Trading in 2025

In the volatile world of cryptocurrency, the difference between profit and loss often comes down to one critical factor: emotion. Fear of missing out (FOMO) can cause you to buy at the peak, while panic can lead you to sell at the bottom. But what if you could remove emotion from the equation entirely? What if you could execute a flawless trading strategy 24/7, without ever sleeping?

Welcome to the world of automated crypto trading, powered by Phemex Trading Bots.

This is not just another theoretical guide. This is a practical, step-by-step masterclass designed to turn you from a curious beginner into a confident bot operator. We’ll show you the secret weapon that sets Phemex apart: a revolutionary Bot Marketplace where over 22,000 active bots are currently managing more than $14 million in value. We’ll even show you how you can one-click copy strategies that have achieved an estimated +278% APR.

Whether you want to launch your first bot in under five minutes or fine-tune a professional-grade custom strategy, this guide is your final destination.

Your First Bot in 3 Clicks: Using the Phemex Bot Marketplace

Here’s how simple it is to get started.

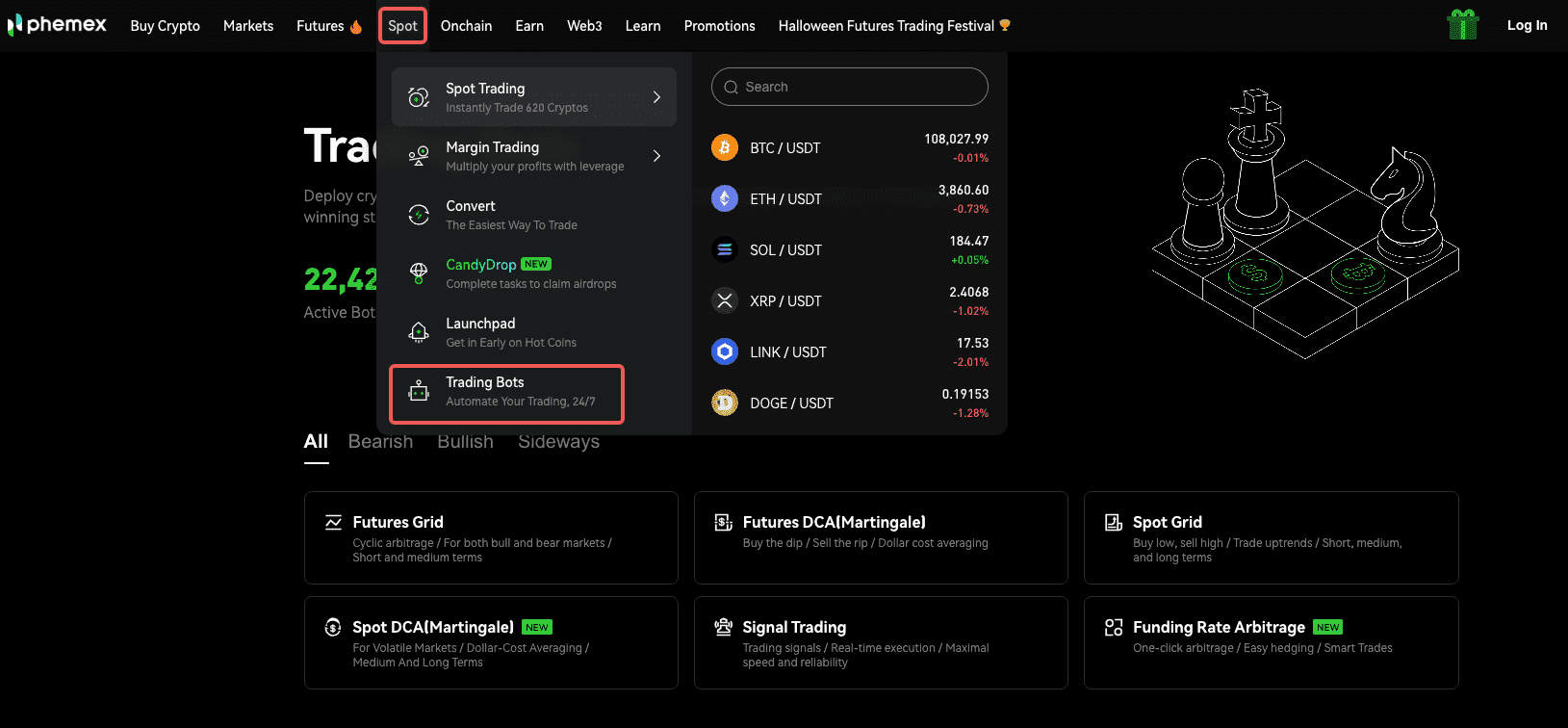

Step 1: Navigate to the Trading Bots Section

Log in to your Phemex account. On the main navigation bar at the top, you'll see a "Spot" dropdown menu. Hover over it and click on "Trading Bots." This will take you to the central dashboard for all automated trading activities.

Step 2: Enter the Bot Marketplace

Once on the Trading Bots page, you'll see an overview of the different bot types. Look for a tab or button labeled "Bot Marketplace." This is your gateway to hundreds of pre-built, active strategies created by other Phemex users.

