The intersection of artificial intelligence (AI) and decentralized finance (DeFi) is creating new opportunities for smarter, automated trading. UnifAI Network (UAI) is at the forefront of this movement, offering a powerful infrastructure for autonomous AI agents that simplify and optimize DeFi strategies. This guide explains what UnifAI Network is, how it works, and how you can be part of this financial evolution. For those looking to get started, Phemex offers a seamless platform to trade UAI.

Summary Box (Quick Facts)

-

Ticker Symbol: UAI

-

Chain: BNB Smart Chain (BEP20)

-

Contract Address: 0x3e5d4f8a64a8809b4f03f7e62a3f5a57d17ba9ea

-

Circulating Supply: 239 Million UAI

-

Total Supply: 1 Billion UAI

-

Primary Use Case: AI-driven DeFi strategy automation and execution.

-

Current Market Cap: Approximately $29 Million

What Is UnifAI Network (UAI)?

UnifAI Network is an infrastructure of autonomous AI agents designed to make decentralized finance more accessible and efficient. For beginners, it executes complex trading and liquidity strategies on their behalf, removing the need for deep technical knowledge or constant market monitoring. For experienced developers, UnifAI provides a modular and secure framework to build, deploy, and scale sophisticated AI agents across various DeFi protocols.

The core vision behind the project is to usher in an era of "agentic finance," where AI functions as a personalized financial advisor and automated trader for every user. By empowering AI agents to discover and use DeFi tools dynamically, UnifAI solves the problem of market complexity and helps users capitalize on opportunities with enhanced intelligence and security.

How Many UAI Are There?

