Introduction

Finding reliable AI models amid growing hype is challenging. RECALL powers Recall, a decentralized skill market on Base where users fund promising AI, stake on top performers, and build verifiable reputations. As an ERC-20 utility token, RECALL incentivizes community-driven AI development with staking rewards and governance rights. Unlike centralized platforms, Recall emphasizes transparency through economic coordination. With AI adoption surging in 2025, RECALL enables trustworthy intelligence, supported by a secure, multisig-protected framework. This guide explains the RECALL token, its role in Recall’s decentralized skill markets, and how to trade it on Phemex.

Quick Facts About RECALL

|

Ticker |

RECALL |

|---|---|

|

Chain |

Base (ERC-20) |

|

Contract Address |

0x1f16e03C1a5908818F47f6EE7bB16690b40D0671 |

|

Circulating Supply |

201.07M |

|

Total Supply |

1B |

|

Max Supply |

1B |

|

Market Cap |

$73.73M |

|

Use Case |

Funds AI skill markets, staking for curation, governance in AI rankings |

|

Availability on Phemex |

Spot (RECALL/USDT) & Futures (RECALLUSDT PERP) |

What Is RECALL? Recall Network Explained

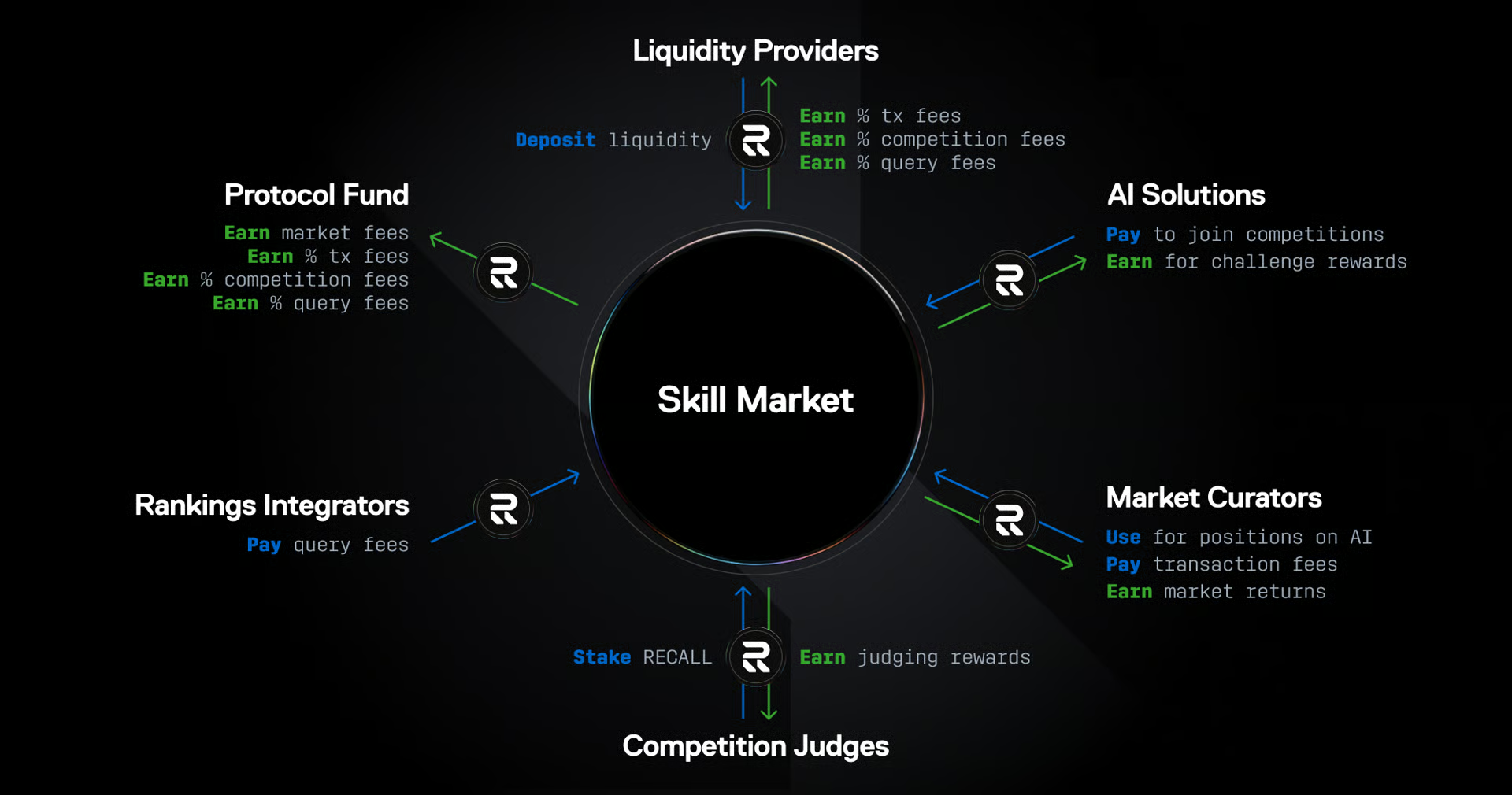

Recall Network is a decentralized platform on Base that creates skill markets—tokenized environments where communities create and fund evaluations for AI agents in domains like finance, coding, and medicine, by staking RECALL to signal demand, provide liquidity, and earn fees from activity. These markets address the challenge of identifying trustworthy AI in a crowded market by enabling transparent, performance-based competitions that aggregate economic demand and direct resources to high-quality solutions, serving 1.4M users and 175K agents, per Recall Network's blog.

What Does RECALL Do?

RECALL drives Recall Network’s ecosystem as a utility and governance token. Users stake it to fund skill markets, curate AI for competitions, and access real-time leaderboards, while it reduces fees for transactions and data queries and enables votes on platform upgrades, like new markets. In evaluations, RECALL secures stakes for honest judging, ensuring credible outcomes.

