—whether it’s gaming, payments, or data-heavy Web3 services.

For example:

-

Ephemeral Rollups: Lightweight, short-lived rollups designed for specific events like NFT mints or game tournaments.

-

Compression Techniques: Using state compression (already live for NFTs) to reduce on-chain data storage requirements, effectively acting as a Layer 2 scaling hack.

These innovations demonstrate that Solana’s Layer 2 ecosystem is still in its early innings, but the momentum is building. As these solutions mature, we can expect more specialized, high-performance subnets to emerge within Solana, each tailored for different use cases while maintaining interoperability with the Layer 1.

Ultimately, the addition of Layer 2s enhances Solana’s value proposition—ensuring it remains a high-throughput platform that can scale horizontally as demand grows, while retaining its fast finality and low-fee advantages.

Comparing Solana and Ethereum’s Scaling Strategies

As the blockchain ecosystem matures, scalability has become the defining battleground for major Layer 1 platforms. While both Solana and Ethereum aim to support large-scale decentralized applications and global user bases, their approaches to scaling are fundamentally different. Understanding these differences is crucial for developers, investors, and users navigating the evolving Web3 landscape.

Solana’s Monolithic Architecture: Speed First, Complexity Later

Solana’s design philosophy is centered on monolithic scalability. This means the network aims to handle all core functions—execution, consensus, and data availability—within a single unified Layer 1 chain. By keeping everything on one layer, Solana minimizes cross-layer complexity and delivers blazing-fast throughput and ultra-low fees. Its innovative use of Proof of History (PoH) and parallel processing (Sealevel runtime) enables Solana to achieve thousands of transactions per second (TPS), with finality times under a second.

This design has allowed Solana to become the go-to chain for high-volume, low-latency use cases like DeFi trading, NFT minting, and Web3 gaming. It’s why Solana routinely handles 30+ million daily transactions—far exceeding Ethereum’s L1 capacity.

However, Solana’s monolithic model has its challenges:

-

Hardware Requirements: Running a Solana validator demands significant computational power, bandwidth, and storage, which can limit validator diversity compared to Ethereum’s lighter requirements.

-

Resilience Risks: With everything running on one layer, bugs or attacks that impact consensus or execution can potentially stall the entire network—as seen in past outages.

-

Scaling Limits: While Solana has pushed monolithic scalability impressively far, there are practical limits to how much a single-layer blockchain can handle without fragmenting resources or compromising decentralization.

This has led to Layer 2 exploration within Solana—not as a core necessity (like Ethereum) but as a strategic enhancement to maintain performance under extreme demand while preserving the core user experience.

Ethereum’s Modular Roadmap: Rollups as the Future

In contrast, Ethereum has fully embraced a modular scaling model, often described as the “rollup-centric roadmap.” After the transition to Proof of Stake with The Merge in 2022, Ethereum pivoted to a long-term vision where the Layer 1 acts as a secure, decentralized settlement layer, while Layer 2 rollups handle most of the execution load.

Ethereum’s Layer 2 ecosystem has exploded with projects like Arbitrum, Optimism, zkSync, and Starknet offering scalability solutions tailored to different needs. These rollups batch transactions off-chain and submit compressed proofs to the Ethereum mainnet, dramatically reducing fees and increasing throughput. The introduction of EIP-4844 (proto-danksharding) and future full sharding plans aim to further optimize data availability and reduce costs for rollups.

Ethereum’s modular design offers several benefits:

-

Decentralization at the Core: The Ethereum mainnet focuses on security and censorship resistance, while rollups can innovate and iterate rapidly without affecting base layer stability.

-

Flexibility: Different rollups can cater to different use cases—DeFi, gaming, social—without competing for the same Layer 1 blockspace.

-

Composability Trade-offs: While modularity brings flexibility, it introduces cross-rollup communication challenges. Composability is no longer atomic across all apps, and users may face fragmented liquidity and bridging complexities.

The Trade-Offs: Monolithic Speed vs. Modular Flexibility

| Factor | Solana Monolithic Model | Ethereum Modular Model |

|---|---|---|

| Architecture | Single-layer, all-in-one | Layer 1 + Layer 2 separation |

| Throughput (L1) | 3,000+ TPS (real-world) | ~15 TPS (L1), scaling via rollups |

| Fees (L1) | ~$0.001–$0.01 per transaction | ~$2–$30 during congestion |

| Validator Requirements | High-performance hardware | Lightweight, consumer-grade |

| Composability | Fully atomic on Layer 1 | Fragmented across rollups |

| Resilience | Prone to L1-wide outages (historically improving) | L2 failures contained; L1 remains stable |

| Developer Experience | Unified environment, Sealevel runtime | Diverse L2 ecosystems, EVM compatibility focus |

| Scaling Trajectory | Exploring Layer 2 for further modularity | Rollup-centric future (e.g., sharding) |

Solana vs. Ethereum: A Converging Vision?