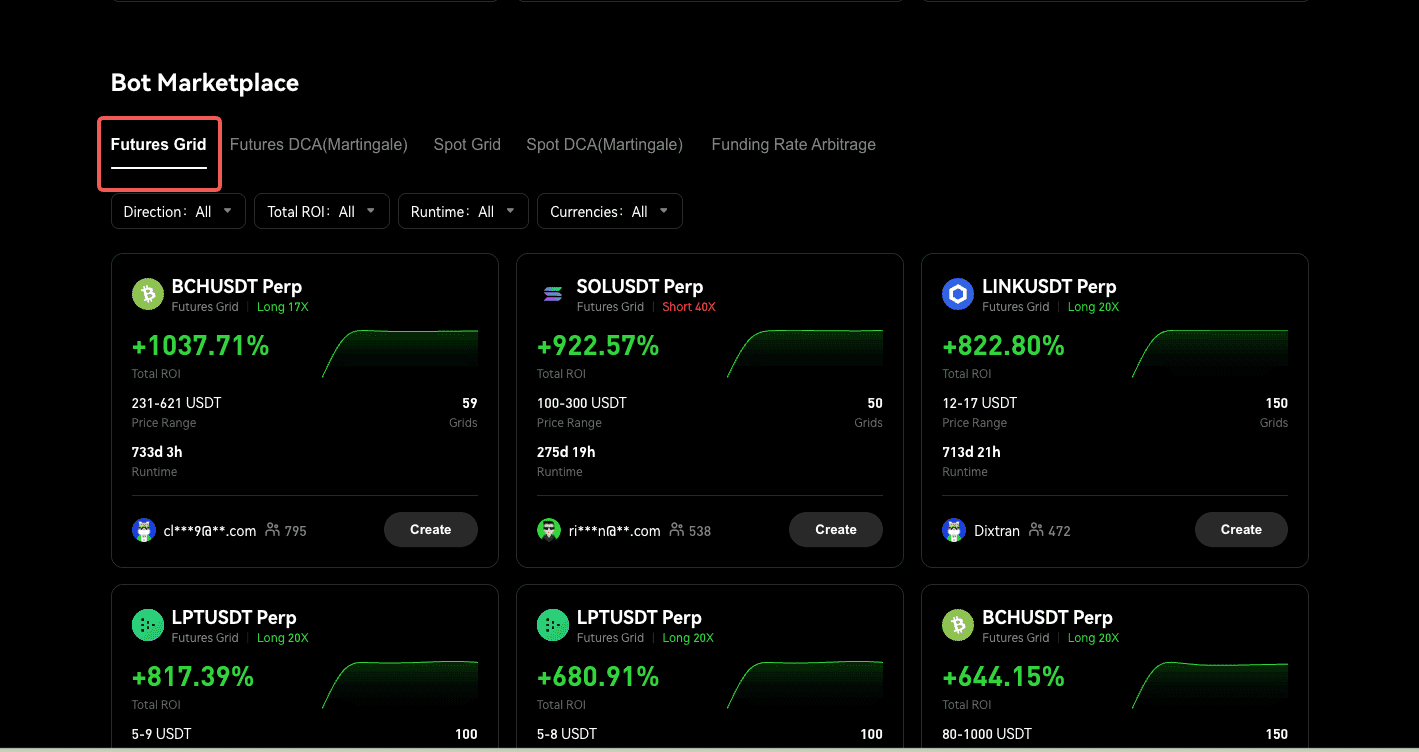

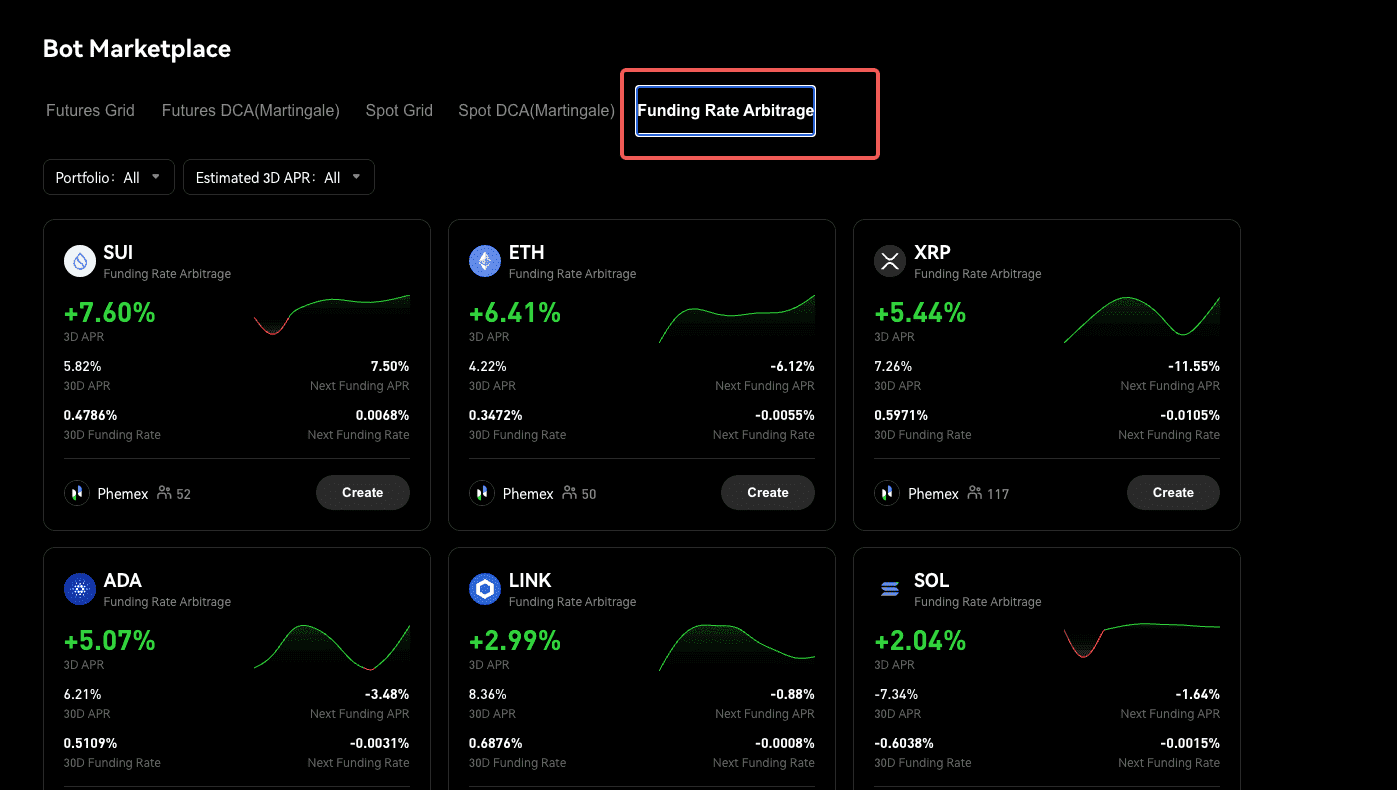

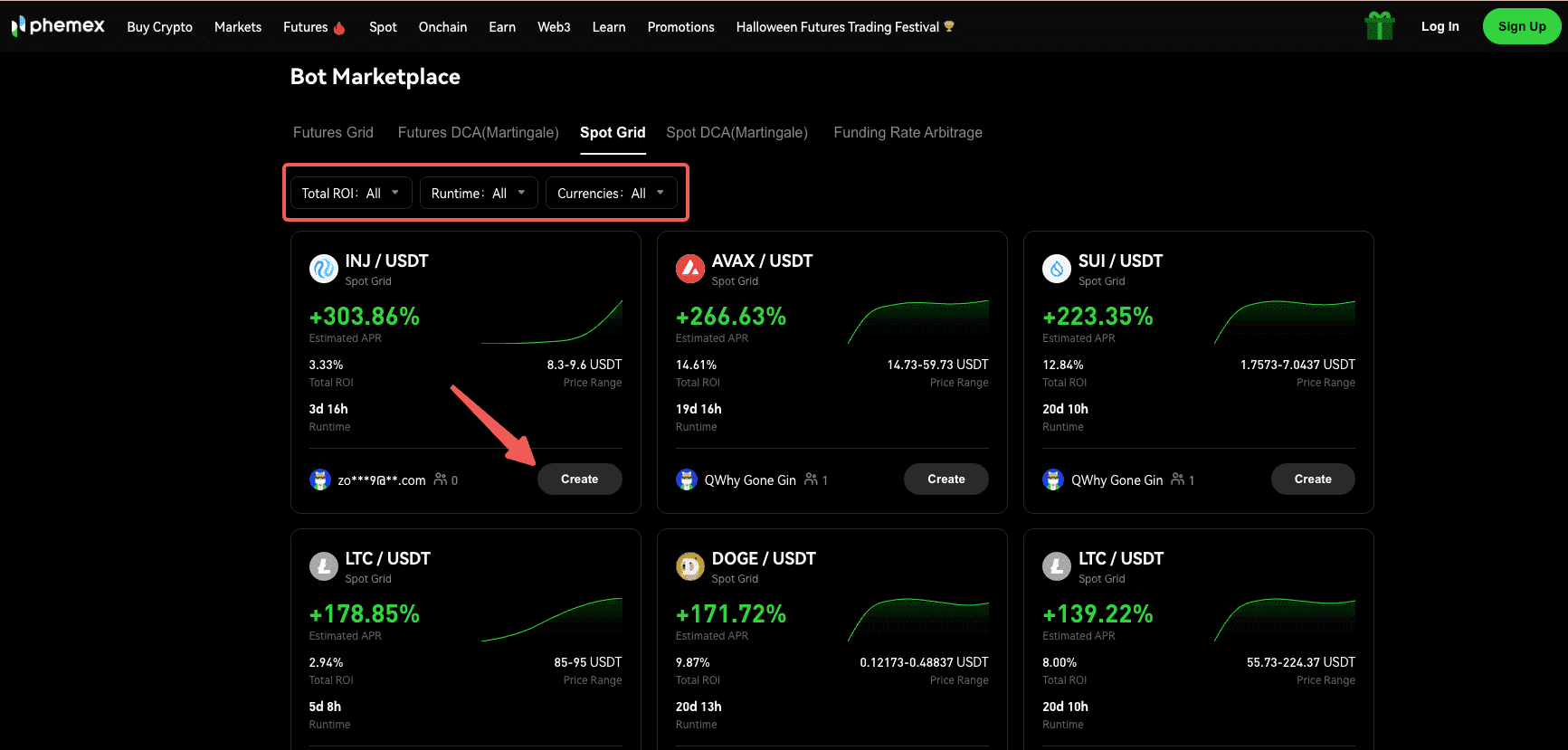

Step 3: Decode the Dashboard & Choose Your Champion

The Marketplace can look overwhelming at first, but it’s incredibly simple once you understand the key metrics. Let’s break down a typical bot card:

-

Pair (e.g., AVAX/USDT): The crypto asset the bot is trading.

-

Estimated APR (Annual Percentage Rate): This is a projection of the bot's potential annual return based on its recent performance. While a high APR is attractive, remember that past performance is not indicative of future results. It's a powerful indicator, but not a guarantee.

-

Total ROI (Return on Investment): This is the bot's actual, realized profit or loss since it was created. This is often a more reliable metric than APR, as it shows real-world performance over time.

