Introduction

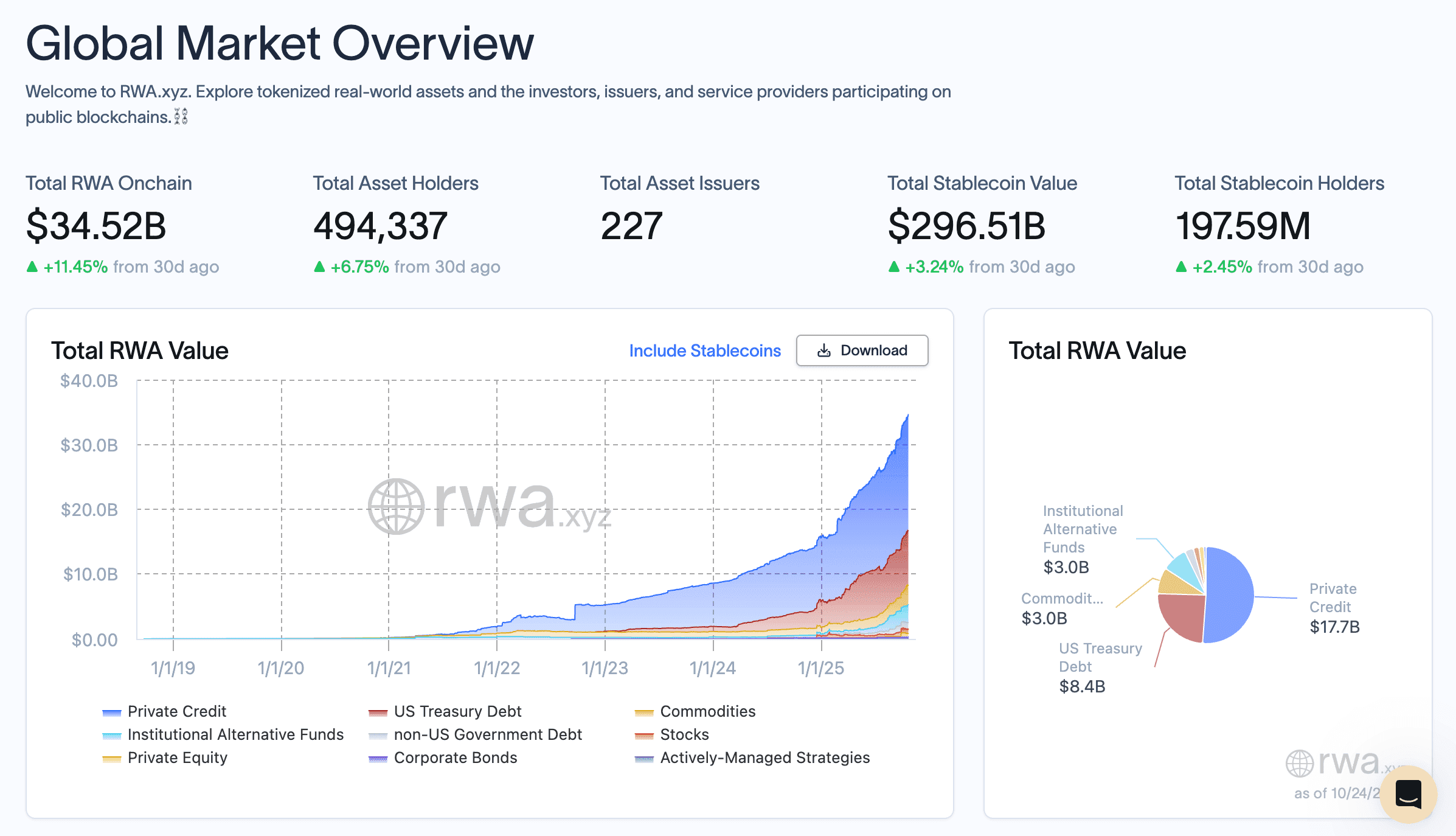

The real-world asset (RWA) market has surged to a valuation of $34.86 billion, reflecting a notable 12.79% growth over the past 30 days as per RWA.xyz. This surge underscores institutional adoption alongside a diverse portfolio of tokenized assets reshaping the onchain economy. The ecosystem now supports 496,289 asset holders and 227 issuers, signaling a stable and expanding market. Explore trading strategies and opportunities on Phemex, your go-to platform for RWA market insights.

RWA Market Overview: Insights and Metrics 2025

Market Snapshot

-

Current Valuation: The RWA market has reached $34.86 billion as of October 24, 2025, per RWA.xyz.

-

Growth Trend: This reflects a 12.79% increase over the past 30 days, indicating rising interest in tokenized assets.

-

Ecosystem Participants: The market is supported by 496,289 asset holders, up 6.89%, and 227 issuers, with Superstate Asset Trust and Anemoy among key contributors in market capitalization and growth performance, fostering a stable and expanding ecosystem.