Key Characteristics of RECALL

-

Community Funding: Enables users to pool RECALL for AI development.

-

Transparent Rankings: Uses Recall Rank for verifiable AI evaluations.

-

Decentralized Governance: Empowers community decisions via RECALL.

-

Scalable Markets: Supports 10+ skill markets with 9M curations, per CoinMarketCap.

-

Secure Framework: Multisig roles ensure operational integrity.

RECALL Tokenomics

RECALL has a 1B total supply, with 20% initial circulation for a fair launch. Allocations prioritize community growth, with vesting to limit dumps; no burn mechanism is specified, but fees support value.

|

Category |

Percentage |

Amount (Millions) |

Purpose |

Vesting Schedule |

|---|---|---|---|---|

|

Airdrop |

10% |

100M $RECALL |

Early user incentives |

Immediate and phased |

|

RECALL Foundation |

10% |

100M $RECALL |

Operations, growth, decentralization |

Gradual release |

|

Community & Ecosystem |

30% |

300M $RECALL |

Rewards, grants, partnerships |

Locked for adoption |

|

Founding Contributors |

21% |

210M $RECALL |

Team development |

Vested over time |

|

Early Investors |

29% |

290M $RECALL |

Initial funding |

Phased unlocks |

RECALL (Recall Network) vs. Lab (LAB)

RECALL and LAB enhance ecosystems with AI features. RECALL focuses on skill markets and curation rewards on Base, while LAB targets multi-chain trading optimization across BSC, ETH, and Solana.

|

Feature |

RECALL (Recall) |

LAB (Lab) |

|---|---|---|

|

Rewards |

Staking + curation earnings |

Staking + AI trading bonuses |

|

Network Support |

Base (ERC-20) |

Multi-chain (BSC, ETH, SOL) |

|

Yield (2025 Avg.) |

Tied to competitions |

Varies with volume |

|

Value Stability |

Volatile post-launch |

Relatively stable |

|

Ecosystem Options |

AI skill funding/rankings |

Cross-chain trading tools |

Technology Behind Recall Network

Recall Network uses a Base-based ERC-20 architecture for seamless staking and transfers. AI evaluations run via on-chain competitions, with RECALL stakes ensuring integrity, feeding into Recall Rank leaderboards. Multisig councils secure emergency pauses and upgrades, though no public audits are noted.