-

Runtime: This shows how long the bot has been active. A bot with a high ROI over a long runtime (e.g., 30+ days) is generally more reliable than a bot with a high ROI over a few hours.

-

Price Range: For Grid Bots, this shows the upper and lower price boundaries within which the bot operates.

-

Creator: The anonymized username of the trader who created the bot.

Use the filters at the top to sort by your preferred currency or runtime to find a bot that matches your risk appetite and goals.

Step 4: Click "Create" and Deploy

Found a bot you like? Simply click the "Create" button. A pop-up will appear. The only thing you need to do is enter the amount of capital you wish to allocate to this bot. The strategy parameters are already locked in from the bot you're copying.

Confirm the details, and that’s it. You have successfully launched your first crypto trading bot. It will now begin executing trades automatically based on its pre-defined strategy.

Choosing Your Weapon: A Detailed Look at the 6 Phemex Bots

Let's dissect each bot so you can choose the right one for any situation.

Spot Grid Bot: Profiting from Sideways Chop

-

What It Is: The Spot Grid Bot is the quintessential tool for ranging markets. It automates the classic "buy low, sell high" strategy.

-

How It Works: Imagine casting a wide fishing net across a price range. The bot places a series of buy orders below the current price and sell orders above it, creating a "grid." As the price fluctuates within this range, it continuously buys when the price dips and sells when it rises, capturing small profits from each trade.

-

Best For: "Sideways" or ranging markets, where a coin is bouncing between a clear support and resistance level. It performs poorly in strong, one-directional trends.

-

Pro Tip: The tighter you make your grid (i.e., more grid lines), the more frequent the trades but the smaller the profit per trade. A wider grid means fewer trades but larger profits each time. For beginners, using the "AI Strategy" option to set the grid parameters is highly recommended.

Futures Grid Bot: Amplifying Grid Profits with Leverage

-

What It Is: This bot applies the same grid logic as the Spot Grid Bot but to futures contracts. This introduces the powerful, and risky, element of leverage.

-

How It Works: You can set up a Long Grid (profiting in an upward-trending range), a Short Grid (profiting in a downward-trending range), or a Neutral Grid (for pure sideways markets). Leverage magnifies both your profits and your losses.

-

Best For: Experienced traders who understand the mechanics of futures trading and risk management.

-

CRUCIAL RISK WARNING: Leverage is a double-edged sword. If the price moves aggressively outside your grid range, you risk liquidation, which means the loss of your entire invested capital. Always use stop-losses and start with low leverage (2-3x).