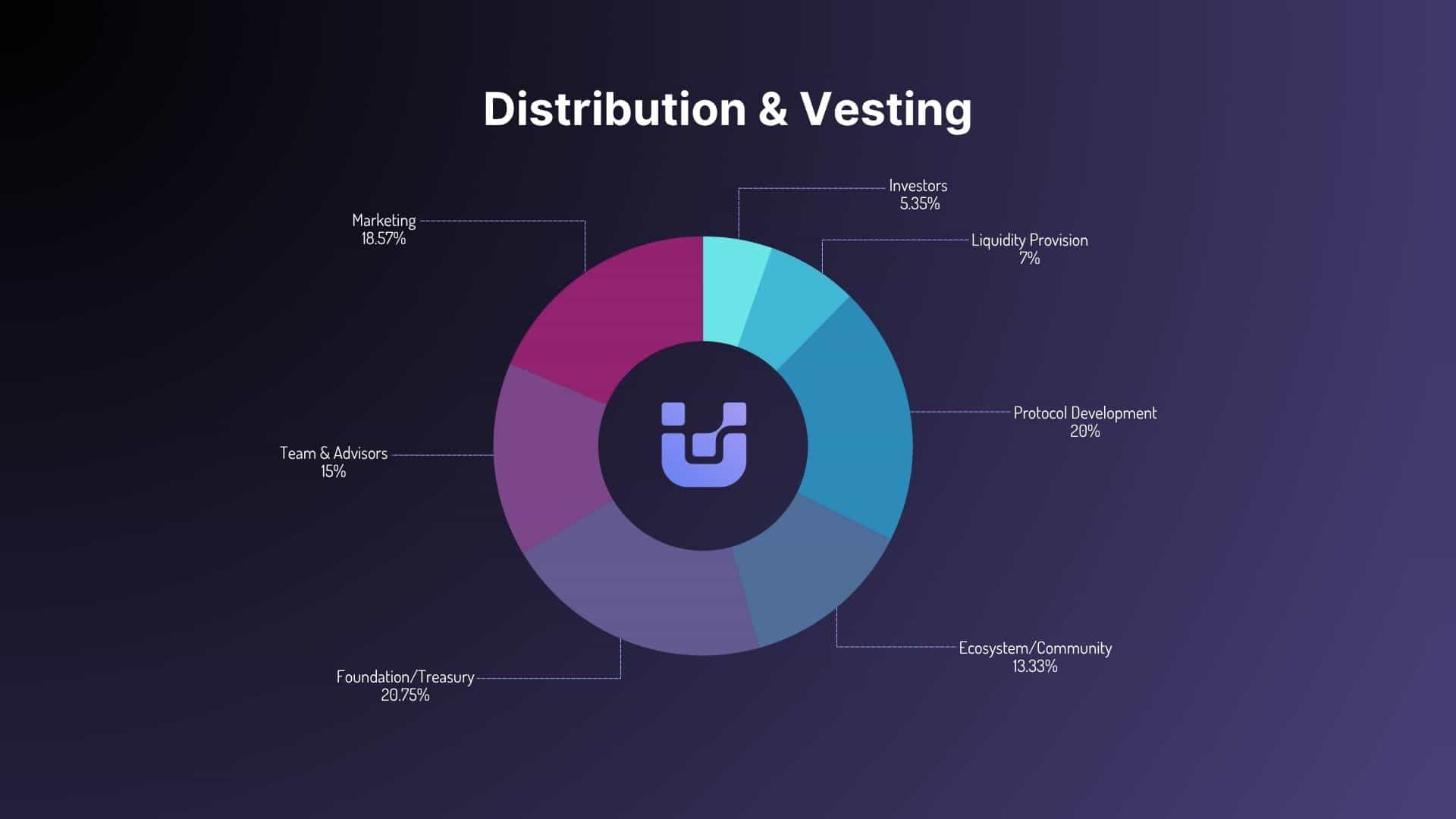

The UAI token has a fixed maximum supply of 1 billion tokens, establishing a hard cap to prevent inflation. The tokenomics are designed to align the interests of all ecosystem participants, from investors to the community.

Token Allocation

The total supply is allocated across several key areas to support long-term growth and stability:

-

Protocol Development (20%): Funds ongoing technical development of the core infrastructure, AI agent integrations, and platform features.

-

Foundation & Treasury (20.75%): Reserved for long-term operational stability, ecosystem grants, research, and future growth initiatives.

-

Marketing (18.57%): Dedicated to building brand awareness, forging partnerships, and funding educational campaigns to drive global adoption.

-

Team & Advisors (15%): Incentivizes the core contributors and strategic advisors with vesting schedules aligned with the project's long-term success.

-

Ecosystem/Community (13.33%): Funds community-focused initiatives, including user incentives like airdrops, developer grants, and partnership programs to foster a vibrant network.

-

Liquidity (7%): Ensures a stable and efficient trading environment for the UAI token across exchanges from its launch.

-

Investors (5.35%): Allocated to strategic partners who provide long-term value and support for the ecosystem.

What Does the UAI Token Do?

The UAI token is the native utility and governance asset of the UnifAI Network, powering all interactions within its AI-driven economy. Its primary functions are designed to create a self-sustaining ecosystem. The main UAI use case includes:

-

Service Access: UAI is the primary medium of exchange within the network. Users and agents use it to pay for AI-driven services, access premium tools, and cover transaction fees.

-

Governance: Token holders are granted the right to participate in the decentralized governance of the protocol. This includes proposing and voting on key upgrades, ecosystem initiatives, and treasury allocations.

-

Staking & Reputation: Users can stake UAI to help secure the network and contribute to its decentralized operations. Staking allows participants to operate or support AI-driven intelligence modules, earning rewards and building a reputation within the ecosystem.

-

Revenue Sharing: The model incorporates a revenue-sharing mechanism where a portion of ecosystem fees is distributed back to active contributors, service providers, and stakers, creating a closed-loop economy.

UAI vs. SHELL

While both UnifAI Network (UAI) and MyShell (SHELL) operate at the intersection of AI and blockchain, they target different use cases and ecosystems. UnifAI is a specialized toolkit for decentralized finance, whereas MyShell is a broad platform for the creation and discovery of all types of AI agents.

Here is a breakdown of their key differences:

| Feature | UnifAI Network (UAI) | MyShell (SHELL) |

| Primary Focus | DeFi Automation: Infrastructure for autonomous AI agents to execute complex trading and liquidity strategies. | General AI Creation: An open platform for building, sharing, and owning a wide variety of AI agents and applications. |

| Target Audience | DeFi users, traders, and developers seeking to automate financial strategies and build DeFi-specific AI tools. | AI creators, developers, and consumers interested in building or using AI agents for entertainment, utility, and other functions. |

| Core Technology | A modular three-layer architecture focused on DeFi tool discovery and execution. | An "AI consumer layer" featuring open-source AI models (like OpenVoice) and a flexible "Agentic Framework" for broad AI application development. |

| Ecosystem Scope | Narrow and deep: Tightly integrated with the financial protocols of blockchains like Ethereum, Solana, and BNB Chain. | Broad and open: A diverse ecosystem of user-generated AI agents, aiming to commercialize them as investable assets. |

| Token Utility | Used for payments, staking for security, and decentralized governance over the financial protocol. | Enables trading and is central to the creator economy for building, sharing, and owning AI agents on the platform. |

The Technology Behind UAI

UnifAI's technical foundation is a modular three-layer architecture designed to connect AI development with user-facing applications in a cohesive system.