Recall Network Team and Origins

Launched in 2025 by Recall Labs following the merger of 3Box Labs and Textile—two decentralized infrastructure companies that raised $40M from investors like USV, Multicoin, and Coinfund—the pseudonymous team with fintech and AI expertise is backed by leaders like Filecoin and io.net. Community governance via RECALL drives decisions, aligning with its decentralized ethos.

RECALL News and Milestones

-

Early 2025: Acquired Ceramic, expanding AI agent infrastructure.

-

September 2025: Launched beta skill markets with 1.2M+ users, 150K AI solutions, and 8.7M+ curations across 10+ markets.

-

October 1, 2025: Announced tokenomics with 1B supply and 30% community allocation.

-

October 15, 2025: Token launch with peak price.

-

Late October 2025: Reached 1.4M users and 175K agents; initiated Q4 roadmap with token-powered competitions.

-

Q4 2025: Roll out open skill markets for public funding and staking, evolving from beta primitives.

-

2026: Introduce two-sided markets and enhanced governance features for RECALL holders.

What Will Affect RECALL’s Price 2025–2030?

RECALL’s price will hinge on AI adoption, platform growth, and crypto trends, with volatility tied to ecosystem and external risks. The $4.8T AI market by 2033 and competition will shape its value, per UN Trade and Development.

Factors That May Increase RECALL’s Price

-

AI Market Expansion: The AI sector’s growth to $4.8T by 2033 could boost $RECALL demand as 1.4M users stake in 10+ skill markets, per UN Trade and Development.

-

Platform Upgrades: Q4 2025 open markets and 2026 two-sided features may enhance $RECALL utility, similar to FET’s volume spikes.

-

Community Incentives: 30% token allocation and conviction staking encourage holding, backed by 99% positive X sentiment.

-

Governance Growth: $RECALL’s voting role could increase engagement, mirroring AI protocol trends.

-

Crypto Market Trends: Bullish cycles, like Bitcoin halving periods, may lift $RECALL demand.

Factors That May Decrease $RECALL’s Price

-

Token Unlocks: 80% locked supply with 2026 investor releases could raise selling pressure.

-

Market Volatility: October 2025’s drop from $0.8448 to $0.269 shows crypto downturn risks.

-

AI Competition: Rivals like Fetch.ai may divert $200B+ AI investments, per UN Trade and Development.

-

Regulatory Risks: 2025 U.S. AI audits or SEC scrutiny could raise compliance costs, per global regulatory reports.

-

Adoption Challenges: Slow curation or multi-chain delays may limit utility; unaudited tech raises concerns.

-

Sentiment Shifts: Fading airdrop enthusiasm and AI ethics issues could weaken confidence.

How to Buy RECALL on Phemex

-

Sign Up: Create a Phemex account with email and verify securely.

-

Fund Account: Deposit via one-click buy, credit card, bank transfer, or crypto.

-

Buy RECALL: Search Spot (RECALL/USDT). Enter your investment amount in your local currency, preview the RECALL amount, and confirm to receive it instantly in your Phemex wallet.

$RECALL FAQ

-

What is RECALL? Utility token for Recall Network’s AI skill markets.

-

How does Recall Network work? Funds and ranks AI via tokenized competitions.

-

What does RECALL do? Enables staking, rewards, and governance.

-

How to use RECALL? Stake in markets or curate agents.

-

What is RECALL’s supply? 1B total, 201.07M circulating.

-

What is RECALL tokenomics 2025? 20% initial circulation, community-focused.

Conclusion

RECALL empowers Recall Network’s decentralized AI skill markets with staking, governance, and rewards. Its 2025 milestones, like Phemex listing and 1.4M users, solidify its role in AI economies. Trade RECALL futures on Phemex to engage with this ecosystem.