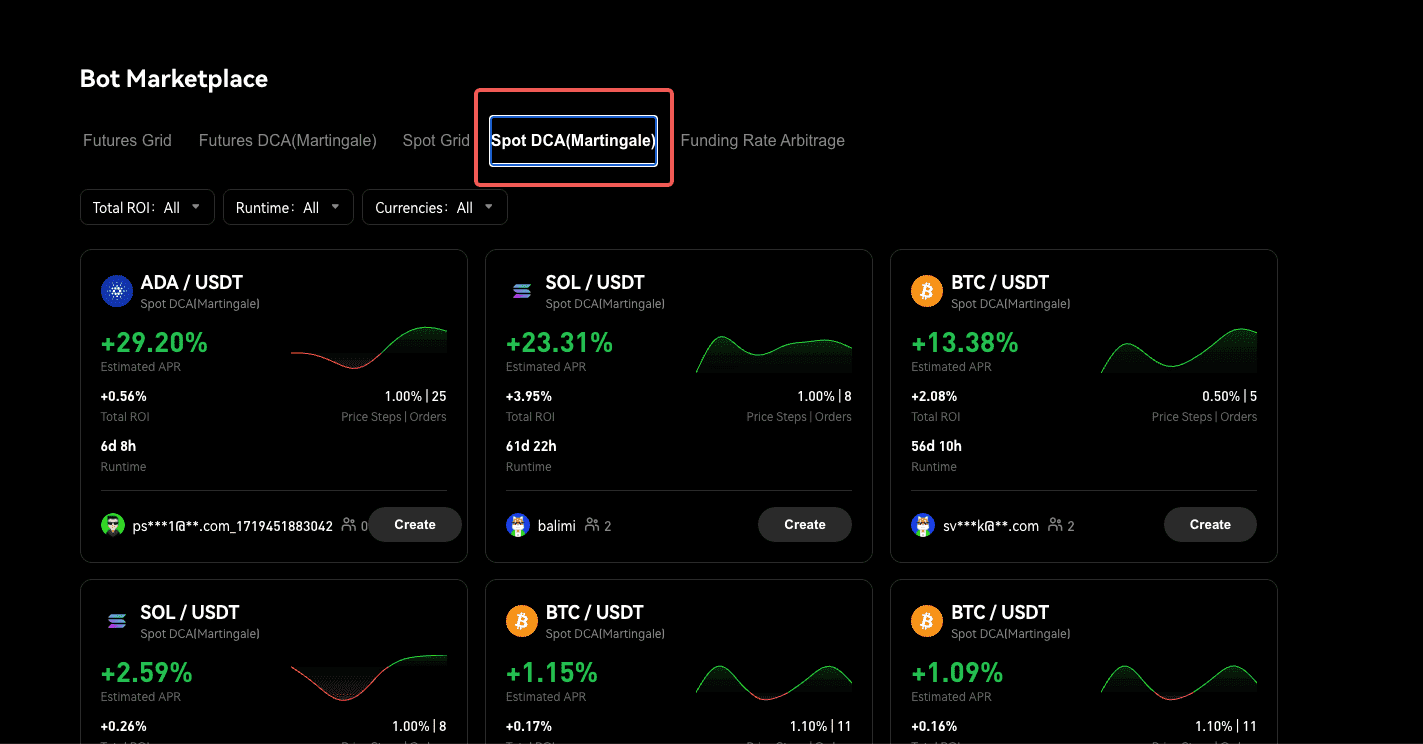

Spot DCA (Martingale): Automating "Buying the Dip"

-

What It Is: The DCA (Dollar-Cost Averaging) Bot, sometimes referred to as a Martingale Bot, is designed to automate the strategy of buying more of an asset as its price falls.

-

How It Works: You set an initial entry. If the price drops by a certain percentage (e.g., 2%), the bot makes a second, larger purchase. If it drops again, it makes an even larger purchase. This systematically lowers your average entry price, meaning you need a smaller price recovery to get into profit.

-

Best For: Markets where you have strong long-term bullish conviction. It’s a strategy for accumulating an asset you believe in during periods of price correction.

-

Pro Tip: This strategy requires significant capital reserves, as you need funds available for subsequent "dip" buys. Ensure your "Max Additions" setting aligns with your available capital.