Interestingly, while Solana and Ethereum started with very different philosophies, their long-term visions are beginning to converge.

-

Ethereum is modular by design, but its Layer 2s are exploring parallel execution and faster finality—concepts pioneered by Solana.

-

Solana, while monolithic at heart, is embracing Layer 2s and rollups like Solaxy, SOON, and ZX to handle specialized workloads, recognizing that monolithic scaling has practical limits.

Both ecosystems are learning from each other. The future may see hybrid architectures, where monolithic Layer 1s like Solana integrate modular components for scalability, and modular ecosystems like Ethereum incorporate high-performance sublayers.

What This Means for SOL

For SOL investors, understanding these differences is crucial. Solana’s monolithic design delivers an unparalleled user experience for fast, cheap transactions, but its Layer 2 evolution—now gaining momentum—will be key to sustaining this performance as demand grows.

Solana’s ability to scale horizontally through Layer 2s, while retaining a fast and composable core Layer 1, could strengthen its position as a go-to platform for high-frequency, real-time decentralized applications.

In the next section, we’ll explore how scalability directly impacts SOL’s value—from user adoption and transaction volumes to market dynamics—and why Solana’s scaling strategy is more than just a technical upgrade; it’s a critical driver of long-term growth.

The Impact of Scalability on SOL’s Value

Scalability is not just a technical detail in blockchain architecture—it is a direct driver of a network’s economic value. For Solana, its ability to scale has profound implications for SOL’s price, demand, and long-term investment potential. Let’s break down how scalability directly influences SOL’s value from multiple angles.

1️⃣ User Adoption and Network Activity

At the core of any blockchain’s value proposition is network usage. More users, more transactions, and more decentralized applications (dApps) all translate into higher demand for the native token, which in Solana’s case is SOL. Scalability is the enabler that makes this growth possible.

-

Low Fees Drive Adoption: Solana’s high throughput and low transaction costs—often just fractions of a cent per transaction—create a welcoming environment for users who might be priced out of other blockchains like Ethereum. This affordability has helped Solana attract millions of users across various sectors: DeFi, NFTs, gaming, and payments. In fact, as of 2024, Solana regularly handles over 35 million transactions per day, a figure that dwarfs most other Layer 1 blockchains.

-

Frictionless User Experience: Scalability ensures that users can interact with Solana dApps without facing delays, stuck transactions, or exorbitant fees. This seamless experience builds trust and fosters retention, creating a virtuous cycle where more users join the network, boosting demand for SOL to pay for transactions and smart contract execution.

As Layer 2 solutions like Solaxy, SOON, and ZX roll out, they will further expand Solana’s capacity, allowing the ecosystem to absorb even more users and applications without compromising performance. By reducing congestion risk, Layer 2s help preserve Solana’s low-fee advantage while supporting a wider variety of use cases—from high-frequency DeFi trading to NFT gaming.

2️⃣ Transaction Volume and Token Utility

Every transaction on Solana—whether on Layer 1 or via Layer 2 rollups—requires SOL as gas. This fundamental token utility ties network activity directly to SOL demand.

-

More Transactions = More SOL Burned: Solana has a burn mechanism that destroys a portion of transaction fees. As scalability improves and transaction volume increases, more SOL is burned, contributing to a deflationary pressure on the supply. While Solana’s overall inflation rate (currently ~5% and declining) still introduces new SOL into circulation, a growing burn rate can help offset issuance and support token value over time.

-

Ecosystem Growth = SOL Demand: New applications built on Solana (DeFi protocols, NFT platforms, gaming projects) generate sustained transaction flow. Each new user and developer building on Solana drives organic demand for SOL—not just as a speculative asset but as the fuel that powers the network’s economy.

With scalability enhancements, the ceiling on transaction volume rises dramatically. This creates an environment where SOL’s utility expands alongside network growth, reinforcing its status as the lifeblood of the Solana ecosystem.

3️⃣ Institutional Adoption and Market Positioning

Scalability is also a key factor in institutional adoption. Institutions and enterprises require blockchain infrastructure that is not only secure but also capable of handling high-volume, real-time transactions without fail. Solana’s scalability edge—particularly as Layer 2 solutions mature—can make it an attractive option for enterprise use cases such as:

-

Tokenized assets and RWAs (Real-World Assets)

-

Payment processing and stablecoin settlement

-

High-frequency trading platforms

-

Global supply chain solutions

These use cases are not theoretical. Solana has already attracted partnerships with major players like Visa for USDC settlement and Janover Inc. for tokenized real estate transactions. As Solana’s throughput expands, it becomes a more viable backbone for such large-scale deployments—driving long-term demand for SOL.

