Introduction

In the evolving DeFi landscape, fragmented liquidity and misaligned incentives often hinder optimal yields for users and protocols alike. TURTLE powers Turtle, a Web3 platform that tracks wallet activities to distribute boosted rewards, bridging liquidity providers (LPs), protocols, and partners through non-custodial tools. As an ERC-20 utility token on Ethereum (with bridges to BSC and Linea), TURTLE incentivizes participation by rewarding liquidity deployment, swaps, staking, and referrals, promoting transparent DeFi growth. Unlike traditional yield aggregators, Turtle emphasizes due diligence and API-driven monetization, backed by over 402,000 registered wallets. With DeFi TVL surpassing $100B in 2025, TURTLE enables accessible, risk-adjusted opportunities via simple wallet integration. This guide explains the TURTLE token, its role in Turtle's distribution layer, and how to trade it on Phemex.

Quick Facts About TURTLE

| Ticker | TURTLE |

|---|---|

| Chain | Ethereum (ERC-20), bridged to BSC and Linea |

| Contract Address |

0x66fd8de541c0594b4dccdfc13bf3a390e50d3afd |

| Circulating Supply | 154.7M |

| Total Supply | 1B |

| Max Supply | 1B |

| Use Case | Governance, rewards for liquidity and on-chain activities, ecosystem incentives in DeFi distribution |

| Availability on Phemex | Spot (TURTLE/USDT) & Futures (TURTLEUSDT Perp) |

What Is TURTLE? Turtle Explained

Turtle is the first unified distribution protocol in Web3, designed to monetize user activities by tracking wallet interactions such as liquidity deployment, yield earning, swaps routed through partners, stakes delegated to validators, and referral usage. Launched in April 2024 by a remote team across Europe, the US, and South America, it addresses DeFi challenges by providing a non-custodial safeguarding layer that ensures transparency and due diligence for liquidity flows. Serving as Web3's largest distribution protocol with over 275,000 registered wallets since its MVP in March 2024, Turtle has facilitated over $293.8M in boosted TVL and $719M in campaign TVL as of October 2025.

What Does TURTLE Do?

TURTLE serves as the primary utility token in Turtle, enabling coordination across the ecosystem by rewarding genuine on-chain activity. Users earn it through liquidity provision in deals and campaigns, staking for governance, and participation in airdrops or referrals. It powers exclusive yield boosts, protocol partnerships, and API integrations for distribution partners, while supporting non-custodial tracking of rewards via battle-tested smart contracts.

Key Characteristics of TURTLE

- Utility in Rewards: Facilitates boosted yields for LPs depositing into partner protocols.

- Governance Role: Allows voting on ecosystem decisions and protocol upgrades.

- Incentive Alignment: Rewards swaps, staking, and referrals to monetize wallet activity.

- Non-Custodial Design: Ensures users retain full control of funds through API and smart contract integrations.

- Inclusive Access: Open to all via simple message signing, democratizing DeFi opportunities.

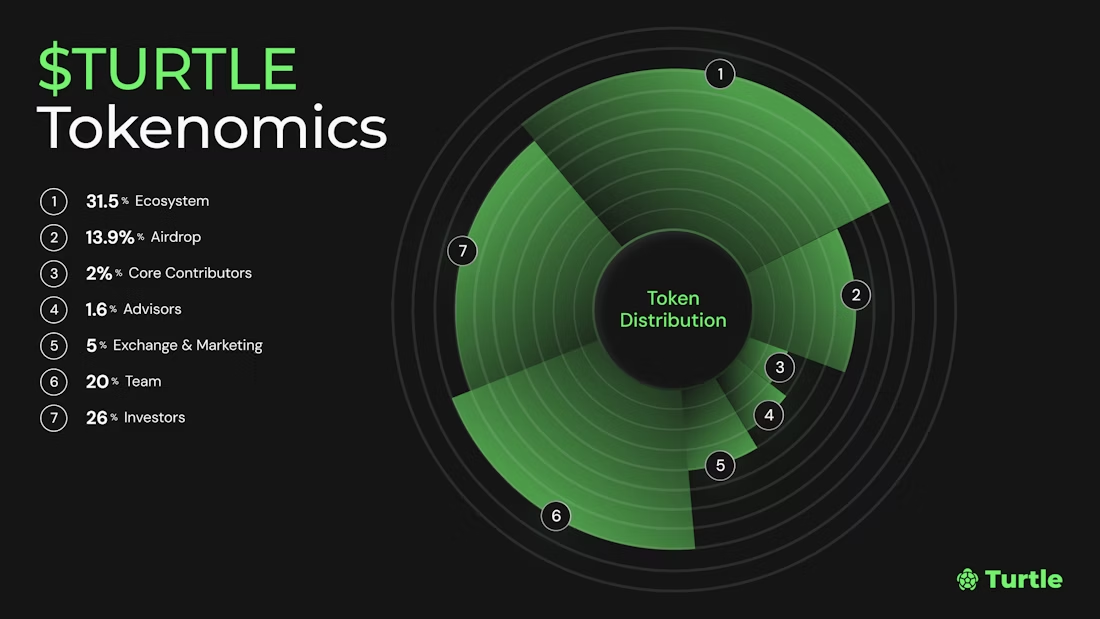

TURTLE Tokenomics

TURTLE features a fixed max supply of 1B tokens, with 15.47% (154.7M) circulating at launch for balanced liquidity. Allocations prioritize ecosystem growth (31.5%) and incentives (13.9% airdrop), with vesting schedules to ensure long-term alignment—such as phased releases for team and investors to mitigate volatility.