- Leading Categories: Commodities, valued at $3.53 billion with a 36% 30-day growth, and Institutional Funds, at $2.97 billion with 22% growth, drive market expansion through diverse asset adoption.

Global Market Overview (Source)

Top RWA Assets (Weekly)

|

Asset |

Value |

7D Change |

30D Change |

Highlight |

|---|---|---|---|---|

|

BlackRock’s BUIDL |

$2.85B |

+0.06% |

+35.58% |

Led by BlackRock, this initiative maintains treasury tokenization stability. |

|

XAUT Tether Gold (XAUT) |

$1.60B |

–6% |

+72.03% |

Supported by Tether, XAUT leads in dynamic commodity tokenization. |

|

PAXG Pax Gold (PAXG) |

$1.37B |

-3% |

+23.68% |

Managed by Paxos, PAXG advances reliable gold-backed commodities tokenization. |

Stablecoin Trends

-

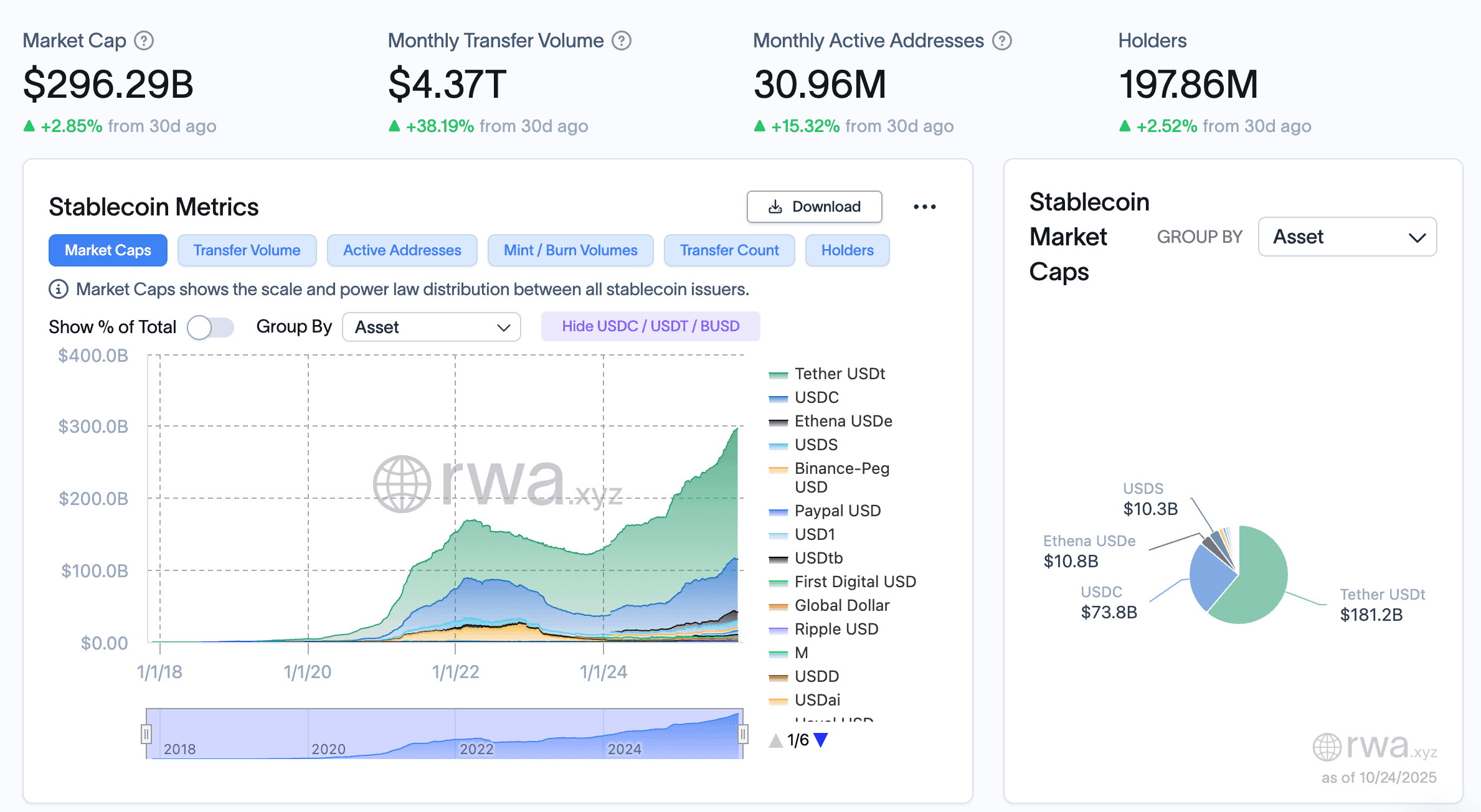

Market Value: Stablecoins have reached $296.29 billion, with a 2.85% increase over the past 30 days per RWA.xyz, led by USDT and USDC.