Additionally, regulatory developments such as the potential approval of SOL ETFs in regions like Canada (and potentially the U.S.) could further increase institutional exposure. A scalable, high-capacity network is more appealing for ETF issuers, as it reduces the risk of slippage, downtime, or technical issues during high-volume trading periods.

4️⃣ Competitive Advantage in the Blockchain Landscape

Scalability is a key differentiator in the Layer 1 wars. While Ethereum has adopted a modular, rollup-centric approach, its L1 fees and congestion issues have historically driven users to alternatives like Solana. However, Ethereum’s Layer 2 ecosystem is growing rapidly, and other L1s like Avalanche, Aptos, and Sui are also vying for market share.

Solana’s continued investment in both its monolithic L1 and modular Layer 2 solutions gives it a unique position:

-

Fast, composable L1 for atomic DeFi and NFTs

-

Specialized Layer 2s for high-frequency use cases

-

Low fees across both layers, enhancing user accessibility

By delivering scalability without fragmenting the user experience, Solana can retain its edge as the go-to platform for high-throughput, low-latency applications. This competitive positioning supports long-term confidence in SOL’s value proposition.

5️⃣ Investor Sentiment and Price Dynamics

Finally, scalability influences market perception, which in turn drives price action. Traders and investors watch key metrics like:

-

TPS and network uptime

-

Transaction fees and congestion reports

-

New Layer 2 rollouts and ecosystem growth

Positive developments—such as the successful launch of a major Layer 2 solution (e.g., Firedancer, Solaxy)—can act as bullish catalysts for SOL. Conversely, scalability failures, such as network outages or congestion crises, can lead to price corrections as confidence wanes.

In crypto markets, narratives matter, and scalability is a major narrative for Solana. The ability to confidently say, “Solana can handle global-scale applications” is a compelling story for both retail and institutional investors. As Layer 2 solutions mature, this narrative becomes even stronger.

In Summary

Scalability is not an abstract concept—it is directly tied to SOL’s utility, demand, and long-term value. The more scalable Solana becomes, the more users it can onboard, the more transactions it can process, and the more compelling SOL becomes as both a utility token and an investment asset.

In the next section, we’ll shift focus to the practical side—exploring how to trade SOL on Phemex amid the evolving scalability narrative, and how to position yourself for potential upside as Solana’s ecosystem continues to grow.

How to Trade SOL on Phemex Amid Scalability Narratives

With Solana’s scalability upgrades and Layer 2 ecosystem rapidly evolving, investors are increasingly looking to capitalize on the network’s growth potential. Whether you’re a long-term believer in Solana’s future or a trader looking to seize short-term opportunities, understanding how to trade SOL effectively is key. Phemex offers a suite of tools and products tailored for both spot investors and derivatives traders to engage with SOL’s price action as scalability narratives unfold.

Spot Trading SOL on Phemex

For investors seeking straightforward exposure to Solana’s growth story, spot trading SOL on Phemex is the simplest option. The SOL/USDT spot pair allows you to buy and hold SOL directly, participating in potential long-term appreciation driven by scalability milestones such as:

-

The rollout of Layer 2 solutions like Solaxy, SOON, and ZX

-

Major ecosystem developments (e.g., Firedancer’s launch, partnerships with enterprises)

-

Increased user adoption as fees remain low and performance scales up

Buying SOL on Phemex is straightforward:

-

Create a Phemex account and complete any necessary KYC steps.

-

Deposit funds (USDT, BTC, or fiat via supported methods).

-

Navigate to the SOL/USDT spot pair and place a market or limit order based on your trading strategy.

-

Once your order is filled, your SOL balance will appear in your Phemex wallet, ready to hold, transfer, or stake (when staking options are available).

For those who believe in Solana’s long-term scalability potential, holding SOL in spot form allows you to benefit from capital appreciation and potential passive income through future staking opportunities.

Trading SOL Futures on Phemex

For more advanced traders looking to capture short-term price movements tied to Solana’s scalability news, SOL/USDT perpetual futures contracts on Phemex offer flexibility and leverage. You can go long if you expect SOL’s price to rise, or short if you anticipate a pullback—perhaps due to network delays, regulatory uncertainties, or general market corrections.

Access the SOL/USDT futures page and explore:

-

Leverage Options: Trade SOL with leverage (up to 100x), magnifying both potential profits and risks. For scalability narratives, leverage can amplify gains if SOL surges on Layer 2 announcements, Firedancer benchmarks, or ecosystem partnerships.

-

Risk Management Tools: Set stop-loss and take-profit orders to manage risk, especially in the volatile crypto market. Scalability events can trigger sudden moves, so disciplined trading is essential.

-

Hedging Strategies: If you hold spot SOL but are concerned about a short-term correction (e.g., due to delays in a Layer 2 launch), you can open a short futures position to offset potential losses.