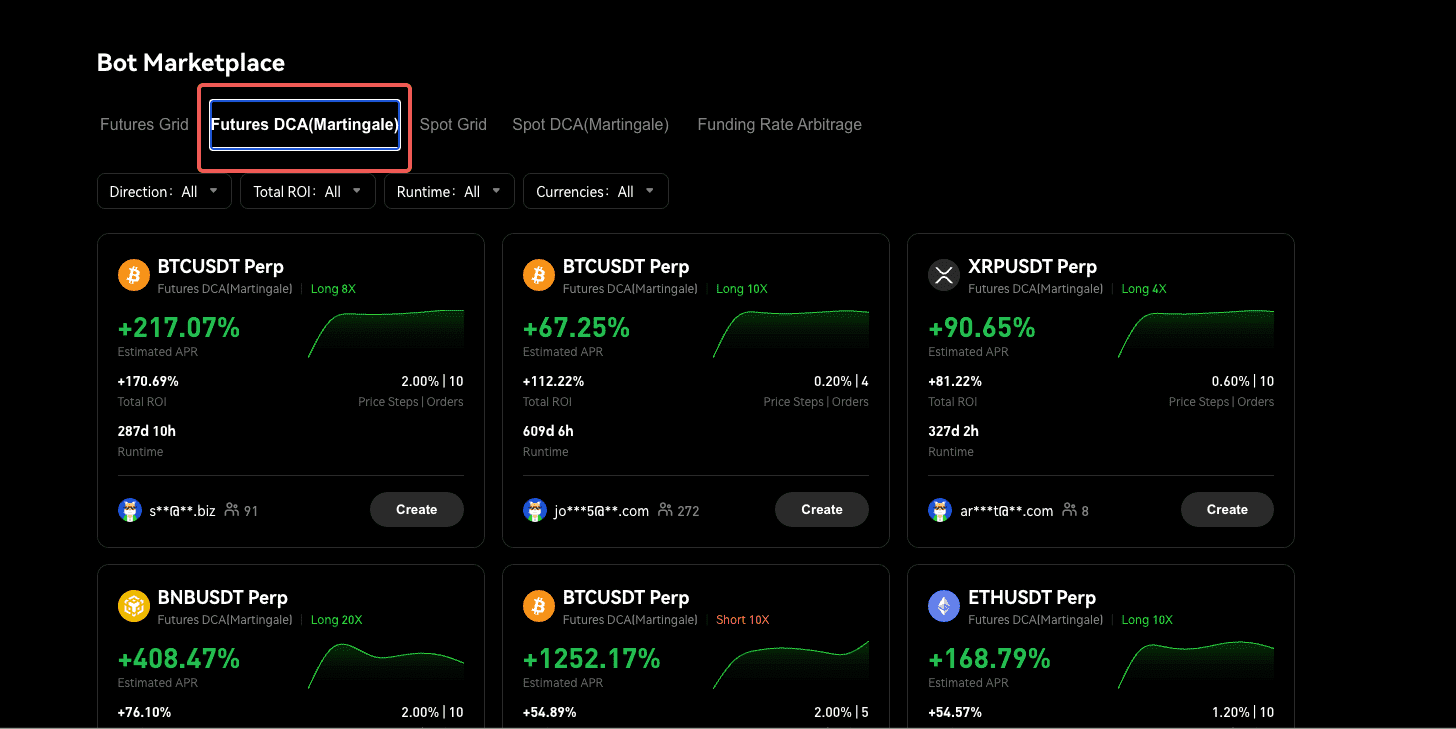

Futures DCA (Martingale): The High-Risk, High-Reward Accumulator

-

What It Is: This bot applies the DCA logic to leveraged futures positions.

-

How It Works: Instead of just buying more of an asset, it increases the size of your leveraged long or short position as the price moves against you, with the goal of profiting from a reversal.

-

Best For: Advanced traders with a very high-risk tolerance who are confident in predicting trend reversals.

-

CRUCIAL RISK WARNING: This is one of the highest-risk bots available. Combining leverage with a Martingale strategy can lead to extremely rapid losses and a high chance of liquidation if the market trend does not reverse as expected. Proceed with extreme caution.

Signal Trading: Your TradingView Strategies on Autopilot

-

What It Is: This is a professional-grade tool that acts as a bridge between your custom trading strategies on TradingView and your Phemex account.

-

How It Works: You can create complex alerts in TradingView based on your unique combination of indicators (RSI, MACD, Bollinger Bands, etc.). By using a webhook, these alerts can trigger the Phemex Signal Bot to automatically execute a buy or sell order.

-

Best For: Quantitative analysts, experienced technical traders, and anyone who wants to fully automate a bespoke trading system.

-

Pro Tip: This removes 100% of execution emotion and latency. If your strategy on TradingView backtests well, the Signal Bot is the perfect way to deploy it in the live market.

Funding Rate Arbitrage: Earning Passive Income

-

What It Is: This sophisticated bot is designed to generate relatively low-risk, market-neutral profits by capturing "funding rates" from the perpetual futures market.

-

How It Works: In simple terms, funding rates are small payments made between traders holding long and short positions to keep the futures price pegged to the spot price. When the rate is positive, longs pay shorts. When negative, shorts pay longs. The bot simultaneously takes a position in the spot market and an opposing position in the futures market, neutralizing price risk while collecting these funding payments.

-

Best For: Traders looking for a passive income strategy that is not dependent on market direction. It's an advanced form of crypto "yield farming."

-

Pro Tip: Profitability depends on the funding rate environment. This bot thrives during periods of high market optimism or pessimism when funding rates are consistently high.

The Phemex Advantage: Security, Cost, and Community

Fort Knox Security: Why "No API Keys" is a Game-Changer

Most third-party trading bots require you to connect your exchange account via API (Application Programming Interface) keys. This process is notoriously risky. If your API keys are compromised through phishing or a data leak on the bot provider's end, a malicious actor could gain full control of your trading account.