| Category | Percentage | Amount (Millions) | Purpose | Vesting Schedule |

|---|---|---|---|---|

| Ecosystem | 31.5% | 315 | Growth initiatives & partnerships | Gradual emissions |

| Airdrop | 13.9% | 139 | Community rewards & adoption | Immediate distribution |

| Core Contributors | 2% | 20 | Development support | Vested over time |

| Advisors | 1.6% | 16 | Strategic guidance | Locked with phased releases |

| Exchange & Marketing | 5% | 50 | Listings & promotion | T+3M unlocks |

| Team | 20% | 200 | Aligned long-term development | Vested over 24-48 months |

| Investors | 26% | 260 | Capital for expansion | Phased unlocks post-seed |

TURTLE vs. SUSHI

TURTLE and SUSHI both enhance DeFi participation through incentive alignment and liquidity rewards, but TURTLE focuses on non-custodial wallet activity tracking for broad distribution boosts, while SUSHI emphasizes revenue-sharing and yield farming within a DEX ecosystem.

| Feature | TURTLE (Turtle) | SUSHI (SushiSwap) |

|---|---|---|

| Rewards | Liquidity provision + on-chain activity | Yield farming + SUSHI emissions |

| Network Support | Ethereum, BSC, Linea | Multi-chain DEX (Ethereum primary) |

| Yield Focus | Curated non-custodial boosts | AMM liquidity incentives |

| Value Stability | Airdrop & vesting emphasis | Governance & staking rewards |

| Ecosystem Options | Deals, campaigns, partnerships | Swaps, staking, Onsen farms |

Technology Behind Turtle

Turtle employs an ERC-20 architecture on Ethereum for secure token transfers, with bridges to BSC and Linea for broader accessibility. Its distribution layer integrates APIs and smart contracts to track liquidity flows non-custodially, enabling features like real-time TVL monitoring and reward distribution. Tools such as widgets, SDKs, and leaderboards (via Kaito and Cookie3) enhance partner integrations, ensuring efficient, transparent DeFi activity without user custody risks.

Turtle Team and Origins

Founded in 2024, Turtle unites a global remote team with expertise in DeFi and Web3 distribution. Led by Founder & CEO Esfandiar Lagevardi, the team draws from backgrounds in protocol development and liquidity management. Backed by investors like THEIA, Consensys, and Chorus One, it raised $6.2M in a seed round, emphasizing community-driven growth and incentive alignment from inception.

TURTLE News and Milestones

- March 2024: MVP launch as Web3's first distribution protocol.

- April 2024: Official launch with non-custodial tracking features.

- Q3 2025: Surpassed 275,000 registered wallets and integrated APIs for swaps/staking.

- October 21, 2025: Airdrop announcement; achieved $293.8M boosted TVL.

- October 22, 2025: Multi-exchange listings; 15M TURTLE airdrop pool.

- Q4 2025: Expanded campaigns and governance activations for TURTLE holders.

What Will Affect TURTLE’s Price 2025–2030?

TURTLE’s price will hinge on DeFi adoption, TVL growth, and exchange integrations, with volatility from recent launch and emissions. The $200B+ DeFi sector by 2030 offers potential, but competition and unlocks pose risks.

Factors That May Increase TURTLE’s Price

- DeFi Expansion: Rising TVL to $500B by 2030 could boost demand as 275,000+ wallets engage.

- Milestone Achievements: Q4 2025 campaign rollouts and partnerships may enhance utility.

- Airdrop Incentives: 13.9% allocation drives community participation and liquidity.

- Governance Growth: TURTLE voting on upgrades could heighten holder engagement.

- Bull Markets: Crypto cycles may elevate TURTLE via multi-chain bridges.

Factors That May Decrease TURTLE’s Price

- Token Unlocks: 84.53% locked supply with phased releases could add selling pressure.

- Launch Volatility: Post-October 2025 listings risk initial dips amid hype.

- Competition: Rivals in yield protocols may capture DeFi funds.

- Regulatory Hurdles: 2025 DeFi rules could increase compliance costs.

- Adoption Delays: Slower wallet growth or partner onboarding may curb utility.

- Sentiment Shifts: Fading post-launch buzz and risk concerns could dampen confidence.

How to Buy TURTLE on Phemex

-

Sign Up: Create a Phemex account with email and verify securely.

-

Fund Account: Deposit via one-click buy, credit card, bank transfer, or crypto.

-

Buy TURTLE: Search TURTLE/USDT, enter your investment amount in your local currency, preview the TURTLE amount, and confirm to receive it instantly in your Phemex wallet.

TURTLE FAQ

- What is TURTLE? Utility token for Turtle's DeFi distribution protocol.

- How does Turtle work? Tracks on-chain activities for monetized rewards via APIs.

- What does TURTLE do? Powers governance, liquidity incentives, and ecosystem rewards.

- How to use TURTLE? Stake for yields or participate in deals/campaigns.

- What is TURTLE’s supply? 1B max, 154.7M circulating.

- What is TURTLE tokenomics 2025? 15.47% genesis, ecosystem-focused allocations.

Conclusion

TURTLE unlocks Turtle's distribution protocol for aligned DeFi incentives, blending liquidity rewards, governance, and partnerships. Its 2025 listings and 402,000+ wallets solidify its role in Web3 yield optimization. Trade TURTLE on Phemex to engage with this protocol.