-

Application Layer: This is the user-centric interface for interacting with the network. It includes the Agentic Wallet, which acts as an AI financial advisor, a Trading Community for social and copy trading, and Trading Agents for automating and monetizing DeFi strategies.

-

Tooling Layer: This is the core engine for developers and strategists. It provides an Open SDK for integration, "as-a-Service" modules (TaaS, DaaS, AaaS), and intuitive design tools like Vibe Coding to simplify the creation of complex strategies.

-

Infrastructure Layer: This is the foundational, open-source protocol that enables AI autonomy across Web3. It features an AI-native protocol for tool discovery and is designed for Web3 interoperability, ensuring transparency and asset ownership for users. Its open-source nature encourages global developer collaboration.

Team & Origins

While the identities of the core founders are not publicly highlighted, the UnifAI Network project is backed by a roster of prominent venture capital firms in the Web3 space. Its supporters include HashKey Capital, Anagram, Symbolic Capital, and Dispersion Capital, among others. This strong backing from established investors lends credibility to the project's vision and its ability to deliver on its ambitious roadmap.

Key News & Events

UnifAI Network has steadily gained traction through strategic partnerships and milestones:

-

Exchange Listings: The UAI token has been listed on several major cryptocurrency exchanges, including Phemex, increasing its liquidity and accessibility to a broader market.

-

Strategic Integrations: UnifAI has integrated with over 100 leading DeFi protocols, including Uniswap, Aave, and Compound, across chains like Solana, Ethereum, and BNB Chain.

-

Community Growth: The project has fostered a growing community of developers and users who actively create and share automated trading strategies on the platform.

Is UAI a Good Investment?

Determining the UAI investment potential requires a balanced look at its strengths and risks. The project's innovative technology places it at the cutting edge of the AI and DeFi sectors—two of the fastest-growing areas in crypto. Its ability to simplify complex trading strategies appeals to both new and experienced users, creating a large addressable market. The strong VC backing also signals confidence from institutional players.

However, like any cryptocurrency, UAI is subject to market volatility and regulatory risks. Its success is closely tied to the broader adoption of DeFi and AI technologies.

Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.

Community Perspectives on UnifAI Network (Reddit)

A look at discussions on platforms like Reddit reveals a cautiously optimistic sentiment from the community. Many users are drawn to the project's ambitious goal of merging AI with DeFi, seeing it as a logical and powerful next step for the industry. Key discussion points often include praise for the "agentic finance" vision, questions about long-term execution and metrics, and analysis of the token's strong utility within the ecosystem.

How to Buy UAI on Phemex

Phemex offers a secure and user-friendly platform to trade UAI and other digital assets. To get started, follow these simple steps:

-

Create an Account: Sign up on Phemex and complete the verification process.

-

Deposit Funds: Fund your account with fiat currency or another cryptocurrency.

-

Navigate to Markets: Find the UAI trading pair (e.g., UAI/USDT) in the Spot market.

-

Place Your Order: Choose your order type, enter the amount you wish to purchase, and confirm the transaction.

For more detailed instructions, explore the official Phemex Academy guides.

FAQs

1. What problem does UnifAI Network solve?

UnifAI Network addresses the complexity and time-consuming nature of DeFi by using AI agents to automate trading, liquidity provision, and other strategies, making DeFi more accessible and efficient for all users.

2. Is the UAI token inflationary or deflationary?

The UAI token has a fixed maximum supply of 1 billion, making it deflationary by design. No new tokens can be minted beyond this cap.

3. What are the main uses of the UAI token?

The UAI token has four primary functions: it is used for paying for services on the network, for staking to secure the network and earn rewards, for governance to vote on proposals, and to participate in the ecosystem's revenue-sharing model.

Summary: Why It Matters

UnifAI Network represents a significant step forward in making decentralized finance truly autonomous and intelligent. By providing the tools for AI agents to operate securely and efficiently, it lowers the barrier to entry for users and unlocks new possibilities for developers. Its infrastructure addresses a core problem in DeFi: complexity. By automating sophisticated strategies, UnifAI empowers users to optimize their financial activities with greater precision and less manual effort.

As the worlds of AI and cryptocurrency continue to merge, platforms like UnifAI are positioned to become essential infrastructure for the future of finance.

Ready to explore the power of AI-driven trading? Trade UAI on Phemex today and be part of the agentic finance revolution. To deepen your knowledge, visit the Phemex Academy for more guides and insights.