Phemex bots are fully integrated into the exchange. They are part of the core infrastructure. This means:

-

Zero API Risk: You never have to generate, copy, or paste sensitive API keys.

-

Instant Execution: Commands are sent internally, eliminating the latency that can occur with external API calls.

-

Total Peace of Mind: Your funds never leave the secure Phemex ecosystem.

The *1 Advantage: A 100% Free, Powerful Tool

Let's be clear: this is the most significant financial advantage. Leading third-party bot platforms like Cryptohopper, 3Commas, or Pionex often operate on a SaaS (Software as a Service) model. This means you pay a recurring monthly subscription fee, which can range from $20 to over $100, regardless of whether your bots are profitable.

On Phemex, all six trading bots are completely free to use.

This means every dollar of profit your bot generates is yours to keep. You are not starting each month in a deficit, trying to earn back your subscription cost. This dramatically lowers the barrier to entry and allows you to experiment with small amounts of capital without worrying about recurring fees.

Beyond the Code: The Power of the AI and Marketplace

Phemex doesn’t just give you a tool; it gives you a strategic ecosystem.

-

The AI Strategy: For users who want to move beyond copy-trading but aren't ready for full manual control, the "AI Strategy" button is the perfect middle ground. It analyzes recent market volatility and suggests optimized parameters for your chosen bot, giving you a professional-grade setup in one click.

-

The Marketplace Community: The Bot Marketplace is more than just a feature; it’s a living library of successful strategies. It fosters a community of learning where you can see what’s working for top traders in real-time and apply it to your own portfolio.

Conclusion: Your Journey to Automated Trading Starts Now

The world of crypto trading is evolving. Manual, emotion-driven trading is being replaced by systematic, automated strategies. Phemex has democratized access to these powerful tools, removing the traditional barriers of cost and security risks.

You no longer need to be a programmer or a quantitative analyst to make a trading bot work for you. Whether you choose the simple path of one-click copying from the Marketplace, the balanced approach of an AI-assisted setup, or the ultimate control of a fully manual strategy, the platform is built for your success.

Stop letting fear and greed dictate your trades. Your journey to becoming a disciplined, automated trader is just one click away.

Go to the Phemex Bot Marketplace right now, find a strategy with a strong runtime and ROI that fits your style, and deploy your first bot. Start small, learn the process, and unlock a new dimension of crypto trading.

Frequently Asked Questions (FAQ)

Q1: Is Crypto Bot Trading Profitable?

Yes, it can be highly profitable, but it is not a "get rich quick" scheme. Profitability depends entirely on choosing the right bot for the right market condition and using sensible parameters. The Phemex Marketplace proves that many users are achieving consistent returns.

Q2: Are Phemex Trading Bots Safe to Use?

Yes. They are arguably the safest way to use trading bots. Because they are integrated directly into the exchange, you are protected from the API key risks that plague external bot providers. Your funds and account security are protected by Phemex's institutional-grade security infrastructure.

Q3: How Much Money Do I Need to Start with a Phemex Bot?

You can start with a very small amount, often the minimum trade size for a given pair (e.g., 50). This is a major advantage of the fee-free model. We highly recommend starting with a small amount of capital that you are comfortable losing while you learn how the bots operate.

Q4: Can a Trading Bot Lose Money?

Absolutely. A trading bot is a tool that executes a strategy. If the market moves against that strategy, the bot will incur losses. For example, a Spot Grid Bot will lose value if the price falls completely below its set price range. Always set a stop-loss and never invest more than you can afford to lose.

Q5: Which Phemex Bot is Best for Beginners?

The Spot Grid Bot is universally recommended for beginners. Its logic is easy to understand, and it's designed for the common "sideways" market condition. The best starting point of all is to copy a successful Spot Grid Bot from the Bot Marketplace.

Q6: Do I Need to Monitor My Bot 24/7?

No, that's the primary benefit of automation. However, it is not "set and forget." You should check in on your bot's performance daily or every few days. It's crucial to monitor if the overall market trend is changing, as you may need to stop your bot if, for example, a ranging market turns into a strong trending market.