This Week at a Glance

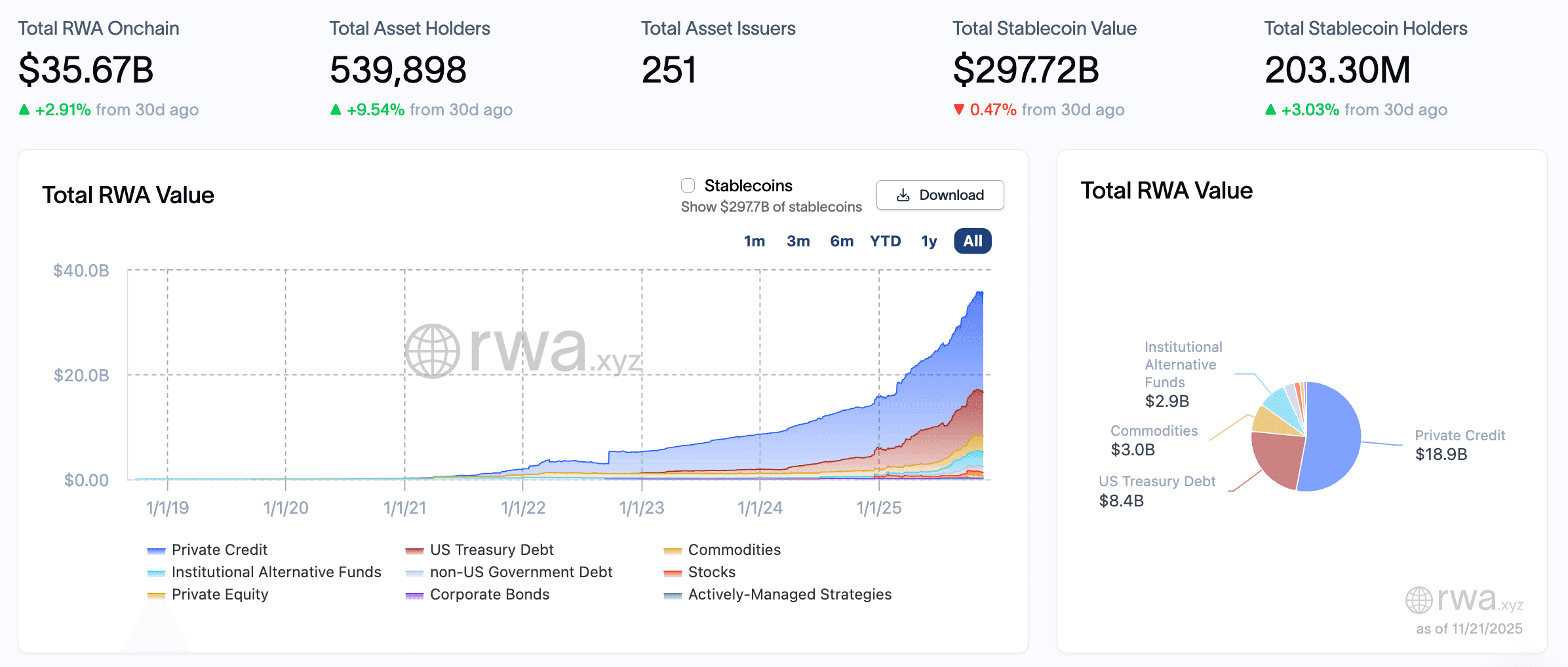

Tokenized RWAs (real-world assets), excluding stablecoins, reached $35.67 billion — up 2.91% in 30 days, with 539,898 unique holders (+9.54% MoM) and 251 active issuers. BlackRock’s BUIDL retained the top position at $2.325 billion. Tokenized gold instruments collectively reached $2.921 billion, placing Tether Gold (XAUT) at #2 ($1.576 billion) and Pax Gold (PAXG) at #3 ($1.345 billion).

Key developments included the launch of Kyrgyzstan’s gold-backed USDKG stablecoin, Saudi Arabia’s first fully tokenized real estate transaction, the release of Dubai VARA’s final stablecoin regulations, the inclusion of a stablecoin framework in Canada’s 2025 federal budget, and the Basel Committee’s revised capital treatment for high-quality tokenized assets.