Pro Tip: Use Phemex’s advanced charting tools to monitor SOL’s price action during key scalability milestones, such as the launch of Solaxy or Firedancer updates. Combine technical analysis with fundamental understanding for more informed trading decisions.

Understanding Scalability Narratives for SOL Trading

Scalability narratives are powerful price catalysts. For SOL traders, staying ahead of the news is critical. Here are some practical tips:

-

Monitor Developer Updates: Follow Solana Foundation announcements and GitHub repositories for Firedancer, Solaxy, SOON, and ZX developments.

-

Watch for Testnet and Mainnet Milestones: Solaxy’s mainnet launch or Firedancer testnet results can trigger market excitement.

-

Track Ecosystem Adoption: Partnerships with payment providers, gaming studios, or enterprise clients using Solana’s Layer 2s can boost demand for SOL.

-

Be Aware of Macroeconomic Factors: Regulatory changes, ETF approvals, or broader market sentiment (Bitcoin halving cycles, for instance) can impact SOL alongside scalability developments.

By integrating scalability narratives into your trading strategy, you position yourself to capitalize on both fundamental trends and technical setups.

Phemex: Your Platform for SOL Trading

Phemex’s zero-fee spot trading for premium users, high-performance futures engine, and robust risk management tools make it an ideal platform for trading SOL. In addition to SOL, you’ll find a wide range of crypto assets, educational resources, and market insights to support your trading journey.

For market insights, the Solana price page provides real-time data, charts, and historical performance metrics to inform your decisions.

By leveraging Phemex’s products, you can trade SOL with confidence—whether you’re speculating on short-term volatility or investing for long-term growth as Solana’s scalability roadmap unfolds.

Conclusion: Solana’s Scaling Future

Solana’s journey is a testament to the evolving landscape of blockchain technology—one where speed, scalability, and innovation converge to power the next generation of decentralized applications. As we’ve explored, Solana’s monolithic architecture has delivered unmatched throughput and low fees, attracting millions of users and developers worldwide. Yet, the challenges of network congestion, occasional outages, and the sheer scale of Web3 ambitions have underscored the need for Layer 2 solutions that complement Solana’s core strengths.

The emergence of Layer 2 projects like Solaxy, SOON, and ZX represents a strategic shift in Solana’s scalability roadmap. These solutions demonstrate that while Solana’s L1 is fast, scalability isn’t just about raw TPS—it’s about building a resilient, modular ecosystem that can handle diverse workloads:

-

Solaxy offers a rollup-powered playground for DeFi, gaming, and NFTs, reducing congestion on the mainnet.

-

SOON brings optimistic rollups to Solana’s Sealevel environment, creating a hybrid model that blends speed and modularity.

-

ZX explores the frontier of ZK rollups on Solana, paving the way for ultra-secure, high-throughput trading applications.

Together, these Layer 2 innovations reinforce Solana’s position as a high-performance blockchain platform capable of evolving with user demand. They also highlight an important reality: no single scaling solution is perfect for all use cases. By integrating both monolithic and modular approaches, Solana is embracing a multi-layered architecture that combines the best of both worlds—speed and flexibility.

For SOL holders and traders, this scaling future carries significant implications:

-

More transactions and users mean higher SOL utility, as every interaction on the network (whether Layer 1 or Layer 2) consumes SOL for fees.

-

Higher throughput supports ecosystem growth, attracting developers and enterprise adoption for real-world use cases like tokenized assets, payments, and gaming.

-

Scalability is a narrative, and narratives drive markets. As Solana rolls out its scalability upgrades, SOL’s price could benefit from renewed interest and positive sentiment.

For those looking to trade or invest in SOL, Phemex offers a robust platform to capture these opportunities. You can buy SOL directly on the spot market, speculate on its price through perpetual futures, or monitor real-time data on the Solana price page. As Solana’s Layer 2 landscape matures, traders on Phemex can position themselves to benefit from both short-term market moves and long-term value growth.

Looking ahead, Solana’s commitment to scalability will be a defining factor for its success. Firedancer’s anticipated launch in 2025, the growth of Layer 2 solutions, and ongoing community contributions all point to a blockchain ecosystem that is not only resilient but poised for expansion. If Solana can deliver on its vision—seamless scalability at internet scale—it could solidify its status as a foundational layer for the future of Web3.

As always, investors and users should stay informed, monitor the latest developments in the Solana ecosystem, and approach the market with a balanced perspective. Scalability is not a destination—it’s an ongoing process. Solana’s willingness to adapt, innovate, and push boundaries suggests a bright future ahead, one where SOL plays a central role in powering the decentralized world.

Disclaimer

This article is for informational purposes only and should not be considered investment advice. Cryptocurrency trading and investing involve significant risks, and you should conduct your own research or consult with a financial advisor before making investment decisions. Phemex does not guarantee the accuracy or completeness of any information provided, and past performance is not indicative of future results.