-

Holder Growth: Holder numbers have risen to 197.86 million, up 2.52%, led by USDT ($181.17B, +4.77%) and BSC-USD ($4.3B, +0.05%).

-

Network Distribution: Dominated by Ethereum ($178.51B), TRON ($73.49B), and Solana ($12.95B).

-

Transaction Activity: Monthly transfers have hit $4.37 trillion, with a 38.19% 30-day rise, indicating robust liquidity.

-

Issuer Dynamics: Limited growth in new issuers suggests expansion by established players like Tether and Circle.

Stablecoin Market Overview (Source)

RWA Tokenization News: Weekly Updates 2025

Regional and Regulatory Developments

-

U.S. GENIUS Act RFI Closure (Oct 20): The GENIUS Act's Request for Information (RFI) closed on October 20, 2025, gathering public input on stablecoin and RWA frameworks since July 2025. This step aims to streamline compliance for tokenized assets, supporting institutional efforts. The stablecoin market reached $308.2 billion as per DeFiLlama, reflecting current market conditions.

-

UK FCA Regulatory Refinement (Oct 22): The Financial Conduct Authority (FCA) advanced its 2026 stablecoin and tokenization regulations on October 22, 2025, using feedback from the September 17 consultation. This update focuses on cross-border compliance and consumer safeguards, targeting RWA integration. The process supports ongoing market development.

Institutional and Market Highlights

- AAVE’s RWA Liquidity Integration (Oct 20): Grove announced on October 20, 2025, plans to boost Ripple USD and USDC liquidity on Aave’s Horizon for RWA-backed borrowing, triggering a 10%+ AAVE price rise. This enables collateral use of RWAs like treasuries. It reflects institutional involvement.

-

Solana’s RWA Market Milestone (Oct 18): Solana’s tokenized RWA market hit $707.79 million on October 18, 2025, driven by treasuries and commodities. This highlights Solana’s low-cost advantage for RWAs like USYC and PAXG. It marks increased adoption.

-

BlackRock’s BUIDL Aptos Investment (Oct 23): BlackRock invested $500 million in Aptos for its BUIDL fund on October 23, 2025, expanding treasury tokenization. With $2.85 billion AUM, it attracts institutional capital to RWAs. Aptos gains liquidity traction.

-

PancakeSwap-Ondo Finance Partnership (Oct 20): PancakeSwap partnered with Ondo Finance on October 20, 2025, to integrate RWAs into DeFi on BNB Chain. This uses Ondo’s treasury expertise for yields. It expands RWA access in decentralized systems.

- Propy’s $100M U.S. Real Estate Expansion (Oct 21): Propy launched a $100 million U.S. expansion on October 21, 2025, to tokenize the $25 billion property title industry. CEO Natalia Karayaneva highlighted fractional ownership and instant settlements, reducing delays. This targets real estate as an RWA growth area.

RWA Highlight from State of Crypto 2025

The a16z Crypto 2025 report details the RWA sector’s current valuation at $30 billion, a 4x growth over two years. The report outlines RWA progress, with $10 billion backing projects like BUIDL and infrastructure focus in DePIN. Regulatory support from 15 jurisdictions reflects current adoption trends, providing a data-driven view of the sector’s state. Key findings include:

-

$10 billion in institutional capital: Investments from firms like BlackRock and Franklin Templeton support RWA expansion.

-

$3.5 trillion DePIN market projection by 2028: Tokenized infrastructure networks target energy and logistics.

-

50% cross-chain liquidity growth: Interoperability across Ethereum, Solana, and others improves asset movement.

-

15 jurisdictions adopting frameworks by 2026: Regulatory support spans the UK, Japan, and others.

Takeaways:

-

Institutional capital strengthens the RWA market’s current foundation.

-

DePIN growth indicates potential for new asset classes.

-

Cross-chain liquidity and regulations enhance market activity.

Recent RWA Developments with Potential Follow-Up

-

Oct 27: UK FCA consultations on 2026 tokenization rules..

-

Oct 28: Mitsubishi UFJ’s stablecoin framework developments.

-

Oct 29: Tether Gold (XAUT) performance update.

-

Oct 30: U.S. GENIUS Act post-RFI updates.

-

Oct 31: Nasdaq’s tokenized trading plan status.

These recent developments provide a basis for monitoring RWA progress.

Conclusion

This week’s RWA market surge to $34.86 billion, highlights 2025’s tokenization trend, driven by Commodities and Institutional Funds. The a16z report and recent developments reflect ongoing market activity. Traders can use Phemex to navigate this landscape.