Source: rwa.xyz

Top 5 Tokenized Real-World Assets (RWA.xyz – November 21, 2025)

| Rank | Asset | Ticker | Issuer / Platform | Total Value | 7-Day Change | 30-Day Change | Asset Class |

|---|---|---|---|---|---|---|---|

| 1 | BlackRock USD Institutional Fund | BUIDL | Securitize / BlackRock | $2.325 billion | –7.89% | –18.47% | U.S. Treasuries |

| 2 | Tether Gold | XAUT | Tether Holdings | $1.576 billion | –3.70% | –7.43% | Tokenized Gold |

| 3 | Pax Gold | PAXG | Paxos Trust Company | $1.345 billion | –3.70% | –6.54% | Tokenized Gold |

| 4 | Syrup USDC | syrupUSDC | Maple Finance | $1.269 billion | +3.79% | –1.25% | Private Credit |

| 5 | Circle USYC | USYC | Circle | $1.074 billion | +1.29% | +37.41% | U.S. Treasuries |

Top 5 RWA-Related Protocol & Infrastructure Tokens (CoinMarketCap – November 21, 2025)

| Rank | Token | Ticker | Current Price | Market Cap | 7-Day Change | Primary Function |

|---|---|---|---|---|---|---|

| 1 | Chainlink | LINK | $12.35 | $8.38 billion | +15.03% | Oracle network for off-chain data and reserve proofs |

| 2 | Stellar | XLM | $0.2232 | $7.19 billion | +15.36% | Cross-border settlement infrastructure |

| 3 | Avalanche | AVAX | $13.01 | $5.58 billion | +16.18% | Layer-1 with institutional-grade subnets |

| 4 | Hedera | HBAR | $0.1270 | $5.40 billion | +19.56% | Enterprise distributed ledger technology |

| 5 | Tether Gold | XAUT | $4,031 | $1.52 billion | +2.69% | Direct exposure to allocated physical gold |

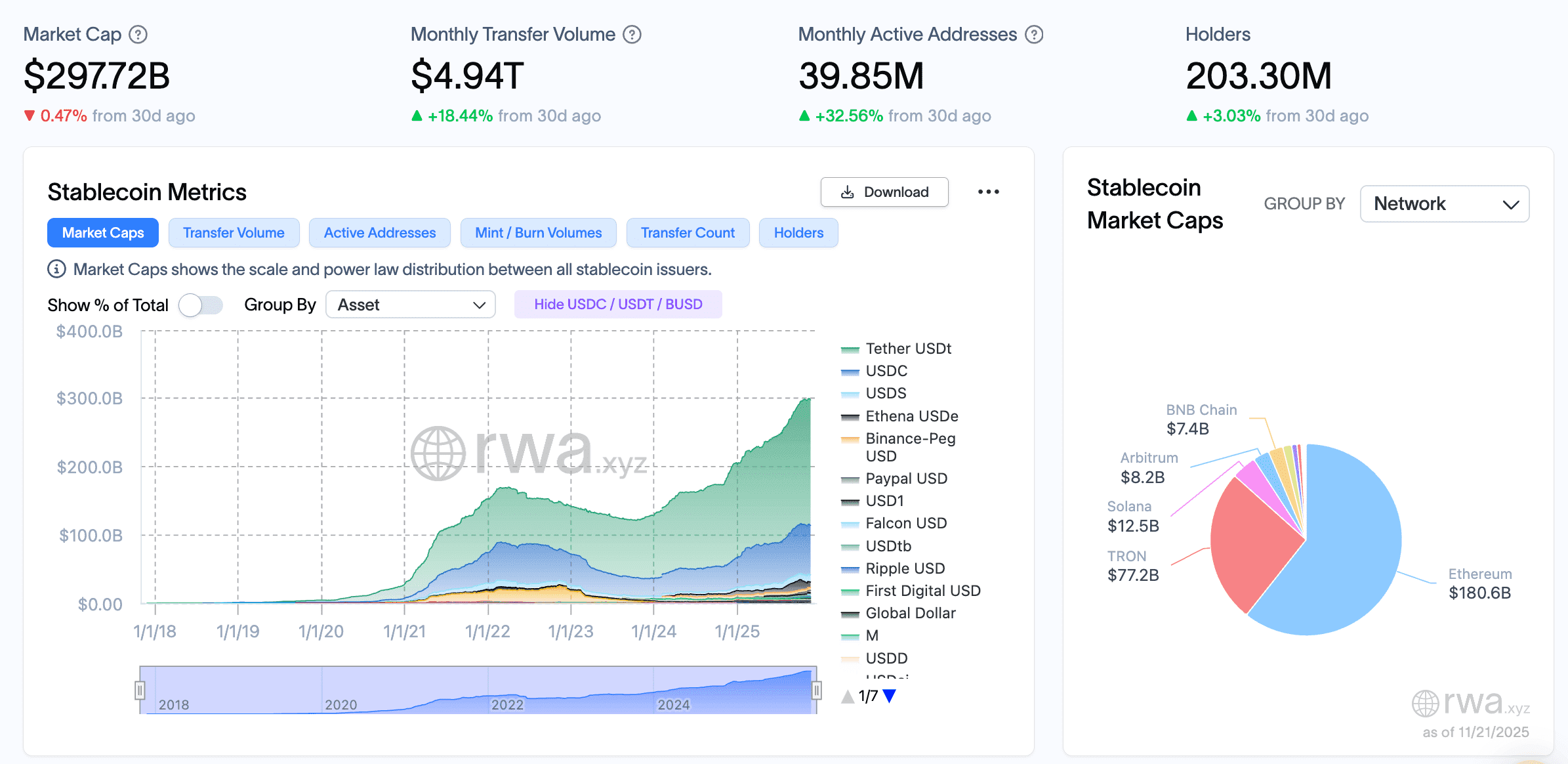

Stablecoin Market Overview – The Primary Liquidity Layer for RWAs

Stablecoins continue to serve as the essential bridge between traditional finance and tokenized real-world assets. As of November 21, 2025:

- Total market capitalization: $297.72 billion (–0.47% over 30 days)

- Unique holder addresses: 203.30 million (+3.03% MoM)

- Dominant issuers: – USDT (Tether): $183.6 billion (–0.53% weekly) – USDC (Circle): $72.7 billion (–0.80% weekly)

- Other notable stablecoins: PYUSD rose to $3.6 billion (+3.23% weekly) on payment-network integrations; USDtb declined to $1.3 billion after reserve rebalancing.

- Yield-bearing segment: Tokens such as rcUSD+, sUSDe, and USYC variants now collectively exceed $15 billion in circulation.

- Transfer volume: Annualized on-chain stablecoin volume remains higher than the combined throughput of Visa and Mastercard.

Stablecoins are the on-ramp and off-ramp for virtually all RWA transactions, enabling seamless movement between fiat banking rails and tokenized Treasuries, gold, credit, or real estate.

Source: rwa.xyz

This Week’s Major Developments & Impact (November 15–21, 2025)

Sovereign & Regional Issuance

- Kyrgyzstan launches gold-backed USDKG stablecoin: National Bank of Kyrgyzstan issued USDKG — a sovereign stablecoin 1:1 backed by physical gold on BNB Chain with regular Big Four audits. Initial $50M minted.

Why it matters: First sovereign tokenized commodity in Central Asia, boosts financial sovereignty and attracts institutional inflows. - Saudi Arabia completes first fully tokenized real estate deal: REGA executed the Kingdom’s first end-to-end blockchain property transfer with fractional ownership using the new national registry.

Why it matters: Sets regulatory precedent for tokenized real estate across the GCC, unlocking liquidity in a $100B+ market.

Regulation & Policy

- Dubai VARA releases final stablecoin framework: VARA finalized full licensing rules for fiat-referenced stablecoins: 100% reserves, daily audits, no algorithmic coins.

Why it matters: Gives onshore regulatory clarity and is expected to attract $5B+ in licensed stablecoin issuance by 2026. - Canada adds stablecoin rules to 2025 federal budget: First federal legislation for fiat-backed stablecoins with full reserves and Bank of Canada oversight.

Why it matters: Marks G7-level recognition of payment stablecoins and tokenized securities. - Basel Committee finalizes new capital rules: From Jan 2026, high-quality tokenized assets get the same risk weights as traditional securities.

Why it matters: Cuts bank capital costs and accelerates global institutional RWA adoption.

Institutional & Infrastructure

- Tether invests in Parfin (Brazil): Tether made a strategic investment in Parfin to embed USDT into custody, tokenization and settlement platforms across Latin America.

Why it matters: Strengthens compliant tokenized fixed-income and trade finance in a region with $1.5T in crypto activity. - HSBC to launch tokenized USD deposits: HSBC will offer blockchain-native USD deposit tokens to institutional clients in the U.S. and UAE starting H1 2026.

Why it matters: First G-SIB to bring balance-sheet deposits on-chain for 24/7 settlement. - Securitize partners with Plume Network Securitize is deploying regulated funds (Hamilton Lane, etc.) on Plume’s RWA-focused Layer 2 for staking and trading.

Why it matters: Connects TradFi funds to 280k+ on-chain holders and boosts secondary-market liquidity. - Dinari adds LayerZero for cross-chain equities Dinari integrated LayerZero OFT to enable native cross-chain transfers of 200+ tokenized U.S. stocks and ETFs.

Why it matters: Ends fragmentation and unlocks true 24/7 global trading of compliant tokenized equities.

Closing Summary

As of November 21, 2025, tokenized real-world assets reached $35.67 billion, with tokenized gold achieving the #2 and #3 positions globally for the first time. The week recorded simultaneous developments across sovereign issuance, regulatory frameworks, and institutional infrastructure in multiple jurisdictions. These included the launch of a sovereign gold-backed stablecoin in Kyrgyzstan, the first tokenized real estate transaction in Saudi Arabia, final stablecoin regulations from Dubai VARA, federal recognition in Canada, revised global banking capital rules from the Basel Committee, and the introduction of tokenized deposits by HSBC. Such concurrent activity across these domains contributes to the ongoing expansion of the sector and aligns with projections targeting in excess of $50 billion by year-end 2025.